- Home

- »

- Pharmaceuticals

- »

-

Autoimmune Hemolytic Anemia Treatment Market Report, 2030GVR Report cover

![Autoimmune Hemolytic Anemia Treatment Market Size, Share & Trends Report]()

Autoimmune Hemolytic Anemia Treatment Market Size, Share & Trends Analysis Report By Type, By Drug Class (Corticosteroids, Immunosuppressive Agents), By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-290-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global autoimmune hemolytic anemia treatment market size was estimated at USD 751.93 million in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030. The growth of the market is attributed to the increasing prevalence of autoimmune hemolytic anemia (AIHA), increasing risk of developing in aging people, rise in research & development activities, and growth in government initiatives to manage anemia across the globe. The increasing incidence of autoimmune hemolytic anemia across the globe is one of the major factors driving the market growth. According to the NCBI report published in September 2023, the incidence of autoimmune hemolytic anemia (AIHA) is 1 to 3 cases per 100,000 population annually. Moreover, the prevalence of AIHA is estimated at around 17 cases per 100,000 across the globe.

Furthermore, the increasing risk of developing autoimmune hemolytic anemia due to other health conditions such as cancer and autoimmune diseases is further anticipated to fuel the growth over the forecast period. Around 15% of hemolytic anemia is associated with any form of cancer worldwide.

Moreover, the increasing geriatric population is expected to increase the patient base of AIHA in the coming years. According to the United Nations data published in 2022, the population above 65 years is increasing at a faster rate, the global population aged 65 and above is expected to rise from 10% in 2022 to 16% in 2050. Moreover, according to the World Bank Group, around 780 million people are aged 65 and over in 2022, worldwide, and this number is anticipated to grow in the coming years. Geriatric population is more prone to acquired hemolytic anemia and it is most common in females over the age of 40 years. The risk of developing AIHA increases with aging.

The introduction and development of novel therapeutic products for autoimmune hemolytic anemia treatment is expected to support the market growth. Increasing approval of novel therapeutic drugs by regulatory bodies for the treatment of autoimmune hemolytic anemia is anticipated to drive the market expansion. For instance, in November 2022, the European Commission granted market approval for Enjaymo (sutimlimab) for the treatment of AIHA in adult patients with cold agglutinin disease (CAD). Similarly, the presence of strong pipeline candidates under clinical trials for AIHA is expected to boost the growth. Some of key therapeutic drugs in development phases are obexelimab by Zenas BioPharma, rilzabrutinib by Sanofi, nipocalimab by Johnson & Johnson Services, Inc., ianalumab by Novartis AG, parsaclisinib by Incyte, fostamatinib disodium by Rigel Pharmaceuticals, Inc., and povetacicept by Alpine Immune Sciences among others. The upcoming launch of these drugs is expected to propel the market growth in the coming years.

Favorable initiatives are undertaken by government and non-government bodies to improve the overall healthcare services for anemia patients and spread awareness among people. For instance, Health Canada regularly monitors the potential risk of hemolytic anemia. As of November 2022, Health Canada received 7 cases of hemolytic anemia associated with methotrexate use in the country. Such initiatives are expected to improve the overall health services and treatment of AIHA patients in the country.

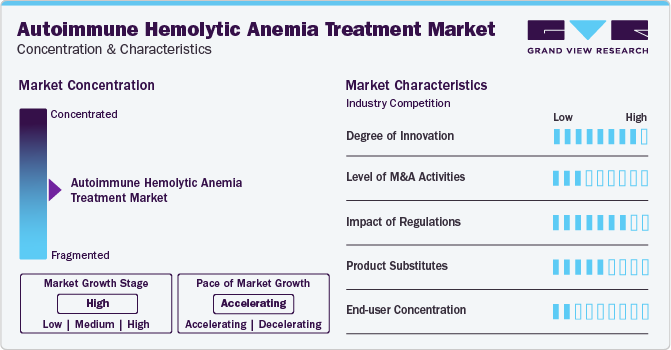

Market Concentration & Characteristics

The degree of innovation is high in the market characterized by a growing level of research and development. Key players are involved in the development of novel biological drugs to manage the disease. Some pipeline drugs are rilzabrutinib, parsaclisinib, and povetacicept among others.

Mergers & acquisitions activities are comparatively low in the market. Key players are involved in mergers & acquisitions to strengthen their market position across the globe. This strategy enables companies to acquire expertise in the anemia segment and expand their product portfolio in the market.

The regulatory framework for drug approvals has always been one of the major restraining factors in the pharmaceutical and biotechnology industries. The approval process for rare diseases is very complex and stringent in target markets. However, favorable initiatives undertaken by regulatory bodies to increase product approvals for rare disease treatment are expected to support market growth.

The level of substitution is moderate for the market due to the availability of alternative therapeutic options such as blood transfusion and splenectomy for the management of AIHA.

The concentration of end users is expected to be low. The number of patients for autoimmune hemolytic anemia disease is limited as it is classified as a rare disease.

Type Insights

Warm autoimmune hemolytic anemia segment led the market with a share of 68.5% in 2023 and is expected to maintain its dominance over the forecast period. High share of the segment can be attributed to the growing prevalence of the disease, increasing treatment rate, and growing awareness among people. For instance, warm autoimmune hemolytic anemia (wAIHA) accounts for around 60% to 70% of total autoimmune hemolytic anemia cases. Moreover, the incidence of wAIHA is around 1 in 35,000 and 1 in 80,000 people in North America and Western Europe, respectively.

Cold autoimmune hemolytic anemia segment is anticipated to grow at the fastest rate over the forecast period owing to the increasing incidence of disease, strong research & development activities, and increasing approval of novel drugs for the disease indication. For instance, Sanofi developed Enjaymo (sutimlimab) for the treatment of cold agglutinin disease and has received market approval from the U.S. FDA, European Commission, and Japanese Ministry of Health, Labor and Welfare. Moreover, people with cold AIHA may experience fatigue, acute hemolytic crisis, and other complications.

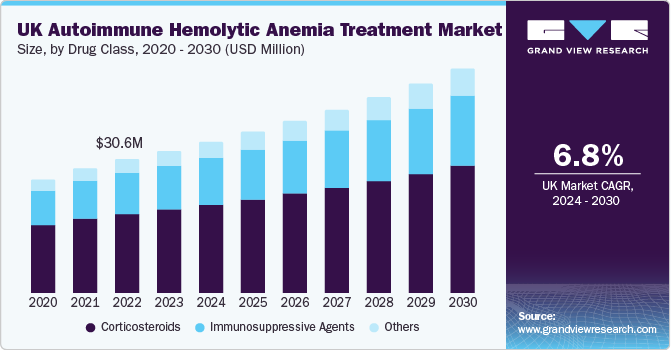

Drug Class Insights

Corticosteroids led the autoimmune hemolytic anemia treatment market with a share of 58.8% in 2023. High prescription rates of corticosteroids such as hydrocortisone and prednisone and better treatment results are some of the key factors supporting the high share of the segment. Corticosteroids are considered the first line of therapy for the treatment of AIHA. Moreover, more than 65% of autoimmune hemolytic anemia patients received corticosteroids that help to weaken the body’s immune response. The second most common drug class used to manage AIHA is immunosuppressive agents.

However, the other drug class segment is projected to grow at the fastest rate over the forecast period. The growth of the segment can be attributed to the increasing R&D of novel drug classes such as biological drugs due to their better results and the increasing introduction of novel drugs by key market players. For instance, the U.S. FDA, European Commission, and Japan’s regulatory authorities have approved sutimlimab for the treatment of cold autoimmune hemolytic anemia in 2022. Moreover, investigational biological drugs and their expected commercial launches are further anticipated to boost the segment growth.

Route Of Administration Insights

The injectable route of administration led the market with a share of 63.1% in 2023 and is projected to be the leading segment over the projected years. High market penetration of injectable drugs such as corticosteroids, folic acids & emerging biological drugs, several pharmaceutical companies offering corticosteroids, and increasing adoption of these drugs for the management of autoimmune hemolytic anemia are the key drivers supporting the segment share. Moreover, increasing R&D activities to develop novel biological therapeutics and approval of injectable drugs are some major factors anticipated to drive the segment growth.

Oral drugs are expected to exhibit the fastest growth rate during the forecast period. Increasing adoption of immunosuppressive agents to weaken the immune system, convenience, and adoption of patient-centric approaches are some of the key factors driving the segment growth over the forecast period. Immunosuppressive agents are the second most common drug class used to manage AIHA, it account for around 30% of total prescription drugs used in AIHA treatment.

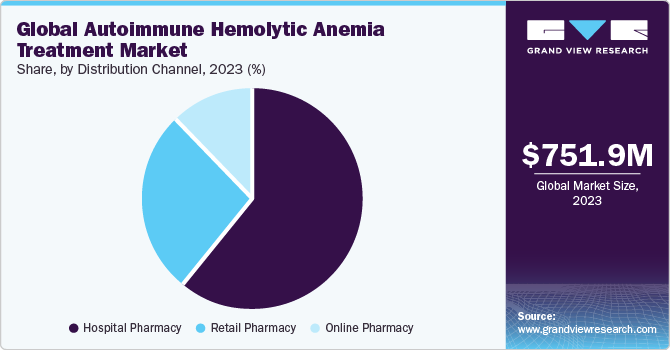

Distribution Channel Insights

Hospital pharmacy led the market with a share of 60.3% in 2023. The increasing hospitalization rate due to hemolytic anemia among the geriatric population is supporting the segment's growth. Moreover, the severity of AIHA and the high mortality rate of diseases have increased the hospitalization rate of AIHA patients which is driving the segment share significantly.

Online pharmacy segment is expected to expand at the fastest rate over the forecast period. Increased user base of internet & smartphone, ease of ordering medications through e-commerce platforms, and increasing e-commerce services offering medicinal products globally are expected to fuel the segment growth in the coming years. Moreover, the increasing adoption of telemedicine to get doctor’s consultations, diagnostic services, and medicinal products is further anticipated to support the segment growth in the coming years.

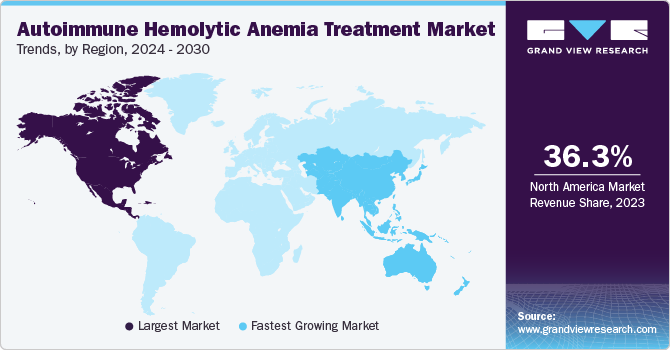

Regional Insights

North America market accounted for the largest share of 36.3% share in 2023 and is expected to dominate the market throughout the forecast period. The high incidence of autoimmune hemolytic anemia, presence of strong pharmaceutical companies involved in the marketing and development of novel therapeutic drugs, and favorable government initiatives are some of the key factors supporting the growth in the region. For instance, in February 2022, the U.S. FDA approved Enjaymo (sutimlimab) for the treatment of hemolysis in adults with cold agglutinin disease (CAD). Such initiatives are expected to maintain regional dominance over the projected years.

U.S. Autoimmune Hemolytic Anemia Treatment Market Trends

The market in the U.S. is expected to grow at a lucrative rate over the forecast period due to the high incidence rate of AIHA, better reimbursement policies, improved healthcare infrastructure, and favorable initiatives undertaken by government & non-government bodies to improve the healthcare services for AIHA patients. For instance, according to the American Society of Hematology, the prevalence of AIHA per 1 million is around 190 in Medicare claims, 70 in Optum claims, and 50 in others.

Europe Autoimmune Hemolytic Anemia Treatment Market Trends

The market in Europe is expected to witness a lucrative growth rate. The growth of the market in the region can be attributed to an increasing incidence of diseases coupled with a rise in the geriatric population, growth in the introduction of novel therapeutic products, and a surge in R&D activities to develop novel drugs to manage autoimmune hemolytic anemia. Moreover, the presence of leading pharmaceutical companies such as Sanofi, Novartis AG, and others involved in the development of novel therapeutics for AIHA patients is expected to drive market growth.

The UK autoimmune hemolytic anemia treatment market is expected to grow substantially over the forecast period due to the presence of local pharmaceutical & biopharmaceutical companies, well-established healthcare infrastructure, and rising awareness about the severity of autoimmune hemolytic anemia disease.

The autoimmune hemolytic anemia treatment market in France is expected to grow over the forecast period attributed to the increasing patient base and the introduction of novel drugs in the country for the treatment of disease.

The Germany autoimmune hemolytic anemia treatment market is expected to grow over the forecast period due to the rising number of market strategies being taken by pharmaceutical companies to develop novel therapies for the management of disease in the country. Moreover, the incidence of AIHA disease is higher in Germany compared to other European countries.

Asia Pacific Autoimmune Hemolytic Anemia Treatment Market Trends

The Asia Pacific market is anticipated to witness the fastest growth over the forecast period. The presence of a large target population, high unmet medical needs, and a growing healthcare industry is anticipated to provide high growth potential for the market in the region. Asian countries such as Japan, China and India have a large patient base with high unmet medical needs that create market opportunities for key players in the region. Moreover, increasing R&D activities in the regions is further expected to drive market growth over the forecast period. For instance, in October 2022, HUTCHMED Limited initiated a phase 2/3 trial of sovleplenib in adult patients with warm antibody autoimmune hemolytic anemia in China.

The China autoimmune hemolytic anemia treatment market The market in China is expected to grow over the forecast period due to the huge potential patient base, increasing R&D activities to develop novel therapeutic drugs, and increasing favorable initiatives undertaken by key governments to control AIHA in the country.

The autoimmune hemolytic anemia treatment market in Japan is expected to grow over the forecast period due to the presence of strong pharmaceutical companies, well-established healthcare systems, and increasing approval of novel biological drugs for the treatment of AIHA in the country.

Latin America Autoimmune Hemolytic Anemia Treatment Market Trends

Latin America market was identified as a lucrative region in this industry. Increasing incidence of disease coupled with high unmet medical needs and increasing demand for novel & effective treatment options for disease management are some of the key factors driving the market over the forecast period.

The Brazil autoimmune hemolytic anemia treatment market is expected to grow over the forecast period due to the rising prevalence of hemolytic anemia and increasing favorable initiatives undertaken by the government and market players to fill the gap between supply and market demand for AIHA therapeutics. Moreover, Brazil held the largest share in the Latin America market.

MEA Autoimmune Hemolytic Anemia Treatment Market Trends

The market in this region is driven by the increasing incidence of AIHA coupled with an increasing geriatric population, and high unmet medical needs, aided by improvements in healthcare infrastructure.

The autoimmune hemolytic anemia treatment market in Saudi Arabia is expected to grow over the forecast period owing to the improvement in the healthcare infrastructure, the increasing patient base due to the rise in the geriatric population, and the adoption of novel therapies.

Key Autoimmune Hemolytic Anemia Treatment Company Insights

Some of the leading players operating in the market include Teva Pharmaceutical Industries Ltd., Viatris Inc., Sanofi, Johnson & Johnson Services, Inc., F. Hoffmann-La Roche Ltd, Lupin, and Novartis AG. Key companies are adopting different strategies such as new product development, collaboration, and partnership to increase the market footprint across the globe. Moreover, leading pharmaceutical companies are conducting clinical trials to develop novel biological drugs for the treatment of AIHA treatment across the globe.

Incyte, Rigel Pharmaceuticals, Inc., and Alpine Immune Sciences are some of the emerging market participants in the market. These companies focus on achieving funding support from government bodies and non-profit organizations to support their research activities related to the development of novel treatments for autoimmune hemolytic anemia.

Key Autoimmune Hemolytic Anemia Treatment Companies:

The following are the leading companies in the autoimmune hemolytic anemia treatment market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- Sanofi

- Lupin

- Johnson & Johnson Services, Inc.

- Novartis AG

- Incyte

- Rigel Pharmaceuticals, Inc.

- Alpine Immune Sciences

Recent Developments

-

In February 2024, Johnson & Johnson Services, Inc. announced that the U.S. FDA granted Breakthrough Therapy Designation for nipocalimab for the treatment of alloimmunizeda in pregnant individuals at high risk of severe hemolytic disease of the fetus and newborn.

-

In November 2022, Sanofi announced that the European Commission approved the market authoriazation of Enjaymo for the treatment of hemolytic anemia in adult patients with cold agglutinin disease (CAD).

-

In June 2022, the Japanese Ministry of Health, Labor and Welfare approved Enjaymo for the treatment of autoimmune hemolytic anemia in adult patients.

-

In February 2022, Agios Pharmaceuticals, Inc. received the U.S. FDA approval for Pyrukynd for the treatment of hemolytic anemia in adults with pyruvate kinase (PK) deficiency.

-

In August 2020, Johnson & Johnson Services, Inc. entered into an agreement to acquire Momenta Pharmaceuticals, Inc., involved in the development of drugs for AIHA, in all cash transactions for approximately USD 6.5 billion.

Autoimmune Hemolytic Anemia Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 796.89 million

Revenue forecast in 2030

USD 1.16 billion

Growth rate

CAGR of 6.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, drug class, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

F. Hoffmann-La Roche Ltd; Viatris Inc.; Teva Pharmaceutical Industries Ltd.; Sanofi; Lupin; Johnson & Johnson Services, Inc.; Novartis AG; Incyte; Rigel Pharmaceuticals, Inc.; Alpine Immune Sciences

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autoimmune Hemolytic Anemia Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global autoimmune hemolytic anemia treatment market report based on type, drug class, route of administration, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Warm Autoimmune Hemolytic Anemia

-

Cold Autoimmune Hemolytic Anemia

-

Others

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Corticosteroids

-

Immunosuppressive agents

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Injectable

-

Oral

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global autoimmune hemolytic anemia treatment market size was valued at USD 751.93 million in 2023 and is expected to reach USD 796.89 million in 2024.

b. The global autoimmune hemolytic anemia treatment market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 1.16 billion by 2030.

b. Corticosteroids led the autoimmune hemolytic anemia treatment market with a share of 58.85% in 2023. High prescription rates of corticosteroids such as hydrocortisone and prednisone and better treatment results are some of the key factors supporting the high share of the segment.

b. Some key players operating in the autoimmune hemolytic anemia treatment market include F. Hoffmann-La Roche Ltd, Viatris Inc., Teva Pharmaceutical Industries Ltd., Sanofi, Lupin, Johnson & Johnson Services, Inc., Novartis AG, Incyte, Rigel Pharmaceuticals, Inc., Alpine Immune Sciences.

b. Key factors that are driving the market growth include increasing prevalence of autoimmune hemolytic anemia (AIHA), the increasing risk of developing in aging people, the rise in research & development activities, and government initiatives to manage anemia across the globe

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."