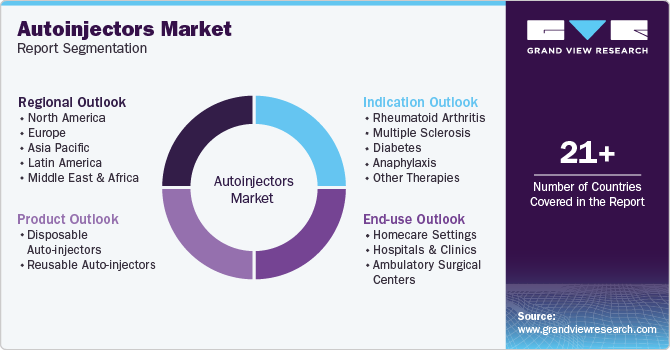

Autoinjectors Market Size, Share & Trends Analysis By Product (Disposable, Reusable), By Indication (Rheumatoid Arthritis, Multiple Sclerosis, Diabetes), By End-use (Home Care Settings, Hospitals & Clinics), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-397-3

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Autoinjectors Market Size & Trends

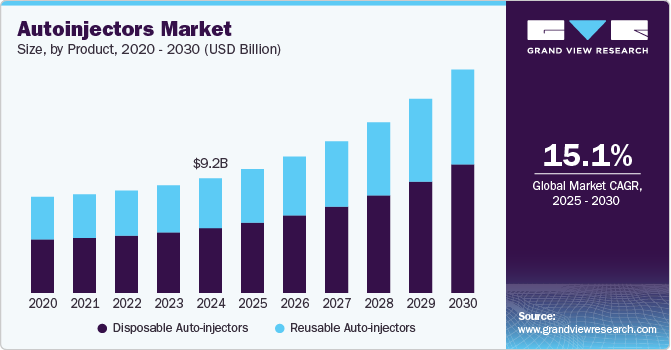

The global autoinjectors market size was valued at USD 9.2 billion in 2024 and is projected to grow at a CAGR of 15.1% from 2025 to 2030. The auto injectors market is driven by the increasing prevalence of chronic diseases such as diabetes and anaphylaxis, necessitating user-friendly medication delivery systems. Rising awareness of self-administration benefits, advancements in biologics, and technological innovations enhance safety and ease of use. Supportive government policies, increased healthcare expenditure, and demand for minimally invasive devices further boost market growth.

Auto-injectors are preferred over conventional devices due to their efficient and enhanced drug delivery capabilities and compatibility with new formulations. They offer several benefits, including reduced needle phobia and anxiety, decreased risk of needle stick injuries, consistent dose accuracy, and improved efficacy, which drives their adoption in diverse patient pools. Similarly, the increasing availability and access to user friendly auto-injectors which can be administered at home is further increasing their adoption. For instance, in May 2024, the FDA approved the Benlysta autoinjector for at-home use in children aged 5 years and older with lupus. This approval aims to improve treatment accessibility and convenience, allowing caregivers to administer the medication outside of clinical settings. The auto-injector is designed to enhance patient adherence to therapy, which is crucial for managing lupus effectively.

Moreover, conditions such as rheumatoid arthritis, multiple sclerosis, and anaphylaxis require frequent injections, making auto-injectors a preferred option due to their ease of use, accuracy, and patient compliance benefits. The shift towards biologics and biosimilars, particularly in therapeutic areas such as immunology and oncology, is further fueling demand. Biopharmaceutical companies are actively investing in patient-centric drug delivery technologies, ensuring that auto-injectors are compatible with a broader range of formulations. Additionally, the expansion of home-based treatment options and self-administration preferences has further strengthened the adoption of these devices, reducing the burden on healthcare facilities while improving patient outcomes.

A List Of Auto-Injector Devices For Administering Various Drugs

|

Clinical condition |

Autoinjector device |

Route of administration |

Dosage forms Strength |

Dose |

|

Anaphylaxis |

Epinephrine (EpiPen) |

Intramuscular |

0.3mg & 0.15 mg |

0.3 mg |

|

Seizures |

Diazepam |

Intramuscular |

10 mg |

10 mg-20 mg |

|

Midazolam |

Intramuscular |

10 mg/2 mL or 5 mg/mL |

|

|

|

Organophosphorus poisoning |

Atropine (AtroPen) |

Intramuscular |

0.5 mg/1 mg/2 mg |

1-2 g |

|

Pralidoxime + Atropine |

Intramuscular |

600 mg/2 mL |

||

|

(DuoDote autoinjector) |

Intramuscular |

(Pralidoxime 600 mg/2 mL + Atropine 2.1 mg/0.7 mL) |

||

|

Migraine |

Sumatriptan (ZEMBRACE SymTouch) |

Subcutaneous |

3 mg |

3-12 mg/day |

|

Psoriasis |

Ixekizumab (TALTZ) |

Subcutaneous |

80 mg/mL |

|

|

Certolizumab pegol (cimzia) |

Subcutaneous |

150 mg or 300 mg |

|

|

|

Rheumatoid arthritis |

Sirukumab (PLIVENSIA) |

Subcutaneous |

50 mg, |

Q4W |

|

Sarilumab (KEVZARA) |

100 mg |

Q2W |

|

|

|

Tocilizumab (ACTpen) |

Subcutaneous |

200 mg |

Q2W |

|

|

Golimumab (SIMPONI) |

Subcutaneous |

62 mg/0.9 mL |

|

|

|

Adalimumab (Humira pen) |

Subcutaneous |

200 mg/mL |

|

|

|

Multiple sclerosis |

Interferon β-1a (Avonex) |

Intramuscular |

30 μg |

30 μg/week |

|

Interferon β-1b (ExtaviPro) |

0.0625 mg alternate day |

|

||

|

Diabetes |

Insulin (KwikPen) |

Subcutaneous |

100 unit/200 units/3 mL pen |

10 units/day |

|

Exenatide (Exenatide QWS AI) |

Subcutaneous |

2 mg |

2 mg/week |

|

|

Hypercholesterolaemia |

Evolocumab (SureClick) |

Subcutaneous |

140 mg/mL |

Q2W |

Source: National Library of Medicine

The global auto-injectors industry is rapidly growing due to the rising prevalence of anaphylaxis and food allergies. Anaphylaxis, a severe and rapid allergic reaction, can occur due to food allergies. It causes symptoms like difficulty breathing, swelling, hives, and a drop in blood pressure. For instance, according to Asthma and Allergy Foundation of America data published in April 2024, over 100 million people in the U.S. suffer from various allergies annually, including seasonal allergies, food allergies, and eczema. Nearly one in three U.S. adults and over one in four U.S. children have a seasonal allergy, eczema, or food allergy. Each year, anaphylaxis due to food allergies leads to an estimated 90,000 emergency room visits in the U.S.

Furthermore, innovations in the functionality of these devices are further expected to strengthen market growth. For instance, in August 2023, Phillips-Medisize was awarded its third industry honor for the SKYTROFA Auto-Injector at the Red Dot Design Awards in Germany. This device, recognized for its design, is reusable and rechargeable, reducing the environmental impact of disposable injector pens and batteries. Each full charge supports weekly injections for up to four weeks. The auto-injector's lifespan spans approximately four years or 210 injections, emphasizing its longevity and efficiency in drug delivery systems.

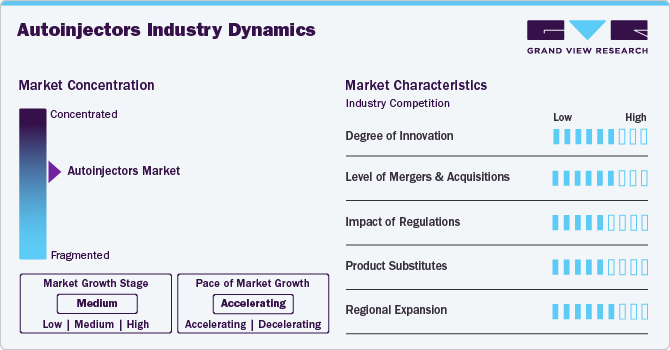

Market Concentration & Characteristics

The auto-injectors industry exhibits notable industry concentration, with key players focusing on innovation and product differentiation. Companies such as Eli Lilly, Pfizer Inc., and Mylan N.V. hold significant market share, leveraging advanced technologies to improve safety and user experience. Key characteristics include a shift towards reusable and sustainable devices, reducing environmental impact. Market growth is driven by rising incidences of allergies and chronic diseases, necessitating reliable drug delivery systems. Regulatory support and increasing healthcare expenditure further propel market expansion.

The autoinjector industry demonstrates a high degree of innovation, with advancements focusing on enhancing safety, usability, and sustainability. Key developments include reusable and rechargeable devices, integration of smart technologies for better dose accuracy, and user-friendly designs to reduce needle anxiety. For instance, in July 2023, researchers at Western University developed an open-source, 3-D printed autoinjector that costs a fraction of commercial versions. The device, costing under USD 7 to produce, aims to improve healthcare access in disadvantaged communities. It's reusable, easy to manufacture, and ensures safe, self-administered medication, enhancing treatment for conditions like diabetes and anaphylaxis.

Mergers and acquisitions in the autoinjectors industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in December 2024, Accord Biopharma announced that Intas Pharmaceuticals Ltd. would acquire the Udenyca (pegfilgrastim) business from Coherus Biosciences Inc. This agreement aims to enhance growth opportunities for Udenyca in the U.S. market, leveraging Intas’s capabilities and resources to expand its presence and accessibility.

Regulations significantly impact the auto-injectors industry by ensuring safety, efficacy, and quality standards. Stringent guidelines from agencies such as the FDA and EMA mandate rigorous testing and approval processes, which drive innovation and improvement in device design. Compliance with these regulations enhances consumer confidence and market adoption. Additionally, regulatory support for sustainable practices and reusable devices promotes environmental responsibility. However, meeting regulatory requirements can increase development costs and time-to-market, influencing competitive dynamics and pricing within the industry. Overall, regulations shape the industry landscape by balancing patient safety with technological advancement.

In the auto-injectors industry, product substitutes include traditional syringes and needle-free injection systems. Traditional syringes are less expensive but lack the convenience and user-friendliness of auto-injectors. Needle-free injection systems offer a pain-free alternative, appealing to patients with needle phobia. However, these substitutes may not provide the same level of dose accuracy and ease of use as auto-injectors, which are designed for reliable, self-administered medication delivery. Emerging technologies and advancements in drug delivery systems continue to enhance the auto-injector market's attractiveness over these alternatives.

Companies are targeting various regions due to the rising prevalence of chronic respiratory conditions and increasing healthcare investments in emerging markets. Regional diversification boosts global market presence for companies and enhances access to advanced autoinjectors in underserved areas, promoting overall healthcare improvements. For instance, in May 2024, Gerresheimer announced expansion of its Peachtree City, Georgia site with a USD 180 million investment. The expansion increases the production of medical systems such as inhalers and autoinjectors.

Product Insights

The disposable autoinjectors segment accounted for the largest market share of 56.8% in 2024 and is expected to witness the fastest CAGR over the forecast period. They are primarily used for self-administration by patients with chronic conditions such as diabetes, rheumatoid arthritis, and severe allergies. Moreover, market players are developing innovative products to address the increasing demand for disposable auto-injectors. For instance, in August 2024, the FDA approved Zurnai (nalmefene) single-dose auto-injector for emergency treatment of known or suspected opioid overdoses in adults and pediatric patients. This approval aims to provide a new option for rapid intervention in overdose situations, addressing the ongoing opioid crisis. The development of such advanced single-use autoinjectors further contributes to the growth of the segment.

The reusable autoinjector segment is witnessing significant growth, driven by increasing patient preference for convenience and cost-effectiveness. The rise in chronic diseases requiring regular medication, such as diabetes and rheumatoid arthritis, further fuels the segment growth. Technological advancements have enhanced their design, improving user experience through features such as user-friendly grips and smart technology integration for dosage tracking. As healthcare systems emphasize personalized medicine, the adaptability of reusable autoinjectors aligns well with evolving treatment protocols.

Indication Insights

The diabetes segment accounted for the largest market share of 28.9% in 2024. This dominance is due to the high prevalence of diabetes worldwide and the necessity for regular insulin injections among diabetic patients. Auto-injectors provide a convenient, reliable method for self-administration of insulin, improving patient compliance and management of blood glucose levels. Innovations in auto-injector technology, such as easy-to-use designs and digital connectivity for monitoring dosage, further boost their adoption. The growing diabetic population, coupled with increasing awareness and preference for advanced drug delivery systems, continues to drive significant demand in this segment.

Themultiple sclerosis (MS) segment is expected to witness the fastest growth over the forecast period. This growth is driven by the rising prevalence of MS and the increasing adoption of disease-modifying therapies (DMTs) that require regular, precise dosing. Auto-injectors offer MS patients enhanced convenience and adherence through easy self-administration and innovative features, such as needle shields and audible cues. As new DMTs are introduced and patient preference for home-based treatments grows, the demand for advanced auto-injectors in the MS segment is expected to surge significantly.

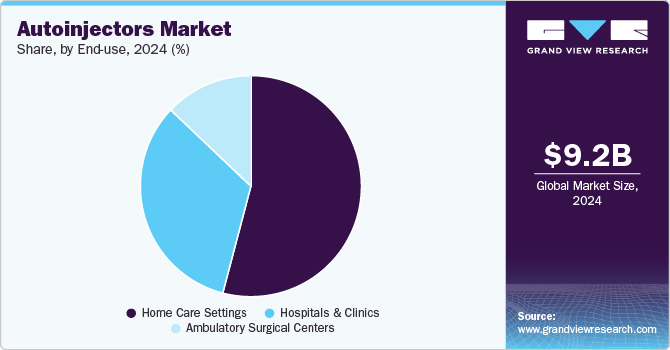

End-use Insights

The homecare settings segment accounted for the largest revenue share of 54.1% in 2024 and is expected to witness the fastest growth over the forecast period. Auto-injectors enable easy, safe self-administration of medications, reducing the need for frequent healthcare visits and offering greater convenience. For instance, in April 2025, Spark Hormone Therapy introduced a new auto-injector designed to simplify at-home hormone injections. This innovative device aims to enhance convenience and comfort for patients undergoing hormone therapy, allowing for easier self-administration. Such initiatives by market players are significantly increasing the access of these devices to patients further contributing to the segment growth.

The hospitals and clinics segment is also expected to witness significant growth over the forecast period. This can be attributed to the rising focus on patient-centered care within hospitals and clinics, as these facilities aim to improve treatment outcomes through innovative medical devices. Additionally, government initiatives promoting self-administration of medications have further enhanced the adoption of auto-injectors in clinical settings.

Regional Insights

The North America autoinjectors market dominated the overall global market and accounted for the 45.3% revenue share in 2024. The market in North America is driven by the high prevalence of chronic diseases such as diabetes, anaphylaxis, and rheumatoid arthritis. Advanced healthcare infrastructure, increased awareness about self-administration of drugs, and technological innovations in drug delivery systems contribute significantly to market growth. Major companies are investing in research and development to introduce user-friendly and efficient auto-injectors. Supportive government policies and high healthcare expenditure further strengthen market expansion.

U.S. Autoinjectors Market Trends

The autoinjectors market in the U.S. held a significant share of North America's auto-injectors industry in 2024. Advancements in medical device technologies, enhanced healthcare facilities, and a strong demand for high-quality products are driving growth in the U.S. market. According to an article by American College of Allergy, Asthma & Immunology in June 2023, around 7.7% of Americans have asthma, totaling approximately 24.9 million individuals, which includes 20.2 million adults and 4.6 million children. The prevalence is higher among adults (8.0%) compared to children (6.5%), and more common in females (9.7%) than males (6.2%). Asthma patients accounted for 94,000 hospital inpatient stays and over 900,000 emergency department visits.

With over 25 million Americans affected by asthma and allergies ranking as a significant chronic health issue, the region sees around 200,000 emergency cases annually due to food allergies, highlighting the anticipated rise in demand.

Europe Autoinjectors Market Trends

The Europe market for autoinjectors has experienced notable expansion, propelled by higher rates of chronic illnesses such as rheumatoid arthritis and multiple sclerosis. Companies such as Stevanato Group have made substantial investments in scalable manufacturing and industrialization in Europe, focusing on tool design, injection molding, and metrology to ensure precision in producing high-quality components for devices such as Aidaptus. These efforts contribute significantly to market growth by meeting increasing demand with reliable, well-crafted products.

UK Autoinjectors Market Trends

In the UK, the autoinjectors market is growing due to the rising prevalence of allergies, with over 20% of the UK population suffering from at least one allergy, making adrenaline auto-injectors (AAIs) vital for those at risk of anaphylaxis, capable of saving lives, according to Medicines and Healthcare products Regulatory Agency data published in June 2023. AAIs like Epipens and Jext are prescribed for these individuals. NHS Digital’s Hospital Episode Statistics reveal that allergy and anaphylaxis hospital admissions in England have almost doubled over twenty years, from 13,440 in 2001-02 to over 26,000 in 2021-22, thereby fueling the market expansion.

The autoinjectors market in France is evolving with a focus on health monitoring for chronic conditions like diabetes and cardiovascular diseases. For instance, according to the IDF Report 10th edition, by 2045, France is expected to have 4,225.7 thousand individuals aged 20-79 living with diabetes. French healthcare policies emphasizing patient-centered care and technological advancements support market expansion.

The Germany autoinjectors market is experiencing notable growth as the German manufacturers have established a strong reputation for producing high-quality medical devices. The country’s rigorous quality control standards and adherence to safety regulations further enhance this reputation. As a result, healthcare providers trust German-made medical devices leading to increased sales and market dominance.

Asia Pacific Autoinjectors Market Trends

The Asia Pacific auto-injectors market is experiencing significant growth, driven by the rising prevalence of chronic diseases, increased awareness about advanced drug delivery systems, and growing demand for self-administration options, contributing to market expansion. Improvements in healthcare infrastructure and economic growth in countries such as China, India, and Japan further support this trend. Additionally, government initiatives to enhance healthcare access and affordability boost market development. The entry of key market players and increasing investments in research and development for innovative auto-injector technologies are also pivotal in driving this region's growth.

The autoinjectors market in Japan is poised for rapid growth, driven by innovations in auto-injectors. such as battery-free, high-tech patches for monitoring lifestyle-related diseases such as heart disorders, stress indicators, and sleep apnea. These advancements offer continuous health monitoring with minimal discomfort, appealing to Japan's aging population and their increasing focus on health management.

The China autoinjectors market is expected to grow in the Asia Pacific in 2024, due to the increasing demand for wearable patches and technological advancements. For instance, in August 2024, AstraZeneca’s Fasenra (benralizumab) was approved in China for treating severe eosinophilic asthma. This approval is based on clinical trial results demonstrating its efficacy in reducing exacerbations and improving lung function, providing a new treatment option for patients with this severe form of asthma. This introduction of new products in the country’s market is expected to fuel the market growth over the forecast period.

The autoinjectors market in India is driven by the rising prevalence of chronic diseases such as diabetes and rheumatoid arthritis. According to a study published by the Indian Council of Medical Research - India Diabetes (ICMR INDIAB) in 2023, the prevalence of diabetes in India is estimated to be 101 million. Increasing awareness and adoption of self-administration devices are boosting market demand. Auto-injectors offer convenience, safety, and improved compliance, making them a preferred choice for patients. The Indian market is also benefiting from advancements in auto-injector technology and supportive government initiatives promoting home healthcare.

Latin America Autoinjectors Trends

The Latin American autoinjectors industry is fueled by the growing elderly demographic. Aging brings about heightened vulnerability to numerous chronic ailments, prompting the need for auto-injectors as a treatment option. This, coupled with the demand for medications, is propelling market growth in the region.

Brazil Autoinjectors Market Trends

The autoinjector market in Brazil is witnessing significant growth, driven by the rising prevalence of chronic diseases such as diabetes and allergies. The demand for self-administration devices is growing, particularly among patients seeking convenience and efficiency in managing their conditions. Furthermore, collaborations between local manufacturers and global pharmaceutical companies are enhancing product availability and innovation.

Middle East and Africa Auto-Injectors Market Trends

The autoinjector market in the MEA is witnessing significant growth, driven by an increasing prevalence of chronic diseases and a rising geriatric population. Government initiatives aimed at improving healthcare access further contribute to market growth. Additionally, advancements in medical technology and increased healthcare expenditure contribute to growth.

Saudi Arabia Autoinjectors Market Trends

The autoinjectors market in Saudi Arabia is anticipated to expand in the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, as per Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

Key Autoinjectors Company Insights

The competitive scenario in the auto-injectors industry is highly competitive, with key players such as Eli Lilly, Gerresheimer and Sanofi holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Autoinjectors Companies:

The following are the leading companies in the autoinjectors market. These companies collectively hold the largest market share and dictate industry trends.

- Eli Lilly

- SHL Medical AG

- AbbVie, Inc.

- Amgen

- Owen Mumford

- Ypsomed

- Teva Pharmaceutical

- Biogen Idec

- Mylan N.V.

- Pfizer, Inc.

- Sanofi

- Gerresheimer

Recent Developments

-

In March 2024, Ypsomed reported to de-invest its insulin pen needle and blood sugar monitoring operations to MTD Group to focus on smart pumps and autoinjector development. This shift allows Ypsomed to invest over USD 111 million in expanding its Solothurn site. The transition, retaining jobs until the end of 2024, will see Ypsomed as a contract manufacturer until mid-2025.

-

In October 2023, Altaviz introduced the AltaVISC auto-injector platform for drug delivery, which is designed to handle high-volume and high-viscosity biologics. Pico-cylinders enable precise and sustainable drug administration by controlling temperature and gas composition. This platform supports various drug formulations, including shear-sensitive molecules, and with its innovative technology, it aims to improve at-home treatments.

-

In May 2023, Revive Innovations, an InnovationRCA start-up, created a stylish, compact auto-injector designed to fit easily into a pocket or handbag, reducing stigma and inconvenience for users. The device aims to make it easier for people to carry life-saving auto-injectors for allergic emergencies.

Autoinjectors Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 10.2 billion |

|

Revenue forecast in 2030 |

USD 20.6 billion |

|

Growth Rate |

CAGR of 15.1% from 2025 to 2030 |

|

Actual Data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, indication, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

Eli Lilly; Scandinavian Health Ltd.; AbbVie, Inc.; Amgen; Owen Mumford; Ypsomed; Teva Pharmaceutical; Biogen Idec; Mylan N.V.; Pfizer, Inc.; Sanofi,Gerresheimer AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Autoinjectors Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global auto-injectors market report on the basis of product, indication, end-use and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Disposable auto-injectors

-

Reusable auto-injectors

-

Prefilled

-

Empty

-

-

-

Indication Outlook (Revenue, USD Million; 2018 - 2030)

-

Rheumatoid Arthritis

-

Multiple Sclerosis

-

Diabetes

-

Anaphylaxis

-

Other Therapies

-

-

End-use Outlook (Revenue, USD Million2018 - 2030)

-

Homecare Settings

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

-

Region Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global autoinjectors market size was estimated at USD 9.2 billion in 2024 and is expected to reach USD 10.22 billion in 2025.

b. The global autoinjectors market is expected to grow at a compound annual growth rate of 15.1% from 2025 to 2030 to reach USD 20.6 billion by 2030.

b. The disposable autoinjectors segment had the largest market share of 56.8% in 2024. This is attributable to advancements in these devices and their increasing adoption for the administration of chronic conditions such as diabetes, rheumatoid arthritis, and severe allergies.

b. Some of the players operating in the market are Eli Lilly; Scandinavian Health Ltd.; AbbVie, Inc.; Amgen; Owen Mumford; Ypsomed; Teva Pharmaceutical; Biogen Idec; Mylan N.V.; Pfizer, Inc.; and Sanofi.

b. Key factors that are driving the market growth include an increasing prevalence of chronic diseases such as diabetes and anaphylaxis, necessitating user-friendly medication delivery systems. Supportive government policies, increased healthcare expenditure, and demand for minimally invasive devices further boost market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."