- Home

- »

- Next Generation Technologies

- »

-

Auto-boxing Technology Market Size And Share Report, 2030GVR Report cover

![Auto-boxing Technology Market Size, Share & Trends Report]()

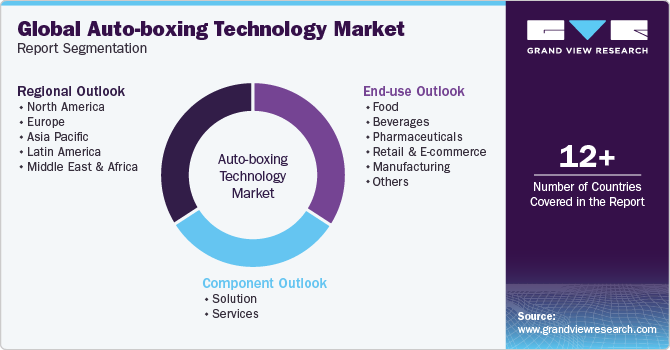

Auto-boxing Technology Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By End-use (Food, Beverages, Pharmaceuticals, Retail & E-commerce, Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-290-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Auto-boxing Technology Market Size & Trends

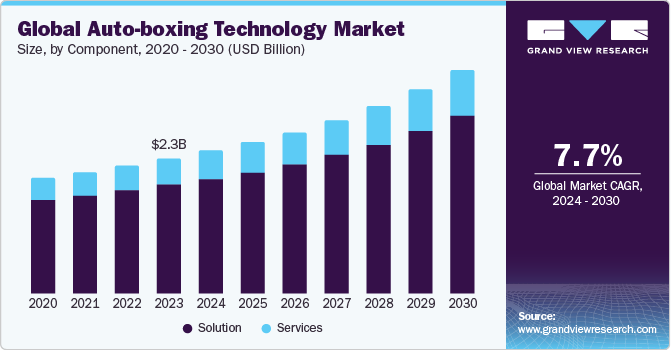

The global auto-boxing technology market size was estimated at USD 2.31 billion in 2023 and is projected to grow at a CAGR of 7.7% from 2024 to 2030. The market growth is driven by various factors, such as the expansion of the e-commerce sector, the need to reduce packaging costs, and to optimize operational efficiency. Auto-boxing technology involves producing on-demand custom sized boxes as per product specifications. Auto-boxing systems utilize intelligent and automated technology to address various applications in the packaging process, such as filling, building, and sealing boxes.

Auto-boxing technology solutions offer numerous benefits, such as enhanced productivity, reduced costs, and a lower environmental footprint. They address various pain points, such as warehouse labor shortages and lower speeds. Automated box-making systems ensure the packaging process runs smoothly despite labor shortages. Moreover, they reduce material usage and shipping volume as they produce optimal sized boxes. Automated packaging solutions help improve the safety of workers thereby enhancing employee satisfaction.

The global e-commerce sector is growing at a rapid pace, driven by the convenience of online shopping and the rising penetration of smartphones and the Internet. According to the International Trade Administration (ITA) of the U.S. Department of Commerce, the Gross Merchandise Value (GMV) of global Business-to-business (B2B) e-commerce is expected to grow from USD 24,453 billion in 2023 to USD 36,163 billion in 2026. The expectations of faster delivery times and broader product selection options on e-commerce websites are likely to continue driving the expansion of the e-commerce market. This is likely to create significant growth opportunities for the market as businesses will look to implement efficient and low-cost protective packaging solutions.

Moreover, the growing awareness about sustainability among businesses and consumers is driving the demand for environmentally sustainable solutions. As auto-boxing technology solutions usually generate less waste and consume less energy than their manual counterparts, they are likely to witness growth in adoption.

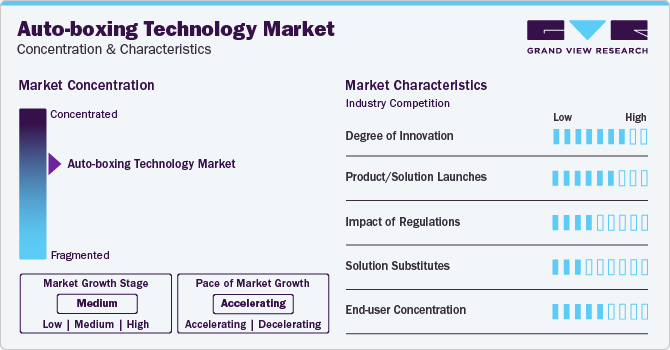

Market Concentration & Characteristics

The auto-boxing technology market growth stage is medium and the pace of growth is accelerating. The market is competitive, with the presence of numerous players. It is characterized by a high degree of innovation owing to advancements in automation technologies and the integration of technologies such as Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT).

The target market is also characterized by a high number of product launches by the leading players. For instance, in August 2023, Packsize International, Inc. announced the launch of PackNet Cloud, a cloud-enabled solution that seamlessly integrates with the company's On Demand Packaging machines. The production and optimization software enables businesses to reduce expenses and optimize their packaging operations.

The companies operating in the market are subject to various laws and regulations concerning product safety, environmental, and trade and import regulations. Moreover, these companies are subject to local, state, federal, and foreign laws concerning occupational health and safety.

The substitutes will depend on various factors, such as budget constraints, sustainability goals, and among others. The substitutes for auto-boxing technology solutions can include traditional packaging machinery or opting for manual box-making methods. However, auto-boxing solutions are highly efficient and cost-effective for standardized and high-volume packaging needs.

Many industries, including healthcare, retail & e-commerce, manufacturing, food, and beverages, are adopting packaging automation to improve their operational efficiency and reduce packaging costs. Moreover, auto-boxing technology solutions can help businesses in sectors such as food, beverages, and pharmaceuticals to maintain product quality and meet regulatory compliance.

Component Insights

The solution segment dominated the target market with a revenue share of over 80.0% in 2023. This can be attributed to various factors, such as the growing innovation in auto-boxing systems and the need for flexible & efficient protective packaging solutions to meet the growing need for safe and fast delivery of products. Auto-boxing solutions consist of hardware, such as automatic box-making machines with integrated software, which helps in making customized boxes. For instance, Packsize International, Inc., a U.S.-based company, offers box-making hardware, such as the X series, integrated with its PackNet software, helping in creating custom-sized boxes efficiently.

The services segment is expected to register the fastest CAGR of 8.3% over the forecast period. The segment’s growth can be attributed to the need to ensure the optimal performance of auto-boxing technology hardware and software and minimize system downtime. Effective maintenance and support services are essential for maximizing the value, reliability, and performance of auto-boxing technology solutions, enabling businesses to streamline their packaging processes, improve efficiency, and enhance customer satisfaction. Sparck Technologies, a Netherlands-based company, offers services, such as on-site services, training services, and remote support, for auto-boxing solutions.

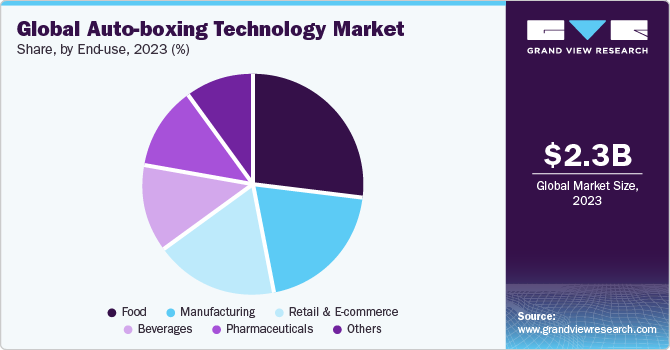

End-use Insights

The food segment held the largest market share of over 26.0% in 2023. The growing demand for packaged food and the need to comply with stringent food safety requirements can be attributed to this segment leading the market. Rising preference for convenience driven by hectic lifestyles is driving the demand for packaged food. Moreover, auto-boxing technology solutions can minimize human contact during the packaging process of food products, minimizing the risk of contamination, maintaining high standards of product quality, and ensuring regulatory compliance.

The retail & e-commerce segment expected to register the fastest CAGR of 8.9% over the forecast period. The segment’s growth can be attributed to the growing need for automated and efficient packaging solutions to address labor shortages and meet the demand for high volumes of shipping orders. The growing trend of online shopping is driving the need for auto-boxing solutions as they can create on-demand custom-sized boxes at a fast pace. For instance, CMC Packaging Automation’s CMC Genesys can produce up to 850 boxes per hour, and Packsize International, Inc.’s X7 box-making machine can produce up to 1,020 boxes per hour. Similarly, with the growing demand for fast delivery times in the e-commerce sector, businesses most likely adopt auto-box-making solutions to improve their packaging process.

Regional Insights

The auto-boxing technology market in North America is expected to grow at a significant CAGR of 7.3% from 2024 to 2030. The growth of the market in the region is attributable to the need to reduce operating costs in the packaging process by minimizing labor costs. The labor costs in North American countries are among the highest in the world. According to the International Labour Organization (ILO), in 2022, the hourly labor costs in the U.S. were USD 40.23, and in Canada, USD 32.74 in 2021. Auto-boxing technology solutions reduce the dependence on labor, thereby streamlining operations and reducing labor costs. Moreover, the region’s developed technological infrastructure is driving the adoption of packaging automation solutions.

U.S. Auto-boxing Technology Market Trends

The auto-boxing technology market in the U.S. is projected to grow at a CAGR of 7.1% from 2024 to 2030. The growth can be attributed to the presence of prominent auto-boxing technology companies, such as Packsize International, Inc. and WestRock Company. Moreover, stringent regulations in the food & beverages and healthcare sectors are likely to drive market growth as businesses will likely adopt solutions that help ensure regulatory compliance in the packaging process.

Europe Auto-boxing Technology Market Trends

The auto-boxing technology market in Europe was estimated at USD 521.6 million in 2023. The market’s growth in the region is driven by the growing introduction of environmental sustainability policies and regulations. For instance, in November 2022, the European Commission introduced new rules regarding packaging across the European Union (EU). The new rules aimed to reduce waste by limiting over-packaging and promoting reusable packaging options. Auto-boxing technology systems make custom-fit boxes, limiting packaging waste. This is likely to drive the market growth in the region.

The Germany auto-boxing technology market is expected to grow at a CAGR of 7.6% from 2024 to 2030. The growth can be attributed to the country's strong manufacturing sector. Germany’s robust automotive and pharmaceutical sectors are likely to drive the demand for auto-boxing machines in these sectors' packaging processes.

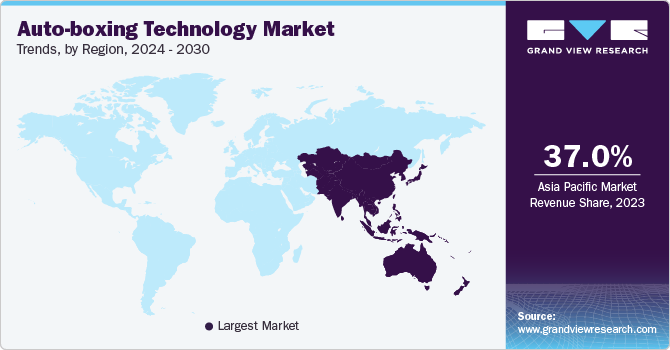

Asia Pacific Auto-boxing Technology Market Trends

Asia Pacific dominated the market and accounted for over 37.0% of the revenue share in 2023. The target market’s growth in the region can be attributed to the rapid expansion of the e-commerce sector in the region. The growing internet and smartphone penetration in the region is driving the growth of the e-commerce sector in the region. Moreover, the region constitutes a high percentage of the global population, which is likely to drive the demand for food & beverages and pharmaceutical products, and for efficient packaging. Governments in the region are taking initiatives to boost automation across industries. For instance, in September 2021, the Singapore government announced the Integrated Robotics & Automation Solutions initiative. Through the initiative, the government aimed to finance construction companies to adopt robotics and automation solutions to address workforce shortages in Singapore. Hence, the growing adoption of automation technologies is likely to impact the market’s growth positively.

The auto-boxing technology market in China is projected to grow at a CAGR of 8.2% from 2024 to 2030. This growth is expected to be driven by the Chinese government's support for automation, high manufacturing activities, and the country's strong e-commerce sector. According to the International Federation of Robotics (IFR), in 2022, China witnessed a surge of 5% in the number of industrial robot installations from 2021. This depicts the growing adoption of automation technologies in the country, positively impacting the target market.

Key Auto-boxing Technology Company Insights

Some of the key companies operating in the market include Bell and Howell LLC; Packsize International, Inc.; WestRock Company; and Ranpak.

-

Packsize International, Inc. is a U.S.-based company manufacturing advanced packaging systems. It offers a range of auto-boxing technology solutions, including automated packaging systems and software platforms. The company has a global presence, with a presence in various countries, including the U.S., Sweden, Germany, France, the U.K., Poland, and the Netherlands.

-

WestRock Company is a U.S.-based company that offers packaging solutions worldwide. The company operates in four business segments, namely, Consumer Packaging, Global Paper, Corrugated Packaging, and Distribution. Its on-demand automation solutions enable businesses to customize box sizes. The company has a global presence, with offices across North America, Europe, South America, Asia, and Australia.

CMC Packaging Automation and T-ROC EQUIPMENT are some of the emerging companies in the target market.

-

CMC Packaging Automation is an Italy-based company that provides automated packaging and mailing solutions. It offers a range of auto-boxing technology solutions designed to streamline the packaging process. These solutions utilize advanced machinery and software to automatically create custom-sized boxes, optimizing efficiency and reducing material waste.

-

T-ROC EQUIPMENT, a U.S.-based company, provides automated box-making machines. The company was founded in 1999, and it provides machines that can create on-demand custom boxes of various sizes. It has sold over 400 machines in about 12 countries worldwide.

Key Auto-Boxing Technology Companies:

The following are the leading companies in the auto-boxing technology market. These companies collectively hold the largest market share and dictate industry trends.

- CMC Packaging Automation

- Bell and Howell LLC

- Packsize International, Inc.

- WestRock Company

- T-Roc Equipment

- Aopack

- Kolbus Autobox (KOLBUS GmbH & Co. KG)

- Ranpak

- Panotec Srl Unipersonale

- EMBA Machinery AB

- Zemat Technology Group

- Pattyn

- Sparck Technologies

Recent Developments

-

In March 2024, CMC Packaging Automation North America, a subsidiary of CMC Packaging Automation, inaugurated its innovative 30,000-square-foot Tech Center in Georgia, U.S. The Tech Center aims to foster experimentation, innovation, and collaboration, positioning CMC Packaging Automation as a frontrunner in developing innovative solutions and sustainable materials to address evolving needs.

-

In February 2023, Packsize International, Inc. announced the launch of X5, a fully automated erected box system designed to produce up to 600 boxes per hour. The X5 streamlines packaging processes while reducing environmental impact. The X5 solution addresses labor shortages, cost concerns, and waste issues and aids manufacturers and e-commerce companies in meeting customer demand.

-

In September 2022, Ranpak announced the launch of the next generation Cut’it! EVO, an automated in-line packing machine designed to reduce costs, enhance efficiency, and improve sustainability in packaging operations. The redesigned Cut’it! EVO utilizes the Industrial Internet of Things (IoT)-enabled technology and can produce up to 15 boxes per minute.

Auto-boxing Technology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.44 billion

Revenue forecast in 2030

USD 3.82 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

CMC Packaging Automation; Bell and Howell LLC; Packsize International Inc.; WestRock Company; T-Roc Equipment; Aopack; Kolbus Autobox (KOLBUS GmbH & Co. KG); Ranpak; Panotec Srl Unipersonale; EMBA Machinery AB; Zemat Technology Group; Pattyn; Sparck Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Auto-boxing Technology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global auto-boxing technology market report based on component, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Food

-

Beverages

-

Pharmaceuticals

-

Retail & E-commerce

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global auto-boxing technology market size was estimated at USD 2.31 billion in 2023 and is expected to reach USD 2.44 billion in 2024.

b. The global auto-boxing technology market is expected to grow at a compound annual growth rate of 7.7% from 2024 to 2030 to reach USD 3.82 billion by 2030.

b. Asia Pacific dominated the auto-boxing technology market with a share of over 37.0% in 2023. This is attributable to the growing e-commerce sector in the region.

b. Some key players operating in the auto-boxing technology market include CMC Packaging Automation, Bell and Howell LLC, Packsize International, Inc., WestRock Company, T-ROC EQUIPMENT, Aopack, Kolbus Autobox (KOLBUS GmbH & Co. KG), Ranpak, PANOTEC SRL UNIPERSONALE, EMBA Machinery AB, Zemat Technology Group, Pattyn, and Sparck Technologies.

b. Key factors driving the market growth include the worldwide expansion of the e-commerce sector and the growing need for cost-effective and efficient packaging solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.