- Home

- »

- Medical Devices

- »

-

Australia And New Zealand Wound Care Market, Report, 2030GVR Report cover

![Australia And New Zealand Wound Care Market Size, Share & Trends Report]()

Australia And New Zealand Wound Care Market Size, Share & Trends Analysis Report By Product (Advanced, Traditional), By Application, By End Use, By Mode Of Purchase, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-413-1

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

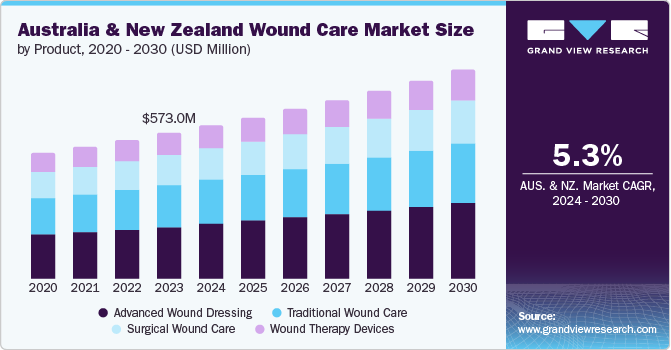

The Australia and New Zealand wound care market size was valued at USD 573.02 million in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030. Several key drivers contributing to its growth include the increasing prevalence of chronic wounds, rising geriatric population, advancements in wound care technology, and heightened wound management awareness. Each factor significantly shapes the market landscape, leading to greater demand for innovative products and services to improve patient outcomes.

The growing prevalence of diseases can be attributed to various factors, including lifestyle changes, obesity rates, and an increase in diabetes cases. For instance, Diabetes Australia reported that approximately 1.2 million Australians were living with diabetes in 2021, a number projected to rise significantly over the next decade. The high burden of chronic wounds necessitates effective wound care solutions, driving demand for advanced products and treatment options.

The aging population in Australia and New Zealand (ANZ) is another critical driver impacting the wound care market. With life expectancy reaching an average of 82 years in Australia, the percentage of older individuals prone to developing wounds is also on the rise. According to The Australian Bureau of Statistics, it is projected that by 2050, nearly 25% of Australia's population will be aged 65 and older. Older adults experience comorbidities such as diabetes or vascular diseases that can lead to chronic wounds. Consequently, healthcare systems increasingly focus on specialized wound care services tailored for this demographic group, further propelling market growth.

Advancements in medical technology also play a vital role in driving the Australia & New Zealand wound care market. Innovations such as bioactive dressings, negative pressure wound therapy, and telemedicine integration enhance wound management practices. For instance, they are introducing bioactive dressings containing growth factors or antimicrobial agents, which have shown promising results in improving healing times and reducing infection rates. These technological advancements encourage healthcare providers to adopt more effective wound care solutions, ultimately benefiting patient outcomes.

Market Concentration & Characteristics

Degree of innovation in the ANZ wound care market is currently assessed as high. This sector has seen significant technological advancements, particularly with the development of advanced wound dressings, bioengineered tissues, and negative pressure wound therapy systems. The integration of digital health technologies, such as telemedicine for wound management and mobile applications for monitoring wound healing, further exemplifies this high level of innovation. For instance, In July 2022, Smith+Nephew launched a Clinical Support App to minimize variations in wound care practices.

Level of merger and acquisition (M&A) activities in the market is considered medium. M&A activities are driven by the need for companies to diversify their product lines and leverage synergies for cost efficiencies. For instance, in July 2023, Coloplast reached a deal to purchase Kerecis, a rapidly growing and innovative company specializing in wound care biologics. While not as rampant as in other sectors, including technology or pharmaceuticals, these strategic moves indicate a healthy level of consolidation within the industry.

Impact of regulations is rated high due to stringent compliance requirements set forth by health authorities such as the Therapeutic Goods Administration (TGA) in Australia and Medsafe in New Zealand. These regulatory bodies enforce rigorous standards for product safety, efficacy, and quality control before new wound care products enter the market. For instance, in April 2023, 3M Australia Pty Ltd received approval from the Australian Register of Therapeutic Goods (ARTG) for their Wound hydrogel dressing, a sterile product.

The trend toward product expansion is classified as high. Companies are actively broadening their product ranges to cater to diverse patient needs across various types of wounds, such as diabetic ulcers, surgical wounds, and burns. For instance, in January 2023, Convatec introduced ConvaFoam, a new series of innovative foam dressings aimed at addressing the requirements of both healthcare professionals and patients. These dressings are versatile and suitable for various types of wounds, regardless of their healing stage, streamlining the processes involved in wound care and skin protection.

Product Insights

Advanced wound dressing held the largest revenue share of 35.4% in 2023. Advanced dressings, including hydrocolloids, hydrogels, and alginates, provide superior moisture management and are designed to create an optimal healing environment. For instance, Smith Nephew’s ALLEVYN LIFE Foam Dressings enhanced efficiency and patient satisfaction in community wound management settings. Their unique design and features help address the challenges faced by clinicians in delivering effective wound care while working within budget constraints.

The surgical wound care segment is experiencing significant market growth, driven by several key factors. One primary driver is the increasing number of surgical procedures performed in these regions, fueled by an aging population and a rise in chronic diseases that necessitate surgical interventions. Additionally, advancements in surgical techniques and technologies, such as minimally invasive surgeries, led to a greater focus on effective wound management to enhance recovery times and reduce complications.

Application Insights

Chronic wounds held the largest revenue share of 60.6% in 2023, primarily driven by an increasing prevalence of chronic conditions such as diabetes and vascular diseases, which lead to complications such as diabetic foot ulcers and venous leg ulcers. Advancements in wound care technologies, including innovative dressings, negative pressure wound therapy (NPWT), and bioengineered tissues, significantly improved treatment outcomes, thereby driving demand for chronic wound management solutions. According to a study by the University of Sheffield and the University of South Australia in March 2024, innovative plasma-activated hydrogel dressings transform the approach to chronic wound care. This treatment utilizes plasma activation on hydrogel dressings, widely used in wound management and incorporating a distinctive blend of chemical oxidants. These oxidants effectively decontaminate wounds and promote healing in chronic cases.

The acute wounds segment is experiencing the fastest-growing CAGR due to several key drivers. Firstly, the increasing incidence of traumatic injuries, surgical procedures, and accidents led to a higher demand for effective wound management solutions. For instance, in 2022-23, the home was the most frequently reported location for injuries, with approximately 162,000 cases. This was followed by streets or highways, which recorded around 51,900 cases, sports areas with 29,700 cases, and aged care facilities with about 27,500 cases, necessitating advanced wound care products that promote rapid healing and reduce infection risks.

End Use Insights

The hospital segment dominated the market in 2023 with a share of 39.01%. Hospitals are crucial in treating acute and chronic wounds, requiring a diverse range of advanced wound care products to manage complex cases effectively. The rising incidence of conditions linked to wound development, including diabetes, obesity, and an aging population, substantially increased the demand for specialized wound care services in hospital settings. Moreover, technological advancements have led to innovative wound care solutions that enhance healing times and patient outcomes, prompting hospitals to allocate more resources toward these products.

The home healthcare segment is emerging as the fastest-growing segment, which is primarily driven by an aging population, increasing prevalence of chronic wounds, and a shift toward patient-centric care models. The rise in home healthcare services is attributed mainly to the growing demand for cost-effective healthcare solutions that allow patients to receive treatment in the comfort of their homes, thereby reducing hospital stays and associated costs. Additionally, advancements in wound care technologies, such as innovative dressings and telehealth services, facilitated the effective management of wounds outside traditional clinical settings.

Mode Of Purchase Insights

Prescribed wound care products dominated the market with a revenue share of 62.7% in 2023. Healthcare systems in ANZ increasingly emphasize evidence-based practices, which promote the use of prescribed wound care solutions that have been clinically validated for effectiveness. Government-funded health programs and insurance coverage for prescribed wound care products further bolster this segment’s growth by making these necessary treatments more accessible to patients. For instance, in March 2024, wounds Australia has been awarded USD 2 million to implement a national education and awareness campaign focused on the prevention and treatment of chronic wounds. The initiative aims to enhance public understanding and patient knowledge regarding effective wound care practices, ultimately improving healing outcomes.

Another driver for the prescribed segment’s growth is the rising awareness among patients regarding proper wound management and care. As patients become more informed about their health conditions, they are more likely to seek professional advice and adhere to prescribed treatments. Moreover, technological advancements resulted in innovative wound care solutions available only through prescription, such as bioengineered skin substitutes and advanced dressings with antimicrobial properties.

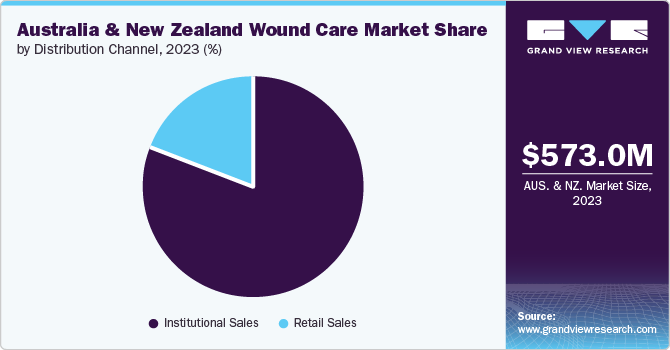

Distribution Channel Insights

The institutional sales segment held the largest share in 2023. Firstly, hospitals and healthcare facilities are significant consumers of wound care products due to their high patient turnover and the necessity for advanced wound management solutions, particularly for chronic wounds, surgical wounds, and burns. The increasing prevalence of conditions such as diabetes and obesity has led to a rise in chronic wounds, thereby amplifying demand for specialized wound care products in institutional settings.

Retail sales are expected to grow at the fastest-growing CAGR over the forecast period owing to the increasing consumer awareness regarding wound care products, which led to a surge in demand for over-the-counter (OTC) wound care solutions available in retail settings. This trend is further fueled by the rise of e-commerce platforms that facilitate more accessible access to wound care products, allowing consumers to purchase items conveniently from home.

Key Australia And New Zealand Wound Care Company Insights

The ANZ wound care market is characterized by a competitive landscape dominated by several key companies holding a significant market share. These companies are involved in developing and distributing advanced wound care products, including dressings, topical agents, and other therapeutic solutions to promote healing and prevent infection. The market is segmented into various categories, such as traditional wound care, advanced wound care, and surgical wound care, with advanced wound care products witnessing the highest growth due to increasing awareness about chronic wounds and the rising prevalence of conditions such as diabetes and obesity.

Key Australia And New Zealand wound Care Companies:

- Smith+Nephew

- Mölnlycke Health Care AB

- Convatec Group PLC

- Ethicon (Johnson & Johnson)

- Baxter

- DeRoyal Industries, Inc.

- Coloplast Corp.

- Medtronic

- 3M

- Integra LifeSciences Corporation.

Recent Developments

-

In April 2024, Smith+Nephew launched the RENASYS EDGE Negative Pressure Wound Therapy System, offering a new home care solution for patients with chronic wounds. This innovative system is designed to be lightweight and portable, allowing patients to manage their treatment comfortably while continuing their daily activities.

-

In April 2024, Mölnlycke Health Care agreed to purchase P.G.F. Industry Solutions GmbH, a producer of products designed for wound cleansing.

Australia And New Zealand Wound Care Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 820.17 million

Growth rate

CAGR of 5.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, mode of purchase, distribution channel

Key companies profiled

Smith+Nephew, Mölnlycke Health Care AB, Convatec Group PLC, Ethicon (Johnson & Johnson), Baxter, DeRoyal Industries, Inc., Coloplast Corp., Medtronic, 3M, Integra LifeSciences Corporation.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia And New Zealand Wound Care Market Report Segmentation

This report forecasts revenue growth in Australia and New Zealand and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Australia and New Zealand Wound Care market report based on product, application, end use, mode of purchase, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Advanced Wound Dressing

-

Foam Dressings

-

Hydrocolloid Dressings

-

Film Dressings

-

Alginate Dressings

-

Hydrogel Dressings

-

Collagen Dressings

-

Other Advanced Dressings

-

-

Surgical Wound Care

-

Sutures & Staples

-

Tissue Adhesives and Sealants

-

Anti-infective Dressing

-

-

Traditional Wound Care

-

Medical Tapes

-

Cotton

-

Bandages

-

Gauzes

-

Sponges

-

Cleansing Agents

-

-

Wound Therapy Devices

-

Negative Pressure Wound Therapy

-

Oxygen and Hyperbaric Oxygen Equipment

-

Electric Stimulation Devices

-

Pressure Relief Devices

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Physician’s Office

-

Nursing Homes

-

Others

-

-

Mode of Purchase Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescribed

-

Non-prescribed (OTC)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Institutional Sales

-

Retail Sales

-

Frequently Asked Questions About This Report

b. The Australia and New Zealand wound care market size was valued at USD 573.02 million in 2023 and is projected to reach USD 602.46 in 2024.

b. The Australia and New Zealand wound care market is projected to grow at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2030 to reach USD 820.17 million in 2030.

b. The advanced wound dressing segment held the largest revenue share of 35.4% in 2023. Advanced dressings, including hydrocolloids, hydrogels, and alginates, provide superior moisture management and are designed to create an optimal healing environment.

b. Some of the key players operating in the ANZ Wound Care market include Smith+Nephew, Mölnlycke Health Care AB, Convatec Group PLC, Ethicon (Johnson & Johnson), Baxter, DeRoyal Industries, Inc., Coloplast Corp., Medtronic, 3M, Integra LifeSciences Corporation.

b. Several key drivers contributing to its growth include the increasing prevalence of chronic wounds, the rising geriatric population, advancements in wound care technology, and heightened awareness of wound management.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."