Australia & New Zealand Research Antibodies Market Size, Share & Trends Analysis Report By Product, By Specificity, By Technology, By Source, By Application, By End Use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-656-1

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

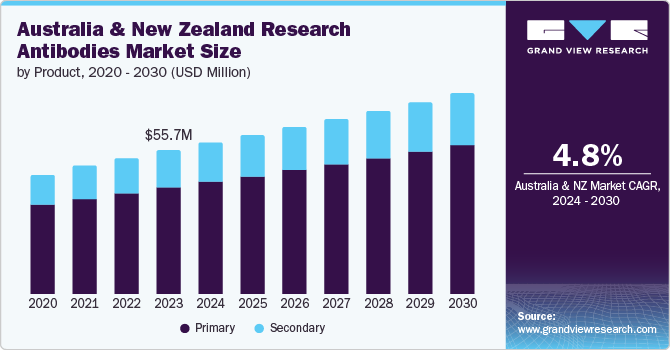

The Australia & New Zealand research antibodies market size was valued at USD 55.7 million in 2023 and is projected to grow at a CAGR of 4.8% from 2024 to 2030. A rise in the number of initiatives undertaken by the Australian government to advance the biotechnology sector is expected to fuel the country's growth. For instance, in February 2024, Australia's National Health and Medical Research Council announced USD 2.8 million in funding for the Global Alliance for Chronic Diseases (GACD) to focus on research activities. This will promote innovation and knowledge in the biotechnology sector. Strategies are being planned to increase researchers' access to government funding. This plan would help increase R&D investments in Australia and is expected to act as a key tool for fostering an alliance between research and industry, thereby improving industrial capabilities in Australia.

The increasing prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders in Australia and New Zealand fuels the demand for research antibodies. This need arises from the push for advanced research to understand these conditions better and develop targeted therapies. Consequently, the market for specific antibodies continues to grow, supporting ongoing biomedical research. For instance, in 2022, around 2.8 million Australians (11% of the population) were living with asthma, which accounted for 2.5% of the total disease burden and 35% of the respiratory disease burden in 2023. Asthma was the leading cause of disease burden in children aged 1-9 years and led to USD 851.7 million in healthcare spending (0.6% of total health expenditure) in 2020-21. The condition was the underlying cause of 467 deaths, or 1.8 per 100,000 population, representing 0.2% of all deaths in 2022.

The growing biotechnology and pharmaceutical sectors in Australia and New Zealand are key market drivers. As these industries expand, the demand for antibodies increases, supporting drug development, diagnostics, and various research activities. The need for innovative solutions in medicine and healthcare fuels this growth. According to the Ministry for Primary Industries, New Zealand's biotech sector, though small, is expanding and comprises 211 companies generating USD 2.7 billion in revenues. Over 45% of these companies are in regional areas, highlighting a significant presence outside major urban centers.

Growth in stem cell and neurobiology-based research is expected to boost the market over the forecast period. The Center of Research Excellence in Neuromuscular Disorders Australia is a wide collaboration of neuromuscular experts to transform treatment into effective therapy of neurological diseases from compassionate management. A rise in the prevalence of neurological disorders is expected to boost the market. According to the statistics presented by the New Zealand government, there will be 30 people aged 65 years and above for every 100 people aged 15-64 by 2028. The prevalence of dementia is, therefore, expected to increase, leading to a rise in R&D about treatment for various neurological disorders.

Product Insights

The primary antibodies segment dominated the market and accounted for a share of 74.1% in 2023 and is expected to grow at the fastest CAGR of 4.8% over the forecast period owing to the rise in the adoption of reagents developed using antibodies, due to the various benefits associated with them such as greater specificity, easy availability, and suitability in various research applications.

The secondary antibodies segment is expected to grow significantly over the forecast period owing to the rising demand for accurate and reliable diagnostic tools, especially in cancer and infectious disease research. These antibodies are crucial for detecting specific proteins or biomarkers in diagnostic assays, ensuring precision and reliability. Consequently, their use is expanding as the need for advanced diagnostic solutions grows in healthcare and research. For instance, Cancer Australia offers online tools to assess cancer risk, including iPrevent, a validated tool for evaluating breast cancer risk and guiding prevention and screening discussions. Additionally, they provide a digital tool for investigating lung cancer symptoms and an online clinical tool for health professionals, aiding in cancer diagnosis and management.

Specificity Insights

The monoclonal antibodies segment dominated the market and accounted for a share of 60.6% in 2023 and is expected to grow at the fastest CAGR of 5.2% over the forecast period due to an increase in research on genomics and personalized medicine, which has led to an increase in the use of these antibodies. As monoclonal antibodies are relatively cost-effective, they are anticipated to grow faster than polyclonal antibodies. In addition, the country exports its antibodies to fuel market growth. For instance, in September 2023, the Indian Council of Medical Research (ICMR) decided to procure 20 more doses of monoclonal antibody from Australia to treat Nipah virus patients in Kerala.

The polyclonal antibodies segment is expected to grow significantly over the forecast period. These have several advantages over monoclonal in various diagnostic settings. Polyclonal antibodies are often the preferred option in routine laboratory tests such as Enzyme-Linked Immunosorbent Assay (ELISA), microarray assays, western blotting, flow cytometry, and immunohistochemistry. These antibodies can be utilized in the study of various diseases. Polyclonal antibodies are relatively inexpensive compared to monoclonal antibodies, which may fuel their demand in low-budget and non-funded research projects.

Technology Insights

The western blotting technology segment dominated the market and accounted for a share of 30.5% in 2023, owing to rising demand for rapid diagnostic methods. On the other hand, technical upgradation is anticipated to create growth prospects for technologies in the pipeline. Western blotting offers high accuracy and sensitivity and is considered a gold standard for testing. In addition, an increase in government initiatives to fund research activities is one of the factors contributing to the highest market share held by this segment, as it is conventionally used in research laboratories.

The immunohistochemistry segment is anticipated to grow at the fastest CAGR of 7.4% over the forecast period. Constant innovations in the technology for better accuracy augment the segment growth. For instance, in November 2023, Bio SB launched a fully automated immunohistochemistry platform for deparaffinization and antigen retrieval and staining. Many leading companies focus on producing quality ICH technology through innovations, product launches, distribution, etc to boost the adoption and contribute to the market's growth in coming years. For instance, in March 2024, Abcam was named a 'Supplier Succeeding in IHC.' The company also received acknowledgment for its biophysical quality control that ensures accuracy in research.

Source Insights

The rabbits segment dominated the market and accounted for a share of 50.8% in 2023. Rabbits are extensively used to produce antibodies, owing to various advantages such as higher affinity and specificity compared with antisera obtained from other animal hosts. The higher specificity of these products makes them ideal for detecting small molecules, such as pollutants, toxins, hormones, drugs, nonprotein targets, such as carbohydrates & lipids, and post-translational alterations, such as phosphorylation. In addition, collaborations between the key players that grant rights to produce rabbit antibodies propel the segment’s growth in the forecast period. For instance, according to the news published by Abcam Limited, the company partnered with Shuwen Biotech to develop and commercialize companion diagnostics. Abcam Limited has also announced that it will provide commercial development rights for high-quality recombinant rabbit monoclonal antibodies to Shuven Biotech. This collaboration is of economic advantage to the company.

The mouse segment is anticipated to grow at the fastest CAGR of 5.1% over the forecast period as mice are convenient to use during the production of antibodies for research purposes and have a wide range of applications. Mice have been predominantly used in the production of antibodies. The structural similarities in mice and human antibodies are a prime factor for high adoption. Cost-effectiveness and the ability to multiply quickly are among the factors fueling the growth of this segment. Moreover, mouse-derived monoclonal and polyclonal antibodies are relatively easier to produce and possess greater specificity. Technological advancements in the development processes of these products, such as hybridoma technology, aid in producing monoclonal antibodies in specialized cells, further augmenting the demand for mouse antibodies.

Application Insights

The oncology segment dominated the market and accounted for a share of 34.3% in 2023. This share can be attributed to the growing prevalence of cancer, which leads to an increase in the need for R&D in advanced therapeutics. Oncology accounted for the largest share of research antibodies in 2018. The segment is also anticipated to grow at a considerable CAGR due to an increased cancer incidence. According to the Global Cancer Observatory, there were 38,157 new cancer cases in New Zealand 2022.These numbers are expected to rise in the coming years.

The infectious diseases segment is expected to grow at the fastest CAGR of 6.7% over the forecast period. The rising prevalence of infectious diseases, the growing geriatric population, decreasing immunity levels, and rising awareness among people about infectious diseases are some of the high-impact-rendering drivers of the market. The growing incidence of autoimmune diseases coupled with the limited presence of advanced therapeutics is predominantly driving the segment growth. Significant advancements in immunology research have boosted the adoption of research antibodies in recent years.

End Use Insights

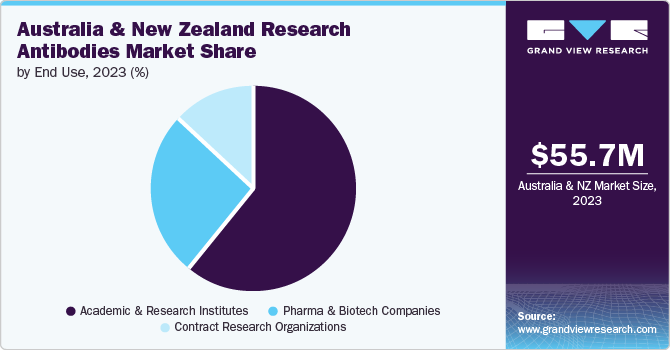

The academic and research institutes segment dominated the market and accounted for a share of 60.6% in 2023 owing to the presence of various academic research groups involved in the study of complex biological systems using advanced reagents. For instance, in June 2021, a gene therapy project in Australia received top rank in National Health and Medical Research Council (NHMRC) Ideas Grant. This research was based on treating neuromuscular disorders in infants.

The contract research organizations segment is expected to grow at the fastest CAGR of 5.4% over the forecast period. The majority of companies prefer CROs owing to the various advantages associated with contract services. These benefits include cost advantage, increased service efficiency, and enhanced productivity, which help a company focus on its core expertise.

Key Australia & New Zealand Research Antibodies Company Insights

Some of the key companies in the Australia & New Zealand research antibodies market include Abcam Limited, Bio-Rad Laboratories, Inc., BD, Merck KGaA, Darmstadt, Germany and its affiliates, Lonza, Thermo Fisher Scientific, Inc., Cell Signaling Technology, Inc., F. Hoffmann-La Roche Ltd., Agilent Technologies, Inc., Revvity. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Abcam Limited is a life science company that develops primary antibodies, ELISA kits, cell lines, sample prep and detection kits, and other similar products to support research, diagnosis, and therapeutic applications.

-

Bio-Rad Laboratories, Inc. has a vast product portfolio that includes antibodies, flow cytometers, immunoassays, etc. Under the antibodies segment, the company provides primary antibodies, secondary antibodies, anti-idiotypic antibodies, fluorescent western blotting antibodies, HRP and AP conjugates, matched antibody pairs, negative isotype controls, and Starbright dyes.

Key Australia & New Zealand Research Antibodies Companies:

- Abcam Limited

- Bio-Rad Laboratories, Inc.

- BD

- Merck KGaA

- Lonza

- Thermo Fisher Scientific Inc.

- Cell Signaling Technology, Inc.

- F. Hoffmann-La Roche Ltd

- Agilent Technologies, Inc.

- Revvity

Recent Developments

-

In June 2024, Bio-Rad Laboratories, Inc launched four anti-idiotypic antibodies along with its anti-monomethyl auristatin E (MMAE) biotherapeutic antibody range. These can be used in bioanalysis, therapeutic drug monitoring for innovator and biosimilar products. This addition expanded its product portfolio under the segment

-

In May 2024, bioLytical Laboratories Inc. announced the distribution of its INSTI Hepatitis C (HCV) Antibody Test in Australian market. This test was registered in the Australian Register of Therapeutic Goods making it a rapid and reliable method to identify hepatitis C.

Australia & New Zealand Research Antibodies Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 58.7 million |

|

Revenue forecast in 2030 |

USD 77.6 million |

|

Growth Rate |

CAGR of 4.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

September 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, specificity, technology, source, application, end use, country |

|

Country scope |

Australia & New Zealand |

|

Key companies profiled |

Abcam Limited; Bio-Rad Laboratories, Inc.; BD; Merck KGaA; Lonza; Thermo Fisher Scientific Inc.; Cell Signaling Technology, Inc.; F. Hoffmann-La Roche Ltd; Agilent Technologies, Inc.; Revvity |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Australia & New Zealand Research Antibodies Market Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Australia & New Zealand research antibodies market report based on product, specificity, technology, source, application, end use, and country.

-

Product (Revenue, USD Million, 2018 - 2030)

-

Primary

-

Secondary

-

-

Specificity (Revenue, USD Million, 2018 - 2030)

-

Monoclonal Antibodies

-

Polyclonal Antibodies

-

-

Technology (Revenue, USD Million, 2018 - 2030)

-

Immunohistochemistry

-

Immunofluorescence

-

Western Blotting

-

Flow Cytometry

-

Immunoprecipitation

-

ELISA

-

Others

-

-

Source (Revenue, USD Million, 2018 - 2030)

-

Mice

-

Rabbit

-

Goat

-

Others

-

-

Application (Revenue, USD Million, 2018 - 2030)

-

Infectious Diseases

-

Immunology

-

Oncology

-

Stem Cells

-

Neurobiology

-

Others

-

-

End Use (Revenue, USD Million, 2018 - 2030)

-

Academic & Research Institutes

-

Contract Research Organizations

-

Pharma & Biotech Companies

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Australia

-

New Zealand

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."