- Home

- »

- Medical Devices

- »

-

Australia And New Zealand Dental Service Organization Market, Report, 2030GVR Report cover

![Australia And New Zealand Dental Service Organization Market Size, Share & Trends Report]()

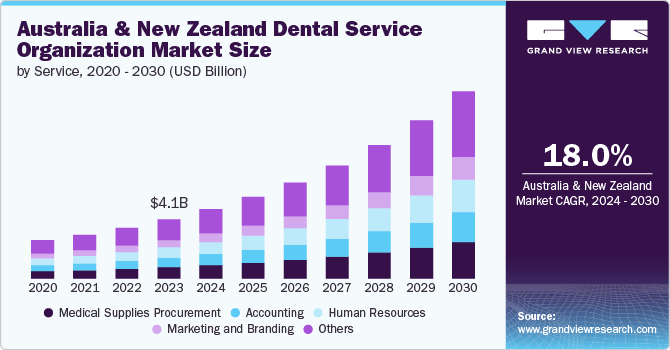

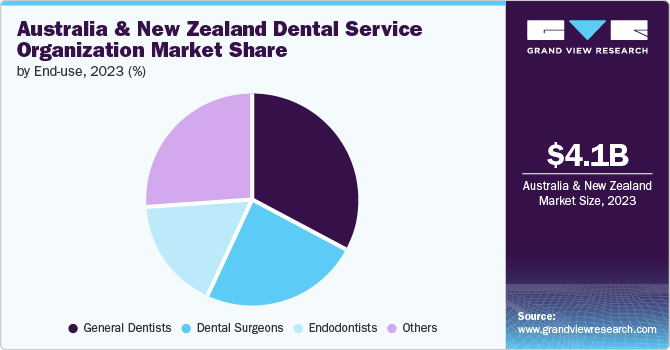

Australia And New Zealand Dental Service Organization Market Size, Share & Trends Analysis Report By Service (Medical Supplies Procurement), By End-use (Dental Surgeons, General Dentists), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-410-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The Australia and New Zealand dental service organization market size was estimated at USD 4.09 billion in 2023 and is anticipated to grow at a CAGR of 18.00% from 2024 to 2030. This growth is primarily attributed to the rising prevalence of dental conditions and the increasing expenditure on dental care. According to the report published by the Australian Institute of Health and Welfare in November 2023, there is a critical need for better dental care access in Australia; in 2021-22, approximately 78,800 hospitalizations were attributed to dental conditions that could have been prevented with earlier intervention. The highest rate of these preventable hospitalizations was observed among children aged 5-9 years, at 10.8 per 1,000 population. This statistic emphasizes the critical need for proactive and accessible dental care to avoid severe outcomes and highlights the potential for dental service organizations to address long-term dental issues.

The rising adoption of Dental Service Organizations (DSOs) in Australia and New Zealand is being driven by a combination of increasing demand for dental care, operational efficiencies offered by DSOs, and significant impacts from the COVID-19 pandemic. DSOs are becoming increasingly popular as they provide a centralized management structure that allows dental practices to focus more on patient care rather than administrative tasks. This model is particularly appealing in a landscape where dental care demand is on the rise, driven by factors such as an aging population, high dental care expenditure, and growing awareness of oral health's importance. According to the Judicial Commission of New South Wales, by 2036, over 21% of people in NSW will be 65 and older.

Dental Service Organizations (DSOs) streamline dental practices by managing non-clinical operations such as human resources, marketing, procurement, and accounting. This allows dental professionals to focus exclusively on patient care. By centralizing these administrative functions, DSOs achieve economies of scale, which significantly reduces operational costs and enhances the financial stability of dental practices. A June 2023 report from the National Aboriginal Community Controlled Health Organisation (NACCHO) underscores the urgent need to improve access to dental services for Aboriginal and Torres Strait Islander communities. The report identifies severe disparities in oral health outcomes, exacerbated by barriers such as geographical isolation, financial constraints, and a lack of culturally appropriate services. NACCHO advocates for increased funding, targeted workforce development, and the integration of dental services within Aboriginal Community Controlled Health Services (ACCHS). These recommendations aim to address systemic issues and ensure more equitable access to dental care, ultimately striving to reduce oral health inequalities and enhance overall health outcomes for Indigenous Australians.

The COVID-19 pandemic accelerated the adoption of Dental Service Organizations (DSOs) due to the challenges faced by individual dental practices, including reduced patient volumes, supply chain disruptions, and increased operational costs from heightened hygiene protocols. The pandemic also shifted patient expectations towards digital tools and telehealth, making advanced technology integration a necessity. DSOs, known for adopting such innovations, have introduced digital solutions like electronic health records, virtual consultations, and advanced diagnostic tools, which not only enhance patient care but also attract a tech-savvy clientele. According to the Australian Institute of Health and Welfare, in 2020-21, 12.6 million Australians, or 49% of the population, were covered by general treatment policies, with dental services accounting for USD 2.2 billion, or 12% of private health insurance expenditure. The rise in net benefits paid for dental services, from USD 1.9 billion in 2019-20 to USD 2.2 billion in 2020-21, reflects the increasing demand for dental care, a trend that DSOs are well-equipped to address.

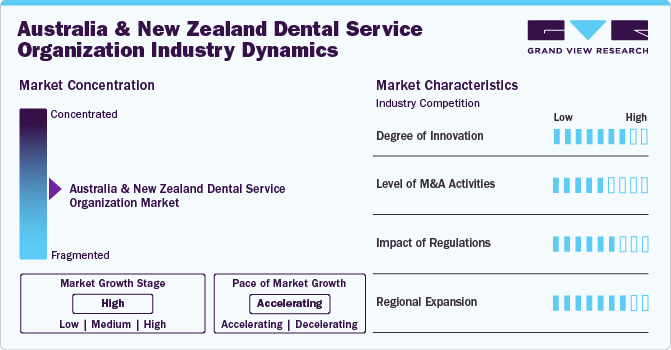

Market Concentration & Characteristics

The Australia and New Zealand dental service organization (DSO) market is characterized by moderate to high market concentration, with a few key players dominating the industry. These larger DSOs, such as Pacific Smiles Group and Maven Dental, have established extensive networks of affiliated practices, offering a wide range of dental services across multiple regions. A trend toward consolidation marks the market as smaller, independent dental practices increasingly align with DSOs to leverage their administrative, technological, and financial resources. This consolidation trend has led to a more competitive landscape, where the ability to offer comprehensive care and streamlined operations is a significant differentiator.

Innovation plays a critical role in the DSO market, with a strong focus on adopting and integrating advanced dental technologies. DSOs are at the forefront of integrating digital tools like electronic health records (EHR), 3D printing, and computer-aided design and manufacturing (CAD/CAM) systems, which enhance precision and patient outcomes. Furthermore, innovations in patient management systems, including sophisticated software for scheduling, billing, and communication, are improving operational efficiency and reducing costs. In June 2024, Henry Schein One (HSO) partnered with Pearl to incorporate AI-driven dental diagnostics into their practice management software (PMS), making it the first of its kind in Australia. This collaboration enables dental practices using HSO's system to leverage Pearl's AI technology for superior imaging analysis, which enhances diagnostic accuracy and efficiency. By integrating real-time, AI-powered insights directly into the PMS platform, this partnership aims to streamline workflows and elevate patient care, underscoring the critical role of innovation in advancing the DSO market.

The Australia and New Zealand Dental Service Organization (DSO) market is characterized by a high level of mergers and acquisitions (M&A), with ongoing consolidation significantly shaping its landscape. Larger DSOs are actively acquiring smaller practices to expand their geographic reach, diversify service offerings, and enhance their market presence. By acquiring practices in new regions, DSOs broaden their patient base and solidify their market dominance. Additionally, the Dental Care Awards collaborate with key organizations such as the Australian Dental Industry Association, Mobile Dental Providers Australia, and Bite Magazine to foster professionalism, innovation, and improved access within the dental sector. These partnerships support the Awards' mission to enhance oral healthcare across Australia, particularly in underserved areas, through effective collaboration, education, and advocacy.

Regulatory frameworks pose a profound impact on the DSO market in Australia and New Zealand. In Australia, the Therapeutic Goods Administration (TGA) ensures that all dental products and services meet stringent safety and efficacy standards, which can increase compliance costs for DSOs but also ensure high-quality care for patients. In New Zealand, Medsafe plays a similar role, enforcing regulations that align with international standards to maintain product and service quality. Compliance with these regulations is crucial for DSOs, as it affects their ability to operate and expand within the market. Additionally, the regulatory environment encourages transparency and accountability, which helps to build trust with patients and healthcare providers.

Regional expansion is a key strategy for Dental Service Organizations (DSOs) in Australia and New Zealand, aimed at addressing the growing demand for dental services in underserved regional and rural areas. By establishing new practices or acquiring existing ones in these locations, DSOs are able to deliver advanced dental care and technology to communities with limited access. This strategy not only broadens their market presence but also helps reduce healthcare disparities. For instance, in September 2022, Pacific Smiles Dental expanded its presence in Queensland with the opening of two new dental centers. Located in the Brisbane suburb of Camp Hill and the regional city of Bundaberg, these centers aim to improve access to dental care for local communities. The new facilities are anticipated to offer a range of services, including general dentistry, orthodontics, and cosmetic treatments, with a focus on providing high-quality, patient-centered care. This expansion reflects Pacific Smiles Dental's commitment to improving dental health access across Queensland.

Service Insights

The service segment is segmented into human resources, medical supplies procurement, marketing, accounting, and others. The other segment held the largest revenue share of 35.0% in 2023. This dominance can be attributed to the diverse and crucial nature of these additional services, which may include IT support, legal services, compliance management, and facility maintenance. These services are important for the efficient operation of DSOs, ensuring that dental practices can focus on delivering high-quality patient care while relying on robust backend support systems.

The broad scope and critical importance of these services in the smooth functioning of DSOs explain their substantial contribution to overall market revenue. For instance, the Dalby Dental Clinic, a partnership between the University of Queensland (UQ) and Goondir Health Services, enhanced oral health care for indigenous communities in southwest Queensland. The clinic offers comprehensive dental services, addressing significant oral health disparities faced by Indigenous Australians. Through this collaboration, dental students from UQ gain practical experience while providing culturally sensitive care and improving access to essential dental services for Indigenous patients in the region.

The medical supplies procurement segment is expected to witness a CAGR of 18.3% due to its substantial role in ensuring the smooth operation of dental practices. DSOs manage multiple affiliated dental clinics, requiring a consistent and reliable supply of essential medical and dental materials such as implants, instruments, personal protective equipment (PPE), and consumables. Effective procurement strategies not only ensure that clinics are well-stocked with high-quality supplies but also help in cost management by leveraging bulk purchasing and supplier relationships.

This procurement process is crucial for maintaining the quality of care and operational efficiency, as any disruption in the supply chain can directly impact the ability of dental professionals to deliver services. The significant share of this segment reflects the importance of procurement in the overall DSO model, where centralized purchasing power and streamlined logistics are key to achieving economies of scale and sustaining a competitive edge in the market.

End-use Insights

In 2023, the general dentist segment held a dominant position in the Australia and New Zealand dental service organization (DSO) market, commanding a revenue share exceeding 32.9%. This significant share underscores the pivotal role that general dentists play within the broader dental care landscape. The growing prevalence of dental conditions, including tooth decay and gum disease, further drives demand for general dental services. According to the Australian Institute of Health and Welfare, expenditure on dental services in Australia reached approximately USD 11.1 billion in the 2020-21 financial year. Notably, patients bore 59.0% of this expenditure, amounting to around USD 6.5 billion, with an average out-of-pocket expense of USD 253.0 per person annually, excluding private health insurance premiums. Private health insurance funds contributed about USD 2.2 billion, representing 20.0% of the total expenditure. These significant out-of-pocket costs and insurance contributions highlight the financial pressures influencing dental care decisions and underscore the critical role general dentists play in managing prevalent dental conditions.

Moreover, the rising focus on preventive care is fueling the segment's growth. Increasing awareness of regular dental check-ups and preventive treatments drives more patients to seek such services, aiming to prevent more complex and costly procedures. General dentists are pivotal in this preventive approach, offering essential services that help maintain optimal oral health and prevent severe conditions. In New Zealand, the Labour Party's proposed initiative to extend free dental care to individuals under 30, starting with 23-year-olds in 2025 and reaching under-30s by 2026, aims to enhance access to dental services for younger adults and address dental health inequalities. This initiative, along with plans to expand mobile dental clinics to underserved areas, is expected to bolster the demand for general dental services further, reinforcing the segment's dominant market position.

Key Australia And New Zealand Dental Service Organization Company Insights

The market is characterized by the presence of several key players who dominate the landscape with substantial market share. These organizations are leading the industry through technological innovations, extensive distribution networks, and a broad portfolio of services.

Key Australia And New Zealand Dental Service Organization Companies:

- Pacific Dental

- Maven Dental

- National Dental Care

- Dental Corporation

- 1300SMILES LIMITED.

Recent Developments

-

In April 2024, NDC Holdco Pty Ltd announced to acquire Pacific Smiles Group Limited for USD 197.59 million. The acquisition deal represents a strategic move to enhance NDC Holdco’s position in the dental services market. Pacific Smiles, a prominent player in the sector, will bring significant value through its established network of dental practices and operational expertise. This acquisition is expected to strengthen NDC Holdco’s market presence and expand its service offerings in Australia, aligning with its growth and consolidation strategy within the dental industry.

Australia And New Zealand Dental Service Organization Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.79 billion

Revenue forecast in 2030

USD 12.93 billion

Growth Rate

CAGR of 18.00% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, End Use

Country scope

Australia & New Zealand

Key companies profiled

Pacific Dental; Maven Dental; National Dental Care; Dental Corporation; 1300SMILES LIMITED.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia And New Zealand Dental Service Organization Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Australia and New Zealand dental service organization market report based on service and end-use:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Human Resources

-

Marketing & Branding

-

Accounting

-

Medical Supplies Procurement

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Surgeons

-

Endodontists

-

General Dentists

-

Others

-

Frequently Asked Questions About This Report

b. The Australia and New Zealand dental service organization market was valued at USD 4.09 billion in 2023 and is anticipated to reach USD 4.79 billion by 2024.

b. The Australia and New Zealand dental service organization market is anticipated to grow at CAGR of 18.00% from 2024 to 2030 to reach USD 12.93 billion in 2030.

b. In 2023, the general dentist segment held a dominant position in the Australia and New Zealand dental service organization (DSO) market, commanding a revenue share exceeding 32.9%.

b. Some prominent players in the market include Pacific Dental, Maven Dental, National Dental Care, Dental Corporation, 1300SMILES LIMITED.

b. The ANZ Dental Service Organizations market growth is primarily attributed to the rising prevalence of dental conditions and the increasing expenditure on dental care.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."