- Home

- »

- Agrochemicals & Fertilizers

- »

-

Australia Fertilizers Market Size, Share, Growth Report, 2030GVR Report cover

![Australia Fertilizers Market Size, Share & Trends Report]()

Australia Fertilizers Market (2023 - 2030 ) Size, Share & Trends Analysis Report By Type (Nitrogenous, Phosphatic, Potassic, Secondary Fertilizers, Others), And Segment Forecasts

- Report ID: GVR-4-68040-064-3

- Number of Report Pages: 50

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

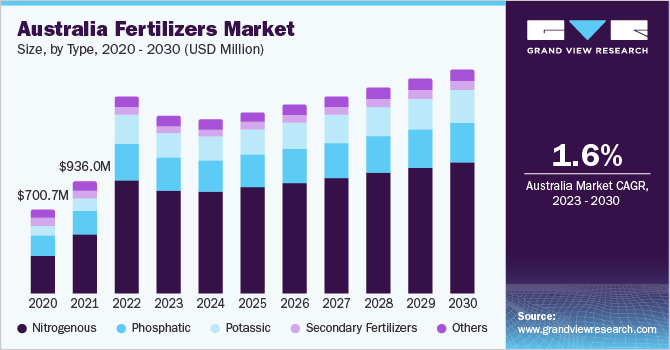

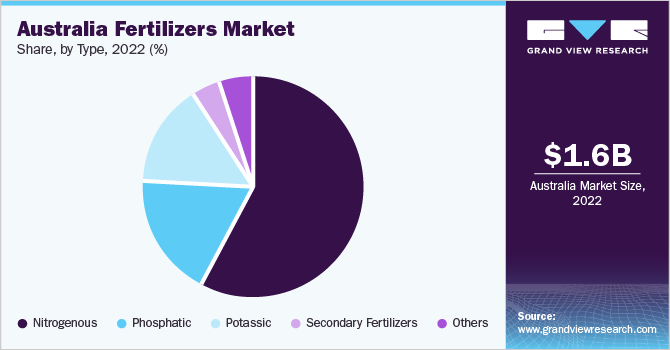

The Australia fertilizers market size was valued at USD 1.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 1.6% from 2023 to 2030. The growth of the product is attributed to the surge in demand for increased crop yield and crop quality. In addition, increasing adoption of precision farming methods, growing demand for food, and shrinking arable land, due to the growing population are some other factors driving the market. Plants require several mineral elements for their nutrition, which include nitrogen, potassium, phosphorous, magnesium, and calcium. These nutrients are usually obtained from the soil. Deficiency of any one of the aforementioned minerals reduces crop yield and affects the growth of plants.

The efficiency of crops gets restricted due to the degrading soil nutrition and the presence of potentially toxic mineral elements in the soil. This has generated the necessity to supply nutrients externally to improve crop productivity thus driving the demand for products in Australia.

Australia is a major importer of urea from China and Russia, with 80% of it being imported from China. The ban on the trade of urea by China in 2021 to lower China’s fertilizer prices domestically has resulted in a shortage of urea in Australia, resulting in increased prices in 2022. Thus, to overcome this shortage, in December 2020, Australia entered an agreement with Incetic Pivot, a fertilizer manufacturer, to secure the local production of urea. All these factors have contributed to the growth of the urea market in the country.

Type Insight

Nitrogenous in type segment dominated the market with a revenue share of 57.8% in 2022. This growth is attributed to the growing production of corn, as it is a widely planted crop in Australia that requires the most nitrogen per hectare of land compared to other crops. According to the Observatory of Economic Complexity, in 2021, Australia exported corn worth USD 34.4 million, making it the 39th largest exporter in the world with South Korea, Malaysia, the UAE, and the Philippines being the major importers and accounting for USD 24.9 million, USD 1.94 million, USD 3.77 million, and USD 0.84 million, respectively.

Urea in nitrogenous fertilizer type dominated the market with a revenue share of 42.9% in 2022. If urea is applied to the bare soil surface, a significant quantity of ammonia might be lost owing to the volatilization of urea caused by its rapid hydrolysis to form ammonium carbonate. Thus, it is necessary to properly place urea fertilizers with respect to seeds. Factors such as the low cost of urea and the high level of nitrogen present in it are expected to fuel the growth of urea.

Potassic is another segment witnessing growth over the forecast period. Potash is the third-most important nutrient required by plants for proper growth and development. It helps improve water retention in plants, influences the texture, improves crop yield, and imparts nutritional value to many crops. Thus, to minimize potassium deficiency and improve productivity, farmers are switching to potassic fertilizers.

Key Companies & Market Share Insights

Australia fertilizers market is highly competitive with the presence of a large number of manufacturers and suppliers. The top players have been dominating the market owing to the increasing investments in research & development activities related to new product developments. Multinational companies have further adopted strategies like partnership, acquisition, and joint venture to maintain a strong foothold in the market. For Instance, in March 2022, Koch Ag & Energy Solutions (Koch) and Morocco-based OCP agreed to enter into a fifty-fifty joint venture in Jorf Fertilizers Company III. This joint venture will help in improving the continuous sulfur and ammonia supply thus, helping the company to strengthen its position among competitors. Some of the prominent players in the Australia fertilizers market include:

-

Koch Fertiliser Australia Pty Ltd

-

Incitec Pivot Limited

-

Wesfarmers Limited

-

Spraygro Liquid Fertilizers

-

S.J.B. Ag-Nutri

-

Yara

-

Tradecorp APAC Pty. Ltd.

-

Neutrog Australia

-

Pacific Fertiliser Pty Ltd

-

Perdaman

Australia Fertilizers Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.8 billion

Growth rate

CAGR of 1.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in kilotons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type

Key companies profiled

Koch Fertiliser Australia Pty Ltd; Incitec Pivot Limited; Wesfarmers Limited; Spraygro Liquid Fertilizers; S.J.B. Ag-Nutri; Yara; Tradecorp APAC Pty. Ltd.; Neutrog Australia; Pacific Fertiliser Pty Ltd; Perdaman

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia Fertilizers Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Australia fertilizers market report based on type:

-

Type Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Nitrogenous

-

Ammonium Nitrate

-

Anhydrous Ammonia

-

Urea

-

Urea Ammonium Nitrate

-

Others

-

-

Phosphatic

-

DAP

-

MAP

-

SSP

-

TSP

-

Others

-

-

Potassic

-

MoP

-

SoP

- Others

-

-

Secondary Fertilizers

-

Others

-

Frequently Asked Questions About This Report

b. The global Australia fertilizers market size was estimated at USD 1.6 billion in 2022 and is expected to reach USD 1.48 billion in 2023

b. The global Australia fertilizers market is expected to grow at a compound annual growth rate of 1.6% from 2023 to 2030 to reach USD 1.8 billion by 2030

b. Nitrogenous in type segment dominated the market with a revenue share of 57.8% in 2022.This growth is attributed to the growing production of corn, as it is a widely planted crop in Australia that requires the most nitrogen per hectare of land compared to other crops.

b. Some of the key players in the market include Koch Fertiliser Australia Pty Ltd, Incitec Pivot Limited, Wesfarmers Limited, Spraygro Liquid Fertilizers, S.J.B. Ag-Nutri, Yara, Tradecorp APAC Pty. Ltd., Neutrog Australia, Pacific Fertiliser Pty Ltd, Perdaman

b. The growth for the Australia fertilizers market is attributed to the surge in demand for increased crop yield and crop quality. In addition, increasing adoption of precision farming methods, growing demand for food, and shrinking arable land, due to growing population are some other factors driving the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.