- Home

- »

- Consumer F&B

- »

-

Australia Bubble Tea Market Size, Industry Report, 2030GVR Report cover

![Australia Bubble Tea Market Size, Share & Trends Report]()

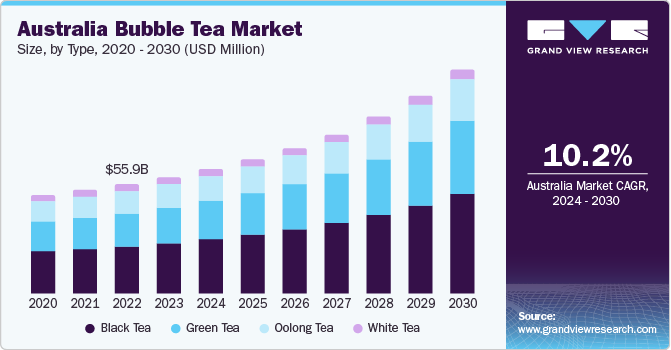

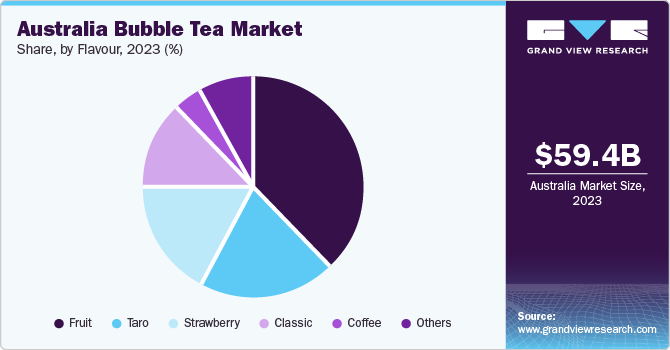

Australia Bubble Tea Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Black Tea, Green Tea, Oolong Tea), By Flavour (Fruit, Taro, Strawberry, Classic, Coffee), And Segment Forecasts

- Report ID: GVR-4-68040-215-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Australia Bubble Tea Market Size & Trends

The Australia bubble tea market size was estimated at USD 59.41 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 10.2% from 2024 to 2030. Expected growth can be attributed to the continuously growing demand for tea and coffee-based beverages as nootropic drinks by young consumers, the availability of numerous tastes created in line with fluctuating consumer behaviour and likings, characteristic offered by bubble tea to be low-calorie, zero-fat beverages. The drink was originally devised in Taiwan in 1980s, which was later brought into the United States in 1990s. Since then, the bubble tea has multiplied its popularity in different local markets of the country with the help of flavors and tastes it has been offering.

In addition, due to growing consciousness about the title role of diet in well-being of human health, great number of consumers in the Australia choose drinks that have a smaller amount of calorie content, fats and sugar in it. Bubble tea is one such drink available in frothy texture, which is served cold beverage with chewy tapioca balls added in it. The bubble tea is also named as Boba tea, Boba juice or bubble milk tea in various parts of the country.

Existence of democratised food culture in the country have resulted in entry of several cuisines, recipes and beverages to the native marketplace, which belong to diverse nations and cultures. As tapioca pearls are gluten free and considered as healthy dietary intake, health conscious groups of consumers choose bubble tea drinks more often as their choice of beverage. In recent past, owing to growing awareness about health and fitness routines, mindfulness about diets and choice of food; a huge number of consumers have been moving their inclinations from carbonated drinks to tea or coffee.

Market Concentration & Characterisation

The Australia bubble tea is growing at accelerating pace and the growth stage is identified as high. The market is characterised by existence of numerous contestants, out of which, some are owned by big brands who are in the business for long time and a few are established in recent times. However, these companies are also generating noteworthy quantity of sales through different strategies.

Degree of innovation is moderate in the industry. The constantly changing preferences of consumers are generally addressed with innovation by inventing novel flavors through use of newly identified technologies as well as ingredients. Often, consumers tend to ask for newly developed flavors, which are not in line with conventional taste preferences and flavour likings.

The mergers & acquisitions in the Australia bubble tea market are at moderate level. The industry is more inclined towards partnerships and collaborations, which are generally formed with an intent to attain technology share and collective innovation effort. In addition, the collaborative strategic initiations are also helpful for companies to distribute their product more efficiently through offline channels.

The impact of regulation in this market is fairly low as bubble tea drinks are generally served on demand. However, usage of materials and quality of ingredient used in the making is highly regularised by food and drug authorities for safety of consumers. Packaged versions of bubble tea are still getting less attention as compared to the ones that are served on demands through cafes and stores. Compliance with regulations stated by government bodies is necessary in the industry as the beverages have capacity to directly impact well-being of customers.

Threat of substitutes is at moderate level for Australia bubble tea market. When it comes to beverages, young and working population tend to look for alternatives which can offer novelty and be in line with their likings as well. This might develop tiny threat of substitutes, but bubble tea market is well equipped with constantly changing flavoured offerings to deal with it.

Type Insights

Black tea-based bubble tea market accounted for a share of 43.6% in 2023. This type of bubble tea is extensively popular in the market due to its genuine and natural flavour. Additionally, it helps users to reduce blood sugar levels and bad cholesterol. It also improves health of gut. It is considered as one of the prized sources of antioxidants as well. These aspects are constantly assisting the rising demand for bubble tea in the country. Black tea, milk, tapioca pearls, and syrups are used to make the classic Taiwanese bubble tea is made out of. This is one of the main reasons why most of the bubble tea serving stores and cafes have black tea alternatives listed on their menu. Black tea’s solid taste and flavour aids in maintaining the authenticity factor of the drink even after mixing other ingredients and agents in it.

In Australia, the green tea-based bubble tea market is anticipated to grow at CAGR of 11.1% from 2024 to 2030. The projected growth can be attributed to the popularity the flavor has gained through the ability of green tea to blend with milk easily. In addition, it is preferred as base ingredient by many consumers owing to benefits such as being extraordinary source of antioxidants and having very less sugar contents.

Flavour Insights

Fruit flavoured bubble tea market accounted for 38.2% in the 2023. The increasing demand for fruit flavors in bubble tea is mostly due the variability it delivers. Fruit flavors are popular as they offer nutrition and the variety at the same time. Health-conscious customers are inclined towards buying these drinks on consistent basis owing to numerous vitamins and minerals offered through them. Less caffeine contents of fruit, flavoured bubble teas make them obvious choice of many consumers. Commonly used fruit flavors in bubble tea variants are pineapple, grape, coconut, kiwi, lychee, lemon, green apple and passion fruit.

The taro flavors bubble tea market in Australia is projected to grow at a CAGR of 11.2% from 2024 to 2030. A root vegetable, taro, is well known for its sweet flavor and the amount of starch it can offer. The taro tea has generated a lot of popularity in the Australian market owing to its sweet flavour. Makers and cafes are adopting this ingredient primarily because of purple colour element that it can add.

Key Australia Bubble Tea Company Insights

-

CHAFFIC is local Australia-based beverage company, which offers combination of rich Chinese heritage and modern recipe in a cup. The company claims that they source their tea leaves from Fujian Wuyi Mountain, which has ancient significance associated with it.

-

Gong Cha, one of the top companies operating in the business of bubble tea, was established in 2006. Currently it has more than 2000 stores across the world.

Key Australia Bubble Tea Companies:

- Gong Cha

- T BUN International

- Chatime

- Ten Ren Tea Co. Ltd

- ShareTea

- Chaffic

- BubbleTea Australia

- Xing Fu Tang

- Palgong

- UTOPIA

Recent Developments

- In June 2023, Chaffic, Australian company working in bubble tea business, expanded its presence to Singapore by launching their first store in the country. The move was aimed at accelerating their expansion strategy in the Southeast Asia.

Australia Bubble Tea Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 63.55 million

Revenue Forecast in 2030

USD 114.01 million

Growth rate

CAGR of 10.2% from 2024 to 2030

Actuals

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Type, flavour

Key companies profiled

Gong Cha; T BUN International; Chatime; Ten Ren Tea Co. Ltd; ShareTea; Chaffic; BubbleTea Australia; Xing Fu Tang; Palgong; UTOPIA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia Bubble Tea Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Australia bubble tea market report based on type and flavor:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Black Tea

-

Green Tea

-

Oolong Tea

-

White Tea

-

-

Flavour Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fruit

-

Taro

-

Strawberry

-

Classic

-

Coffee

-

Other

-

Frequently Asked Questions About This Report

b. The Australia bubble tea market size was estimated at USD 59.41 million in 2023 and is expected to reach USD 63.55 million in 2024.

b. The Australia bubble tea market is expected to grow at a compounded growth rate of 10.2% from 2024 to 2030 to reach USD 114.01 million by 2030.

b. Black tea-based bubble tea market accounted for a share of 43.6% in 2023. This type of bubble tea is extensively popular in the market due to its genuine and natural flavour. Additionally, it helps users to reduce blood sugar levels and bad cholesterol. It also improves health of gut. It is considered as one of the prized sources of antioxidants as well. These aspects are constantly assisting the rising demand for bubble tea in the country.

b. Some key players operating in the Australia bubble tea market include Gong Cha; T BUN International; Chatime; Ten Ren Tea Co. Ltd; ShareTea; Chaffic; BubbleTea Australia; Xing Fu Tang; Palgong; UTOPIA

b. Key factors that are driving the Australia bubble tea market growth include continuously growing demand for tea and coffee-based beverages as nootropic drinks by young consumers, the availability of numerous tastes created in line with fluctuating consumer behaviour and likings, characteristic offered by bubble tea to be low-calorie, zero-fat beverages.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.