Augmented Reality And Virtual Reality In Aviation Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Technology, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-335-5

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

AR & VR In Aviation Market Size & Trends

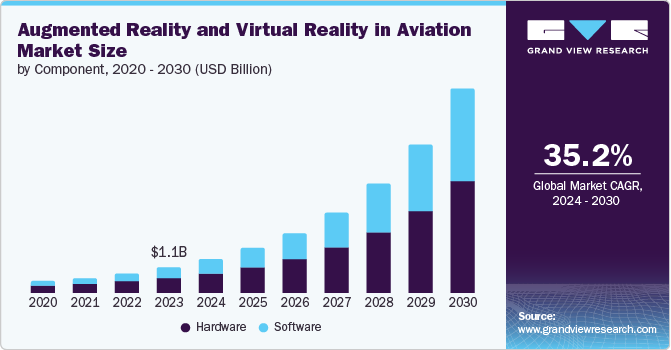

The global augmented reality and virtual reality in aviation market size was estimated at USD 1,076.6 million in 2023 and is expected to grow at a CAGR of 35.2% from 2024 to 2030. The market is witnessing significant advancements through the integration of augmented reality (AR) and virtual reality (VR) technologies. These technologies allow trainees to practice real-world scenarios, ranging from routine flight operations to emergency situations, with high fidelity and without associated risks. This enhanced training capability results in better-prepared personnel and potentially lower training costs, which is expected to drive market growth.

Moreover, another emerging trend is the application of AR in aircraft maintenance and repair operations. AR tools enable maintenance crews to overlay digital information onto physical aircraft components, facilitating more efficient diagnostics and repairs. Technicians can access real-time data, step-by-step instructions, and 3D visualizations of complex systems, all while working hands-free. This speeds up the maintenance process as well as reduces the likelihood of human error, thereby leading to improved aircraft reliability and safety.

In-flight navigation and situational awareness are also being revolutionized by AR technology. Pilots can use AR headsets or augmented displays to receive critical information about their flight path, weather conditions, and nearby terrain, directly overlaid on their real-world view. This enhanced situational awareness supports better decision-making and improves overall flight safety. By reducing the cognitive load on pilots, AR helps to manage the increasing complexity of modern aviation environments. This, in turn, is expected to fuel market growth in the coming years.

Passenger experience is another area where AR and VR are making substantial inroads. Airlines are incorporating virtual reality headsets into their in-flight entertainment systems, offering passengers immersive experiences such as virtual tours, interactive games, and cinematic adventures. This not only enhances the travel experience but also provides a unique selling point for airlines looking to differentiate themselves in a competitive market. Additionally, AR applications in airports are helping passengers navigate large terminals more easily, improving overall customer satisfaction.

Furthermore, AR and VR are becoming crucial tools in the marketing and sales strategies of airlines and aircraft manufacturers. VR experiences allow potential customers to take virtual tours of new aircraft models, explore cabin configurations, and experience amenities in a highly engaging way. This immersive marketing approach helps build stronger customer connections and drives sales by providing a tangible sense of what the products offer. Additionally, AR applications in sales presentations can provide interactive 3D models and real-time customization options, making the sales process more dynamic and effective.

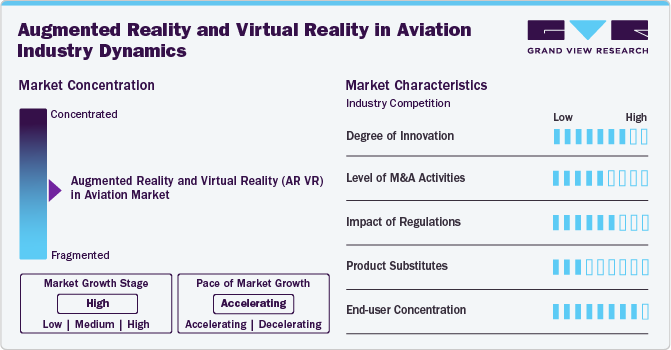

Market Concentration & Characteristics

The degree of innovation in the market is high. This is driven by the industry's continuous pursuit of advancements that enhance safety, efficiency, and passenger experience. The rapid development and adoption of AR and VR technologies are transforming pilot and crew training through immersive simulations, improving maintenance and repair processes with real-time data overlays, and enhancing in-flight navigation with augmented situational awareness.

The level of mergers and acquisitions activities in the market is moderate to high. This is driven by the aviation industry's growing recognition of the transformative potential of AR and VR technologies. Companies are increasingly acquiring or merging with technology firms specializing in AR and VR to enhance their capabilities and maintain a competitive edge. These strategic moves are aimed at accelerating innovation, expanding technological expertise, and integrating advanced solutions into aviation operations, training, and passenger services. The continuous evolution of AR and VR applications in aviation fosters a dynamic environment, making M&A activities a key strategy for growth and innovation.

The impact of regulations on the market is high. Aviation is a heavily regulated industry with stringent safety and operational standards that all technologies must adhere to. Regulatory bodies such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) closely monitor and control the implementation of new technologies in aviation. Compliance with these regulations is essential, necessitating thorough testing and certification processes, which significantly influence the development and deployment of AR and VR solutions in the aviation sector.

The availability of product substitutes in the market is relatively low. AR and VR technologies offer unique capabilities that traditional methods cannot fully replicate. For example, while conventional flight simulators and training programs provide valuable training experiences, they lack the immersive, interactive nature and flexibility that AR and VR simulations offer. Similarly, standard maintenance procedures and in-flight navigation systems do not provide the real-time data overlay and enhanced situational awareness that AR can deliver. The distinctive advantages of AR and VR in enhancing training, maintenance, and operational efficiency make them difficult to substitute with existing technologies, thereby maintaining their unique position in the aviation market.

The end-user concentration in the market is high. The primary users of AR and VR technologies in aviation are concentrated among a few key segments, such as commercial airlines, military organizations, and overhaul (MRO) providers. These entities have substantial financial resources and specific operational needs that drive the adoption of advanced AR and VR solutions. Smaller aviation operators and service providers, while interested, often lack the capital to invest heavily in these technologies, leading to a higher concentration of end-users within the larger, well-funded sectors of the aviation industry.

Component Insights

The hardware segment dominated the market in 2023 with a revenue share of around 58%, driven by advancements in specialized components like head-mounted displays and sensors, crucial for applications in pilot training, navigation, and maintenance. Increased affordability and improved performance have fueled widespread adoption across the industry, emphasizing hardware's pivotal role in advancing aviation technology and operational efficiency.

The software segment is expected to record a significant CAGR of over 37% from 2024 to 2030, driven by increasing demand for sophisticated applications that enhance training simulations, data analytics, and operational efficiencies. Moreover, advancements in AI and machine learning are enabling software solutions to provide more personalized and responsive experiences, further driving adoption across various aviation applications.

Technology Insights

The augmented reality (AR) segment held the highest revenue share in 2023, due to its transformative impact on enhancing situational awareness, training effectiveness, and operational efficiencies within the industry. Furthermore, AR's applications in training simulate realistic scenarios without the risks associated with actual flight operations, offering cost-effective and scalable solutions for skill development. Thus, driving the segment growth in the coming years.

The virtual reality (VR) segment is estimated to register the fastest CAGR from 2024 to 2030. The growth is attributed to the due to its expanding applications in immersive training and passenger experience enhancement. Additionally, airlines are increasingly integrating VR into their in-flight entertainment systems to offer passengers immersive experiences, ranging from virtual tours to interactive games, thereby enhancing customer satisfaction and differentiating their services in a competitive market.

End Use Insights

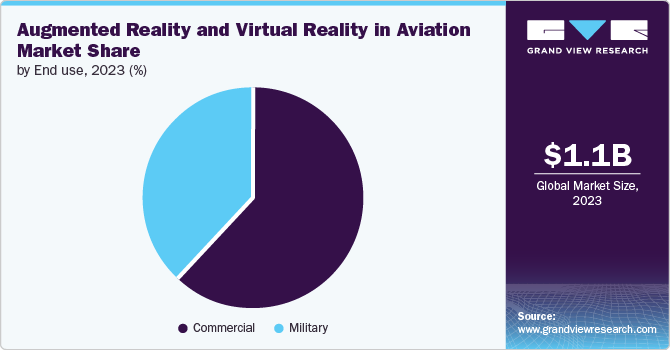

The commercial segment accounted for the highest revenue share in 2023, due to the widespread adoption of AR and VR technologies by commercial airlines to improve passenger experience, operational efficiency, and safety standards. Airlines are increasingly integrating AR and VR into various aspects of their operations, including pilot training, cabin crew instruction, and in-flight entertainment systems, thereby driving segmental growth.

The military segment is anticipated to expand at the fastest CAGR from 2024 to 2030, owing to increasing investments in defense modernization programs globally. AR and VR technologies offer significant advantages to military forces by enhancing training effectiveness, mission planning, and operational readiness. AR enables soldiers and pilots to receive real-time battlefield data overlays, improving situational awareness and decision-making in complex environments. Such developments are contributing to segmental growth in the coming years.

Regional Insights

The augmented reality and virtual reality in aviation market in North America accounted for a significant revenue share of over 37% in 2023, driven by robust investments from aerospace leaders, supportive regulatory environments, and strong demand for advanced training and operational solutions in aviation.

U.S. Augmented Reality And Virtual Reality In Aviation Market Trends

The augmented reality and virtual reality in the aviation market in the U.S. is anticipated to grow at a CAGR of over 32% from 2024 to 2030. The market is fueled by increasing investments in defense and commercial aviation sectors. Additionally, advancements in technology and favorable regulatory support further accelerate adoption, ensuring sustained growth in the market.

Asia Pacific Augmented Reality And Virtual Reality In Aviation Market Trends

Asia Pacific Augmented reality and virtual reality in the aviation market accounted for a significant revenue share in 2023. Rapid economic growth in countries like China, India, and South Korea is driving increased investments in aviation infrastructure and technology upgrades. Furthermore, rising air passenger traffic in the region is fueling demand for enhanced passenger experiences through AR and VR applications in in-flight entertainment and customer service.

The augmented reality and virtual reality in the aviation market in India is estimated to record the fastest CAGR from 2024 to 2030. India's expanding aviation sector, coupled with increasing passenger traffic, creates a demand for advanced technologies to improve operational efficiency and passenger experience. Moreover, government initiatives such as Digital India and Make in India encourage technological innovation and adoption across various industries, including aviation.

China augmented reality and virtual reality in aviation market is projected to grow at a significant CAGR from 2024 to 2030. China's ambitious plans for aviation modernization and infrastructure development are fostering increased adoption of advanced technologies like AR and VR to enhance operational efficiency and safety standards. Also, rising air travel demand in the region is fueling investments in innovative solutions to improve passenger experiences and streamline airport operations.

The augmented reality and virtual reality in aviation market in Japan is projected to grow at a CAGR from 2024 to 2030. Japan's advanced technological capabilities and strong emphasis on innovation make it conducive for adopting cutting-edge technologies like AR and VR in aviation.

Europe Augmented Reality And Virtual Reality In Aviation Market Trends

The Europe augmented reality and virtual reality in aviation market accounted for a second largest revenue share in 2023, driven by the region's strong emphasis on aviation safety, efficiency, and passenger experience. European airlines and aviation authorities are actively integrating AR and VR technologies to enhance pilot training, maintenance operations, and in-flight services.

The augmented reality and virtual reality in aviation market in the UK is projected to grow at a CAGR from 2024 to 2030. The UK aviation sector's focus on enhancing operational efficiency and safety through advanced technologies like AR and VR is increasing. Moreover, ongoing investments in airport infrastructure and digital transformation initiatives are accelerating the adoption of AR VR solutions to improve passenger experiences and streamline operations.

The Germany augmented reality and virtual reality in aviation market is estimated to record a notable CAGR from 2024 to 2030, owing to the increasing investments in digital transformation and smart airport initiatives are fostering the integration of AR VR solutions to enhance operational efficiency, safety standards, and passenger experiences.

Middle East And Africa Augmented Reality And Virtual Reality In Aviation Market Trends

The augmented reality and virtual reality in aviation market in the Middle East and Africa (MEA) region is anticipated to grow at CAGR of around 33% from 2024 to 2030. The increasing air passenger traffic and the region's strategic position as a global aviation hub are prompting investments in advanced technologies like AR and VR to enhance operational efficiency and passenger services.

Saudi Arabia augmented reality and virtual reality in aviation market accounted for a considerable revenue share in 2023. Saudi Arabia's strategic location and growing air traffic are driving demand for advanced technologies like AR and VR to enhance operational efficiency and passenger experience.

Key Augmented Reality And Virtual Reality In Aviation Company Insights

Some key players operating in the market are Honeywell International Inc., Sony Corporation, Goggle LLC, and others.

-

Sony Corporation specializes in consumer electronics, entertainment, and technology solutions. The company offers a wide range of products and services, including electronics, gaming, entertainment, and financial services. Sony's diverse portfolio includes televisions, audio equipment, gaming consoles (PlayStation), cameras, smartphones, and professional solutions like imaging sensors and audiovisual equipment. Sony operates through multiple segments, including Electronics Products & Solutions, Imaging & Sensing Solutions, Music, Pictures, and Financial Services, innovating across various industries with a commitment to quality and cutting-edge technology.

-

Google LLC is a multinational technology company specializing in Internet-related services and products. The company's offerings span across search engines, online advertising technologies, cloud computing, software, and hardware. The company also develops and provides popular software applications and services such as Google Chrome, Gmail, Google Drive, and Google Maps. Its cloud computing capabilities via Google Cloud support AR VR content delivery, and mapping services like Google Maps enhance navigation and situational awareness in aviation, advancing operational efficiency and user engagement in the industry.

Aero Glass, and Jasoren are some emerging market participants in the market.

-

Aero Glass is an emerging player in the augmented reality (AR) sector, specifically targeting the aviation industry. It offers AR solutions designed to enhance pilot situational awareness and operational efficiency. Aero Glass provides AR glasses that overlay critical flight information, navigation data, and real-time weather updates directly onto a pilot's field of view. This technology aims to improve decision-making capabilities and reduce cockpit workload by integrating advanced AR features into aviation operations.

-

Jasoren is a software development company specializing in custom software solutions, mobile applications, and web development. They offer a range of services including AR and VR development, IoT solutions, and AI applications. Jasoren is known for its expertise in creating innovative digital experiences across various industries, focusing on cutting-edge technologies to meet client needs for digital transformation and enhanced user engagement.

Key Augmented Reality And Virtual Reality In Aviation Companies:

The following are the leading companies in the AR and VR in aviation market. These companies collectively hold the largest market share and dictate industry trends.

- Aero Glass

- Bohemia Interactive Simulations

- Elbit Systems Ltd.

- Goggle LLC

- Honeywell International, Inc.

- HTC Corporation

- IBM Corporation

- Jasoren

- Microsoft Corporation

- Sony Corporation

Recent Developments

-

In April 2024, Bohemia Interactive Simulations and uCrowds collaborated to integrate uCrowds' TerraCrowds technology into VBS4, a military training simulation platform. This integration enables VBS4 users to simulate large crowds in training scenarios, such as riots or evacuations, with realistic behaviors like queuing and fleeing.

-

In January 2024, HTC VIVE launched the VIVE XR Elite headset, which combines Mixed Reality and Virtual Reality capabilities into one compact, lightweight, powerful, and highly versatile device, suitable for gaming, fitness, productivity, etc.

-

In May 2023, Microsoft launched its HoloLens 2 mixed reality headset in Saudi Arabia, marking a significant advancement in computing for the Kingdom. Backed by the reliability and scalability of the Microsoft Cloud and AI services, HoloLens 2 offers immersive mixed reality experiences tailored for various industries.

Augmented Reality And Virtual Reality In Aviation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.42 billion |

|

Revenue forecast in 2030 |

USD 8.66 billion |

|

Growth rate |

CAGR of 35.2% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, technology, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Aero Glass; Bohemia Interactive Simulations; Elbit Systems Ltd.; Goggle LLC; Honeywell International, Inc.; HTC Corporation; IBM Corporation; Jasoren; Microsoft Corporation; Sony Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Augmented Reality And Virtual Reality In Aviation Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global AR and VR in aviation market report based on component, technology, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Augmented Reality (AR)

-

Virtual Reality (VR)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Military

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global augmented reality and virtual reality in aviation market size was estimated at USD 1,076.6 million in 2023 and is expected to reach USD 1.42 billion in 2024.

b. The global augmented reality and virtual reality in aviation market is expected to grow at a compound annual growth rate of 35.2% from 2024 to 2030 to reach USD 8.66 billion by 2030.

b. North America dominated the AR and VR in aviation market with a share of around 37% in 2023, driven by robust investments from aerospace leaders, supportive regulatory environments, and strong demand for advanced training and operational solutions in aviation.

b. Some key players operating in the augmented reality and virtual reality in aviation market include Aero Glass, Bohemia Interactive Simulations, Elbit Systems Ltd., Goggle LLC, Honeywell International, Inc., HTC Corporation, IBM Corporation, Jasoren, Microsoft Corporation, Sony Corporation.

b. Key factors that are driving the augmented reality and virtual reality in aviation market growth include driven by robust investments from aerospace leaders, supportive regulatory environments, and strong demand for advanced training and operational solutions in aviation.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."