- Home

- »

- Next Generation Technologies

- »

-

Augmented Reality In Automotive Market Size Report, 2030GVR Report cover

![Augmented Reality In Automotive Market Size, Share & Trends Report]()

Augmented Reality In Automotive Market (2024 - 2030) Size, Share & Trends Analysis Report By Function, By Sensor Technology, By Display Technology, By Propulsion, By Level Of Autonomous Driving, By Vehicle Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-298-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Augmented Reality in Automotive Market Summary

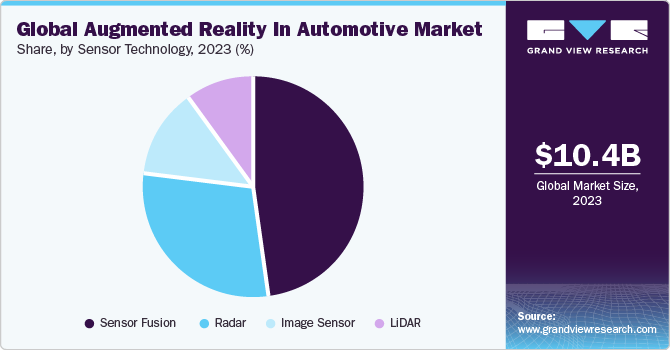

The global augmented reality in automotive market size was estimated at USD 10.41 billion in 2023 and is projected to reach USD 122.40 billion by 2030, growing at a CAGR of 41.2% from 2024 to 2030. With the help of augmented reality technology in showrooms, consumers interact with virtual 3D models of vehicles, enabling them to visualize various customizations such as color options and wheel designs.

Key Market Trends & Insights

- North America dominated the global market with a revenue share of 43.3% in 2023.

- The U.S. accounted for a revenue share of 39.5% in the global augmented reality automotive market.

- By function, AR HUD, with its standard functions segment, accounted for the highest market share of 47.1% in 2023.

- By sensor technology, the radar segment is anticipated to witness significant growth over the forecast period.

- By display technology, the TFT-LCD segment held the largest share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 10.41 Billion

- 2030 Projected Market Size: USD 122.40 Billion

- CAGR (2024-2030): 41.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

This immersive experience allows potential buyers to explore different configurations, compare models, and learn about unique features. Augmented reality (AR) technology enhances the overall driving experience by providing direct real-time information, navigation guidance, and safety alerts, ultimately improving drivers' convenience, safety, and engagement. Integrating AR into vehicles through head-up displays (HUDs) and aftermarket solutions allows drivers to access real-time data without taking their eyes off the road, ensuring minimal distractions and a safer driving experience.

Augmented reality plays a significant role in facilitating designers' creation of virtual models of vehicles, testing different configurations, and refining the user experience before advancing to the development stage. Designers can leverage AR technology to present ideas to clients, create fast prototypes using wireframes, and make changes according to clients' feedback.

Augmented reality in maintenance and repair offers instant access to digital manuals, inventory management, and remote consultation, which leads to cost savings and fast training. These factors are driving the demand for augmented reality in the automotive sector.

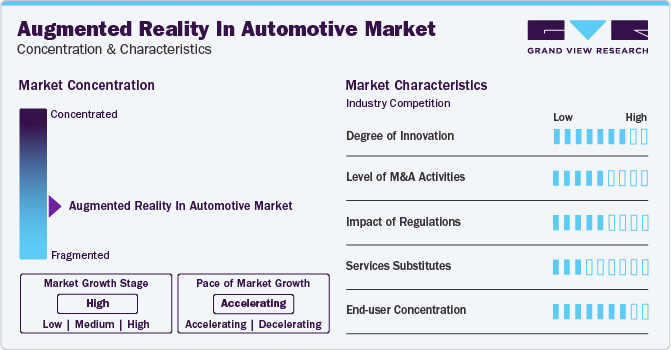

Market Concentration & Characteristics

The augmented reality growth stage in the automotive industry is high, and the pace is accelerating. The industry is significantly fragmented, with several established tire manufacturers and new entrants competing for the highest market share. Technological advancements, such as smart glasses displaying a digital overlay that provides technical details, torque settings, service instructions, and other information, have increased the pace.`

The augmented reality growth stage in the automotive industry is high, and the pace is accelerating. The industry is significantly fragmented, with several established tire manufacturers and new entrants competing for the highest market share. Technological advancements have increased the pace, such as smart glasses displaying a digital overlay that provides technical details, torque settings, service instructions, and other information.

The increased adoption of augmented reality in end-user automotive industry applications, such as visualizing wheel design, color options, interior trims, and real-time customization, drives demand for integrating AR in automotive. These animations require sensors to show real-time information and give accurate output.

The global trend towards autonomous driving also influences the adoption of augmented reality technologies in the automotive sector. Leading market players are investing substantially in research and development to expand their product lines, which is expected to drive growth in the automotive augmented reality industry.

Function Insights

AR HUD, with its standard functions segment, accounted for the highest market share, 47.1%, in 2023. This function offers essential features such as vehicle speed, tire pressure, and revolutions per minute (rpm). This technology enhances the driving experience by projecting high-resolution AR images onto the windshield, providing drivers with crucial information without looking away from the road or exiting the car. Its refined driving experience boosts segment growth.

The AR HUD-based navigation segment is anticipated to witness the fastest CAGR over the forecast period. This function facilitates turn-by-turn navigation, lane safety, destination distance, and warnings without diverting the driver’s attention from the road, resulting in improved safety, convenience, and engagement.

Sensor Technology Insights

Sensor fusion segment held the largest share in 2023. Sensor fusion technology enhances accuracy, reliability, and real-time data by merging data from cameras, inertial systems, and sensors like radars and LiDAR. Continuous advancements in Advanced Driver-Assistance Systems (ADAS), such as automatic parking systems, active lane keep assist, and cruise control, enhance vehicle safety and automation capabilities by providing accurate data inputs.

The radar segment is anticipated to witness significant growth over the forecast period. This sensor collects information about surroundings and features such as object detection and collision avoidance. Integrating radar sensor technology in vehicles enhances safety. In January 2023, Texas Instruments launched the AWR2544 77GHz millimeter-wave radar sensor chip to enhance vehicle safety and autonomy. These technological advancements are improving automotive safety and intelligence, aligning with the industry's focus on developing smarter and safer vehicles.

Display Technology

The TFT-LCD segment held the largest share in 2023. TFT-LCD technology offers high-resolution, vibrant colors and fast response times for creating immersive and detailed AR visuals in automotive applications. TFT-LCD technology in AR systems ensures that virtual information, such as navigation guidance and safety alerts, is displayed precisely and clearly, enhancing the overall user experience and vehicle safety features. As the automotive industry continues to use AR technology for improved driver assistance and augmented experiences, the demand for TFT-LCD displays in AR applications is expected to grow.

The other display technologies segment is anticipated to grow significantly over the forecast period. These technologies comprise OLED (Organic Light Emitting Diode) displays and Micro LED displays. OLED displays are made using circuits on a silicon backplane to control individual pixels, allowing for very high-resolution images with excellent pixel density. Due to their superior performance and high visual quality, OLED is driving growth in the automotive industry.

Propulsion Insight

The battery-electric vehicle segment held the largest revenue share in 2023. AR technology in electric vehicles can provide users with interactive and real-time information, such as visualizing charging stations, battery status, energy consumption, optimizing navigation based on battery range, and accessing guidance for maintenance and troubleshooting, improving the overall user experience. These factors are boosting segment growth.

The others segment is expected to witness significant growth over the forecast period. This segment comprises hybrid and electric vehicles. AR in hybrid electric vehicles can assist technicians in identifying vehicle issues and accessing repair instructions.

Level Of Autonomous In Driving

The autonomous segment held the largest revenue share in 2023. AR technology in autonomous vehicles offers interactive and informative experiences, such as visualizing navigation instructions, providing real-time information, displaying alerts and warnings, and improving the driving experience. Apple has patented an AR Windshield System for fully autonomous vehicles. The system integrates lighting and camera technology on the windshield to detect debris and provide advanced features for autonomous driving.

Non-autonomous segment is expected to witness significant growth over the forecast period. AR technology in non-autonomous vehicles can offer features like visual navigation aids and alerts for drivers, enhancing the driving experience and providing valuable assistance on the road. Additionally, AR applications can improve driver safety by providing alerts about traffic conditions, potential hazards, and navigation guidance, contributing to the rising demand.

Vehicle Type Insights

The passenger car segment held the largest revenue share in 2023. The increasing digitization of automotive retail and aftersales services is driving the adoption of AR in this segment. Automotive dealerships are adopting AR technology to create immersive virtual showrooms, allowing customers to explore different vehicle models, configurations, and features in a virtual environment. It enhances the car-buying experience and improves customer engagement and satisfaction, ultimately driving sales and brand loyalty.

The commercial vehicle segment is expected to grow significantly over the forecast period. Commercial vehicles such as excavators, cranes, and construction machinery often have restricted visibility, leading to severe accidents. AR in commercial vehicles handles this challenge by providing assistance systems that enhance driver visibility, detect unsafe situations, and intervene to control the machine effectively, improving overall safety and reducing accidents.

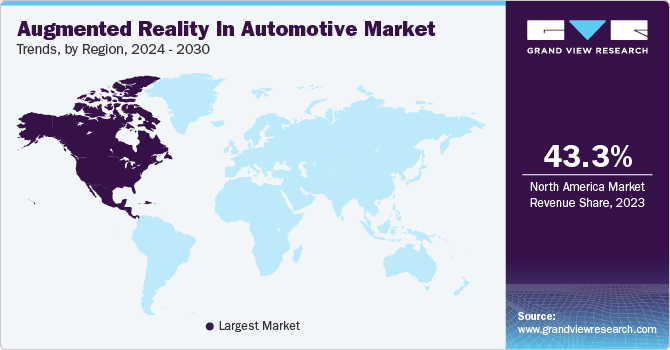

Regional Insights

North America dominated the market with a revenue share of 43.3% in global augmented reality in the automotive market in 2023. Regulatory mandates and safety considerations drive AR technology adoption in the North American automotive market. As safety regulations become increasingly stringent, automakers are turning to AR-based driver assistance systems to enhance situational awareness and reduce distractions for drivers. AR-enabled HUDs can project essential information, such as navigation directions, speed limits, and collision warnings, directly onto the windshield, allowing drivers to access critical data without taking their eyes off the road.

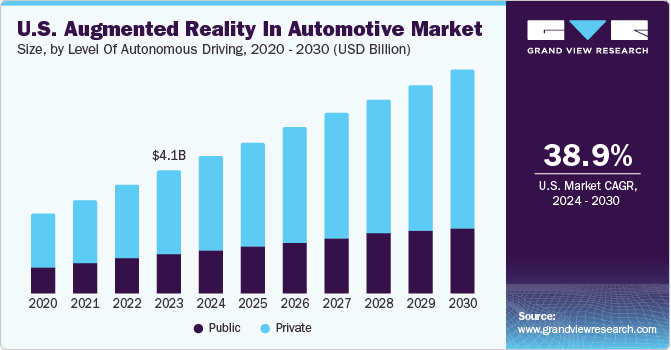

U.S. Augmented Reality In Automotive Market Trends

The U.S. accounted for a revenue share of 39.5% in the global augmented reality automotive market. AR technology is increasingly utilized in the automotive industry in the U.S. for product innovation, repair, inspection, prototyping, and enhancing the overall customer experience. The increasing adoption of electric vehicles and the number of passenger vehicle sales are anticipated to influence market growth positively.

Asia Pacific Augmented Reality In Automotive Market Trends

Asia Pacific market is expected to witness the fastest CAGR during the forecast period. AR technology offers innovative solutions for enhancing vehicle design, manufacturing processes, and customer experience. It includes features such as AR-assisted design and prototyping, virtual showrooms, and interactive user manuals, boosting market growth.

China augmented reality in automotive market has been forefront of technological advancements, including augmented reality (AR) applications. The country has made significant investments in research and development, leading to the integration of AR technology in various sectors, including automotive. For instance, China's Raythink has launched a new Smart Car AR Head-Up Display at the Shanghai Auto Show. Raythink's AR-HUD solution, utilizing the OpticalCore picture generation module, projects fully 3D images visible to the naked eye, enhancing the driving experience.

Augmented reality in automotive market in India is expected to witness the fastest CAGR during the forecast period. The increasing demand for Advanced Driving Assistance Systems (ADAS) drives the growth of augmented reality in India's automotive industry. These systems, which include features like lane departure warnings, adaptive cruise control, and navigation assistance, are becoming more used in vehicles as consumers seek enhanced safety and convenience while driving. For instance, MG Motor launched the StudioZ AR experience center in Chennai, introducing an immersive digital environment that leverages the interactive capabilities of augmented reality. This cutting-edge initiative aims to bring the MG brand closer to car enthusiasts by providing a unique and unparalleled encounter with the brand.

Europe Augmented Reality In Automotive Market Trends

The Europe market is expected to witness significant growth during the forecast period. The European automotive market is indeed experiencing a significant increase in the adoption of advanced driving assistance systems (ADAS) by original equipment manufacturers (OEMs). Various factors drive this trend, including technological advancements, regulatory requirements, consumer demand for safety features, and the need for differentiation in the competitive automotive landscape.

Key Augmented Reality In Automotive Company Insights

Some of the key players operating in the augmented reality in automotive market include Bosch GmbH, WayRay AG, Continental AG and others

-

WayRay is a deep-tech company specializing in holographic augmented reality (AR) displays for vehicles. They have developed innovative technologies like the True AR HUD, which projects driving information onto the windshield in a holographic format.

-

Bosch has made significant strides in the field of augmented reality (AR) across various applications, including automotive, manufacturing, and smart wearables. The company's AR solutions aim to enhance user experiences, improve efficiency, and revolutionize traditional processes through innovative technology.

Key Augmented Reality In Automotive Companies:

The following are the leading companies in the augmented reality in automotive market. These companies collectively hold the largest market share and dictate industry trends.

- Bosch GmbH

- Continental AG

- Denso Corporation

- Magic leap

- Mapbox

- Novac Technology Solutions

- Panasonic Connect

- Visteon Corporation

- WayRay AG

- Texas Instruments Incorporated

Recent Developments

-

In January 2024, Bosch launched a groundbreaking System on a Chip (SoC) for automotive applications at CES 2024. This innovative technology integrates infotainment and driver assistance functions on a single SoC, marking a significant advancement in the automotive industry.

-

In September 2023, AUDI launched a groundbreaking feature for the AUDI Q6 e-tron, where driving information is projected onto the front windshield using augmented reality technology. This cutting-edge addition entails an Augmented Reality Head-Up Display (AR HUD), which casts a sizable, angled display onto the windshield, exclusively visible to the driver. This AR HUD can showcase vital driving data, including speed, traffic signs, navigation specifics, and assistance indicators.

-

In January 2023, Visteon showcased its complete lineup of digital cockpit solutions during CES 2023, demonstrating innovative technologies that enable automakers to create safer, more connected, and more convenient driving experiences. These solutions offer advanced features such as high-performance display solutions, active privacy, sunlight readability, and low power consumption, providing an immersive user experience.

Augmented Reality In Automotive Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.47 billion

Revenue forecast in 2030

USD 122.40 billion

Growth rate

CAGR of 41.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Function, sensor technology, display technology, propulsion, level of autonomous driving, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; UAE; South Africa

Key companies profiled

Bosch GmbH; Continental AG; Denso Corporation; Magic leap; Mapbox; Novac Technology Solutions; Panasonic Connect; Visteon Corporation; WayRay AG; Texas Instruments Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Augmented Reality In Automotive Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the augmented reality in automotive market report based on function, sensor technology, display technology, propulsion, level of autonomous driving, vehicle type, and region:

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

AR HUD with Standard Functions

-

AR HUD Based Navigation

-

AR HUD Based Adaptive Cruise Control

-

AR HUD Based Lane Departure Warning

-

-

Sensor Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Radar

-

LiDAR

-

Image Sensor

-

Sensor Fusion

-

-

Display Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

TFT-LCD

-

Others Display Technology

-

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

Battery Electric Vehicle

-

Others

-

-

Level of Autonomous Driving Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-Autonomous

-

Autonomous

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global augmented reality in automotive market size was estimated at USD 10.41 billion in 2023 and is expected to reach USD 15.47 billion in 2024

b. The global augmented reality in automotive market is expected to grow at a compound annual growth rate of 41.2% from 2024 to 2030 to reach USD 122.40 billion by 2030

b. North America dominated the augmented reality in automotive market with a share of 43.2% in 2023. Regulatory mandates and safety considerations are driving the adoption of AR technology in the North American automotive market.

b. Some key players operating in the augmented reality in automotive market include Bosch GmbH, Continental AG, Denso Corporation, Magic leap, Mapbox, Novac Technology Solutions, Panasonic Connect, Visteon Corporation, WayRay AG, Texas Instruments Incorporated

b. Factors such as integrating AR in vehicles enhance driving experience and AR assistance aids technicians improve efficiency, reduce maintenance, and repair errors are driving the market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.