Augmented Intelligence Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Technology (ML, NLP), By Organization Size, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-353-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Augmented Intelligence Market Trends

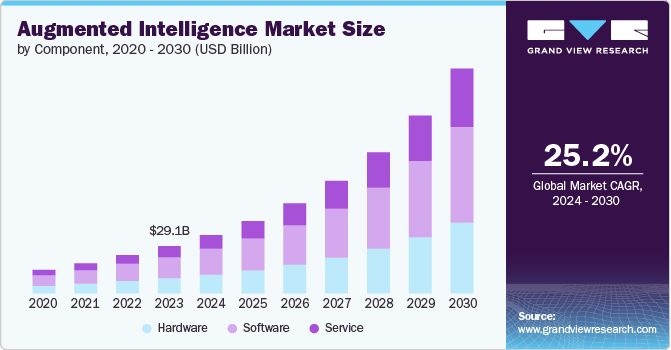

The global augmented intelligence market size was estimated at USD 29.15 billion in 2023 and is estimated to grow at a CAGR of 25.2% from 2024 to 2030. Augmented intelligence is becoming crucial for advanced analytics, enabling organizations to leverage vast amounts of data for predictive insights and decision support. In sectors like healthcare, artificial intelligence (AI) algorithms analyze patient data to assist in diagnostics and treatment planning, reducing error rates and improving outcomes. These capabilities help businesses anticipate market trends, optimize operations, and make data-driven decisions. The ability to provide actionable insights from complex data sets positions augmented intelligence as a valuable tool for strategic planning and operational efficiency.

The integration of AI tools is revolutionizing workplace dynamics by complementing human capabilities in the era of augmented intelligence. AI-powered virtual assistants are widely adopted in customer service to enhance agents' efficiency and provide real-time support, enabling employees to focus on complex problem-solving while AI handles repetitive tasks. As organizations embrace hybrid workforce models, the synergistic relationship between AI and human workers is expected to boost overall productivity and job satisfaction by allowing employees to leverage AI's analytical power and speed to augment their skills and decision-making abilities. The rise of augmented intelligence in the workplace underscores the growing importance of human-AI collaboration in driving innovation, improving customer experiences, and optimizing business outcomes in an increasingly digital and data-driven business landscape.

The demand for real-time data processing capabilities in augmented intelligence is growing, driven by the need for instant decision-making in dynamic environments. AI systems can analyze and interpret streaming data from sources like social media, Internet of Things (IoT) devices, and financial markets, providing immediate insights and responses. This capability is crucial in sectors such as retail, where real-time inventory management and customer behavior analysis can optimize sales and enhance the shopping experience. Real-time augmented intelligence enables organizations to react swiftly to changes and capitalize on emerging opportunities.

Component Insights

The software segment led the market, accounting for 44.88% of the global revenue in 2023. Augmented intelligence software increasingly enhances analytics and business intelligence (BI) capabilities by embedding advanced AI algorithms into BI platforms. These integrations automate data processing, generate insights, and predict trends, revolutionizing strategic decision-making. Tools like Microsoft Power BI, Tableau, and Qlik use AI to simplify data analysis and visualization, making intricate data more accessible and actionable. For instance, in June 2021, Tableau introduced new augmented analytics features that combine data analytics with AI, empowering users across various roles to make smarter, faster decisions. Recent IDC research highlights that a strong data culture boosts collaboration, innovation, and values like trust and accountability across industries.

Service is projected to expand with the highest growth rate from 2024 to 2030. The rise of Industry 4.0 and smart manufacturing drives demand for advanced digital solutions integrating IoT and AI technologies, enabling real-time monitoring and predictive maintenance in industrial environments. This shift helps organizations optimize operations, reduce downtime, and improve overall productivity. For instance, In June 2021, SAP SE partnered with TeamViewer, a prominent provider of remote connectivity and digital workplace solutions, to accelerate digital transformation in industrial settings. This collaboration aims to enhance the delivery of outcome-based services, meeting the increasing demand from customers for improved digital solutions. This trend aligns with the broader movement towards leveraging IoT and remote connectivity to streamline operations and drive efficiency in industrial processes.

Technology Insights

The machine learning segment accounted for the dominant market revenue share in 2023. The growing demand for streamlined and accessible machine learning solutions drives the development of platforms that simplify the ML model lifecycle. This trend reflects an increasing focus on MLOps, which enhances collaboration, reduces complexity, and accelerates the deployment of AI applications. It makes advanced ML capabilities more accessible to organizations regardless of their technical expertise. For instance, In May 2021, Google launched Vertex AI, a managed machine learning (ML) platform designed to expedite the deployment and management of AI models. Vertex AI significantly reduces the code required to train a model by approximately 80% compared to other platforms. It enables data scientists and ML engineers of varying skill levels to efficiently execute Machine Learning Operations (MLOps) and manage ML projects throughout their development lifecycle.

Natural Language Processing (NLP) rapidly evolves, empowering AI systems to comprehend, interpret, and respond to human language more effectively. This advancement transforms conversational AI, making interactions with machines more intuitive and enabling applications such as AI-driven customer support, virtual assistants, and sentiment analysis. Technologies like OpenAI's GPT models and Google's BERT are pushing the boundaries of what NLP can achieve, broadening its adoption across various sectors and facilitating more natural and effective communication between humans and AI systems. As a result, NLP is becoming a crucial component of many business operations, enhancing productivity and improving customer experiences through more personalized and efficient interactions.

Organization Size Insights

The large enterprises segment accounted for the dominant market revenue share in 2023. Large enterprises invest in advanced data management and integration capabilities to support AI-driven insights and decision-making. This trend involves consolidating data from disparate sources into unified platforms that AI systems can analyze comprehensively. AI technologies such as machine learning and natural language processing (NLP) extract actionable insights from vast datasets, facilitating informed decision-making at scale. Improved data governance and integration frameworks ensure data quality and consistency, which is crucial for accurate AI-driven predictions and recommendations.

SMEs are leveraging AI to gain deeper customer insights and deliver personalized experiences. This trend involves analyzing customer data to understand preferences, predict behavior, and tailor products or services accordingly. AI-powered analytics tools enable SMEs to segment their customer base effectively, identify trends, and launch targeted marketing campaigns. By offering personalized recommendations and proactive customer support, SMEs can enhance customer satisfaction and loyalty, driving revenue growth and competitive advantage in their respective markets.

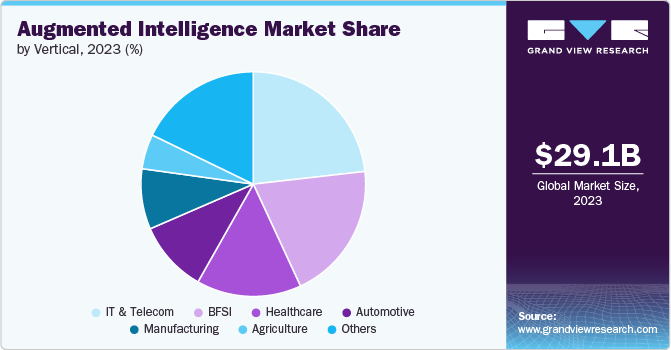

Vertical Insights

The IT and telecom segment dominated the market in 2023. AI is increasingly deployed in these sectors for cybersecurity threat detection and response. AI algorithms analyze network traffic patterns, detect anomalies, and identify potential security breaches in real time. Telecom companies use AI-powered cybersecurity solutions to strengthen defenses against evolving cyber threats, protect sensitive data, and ensure regulatory compliance. This trend emphasizes the critical role of AI in enhancing cybersecurity resilience and safeguarding digital infrastructure in an increasingly interconnected environment.

The healthcare industry is witnessing a growing trend toward adopting AI-powered solutions to automate administrative tasks, optimize hospital workflows, and improve operational efficiency. AI-driven technologies are being leveraged to streamline patient scheduling, manage electronic health records (EHRs), and optimize billing processes, reducing administrative burdens and enhancing staff productivity. Healthcare providers are also utilizing AI-powered predictive analytics to forecast patient admission rates, allocate resources effectively, and optimize hospital bed occupancy to improve healthcare delivery efficiency while maintaining high patient care standards. This trend towards AI-enabled automation and optimization in healthcare settings aims to enable healthcare organizations to focus more on delivering quality patient care by automating repetitive and time-consuming administrative tasks.

Regional Insights

North America accounted for a significant share of the market and accounted for a 37.39% share in 2023. North America leads in the adoption of AI technologies, particularly in healthcare and life sciences. The region invests significantly in AI-powered medical imaging, diagnostics, and personalized medicine to enhance patient care outcomes. AI startups and established tech companies in hubs like Silicon Valley drive innovation, collaborating with healthcare providers to develop advanced AI solutions for disease detection and treatment planning.

U.S. Augmented Intelligence Market Trends

The U.S. augmented intelligence market dominated the North American region. In the U.S., AI adoption in education and EdTech accelerates with personalized learning platforms, AI tutors, and adaptive assessment tools. AI-powered educational applications analyze student performance data to deliver customized learning experiences and improve academic outcomes. U.S. universities and EdTech startups innovate in AI-driven educational technologies, enhancing access to quality education and supporting lifelong learning initiatives nationwide.

Europe Augmented Intelligence Market Trends

The augmented intelligence market in Europe is expected to grow significantly during the forecast period. The retail and consumer goods sectors in Europe adopt AI to enhance customer experiences, optimize supply chain operations, and personalize marketing strategies. AI-powered recommendation engines analyze consumer behavior and preferences to deliver targeted product recommendations and promotions. European retailers invest in AI-driven inventory management systems and logistics optimization to streamline operations and improve profitability in competitive markets.

Asia Pacific Augmented Intelligence Market Trends

The augmented intelligence market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. The Asia Pacific fintech sector embraces AI for digital banking, financial inclusion, and risk management solutions. AI algorithms analyze consumer behavior, creditworthiness, and transaction patterns to enhance fraud detection, credit scoring, and personalized financial services. Financial hubs like Singapore, Hong Kong, and Mumbai lead in AI-driven fintech innovations, collaborating with banks, startups, and regulatory authorities to promote secure and efficient financial ecosystems.

Key Augmented Intelligence Company Insights

Major players in the incident response market, such as Amazon Web Services, Google LLC, Microsoft, and IBM, are intensely focused on expanding their market reach and outperforming competitors. To achieve this, they are actively pursuing strategic initiatives like partnerships, mergers and acquisitions, collaborations, and advancing their product and technology offerings. These efforts are geared towards strengthening their competitive positions and meeting the evolving needs of their customer base effectively. For instance, In March 2022, SAP SE partnered with Consilium Software, a leading provider of customer engagement solutions. Under this agreement, Consilium joined the SAP PartnerEdge program, enabling both companies to collaborate in expanding their market reach, driving innovation, and delivering enhanced customer success. As an independent software vendor (ISV), Consilium can now leverage SAP's extensive customer base and technology ecosystem to advance the design, development, and commercialization of its customer engagement solutions by directly integrating with SAP's business applications through their APIs. This partnership allows SAP and Consilium to provide customers with more comprehensive and seamless solutions that combine Consilium's expertise in customer experience with the power of SAP's enterprise software, addressing evolving customer needs and driving digital transformation across various industries.

Key Augmented Intelligence Companies:

The following are the leading companies in the augmented intelligence market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture PLC

- Alibaba Group Holding Ltd.

- Amazon Web Services

- Apple Inc.

- Baidu, Inc.

- Cognizant Technology Solutions Corporation

- Facebook, Inc.

- Huawei Technologies Co., Ltd.

- Infosys Limited

- Intel Corporation

- IBM

- Microsoft

- NVIDIA Corporation

- Oracle Corporation

- Qlik Technologies Inc.

- Salesforce.com, Inc.

- SAP SE

- SAS Institute Inc.

- Tencent Holdings Ltd.

Recent Developments

-

In September 2023, Oracle Corp unveiled new AI-powered capabilities within its Oracle Analytics Cloud platform. These self-service AI features, including generative AI assistants and augmented analytics, are designed to help organizations leverage data more effectively to drive decision-making. By automating tasks like data preparation, visualization generation, and pattern detection, the AI-driven capabilities in Oracle Analytics Cloud empower users across the organization to uncover insights and make more informed decisions without requiring advanced data science expertise.

-

In May 2023, QlikTech International AB announced the acquisition of Talend, Inc., a strategic move aimed at creating a comprehensive, cloud-independent portfolio of data integration, transformation, and governance solutions. The combination of Qlik's and Talend's industry-leading capabilities across real-time data integration, data quality, analytics, AI, and ML enables the delivery of a robust and holistic approach to data management and utilization for customers. This strategic acquisition empowers organizations to address their evolving data integration, transformation, and governance needs through a unified suite of complementary technologies, providing them with the tools to derive greater value from their data and drive informed decision-making.

-

In March 2022, Google announced a partnership with Impactsure Technologies, a company that provides AI and ML-powered solutions for financial institutions and corporate clients. Impactsure's solutions, built on Google Cloud, enable organizations to execute AI and machine learning initiatives that can enhance operational efficiency and reduce compliance-related risks. This collaboration allows financial institutions and enterprises to leverage Google Cloud's scalability, security, and advanced AI/ML capabilities to drive innovation and optimize their operations.

-

In February 2022, Sisense, a leading data analytics platform, partnered with Yieldbroker, a prominent Tier 1 licensed electronic trading platform. The collaboration aimed to help Yieldbroker expand its geographical footprint in the Australian and New Zealand markets by leveraging Sisense's advanced analytics capabilities. Through this partnership, Yieldbroker can now provide its clients with more comprehensive and data-driven trading insights, empowering them to make informed decisions and optimize their trading strategies. The partnership highlights the growing importance of data analytics in the financial services industry as organizations seek to gain a competitive edge by deriving actionable insights from their trading data.

Augmented Intelligence Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 36.00 billion |

|

Revenue forecast in 2030 |

USD 138.82 billion |

|

Growth rate |

CAGR of 25.2% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, technology, organization size, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Accenture PLC; Alibaba Group Holding Ltd.; Amazon Web Services; Apple Inc.; Baidu, Inc.; Cognizant Technology Solutions Corporation; Facebook, Inc.; Google; Huawei Technologies Co., Ltd.; Infosys Limited; Intel Corporation; IBM; Microsoft; NVIDIA Corporation; Oracle Corporation; Qlik Technologies Inc.; Salesforce.com, Inc.; SAP SE; SAS Institute Inc.; Tencent Holdings Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Augmented Intelligence Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global augmented intelligence market report based on component, technology, organization size, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Service

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Machine Learning

-

Natural Language Processing

-

Context-Aware Computing

-

Computer Vision

-

Others

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small and Medium-Sized Enterprises

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

IT and Telecom

-

BFSI

-

Healthcare

-

Manufacturing

-

Automotive

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global augmented intelligence market size was estimated at USD 29.15 billion in 2023 and is expected to reach USD 36.00 billion in 2024.

b. The global augmented intelligence market is expected to grow at a compound annual growth rate of 25.2% from 2024 to 2030 to reach USD 138.82 billion by 2030.

b. North America dominated the augmented intelligence market with a share of 37.39% in 2023. North America leads in the adoption of AI technologies, particularly in healthcare and life sciences. The region invests significantly in AI-powered medical imaging, diagnostics, and personalized medicine to enhance patient care outcomes. AI startups and established tech companies in hubs like Silicon Valley drive innovation, collaborating with healthcare providers to develop advanced AI solutions for disease detection and treatment planning.

b. Some key players operating in the augmented intelligence market include Accenture PLC, Alibaba Group Holding Ltd., Amazon Web Services, Apple Inc., Baidu, Inc., Cognizant Technology Solutions Corporation, Facebook, Inc., Google, Huawei Technologies Co., Ltd., Infosys Limited Intel Corporation, IBM, Microsoft, NVIDIA Corporation, Oracle Corporation, Qlik Technologies Inc., Salesforce.com, Inc., SAP SE, SAS Institute Inc., Tencent Holdings Ltd.

b. Key factors driving market growth include the rising demand for efficiency and productivity and the growing adoption of cloud-based solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."