- Home

- »

- Medical Devices

- »

-

Audiology Devices Market Size, Share, Industry Report, 2030GVR Report cover

![Audiology Devices Market Size, Share & Trends Report]()

Audiology Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Digital, Analog), By Age Group (Pediatrics, Adults), By Product (Cochlear Implants, Hearing Aids), By Sales Channel, And Segment Forecasts

- Report ID: 978-1-68038-217-4

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Audiology Devices Market Summary

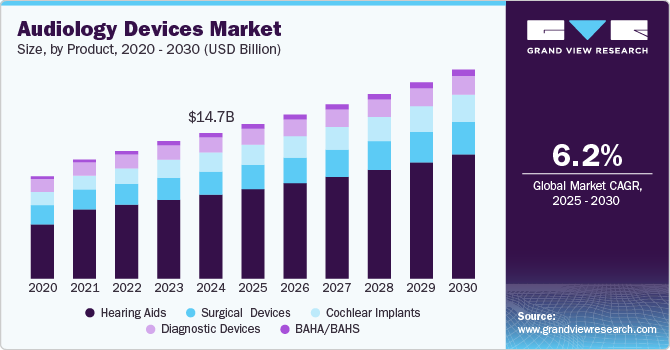

The global audiology devices market size was estimated at USD 14,725.0 million in 2024 and is projected to reach USD 21,125.3 million by 2030, growing at a CAGR of 6.24% from 2025 to 2030. This growth can be attributed to factors such as the growing geriatric population, rising prevalence of hearing disorders, and supportive government initiatives for easy access to hearing aids.

Key Market Trends & Insights

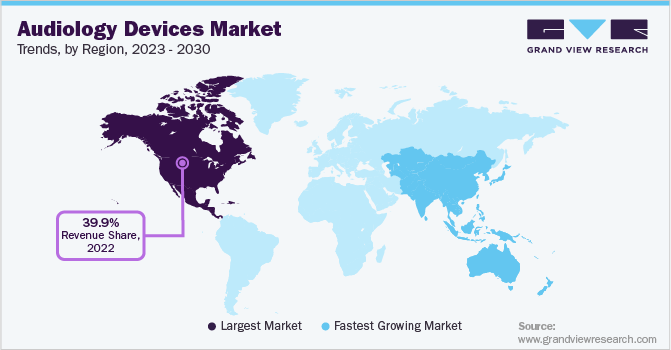

- In terms of region, Europe was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, hearing aids accounted for a revenue of USD 9,039.0 million in 2024.

- Hearing Aids is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 14,725.0 Million

- 2030 Projected Market Size: USD 21,125.3 Million

- CAGR (2025-2030): 6.24%

- Europe: Largest market in 2024

Hearing loss and impairment have become a significant public health concern, particularly in developed economies. The prevalence of hearing loss is increasing; it is considered one of the most common conditions affecting patients globally.

According to the WHO factsheet of February 2024, around 5% of the global population requires rehabilitation to address their hearing loss. Moreover, around 2.5 billion individuals are projected to have some hearing loss by 2050, and around 700 million are expected to require hearing rehabilitation by 2050. In addition, the increasing life expectancy and the growing noise pollution are expected to contribute to the rise in age-related hearing loss. Hence, the rise in hearing aid sales and the high prevalence of hearing loss are expected to drive the market.

Furthermore, Recent technologies in the audiology devices industry focus on providing various benefits compared to traditional hearing aids. Rechargeable hearing aid devices are small, easy to use/user-friendly, and environmentally friendly. In addition, different hearing aids that help patients with hearing loss have been introduced in the market by several key players, such as Starkey and Cochlear Limited.

In August 2024, Sonova launched two new hearing aid platforms, including the first hearing aid to feature real-time AI technology, addressing the most pressing needs in hearing loss. The Phonak Audéo Sphere Infinio is the first hearing aid with dual-chip AI technology. It uses a special AI chip to separate clear speech from background noise in real-time, making it easier to understand speech in noisy environments. Clinical studies show that users had over double the speech understanding compared to traditional hearing aids.

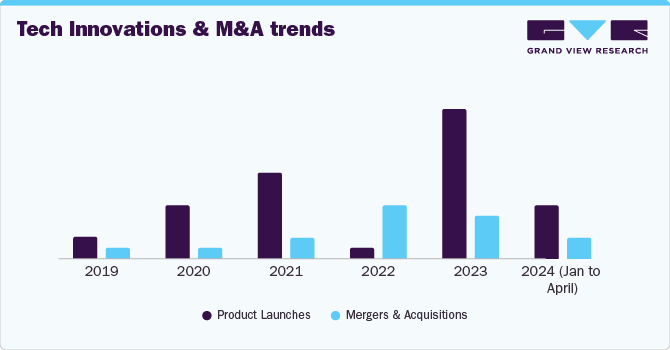

The audiology devices industry has witnessed a surge in mergers and acquisitions (M&A) as leading players seek to expand their product portfolios, enhance technological capabilities, and extend their geographical reach. The number of mergers and acquisitions remained low from 2019 to 2021, but it has increased from 2022 to 2023 as companies are increasingly engaging in strategic acquisition to expand their market presence. Furthermore, there are more new products launched by companies from 2019 to 2024, with 2023 showcasing a higher number of launches compared to previous years. This increase in new product launches indicates that there is more focus on innovation and growth in the market.

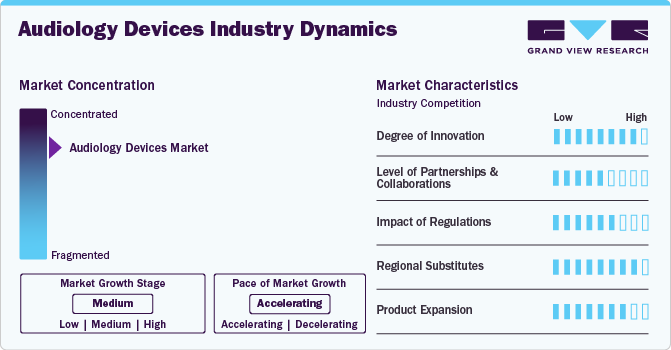

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The market is consolidated, with the presence of key providers dominating the market. The degree of innovation is high, and the level of partnerships & collaboration activities is high. The impact of regulations on the industry is high, and the regional expansion of the industry is moderate.

Key players invest in technological advancements, such as developing intelligent hearing devices. Smart hearing aids are advanced devices that enhance hearing using digital technology to automatically adjust sound settings based on the environment. They often feature wireless connectivity, allowing users to stream audio directly from smartphones and other devices. For instance, in February 2024, Widex launched the SmartRIC hearing aid, designed to improve natural hearing quality. The L-shaped device strategically places microphones to enhance speech capture and align with the user’s auditory focus. As Widex’s most durable rechargeable Receiver-in-Canal (RIC) model, the SmartRIC provides up to 37 hours of functionality on a single charge. It has microphone inlets that minimize wind & handling noise and has Widex’s portable charging option.

Partnerships and collaborations are thriving in the industry as companies seek to improve patient outcomes by integrating advanced technologies. These alliances leverage combined clinical expertise and tech innovation to enhance products, expand market access, and accelerate development through shared R&D investments. For instance, in February 2023, Cochlear Ltd. announced a partnership with Amazon.com, Inc. to expand audio streaming for hearing aids for people with Cochlear's hearing implants to provide comfortable entertainment.

Government initiatives designed to raise awareness about hearing screenings among infants and older adults are fostering industry growth. Strong government support to improve accessibility is anticipated to drive demand. The FDA shapes the U.S. audiology market's regulatory framework, overseeing the safety and efficacy of audiology devices. In addition to the growing demand driven by the aging population, there is an increasing focus on the accessibility and affordability of audiology devices, which drives the market in the U.S. Recent legislative and regulatory changes have made hearing aids more accessible, especially for those with mild to moderate hearing loss.

The audiology devices industry experiences moderate regional expansion due to several challenges. These include stringent regulatory barriers across different regions, disparities in healthcare infrastructure between developed and developing countries, High prices, particularly for advanced hearing aids and cochlear implants, create a significant barrier, especially in low- and middle-income countries, and a shortage of trained healthcare professionals in low- and middle-income countries.

Product Insights

The hearing aids segment led the market with the largest revenue share of 57.59% in 2024 and expected to witness at the fastest CAGR during the forecast period, owing to the significant demand for invisible-in-canal hearing aids and complete-in-canal hearing aids. This can be attributed to the rising awareness of cochlear implants as noninvasive procedures and new products launched by key companies. For instance, in August 2021, Cochlear Ltd. launched the Nucleus Kanso-2 sound processor for a cochlear implant.

The surgical devices segment is anticipated to grow at a significant CAGR over the forecast period, due to increasing advancements reflect a growing trend in audiology towards personalized solutions that leverage technology to enhance patient outcomes in hearing rehabilitation. For instance, in October 2021, Acclarent, part of Johnson & Johnson Medical Devices, launched an AI-powered ENT navigation system called TruDi. This technology enhances surgical planning and offers real-time feedback during procedures such as endoscopic sinus surgery. It features TruSeg for anatomical segmentation and TruPath for optimal surgical routing, significantly improving the accuracy and safety of ENT surgeries.

Technology Insights

Based on technology, the digital segment led the market with the largest revenue share of 92.96% in 2024. This is attributed to the quick adaptability of these devices. Many manufacturers offer digital hearing aids with Bluetooth connectivity integrated with In-The-Ear (ITE) and Behind-The-Ear (BTE) models. The Open hearing aid range by Oticon can be connected to iPhone, iPad, and iPod touch devices, allowing users to stream audio directly into their hearing aids.

The analog segment is anticipated to grow at a significant CAGR over the forecast year. Analog hearing aids offer a traditional and straightforward approach to hearing assistance by processing sound waves as continuous electrical signals, amplifying all sounds uniformly. Known for their simplicity, they provide a consistent listening experience without advanced features, making them suitable for those who prefer ease of use. These devices are valued for their durability and reliability, as they contain fewer electronic components, resulting in lower maintenance needs and longer lifespans. Analog hearing aids operate without needing a battery, making them ideal for individuals who may forget to charge their devices or prefer to avoid managing battery replacements. This is expected to boost the demand for analog hearing aids in the market.

Sales Channel Insights

Based on sales channel, the retail sales segment accounted for the largest market revenue share in 2024 and is projected to register at the fastest CAGR of over the forecast period, due to the presence of large retail store chains, such as CVS, Walgreens, Walmart, and Amazon. These retail stores are entering into the healthcare retail sector. Furthermore, rising government initiatives for audiology care products and remote care are expected to drive the growth of the retail sales segment during the forecast period.

The e-commerce segment is anticipated to grow at a significant CAGR over the forecast year, driven by the increasing preference for online shopping and its convenience. E-commerce platforms provide an accessible channel for customers to research, compare, and purchase hearing aids and related devices from the comfort of their homes. With a growing number of consumers opting for online shopping, particularly in regions with limited access to physical stores, e-commerce plays a crucial role in expanding the reach of audiology products to a broader audience.

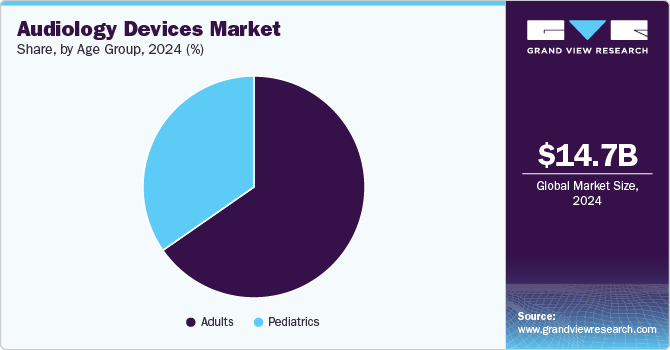

Age Group Insights

Based on age group, the adult segment accounted for the largest market revenue share in 2024. The increasing geriatric population and growing awareness about available hearing implants & devices are some of the major factors contributing to the growth of the segment. According to the National Institute on Deafness Other Communication Disorders (NIDCD), around 5% of adults between the ages of 45 and 54 experience disabling hearing loss. This percentage rises to 10% for adults aged 55-64, 22% for those aged 65-74, and 55% for individuals aged 75 and older.

The pediatrics segment is projected to witness at a remarkable CAGR during the forecast period, due to the rising number of infants born with sensorineural hearing loss and the effectiveness of cochlear implants in treating these hearing abnormalities in children. According to the NIDCD, in the U.S., approximately 2 to 3 per 1,000 newborns are born with hearing loss in one or both ears. This growing recognition among parents and healthcare professionals led to a surge in demand for pediatric hearing aids and related devices.

Regional Insights

The audiology devices market in North America accounted for a significant market share in 2024, due to the increasing prevalence of hearing loss, an aging population, and technological advancements. According to the World Health Organization (WHO), approximately 466 million people worldwide have disabling hearing loss, with a substantial portion residing in North America. This demographic shift towards an older population is expected to amplify demand for audiology devices such as hearing aids, cochlear implants, and diagnostic equipment. The heightened awareness of hearing health and the importance of early diagnosis and intervention drive market growth. For instance, campaigns by organizations like the American Speech-Language-Hearing Association (ASHA) have been instrumental in educating the public about hearing loss and available treatment options.

U.S. Audiology Devices Market Trends

The audiology devices market in the U.S. is driven by the rising prevalence of hearing loss, especially among the aging population, and the increasing awareness of hearing health. According to the National Institute on Deafness and Other Communication Disorders (NIDCD) statistics published in September 2024, approximately 15% of American adults report hearing loss, driving greater demand for hearing aids and related devices. This growth is fueled by the aging Baby Boomer generation, which is more susceptible to age-related hearing loss, leading to higher adoption rates of hearing aids.

Europe Audiology Devices Market Trends

Europe dominated the audiology devices market with the largest revenue share of 36.30% in 2024. Key factors contributing to the growth of this region are the growing geriatric population and the increasing prevalence of hearing loss. Moreover, increasing government support in the form of approvals and reimbursement, coupled with growing awareness, is driving market growth. Furthermore, the presence of several key players is positively impacting market growth as these players tend to engage in strategic initiatives.

The audiology devices market in the UK held a significant market share in Europe in 2024, owing to the increasing prevalence of hearing disabilities, a growing geriatric population, and technological advancements. Moreover, new initiatives in the country are expected to drive the hearing aids market, with a growing focus on enhancing accessibility, affordability, and innovation in hearing healthcare solutions.

The Germanyaudiology devices market held the largest market share in Europe in 2024. Germany is one of Europe's largest and most mature audiology device industry, driven by factors such as an aging population, high healthcare expenditure, and advancements in hearing aid technologies. As per an article published by BioMed Central Ltd in 2023, around 235,000 deaf and hard of hearing individuals reside in Germany who face a communication barrier in accessing medical care. This group encounters limitations in receiving urgent medical attention, as options for communication and sign language interpreters are restricted. This factor drives the country's demand for hearing aids.

Asia Pacific Audiology Devices Market Trends

The audiology devices market in Asia Pacific is expected to witness at a significant CAGR over the forecast period, owing to the increasing geriatric population and the rising prevalence of age-related hearing problems. Asian countries, such as India and China have a large geriatric population, which results in lucrative market growth.

The Chinaaudiology devices market accounted for the largest market share in Asia Pacific in 2024. The China audiology devices industry is experiencing growth driven by an aging population, increased healthcare awareness, and expanding government support. The Chinese government implemented several initiatives to improve healthcare accessibility, including support for hearing rehabilitation services. These factors and growing awareness about hearing loss and the benefits of early intervention fuel the demand for audiology devices in the region.

The audiology devices market in India is expected to witness at a significant CAGR over the forecast period. The government is putting effort into improving the country’s healthcare infrastructure to provide improved diagnostics and hearing disorder treatments. The rising awareness among the population and the increased literacy rate are expected to drive market growth in the country.

Latin America Audiology Devices Market Trends

The audiology devices market in Latin America is experiencing growth due to factors such as high decibel exposure, increased noise pollution, and digital enhancement of hearing aids. The region experiences significant noise pollution, which impacts adult hearing ability, leading to a higher demand for hearing aids. The area holds considerable growth potential for hearing aids.

The Brazil audiology devices market is one of the emerging economies with significant growth potential in the Latin American market. Rising per capita disposable income is leading to increased expenditure on healthcare. According to the Brazilian Journal of Otorhinolaryngology, in February 2023, the estimated prevalence of hearing loss in children up to 18 years of age was reported to be 18% in the country. This is expected to increase, fueling the demand for hearing aids in Brazil.

Middle East & Africa Audiology Devices Market Trends

The audiology devices market in the Middle East & Africa is experiencing significant growth due to increasing awareness about hearing health, an aging population, and rising disposable income levels. Countries in the region are witnessing a gradual shift in healthcare priorities, with governments investing more in improving public health services. The prevalence of hearing loss, especially among older populations, is also on the rise.

The South Africa audiology devices market is anticipated to grow at a significant CAGR over the forecast period. The government celebrates Deaf Awareness Week every year to raise awareness. It aims to inform the public about hearing loss, the deaf community, its culture, and sign language. It is working toward fostering understanding among the hearing population regarding deafness and the cultural identity of the deaf community. Thus, such factors are expected to drive market growth over the forecast period.

Key Audiology Devices Company Insights

The market is consolidated, with several large players operating in this space adopting various strategies such as collaborations, acquisitions, partnerships, and launching new devices. Some emerging market players in the audiology devices industry include Arphi Electronics Private Limited, WiscMed, LLC, JEDMED, and Sivantos Pte. Ltd.

The following are the leading companies in the audiology devices market. These companies collectively hold the largest market share and dictate industry trends.

Key Audiology Devices Companies:

- Demant A/S

- GN Store Nord A/S

- Sonova

- Starkey Laboratories, Inc.

- MED-EL Medical Electronics

- Cochlear Ltd.

- WS Audiology A/S

- MAICO Diagnostics GmbH

- Oticon Medical

- INVENTIS srl

- Tech Innovations and M&A trends

Recent Developments

-

In August 2024, Sonova launched two new hearing aid platforms, including the first real-time AI-enabled device to dive into critical hearing loss challenges.

-

In March 2024, WSAudiology introduces Rexton ReCharge, an affordable range of rechargeable hearing solutions designed to meet global hearing needs.

-

In February 2023, Cochlear Ltd. announced a partnership with Amazon.com, Inc. to expand audio streaming for hearing aids for people with Cochlear's hearing implants to provide comfortable entertainment.

Audiology Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.61 billion

Revenue forecast in 2030

USD 21.13 billion

Growth rate

CAGR of 6.24% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, age group, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Demant A/S; GN Store Nord A/S; Sonova; Starkey Laboratories, Inc.; MED-EL Medical Electronics; Cochlear Ltd.; WS Audiology A/S; MAICO Diagnostics GmbH; Oticon Medical; INVENTIS srl

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Audiology Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global audiology devices market report based on product, sales channel, technology, age group, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hearing Aids

-

Cochlear Implants

-

BAHA/BAHS

-

Diagnostic Devices

-

Surgical Devices

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital

-

Analog

-

-

Sales channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Sales

-

E-commerce

-

Government Purchases

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Pediatrics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global audiology devices market size was estimated at USD 14.72 billion in 2024 and is expected to reach USD 15.61 billion in 2025.

b. The global audiology devices market is expected to grow at a compound annual growth rate of 6.24% from 2025 to 2030 to reach USD 21.13 billion by 2030.

b. North America dominated the audiology devices market in 2024. This is attributable to advancements in audiology systems, an increase in the number of audiologists, and current providers' introduction of innovative digital platforms.

b. Some of the major companies in the global audiology devices market are Demant A/S; GN Store Nord A/S; Sonova; Starkey Laboratories, Inc.; MED-EL Medical Electronics; Cochlear Ltd.; WS Audiology A/S; MAICO Diagnostics GmbH; Oticon Medical; and INVENTIS srl.

b. Key factors that are driving the audiology devices market growth include the growing geriatric population and cases of hearing disorders along with supportive government initiatives for easy access to hearing aid. The total geriatric population in the world is estimated to be 1.4 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.