Audio Codec Market Size, Share & Trends Analysis Report By Function (With DSP, Without DSP), By Component Type (Hardware Codecs, Software Codecs), By Application (Automobile, Television Sets), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-391-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Audio Codec Market Size & Trends

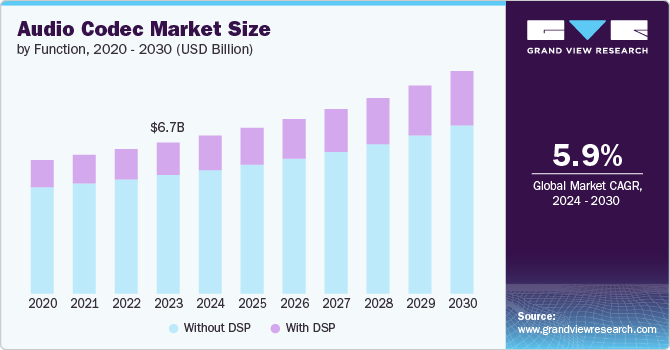

The global audio codec market size was valued at USD 6.71 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030. The integration of AI in audio codecs is becoming more prevalent, enabling smarter and more efficient audio processing. AI-powered codecs can optimize audio quality based on the content being played and the environment. This includes features such as adaptive noise cancellation, audio enhancement, and real-time translation. Such capabilities are increasingly sought after in consumer electronics, where seamless and high-quality audio experiences are a priority. As AI technology continues to advance, its incorporation into audio codecs is likely to become even more sophisticated and widespread.

The expanding market for smart home devices, such as smart speakers and home assistants, is driving the need for high-quality audio Codecs. These devices require Codecs that can handle voice recognition and command processing with high accuracy and clarity. High-performance audio Codecs ensure that smart home devices can provide clear and reliable voice interactions. As the smart home market continues to grow, the demand for advanced audio Codecs is expected to increase. This trend underscores the importance of integrating high-quality audio processing into connected home devices.

There's a growing demand for high-resolution audio (Hi-Res Audio), which offers better sound quality than standard audio formats. Audiophiles and general consumers alike are seeking out devices and services that provide superior audio fidelity. This trend is driving the adoption of advanced audio Codecs that can support higher bit rates and sample rates. These Codecs are crucial for delivering the detailed and nuanced sound that high-resolution audio formats require. As more streaming services and audio equipment manufacturers embrace Hi-Res Audio, the market for compatible codecs is set to expand.

Function Insights

The without DSP segment led the market and accounted for 78.6% of the global revenue in 2023. Audio codecs without DSP are favored for applications where cost is a critical factor. These Codecs provide the necessary audio compression and decompression without the added expense of DSP capabilities. This makes them ideal for low-cost consumer electronics, such as budget smartphones, basic feature phones, and entry-level audio devices. The demand for affordable audio solutions remains strong, especially in emerging markets where price sensitivity is high. Manufacturers in these regions prioritize keeping costs down, ensuring a steady demand for non-DSP audio Codecs.

Smart devices and IoT applications are driving the need for DSP-equipped audio Codecs that can handle complex audio tasks. Smart speakers, home assistants, and wearable devices require advanced audio processing for voice recognition and command execution. DSP-equipped Codecs ensure that these devices deliver clear and accurate audio responses, enhancing user interaction. As the number of connected devices in homes and workplaces continues to grow, the demand for high-performance audio solutions is set to rise. This trend underscores the critical role of DSP in the future of smart audio devices.

Component Type Insights

The hardware segment held the highest market share in 2023. Advancements in technology are enabling hardware Codecs to become more compact and power efficient. This miniaturization is crucial for integrating high-quality audio processing into portable and wearable devices. Smaller and more efficient hardware Codecs allow manufacturers to design sleek and lightweight products without sacrificing audio quality. These advancements also contribute to better battery life, which is a significant advantage for mobile devices. As technology continues to evolve, hardware Codecs will likely become even more efficient and versatile, broadening their application scope.

The growing integration of software Codecs with cloud services is enhancing their capabilities and applications. Cloud-based audio processing allows for more sophisticated and resource-intensive audio features that might not be feasible on-device. This includes advanced audio analytics, real-time audio enhancements, and improved voice recognition accuracy. The ability to offload processing to the cloud can also reduce the power consumption and processing load on the device itself. As cloud computing continues to advance, the synergy between software Codecs and cloud services is expected to grow.

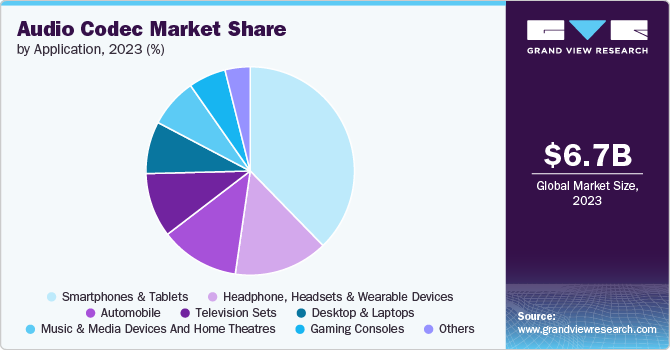

Application Insights

Smartphones and tablets held the highest market share in 2023. Smartphones and tablets are increasingly supporting high-resolution audio, driven by consumer demand for superior sound quality. Manufacturers are incorporating advanced audio Codecs capable of handling higher bit rates and sample rates to deliver detailed and immersive audio experiences. This trend is particularly evident in flagship models and premium devices where audio quality is a key differentiator. As streaming services and digital music platforms offer more high-resolution content, the need for compatible audio Codecs in smartphones and tablets is rising. This push towards high-resolution audio is reshaping user expectations and setting new standards in the mobile audio market.

Automobile manufacturers are increasingly integrating advanced audio Codecs into in-car entertainment systems to enhance the driving experience. High-quality audio Codecs support features like immersive surround sound and high-fidelity music playback, contributing to a premium audio environment within the vehicle. As consumer expectations for in-car entertainment rise, automakers are incorporating sophisticated audio technologies to differentiate their offerings. This trend is driving the adoption of Codecs that can deliver rich, clear audio across various media formats. Advanced in-car audio systems are becoming a significant selling point for modern vehicles, reflecting the growing importance of audio quality in automotive design.

Regional Insights

North America audio codec market dominated the market and accounted for a 34.4% share in 2023. North America is witnessing a strong demand for premium audio experiences, driven by the popularity of high-end consumer electronics and advanced in-car entertainment systems. This trend is leading to increased adoption of sophisticated audio Codecs that support high-resolution audio and immersive sound technologies. As consumers seek superior audio quality in their devices, manufacturers are focusing on integrating advanced Codecs to meet these expectations.

U.S. Audio Codec Market Trends

The audio codec market in the U.S. is seeing a strong emphasis on wireless and streaming technologies, leading to increased demand for audio Codecs that support high-quality wireless audio transmission. As consumers continue to adopt Bluetooth headphones, smart speakers, and streaming services, the need for efficient and high-performance audio Codecs is growing. This trend highlights the U.S.'s focus on integrating advanced Codecs to enhance the wireless audio experience.

Europe Audio Codec Market Trends

The audio codec market in Europe is growing as the rollout of 5G connectivity is enhancing the capabilities of audio Codecs by enabling faster data transfer rates and lower latency. This advancement supports high-quality streaming services and improved wireless audio experiences, such as high-fidelity Bluetooth audio and real-time communications. The integration of 5G technology is expected to drive further innovation in audio Codecs, allowing for more immersive and seamless audio applications. This trend highlights Europe's commitment to leveraging cutting-edge connectivity to enhance audio technology.

Asia Pacific Audio Codec Trends

The audio codec market in Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific region is seeing rapid adoption of mobile devices, including smartphones and tablets, which is driving the demand for high-performance audio Codecs. As the market for mobile technology expands, consumers are seeking devices with enhanced audio capabilities, leading to increased integration of advanced Codecs. This trend reflects the region's growing focus on delivering superior audio experiences in affordable and high-end mobile devices.

Key Audio Codec Company Insights

The market is characterized by intense competition and a significant concentration of market share among leading players such as DSP Group Inc., Qualcomm Inc., STMicroelectronics, and Texas Instruments Inc. as of 2023. These companies focus on expanding their customer bases to maintain a competitive advantage, employing strategic initiatives such as partnerships, mergers, acquisitions, collaborations, and the development of new products and technologies. For instance, In January 2024, Vortex Communications announced the integration of its CallMe IP soft audio Codec with Rode's RodeCaster Pro-II and Duo portable audio mixers. This development effectively transforms these mixers into devices equipped with a built-in audio Codec, facilitating audio contributions from remote guests and sources. The upgrade offers a streamlined, cost-effective solution for outside broadcasting, podcasting, and web streaming, utilizing various internet connectivity options. Additionally, it supports high-quality audio delivery to off-site recipients, enhancing the capabilities of content creators and broadcasters alike.

Key Audio Codec Companies:

The following are the leading companies in the audio codec market. These companies collectively hold the largest market share and dictate industry trends.

- Analog Devices Inc.

- ATC LABS

- Barix AG

- Cirrus Logic Inc.

- DSP Group Inc.

- Maxim Integrated

- Qualcomm Inc.

- Realtek Semiconductor Corp.

- Rohm Co. Ltd

- Sony Corporation

- STMicroelectronics

- Synopsys

- Texas Instruments Inc.

Recent Developments

-

In March 2024, AEQ introduced the Solaris Codec, marking a significant advancement in audio technology, particularly for broadcasting. Designed to facilitate multiple STL (Studio Transmitter Link) connections and remote contributions, Solaris offers a versatile solution for various broadcast applications. Its architecture supports up to 64 bidirectional stereo channels in a compact 1RU form factor, making it suitable for both large and small setups. The Codec employs IP audio I/O via Dante, ensuring compatibility with AES-67, and features redundancy options to enhance reliability during operations.

-

In February 2024, Sony India launched the XAV-AX8500, a cutting-edge in-car audio system that elevates the auditory and visual experience for users. This innovative system incorporates adjustable features that allow users to customize their listening environment. Utilizing LDAC technology, the XAV-AX8500 enhances sound quality, enabling Bluetooth wireless audio streaming at an impressive 96 kHz/24-bit sampling rate. This advancement not only improves the overall audio fidelity but also caters to the growing demand for high-quality in-car entertainment solutions.

Audio Codec Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 7.02 billion |

|

Revenue forecast in 2030 |

USD 9.89 billion |

|

Growth Rate |

CAGR of 5.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

function, component type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; South Korea; Australia; Brazil; UAE; KSA; South Africa |

|

Key companies profiled |

Analog Devices Inc.; ATC LABS; Barix AG; Cirrus Logic Inc.; DSP Group Inc.; Maxim Integrated; Qualcomm Inc.; Realtek Semiconductor Corp.; Rohm Co. Ltd; Sony Corporation; STMicroelectronics; Synopsys; Texas Instruments Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Audio Codec Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global audio codec market report based on function, component type, application and region:

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

With DSP

-

Without DSP

-

-

Component Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware Codecs

-

Software Codecs

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automobile

-

Television Sets

-

Smartphones and tablets

-

Desktop and laptops

-

Headphone, Headsets and Wearable devices

-

Music & Media Devices and Home Theatres

-

Gaming consoles

-

Others (AR/VR, Broadcasting Equipment, Smart Home Devices)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global audio codec market size was estimated at USD 6.71 billion in 2023 and is expected to reach USD 7.02 billion in 2024.

b. The global audio codec market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 9.89 billion by 2030

b. North America dominated the audio codec market with a share of 34.4% in 2023. North America is witnessing a strong demand for premium audio experiences, driven by the popularity of high-end consumer electronics and advanced in-car entertainment systems. This trend is leading to increased adoption of sophisticated audio codecs that support high-resolution audio and immersive sound technologies.

b. Some key players operating in the audio codec market include Analog Devices Inc., ATC LABS, Barix AG, Cirrus Logic Inc., DSP Group Inc., Maxim Integrated, Qualcomm Inc., Realtek Semiconductor Corp., Rohm Co. Ltd, Sony Corporation, STMicroelectronics, Synopsys, and Texas Instruments Inc.

b. Key factors driving market growth include Rising Demand for Mobile Devices, Market Fragmentation and Competition, and Advancements in Audio Streaming.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."