ATP Assays Market Size, Share & Trends Analysis Report By Type (Luminometric ATP Assays, Enzymatic ATP Assays), By Application (Drug Discovery & Development, Clinical Diagnostics, Environmental Testing), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-390-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

ATP Assays Market Size & Trends

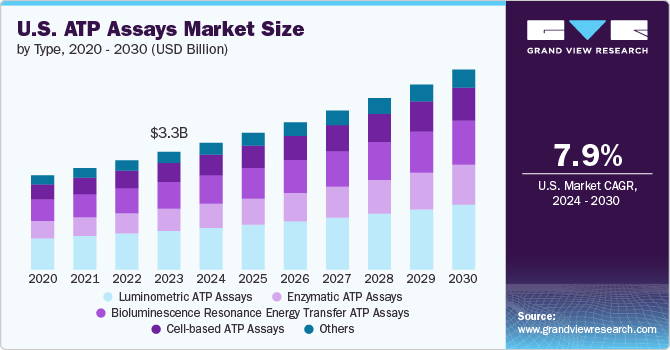

The global ATP assays market size was estimated at USD 3.31 billion in 2023 and is projected to grow at a CAGR of 7.9% from 2024 to 2030. This is attributed to the demand for rapid and sensitive detection methods, expanding pharmaceutical and biotechnology research applications, regulatory approvals, and the rising burden of chronic diseases. These drivers underscore the critical role of ATP assays in healthcare, research, and industrial sectors, facilitating advancements in personalized medicine, drug discovery, environmental monitoring, food safety and quality testing, and disease management. The 2022 WHO report highlights that food contamination affects about 600 million people globally, leading to over 200 diseases annually, including severe conditions such as diarrhea, resulting in 420,000 deaths and 33 million healthy life years lost.

The increasing prevalence of chronic diseases, such as cancer, diabetes, cardiovascular disorders, and infectious diseases, drives the demand for ATP assays in diagnostic testing and disease management. According to the report published by the World Health Organization (WHO) in July 2023, 116 million people live with hepatitis B and 10 million with hepatitis C, leading to cancer, liver cirrhosis, and viral hepatitis-related deaths, and around 3 million new infections occur annually, with most going undetected In the Western Pacific Region. ATP levels indicate cellular dysfunction and disease progression, making these assays valuable tools for disease diagnosis, prognosis, and monitoring of therapeutic responses. As healthcare systems worldwide face the challenge of managing chronic conditions, assays contribute to improving patient outcomes through early detection and personalized treatment strategies.

Contaminated food contains harmful pathogens like bacteria, viruses, parasites, and chemical substances, posing significant health risks. ATP assays are pivotal in combating food contamination by swiftly and sensitively detecting microbial presence. These assays measure adenosine triphosphate, a universal indicator of microbial activity in all living cells. ATP levels serve as reliable markers for assessing cleanliness in food surfaces, equipment, and processing areas. They enable prompt identification of contamination sources, empowering food manufacturers, processors, and regulators to take immediate corrective actions to prevent foodborne illnesses. In food processing, these products monitor hygiene practices, validate cleaning procedures, ensure compliance with safety standards, and enable real-time microbial monitoring to uphold food quality and safety across supply chains.

Technological innovations play a pivotal role in driving the market forward. Advances in assay sensitivity, accuracy, and automation have enhanced the performance and reliability of AP detection methods. Manufacturers are developing novel platforms integrating cutting-edge technologies such as bioluminescence, fluorescence, and chemiluminescence to provide rapid and precise measurements. For instance, The RealTime-Glo Extracellular ATP Assay by Promega Corporation is a bioluminescent method designed to detect ATP released from cells undergoing stress, activation, or apoptosis. It serves as a pivotal biomarker for assessing treatments that may induce immunogenic cell death, a significant aspect of immune response modulation. These advancements cater to the growing demand for high-throughput screening and automated workflows in research laboratories and diagnostic settings.

Type Insights

Based on the type, luminometric ATP Assays held the largest market share of 33.03% in 2023 due to their sensitivity, broad application spectrum, rapid detection capabilities, technological advancements, and compliance with regulatory standards. As industries prioritize enhanced quality control and safety measures, luminometric ATP assays are pivotal in ensuring product integrity, environmental health, and public safety across various sectors globally. For instance, the Luminescent ATP Detection Assay Kit by Abcam plc measures cellular ATP levels by lysing cell samples, adding luciferase enzyme and luciferin, and measuring the emitted light with a luminometer. It is significantly used in assessing cell viability, monitoring cellular metabolic activity, evaluating cytotoxicity in drug testing, and conducting research in cancer, microbiology, and biochemistry.

Enzymatic ATP Assays are expected to grow at the fastest CAGR during the forecast period. These assays leverage the enzyme luciferase, which catalyzes the reaction between ATP and luciferin, producing light that can be quantitatively measured. This bioluminescent reaction is highly specific to ATP, allowing for precise detection and quantification even at very low concentrations. This precision makes enzymatic assays particularly valuable in numerous fields, such as clinical diagnostics, pharmaceutical research, and environmental monitoring. In healthcare, these assays are used to monitor microbial contamination, assess hygiene in clinical settings, and diagnose infectious diseases. In environmental monitoring, enzymatic ATP assays help detect microbial contamination in water, food, and industrial processes, ensuring safety and compliance with regulatory standards.

Application Insights

The drug discovery and development segment held the largest share of 32.38% of the market in 2023. This dominance is driven by the critical role in evaluating cellular responses to drug candidates, assessing cytotoxicity, and screening for potential therapeutic compounds. The ability to measure cellular ATP levels provides insights into cell viability and metabolic activity, which are essential for identifying and optimizing effective drugs. The increasing investment in pharmaceutical research, the growing prevalence of chronic diseases, and the need for efficient high-throughput screening methods further fuel the demand for assays in this segment.

Clinical diagnostics is expected to grow at the fastest CAGR during the forecast period. In clinical diagnostics, quickly determining the presence of pathogenic bacteria, viruses, and other microorganisms is crucial for timely and effective treatment. For instance, ATP assays are widely used in hospitals and clinics to monitor hygiene and sterility, reducing the risk of healthcare-associated infections (HAIs). Integrating assays with advanced diagnostic technologies, such as molecular diagnostics and point-of-care testing, enhances their utility in clinical settings. Combining ATP assays with techniques like polymerase chain reaction (PCR) and next-generation sequencing (NGS) allows for comprehensive analysis of microbial presence and activity, improving diagnostic accuracy and patient outcomes.

End Use Insights

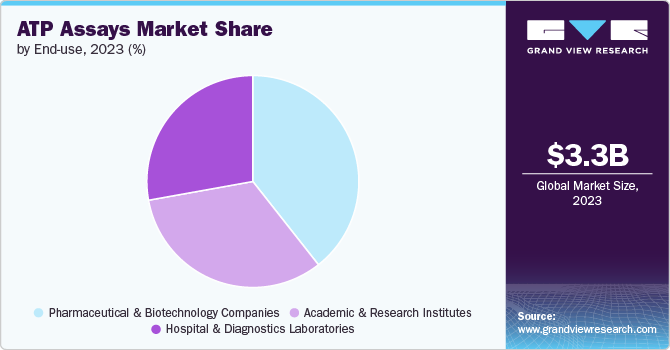

The pharmaceutical and biotechnology companies segment held the largest share of 39.38% in 2023 and is also expected to grow at the fastest CAGR during the forecast period due to its indispensable role in drug discovery, technological advancements in high-throughput screening, the shift towards personalized medicine, regulatory compliance, and diverse applications across industries. Pharmaceutical and biotechnology companies rely heavily on these products to assess drug candidates' efficacy and safety during various stages of drug discovery and development. These assays measure cellular ATP levels, providing insights into cellular metabolism, viability, and response to drug treatments. For instance, ATP assays evaluate how potential therapies affect cancer cell proliferation or microbial growth, which are crucial steps in identifying promising drug candidates.

In diagnostics laboratories, these products contribute significantly to research and development efforts across various fields. Pharmaceutical laboratories utilize these assays extensively in drug discovery processes to screen for cytotoxic effects and evaluate drug efficacy. The high sensitivity of enzymatic ATP assays allows researchers to conduct large-scale screenings efficiently, accelerating the identification of potential therapeutic compounds.

Regional Insights

North America dominated the global ATP assays market, with a revenue share of over 39.35% in 2023. The region boasts a well-developed healthcare infrastructure and advanced research facilities, particularly in the pharmaceutical and biotechnology sectors. It is home to numerous leading pharmaceutical companies, biotech firms, and academic research institutions conducting extensive research and development activities. These entities heavily rely on assays for drug discovery, toxicity testing, and clinical diagnostics, driving the demand for ATP assay products and technologies.

Europe ATP Assays Market Trends

Europe is characterized by advanced healthcare systems and robust research infrastructure. Countries within the European Union (EU) invest significantly in biomedical research, fostering innovation in diagnostic technologies. Leading academic institutions and research organizations across Europe conduct extensive studies using ATP assays to advance understanding in drug discovery, environmental monitoring, and clinical diagnostics.

Asia Pacific ATP Assays Market Trends

The Asia Pacific ATP assays market is anticipated to grow significantly at a CAGR of XX% over the forecast period. Asia Pacific countries face significant challenges related to infectious diseases and public health threats. The 2021 report from the National Health Commission in China disclosed a total of 2,711,785 reported cases of 27 Class A and B notifiable infectious diseases. These products offer rapid and sensitive detection methods for pathogens, supporting timely diagnosis and containment of infectious outbreaks. Governments and healthcare authorities in the region prioritize disease surveillance and management, driving the demand for ATP assays in epidemiological studies and healthcare settings. The Asia Pacific region is home to a burgeoning biotechnology and pharmaceutical industry, with rapid growth in research and development activities. They play a crucial role in drug discovery, toxicity testing, and bioprocessing applications. Pharmaceutical companies across countries like China, India, Japan, and South Korea utilize these assays to evaluate drug candidates, ensuring safety and efficacy before market introduction.

Key ATP Assays Company Insights

Key players operating in the market aim to drive innovation, expand market reach, and strengthen their competitive position. To ensure compliance and expand their market access, the players are seeking regulatory approvals, such as FDA and CE-IVD, for their products.

Key ATP Assays Companies:

The following are the leading companies in the ATP assays market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific

- Promega Corporation

- PerkinElmer Inc.

- Becton, Dickinson and Company (BD)

- Lonza Group Ltd.

- Danaher Corporation

- Abcam plc

- Quest Diagnostics Incorporated

- Biomerieux SA

- 3M Company

Recent Developments

-

In January 2022, Agilent Technologies, Inc., announced the launch of the Seahorse XF Pro Analyzer. The analyzer provides access to the most advanced cellular metabolism analysis technology, allowing for an understanding of cellular function, fate, and fitness.

-

In May 2021, Neogen Corp. launched an improved AccuPoint Advanced sanitation monitoring system version. The system uses a flat tip sampler for maximum recovery of ATP.

ATP Assays Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.57 billion |

|

Revenue forecast in 2030 |

USD 5.62 billion |

|

Growth rate |

CAGR of 7.9% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, clinical trials outlook, volume analysis |

|

Segments covered |

Type, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country Scope |

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Thermo Fisher Scientific; Promega Corporation; PerkinElmer Inc.; Becton, Dickinson and Company (BD); Lonza Group Ltd.; Danaher Corporation; Abcam plc; Quest Diagnostics Incorporated; Biomerieux SA; 3M Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global ATP Assays Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global ATP assays market based on type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Luminometric ATP Assays

-

Enzymatic ATP Assays

-

Bioluminescence Resonance Energy Transfer (BRET) ATP Assays

-

Cell-based ATP Assays

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery and Development

-

Clinical Diagnostics

-

Environmental Testing

-

Food Safety and Quality Testing

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Companies

-

Academic and Research Institutes

-

Hospital and Diagnostics Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazi

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ATP assays market was valued at USD 3.31 billion in 2023 and is expected to reach USD 3.57 billion in 2024

b. The global ATP assays market is projected to grow at a compound annual growth rate (CAGR) of 7.9% from 2024 to 2030 to reach USD 5.62 billion by 2030.

b. Luminometric ATP Assays held the largest share of 33.03% of the ATP assays market in 2023 due to their sensitivity, broad application spectrum, rapid detection capabilities, technological advancements, and compliance with regulatory standards

b. Some key players operating in the ATP assays market include Thermo Fisher Scientific; Promega Corporation; PerkinElmer Inc.; Becton, Dickinson and Company (BD); Lonza Group Ltd.; Danaher Corporation; Abcam plc; Quest Diagnostics Incorporated; Biomerieux SA; 3M Company

b. Key factors that are driving the market growth include demand for rapid and sensitive detection methods, expanding applications in pharmaceutical and biotechnology research, regulatory approvals, and rising burden of chronic diseases

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."