- Home

- »

- Medical Devices

- »

-

Atopic Dermatitis Clinical Trials Market Size Report, 2030GVR Report cover

![Atopic Dermatitis Clinical Trials Market Size, Share & Trends Report]()

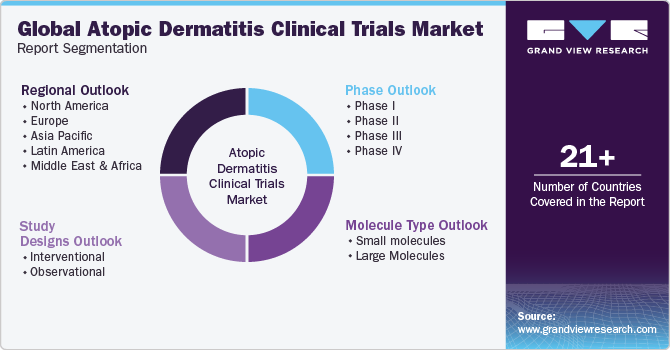

Atopic Dermatitis Clinical Trials Market Size, Share & Trends Analysis Report By Molecule Type (Small Molecules, Large Molecules), By Study Designs, By Study Phase, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-182-6

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global atopic dermatitis clinical trials market size was estimated at USD 2.33 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.1% from 2024 to 2030. Advancements in technology, rising incidence of atopic dermatitis, a growing pipeline of therapeutics for treating the condition, and increasing funding and investments are a few of the factors driving the market growth. Furthermore, collaborations between pharmaceutical and dermatological companies and contract researchers allow for shared expertise, accelerated product development, and risk mitigation, fostering industry growth.

The prevalence of atopic dermatitis has been on rise globally. This increased number of affected individuals has created a greater demand for effective treatments, prompting researchers and pharmaceutical companies to invest in developing new therapies. For instance, according to International Eczema Council Global Burden of Disease (GBD) 2022 report, around 223 million individuals are affected by atopic dermatitis in 2022, among which approximately 43 million are within age group of 1-4 years old. Hence, growing prevalence of the condition is one of the major factors supporting demand for its novel therapeutics, thereby augmenting the growth of the market.

Moreover, a robust pipeline of therapeutics is under development to treat the condition. Several pharmaceutical and biopharmaceutical companies are significantly investing in research and development of innovative drugs to manage and treat atopic dermatitis. For instance, in June 2023, Sanofi disclosed encouraging topline Phase 2b data for amlitelimab in context of atopic dermatitis. The findings support amlitelimab as a promising candidate for a first-in-class and best-in-class novel investigational anti-OX40-ligand monoclonal antibody in treating atopic dermatitis.

Additionally, increasing mergers and acquisitions amongst pharmaceutical companies and CROs is another significant factor boosting fast-track approval of atopic dermatitis therapeutics, thereby augmenting its development growth. However, COVID-19 pandemic has devastated sponsor companies and contract manufacturers specialized in atopic dermatitis field. The dermatological industry as a whole has faced considerable losses from COVID-19 pandemic due to delays in clinical trials and supply chain issues. However, the rising investments from sponsor companies post-2020 have supported developers to regain their market revenues.

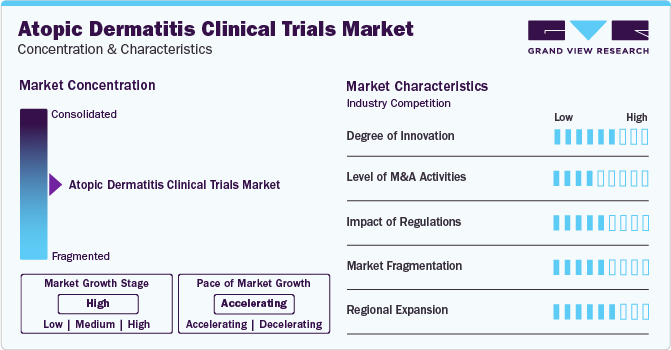

Market Concentration & Characteristics

Market growth stage is stable, and pace of the market growth is accelerating. The market is characterized by increasing pipeline, regulatory considerations, investment growth, globalization, and outsourcing development processes to leverage cost advantages and specialized capabilities.

Degree of Innovation: A high degree of innovation has been witnessed in atopic dermatitis clinical trials industry by a notable shift towards developing biologics and targeted therapies for atopic dermatitis. Moreover, many biopharmaceutical companies are focusing on developing large molecule-based drugs, driving a new innovation in market.

Impact of Regulations: Stringent regulatory norms and quality protocols govern the market, and contract developers must follow regulatory guidelines to ensure efficacy and safety of their products.

Level of Mergers and Acquisition (M&A) Activities: Companies often merge to strengthen their pipelines and portfolios. The market has seen stable growth in mergers and acquisitions.

Market Fragmentation: The industry was characterized by high market fragmentation. Specialization in specific technologies and products has led to a fragmented market scenario.

Regional Expansion: Globalization of clinical trials and rising trend of outsourcing to leverage specialized capabilities and cost efficiencies is another considerable market characteristic supporting industry growth. Pharmaceutical and biopharmaceutical companies are supporting regional expansion by partnering with CROs across the globe to augment its market positions and penetrate maximum economies.

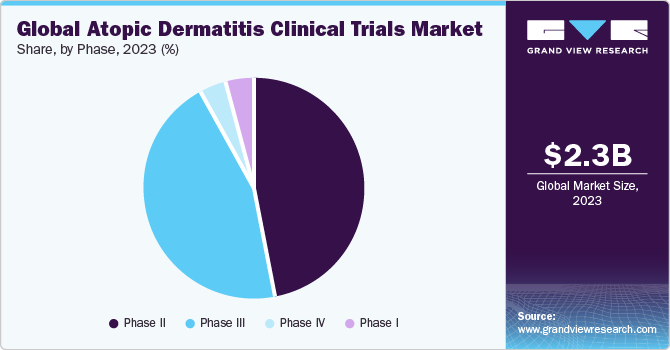

Phase Insights

Phase II segment accounted for largest market revenue of 47.1% share in 2023. High segment shares are majorly due to increasing number of drugs under phase II trials. Moreover, cost of development of phase II trials is significantly high. Hence, investment across these phases is considerably more, thus supporting high segment shares. Furthermore, several pharmaceutical companies are investing huge amounts of capital in clinical development of these drugs. For instance, in October 2023, Triventi Bio secured USD 92 million in Series A funding to progress its primary antibody program, TRIV-509, into clinical development. Currently, in pre-clinical stage, TRIV-509 is anticipated to be supported by the obtained funding, sustaining operations through Phase IIa clinical trial.

Phase III segment is anticipated to witness a lucrative growth rate across the analysis period. High growth of the segment is majorly due to increasing growing number of pipeline drugs for atopic dermatitis entering phase III phase of development. Moreover, growing partnerships amongst biopharmaceutical companies to expand its clinical pipeline of drugs is another considerable factor supporting segmental growth. In addition, scientific advancements, need for better treatments, a robust developmental pipeline, regulatory requirements, patient-centric approaches, competition in pharmaceutical industry, and collaborative efforts to address the challenges associated with this prevalent skin condition are few of the important factors supporting semental growth.

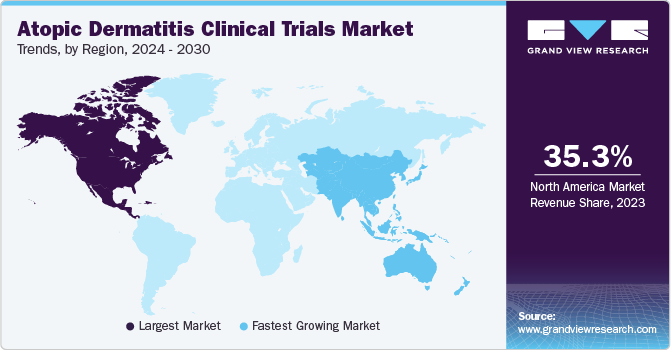

Regional Insights

North America dominated the market and accounted for a 35.3% share in 2023. North America is one of the major contributors to the growth of atopic dermatitis clinical trials industry. This region is home to numerous pharmaceutical and dermatological companies, which are outsourcing part of their development activities to contract service providers, thereby contributing towards the growth of the market.

The U.S. held largest market share in North America. The U.S., has a sizable population, including a significant number of individuals affected by atopic dermatitis. Availability of a large patient pool is attractive for conducting clinical trials, especially those requiring diverse participant groups. The U.S. boasts robust research infrastructure, including well-established clinical trial sites, research institutions, and academic medical centers. This infrastructure facilitates the efficient conduct of clinical trials, making it an attractive region for sponsors and investigators, which are pertinent to gaining competitive advantages.

Asia Pacific is anticipated to witness significant growth in the market. Asia Pacific is the fastest-growing market, as many developed economies are outsourcing clinical trials to countries such as India, China, and South Korea. The evolving business model of outsourcing and R&D activities among key global companies is expected to increase clinical trial services demand in the region, owing to the cost efficiency offered by CROs in countries such as India and China. Furthermore, large & diverse patient pools, recruitment for clinical trials, established clinical infrastructure, and the availability of skilled medical practitioners are supporting market growth.

In addition, the presence of multinational pharmaceutical/biopharmaceutical companies & CROs in the region, and the higher cost-efficiency of conducting clinical trials compared to the U.S. and European countries are creating growth opportunities in the market. Governments are undertaking efforts to drive the atopic dermatitis clinical trials market. In addition, APAC hosts a growing pool of scientific & development expertise, enabling rapid adoption of advanced technologies & quality clinical outsourcing services.

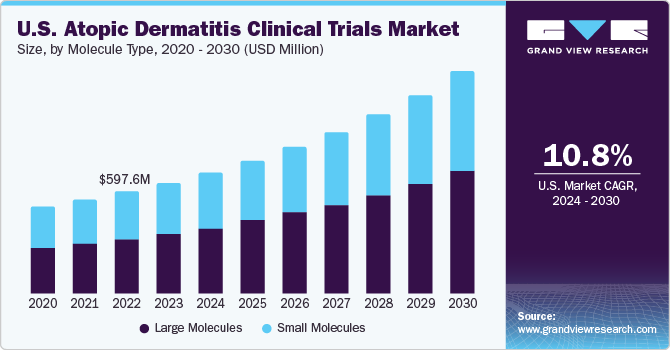

Molecule Type Insights

Large molecules led the market, accounting for 53.2% of the global revenue in 2023. This high percentage can be attributed to increasing demand for biologics, driven by rising incidence of atopic dermatitis and skin eczema across globe. Several biopharmaceutical companies are expanding their therapeutics pipeline to treat the condition. For instance, as per an article published by Springer Nature Limited in 2022 stated that apart from obtaining regulatory approval for biologics such as anti-IL-13 inhibitor tralokinumab, IL-4Ra inhibitor dupilumab, JAK1/2 inhibitor baricitinib in Europe, there are more than 70 new compounds under development for treatment of mild to severe atopic dermatitis. Hence, increasing pipeline of products under large molecules is primary factor supporting segment’s robust shares and lucrative growth rate across the forecast period.

The small molecules segment is anticipated to witness a stable CAGR during the analysis timeframe. Small molecule drugs have potential to manage atopic dermatitis effectively due to their availability in several dosage forms. For instance, topical form of drugs is much easier to apply and hence has a higher demand across the patient population. Moreover, several pharmaceutical companies are investigating potential of such therapies, and so far, positive results have been witnessed across these developments. For instance, in 2022, Arcutis Biotherapeutics, Inc. announced topline positive results of phase III trials of topical roflumilast cream, a small molecule inhibitor of phosphodiesterase-4 (PDE4) in patients with atopic dermatitis. The drug is under NDA submission review and is expected to gain approval soon.

Study Design Insights

Interventional trials accounted for largest market revenue share of 71.1% in 2023. High segment shares are majorly due to increasing number of interventional study designs adopted in clinical trials. For instance, as per clinicaltrials.gov in 2022, approximately 60 to 70% of atopic dermatitis clinical trials are interventional studies. Interventional trials have a controlled design, often involving comparison of the intervention group (those receiving treatment) with a control group (those receiving a placebo or standard treatment). Furthermore, increasing number of clinical trials for atopic dermatitis is another considerable factor supporting segment’s growth.

Observational trials segment is anticipated to witness a lucrative growth rate across the analysis period. High growth of segment is majorly due to increasing demand for atopic dermatitis and eczema products globally. Moreover, increasing prevalence of such conditions is one of the primary factors boosting demand for effective therapeutics and augmenting segmental growth. For instance, according to Global Burden of Disease (GBD) estimates, atopic dermatitis, is a chronic skin condition and is widely prevalent and non-communicable. It holds 15th position among non-fatal diseases in terms of disability-adjusted life years, claiming top spot among all skin diseases. The primary impact is notably observed in children.

Key Companies & Market Share Insights

Some of the key players operating in the market include Charles River Laboratories, Imavita, REPROCELL Inc., Oncodesign services among others.

-

Charles River Laboratories has developed various translational animal models to assist clients in their atopic dermatitis drug discovery programs. These models encompass Oxazolone-induced Atopic Dermatitis, HDM-induced, VD3 analog-induced (MC903), and Ovalbumin-induced models in both wild-type and mutant mice.

-

Imavita typically offers a range of preclinical services and animal models to support research in various therapeutic areas, including dermatology. The company’s atopic dermatitis (ad) preclinical model includes Oxazolone-induced AD preclinical model, IL23-induced AD preclinical model etc.

-

BIOCYTOGEN, QIMA LTD, Novotech some of the emerging market participants in the market.

-

Biocytogen employs both wild-type C57BL/6 mice and B-hIL4/hIL4RA double humanized mice models for atopic dermatitis experimental methods.

-

QIMA LTD offers a research program dedicated to atopic dermatitis several years ago. The company has successfully created and validated predictive in vitro pharmacological assays through this initiative. The aim is to mitigate attrition in clinical trials by employing these assays during the drug development.

Key Atopic Dermatitis Clinical Trials Companies:

- Charles River Laboratories

- Imavita

- REPROCELL Inc.

- Oncodesign services

- BIOCYTOGEN

- QIMA LTD

- Novotech

- Redoxis

- Syneos Health

- Hooke Laboratories, LLC

Recent Developments

-

In May 2023, Sciences announced positive outcomes from ADORING 1, the second Phase 3 study evaluating the efficacy and safety of VTAMA (tapinarof) cream, 1%, for moderate to severe atopic dermatitis in adults and pediatric subjects as young as 2 years old, in a double-blind, randomized trial.

-

In March 2023, LEO Pharma unveiled positive findings from the DELTA 1 pivotal phase 3 clinical trial assessing delgocitinib cream, an investigational topical pan-Janus kinase (JAK) inhibitor, for potential use in treating adults with moderate to severe chronic hand eczema (CHE).

-

In January 2022, the U.S. Food and Drug Administration (FDA) has granted approval for Pfizer's CIBINQO (abrocitinib) for the treatment of moderate-to-severe atopic dermatitis in adults.

Atopic Dermatitis Clinical Trials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.57 billion

Revenue forecast in 2030

USD 4.84 billion

Growth rate

CAGR of 11.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Molecule Type, Study Designs, Phase, and Region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Charles River Laboratories, Imavita, REPROCELL Inc., Oncodesign services, BIOCYTOGEN, QIMA LTD, Novotech, Redoxis, Syneos Health, Hooke Laboratories, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Atopic Dermatitis Clinical Trials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global atopic dermatitis clinical trials market report based on molecule type, study designs, phase and region.

-

Molecule Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small molecules

-

Large Molecules

-

-

Study Designs Outlook (Revenue, USD Billion, 2018 - 2030)

-

Interventional

-

Observational

-

-

Phase Outlook (Revenue, USD Billion, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Advancements in technology, rising incidence of atopic dermatitis, a growing pipeline of therapeutics for treating the condition, and increasing funding and investments are a few of the factors driving atopic dermatitis clinical trials market

b. The global atopic dermatitis clinical trials market size was estimated at USD 2.33 billion in 2023 and is expected to reach USD 2.57 billion in 2024.

b. The global atopic dermatitis clinical trials market is expected to grow at a compound annual growth rate of 11.1% from 2024 to 2030 to reach USD 4.84 billion by 2030.

b. North America dominated the market and accounted for a 35.3% share in 2023. This region is home to numerous pharmaceutical and dermatological companies, which are outsourcing part of their development activities to contract service providers, thereby contributing towards the growth of atopic dermatitis clinical trials market.

b. Some key players operating in the atopic dermatitis clinical trials market include Charles River Laboratories, Imavita, REPROCELL Inc., Oncodesign services, BIOCYTOGEN, QIMA LTD, Novotech, Redoxis, Syneos Health, Hooke Laboratories, LLC

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."