Asset Performance Management Market Size, Share & Trends Analysis Report By Category (Predictive Asset Management, Asset Reliability Management), By Deployment, By Vertical, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-727-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

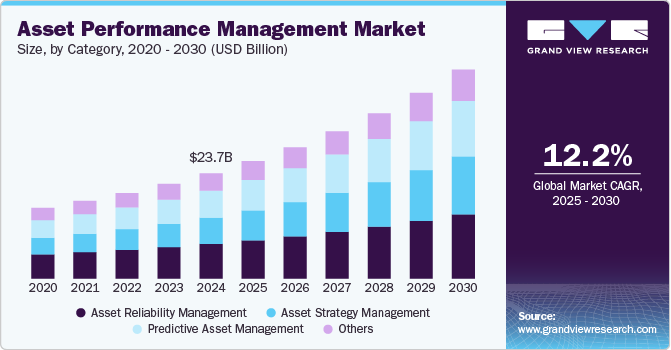

The global asset performance management market size was estimated at USD 23.75 billion in 2024 and is anticipated to grow at a CAGR of 12.2% from 2025 to 2030. The emergence of the fourth industrial revolution (Industry 4.0) has encouraged the adoption of Internet of Things (IoT) technologies, such as industrial sensors, across several industry verticals. The growing adoption of industrial sensors has enabled the rapid deployment of Asset Performance Management (APM) solutions. The market growth can also be attributed to the adoption of digital twin technology due to increased asset efficiency and utilization. Organizations can simulate multiple possibilities and make data-driven choices that optimize asset utilization using a virtual representation of tangible assets. This may lead to better asset performance and more effective operations.

The asset performance management industry is anticipated to witness significant growth over the forecast period, on account of the growing popularity of digital asset performance management solutions across the oil & gas, government, and public sectors, among others. The potential integration of the Industrial Internet of Things (IIoT) and digital twin technology with asset performance management systems is expected to further boost the market growth.

The state-of-the-art asset performance management (APM) systems available in the market are already leveraging IIoT to provide equipment reliability. The integration of asset performance management systems with complementary solutions, such as mobile solutions and Geographic Information System (GIS) solutions, is also leading to more efficient use cases for the deployment of asset performance management systems, thereby contributing to market growth.

As industries continue to prioritize sustainability and efficiency, APM solutions are playing a critical role in reducing resource wastage and ensuring compliance with regulatory standards. Governments and enterprises are increasingly relying on these systems to achieve operational resilience and adaptability in an era of rapid technological advancements and global challenges. With these trends and innovations, the APM industry is expected to become an indispensable part of asset management strategies, driving its sustained growth and evolution.

The push for regulatory compliance and safety also drives APM adoption. Industries like energy, healthcare, and transportation face stringent regulations that require strict monitoring and maintenance of critical assets to avoid environmental hazards, accidents, or operational failures. APM tools help organizations streamline compliance by providing comprehensive reporting, real-time alerts, and historical performance data to meet regulatory standards effectively. Moreover, the focus on sustainability and environmental impact is influencing the APM market. Companies are increasingly incorporating sustainable practices to meet Environmental, Social, and Governance (ESG) goals. APM systems enable efficient resource utilization and energy management, reducing carbon footprints and aligning with global sustainability efforts.

Category Insights

The asset reliability management segment dominated the market and accounted for the revenue share of over 33.0% in 2024. Asset reliability management solutions allow operators to identify errors in the equipment in advance and subsequently help them in making smarter and more economical decisions for the assets. As a result, in addition to the reduction in maintenance costs, operators can also ensure higher efficiency and a longer service life of their critical assets. A majority of enterprises require risk-based inspection, reliability-centered maintenance, and real-time condition monitoring for their assets; and asset reliability management solutions can potentially cater to all these requirements and play a decisive role in improving the productivity of assets and business operations.

The predictive asset management segment is expected to grow at a significant CAGR of 14.1% over the forecast period. Predictive asset management includes examining the conditions of assets while in service to determine the appropriate remediation and subsequently improve the reliability and enhance the performance of the system. It allows users to address issues before they occur and hamper business operations. For the incumbents of the oil & gas industry, the lack of visibility into crucial operations of drilling and extraction rigs and the resultant increase in the number of instances of unexpected downtimes are some of the major restraints.

Deployment Insights

The on-premise segment accounted for a largest revenue share of over 63.0% in 2024. On-premise solutions offer organizations the ability to maintain full ownership and control of their data, which is critical for sectors like oil and gas, utilities, and manufacturing that handle sensitive operational information. The assurance of data privacy and protection against potential breaches makes on-premise deployment a preferred choice for businesses operating in highly regulated environments.

The hosted segment is expected to grow at a significant CAGR over the forecast period. The segment is bifurcated into public cloud and private cloud. Organizations of all sizes can easily scale their APM solutions based on their changing needs, making it an ideal choice for businesses operating in dynamic environments. This flexibility is especially beneficial for industries like oil and gas, manufacturing, and utilities, where asset management requirements often vary depending on project size, location, and complexity. The ability to rapidly adapt to these needs without incurring significant costs is a key advantage of hosted deployment models.

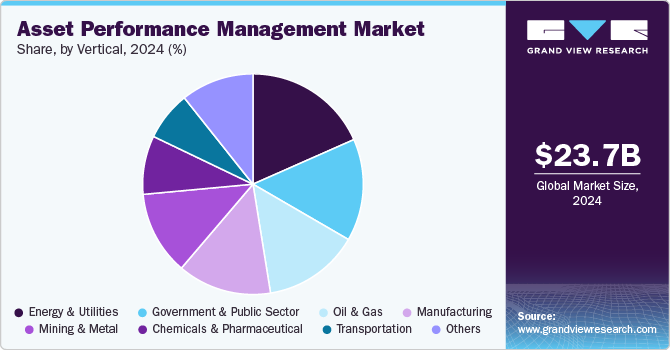

Vertical Insights

The energy & utilities segment dominated the market and accounted for a revenue share of over 18.0% in 2024. With aging infrastructure, energy and utilities companies are under increasing pressure to prevent equipment failures and ensure service continuity. APM solutions, particularly those that integrate with advanced technologies like the Industrial Internet of Things (IIoT), enable organizations to monitor the health of critical assets in real time, predict when maintenance is required, and proactively address potential issues before they lead to costly downtime or service interruptions. This predictive capability helps energy companies optimize maintenance schedules and reduce the likelihood of unexpected failures, leading to significant cost savings and improved operational efficiency.

The government & public sector segment is expected to register the fastest CAGR over the forecast period. Governments worldwide are increasingly investing in advanced technologies to modernize their operations, improve public services, and drive transparency. APM solutions are integral to this transformation, offering tools for tracking and managing physical assets such as public transportation systems, utilities, and government buildings. The integration of digital solutions with existing infrastructure allows public sector organizations to enhance decision-making processes, ensure regulatory compliance, and improve the reliability of essential services.

Regional Insights

The North America asset performance management industry held the largest share of over 33.0% in 2024, driven by the growing awareness of the importance of asset health management in reducing environmental impact and promoting sustainability. Industries are leveraging APM systems to monitor emissions, improve energy efficiency, and comply with stringent environmental regulations, which are particularly emphasized in North America.

U.S. Asset Performance Management Market Trends

The asset performance management industry in the U.S. is expected to grow significantly at a CAGR of 11.3% from 2025 to 2030. The country’s focus on infrastructure modernization, particularly in sectors like energy, transportation, and manufacturing, is another significant driver. With aging infrastructure and growing demand for reliability, APM systems are becoming indispensable in ensuring asset health and minimizing downtime.

Europe Asset Performance Management Market Trends

The Europe asset performance management industry is anticipated to register considerable growth from 2025 to 2030. European manufacturers and transport operators are increasingly adopting advanced asset performance management solutions and technologies such as predictive analytics to predict the potential failure of their machinery and equipment and optimize their asset maintenance processes.

The UK asset performance management market is expected to grow rapidly in the coming years. In the UK, the market is benefitting from a substantial and diversified pool of talent as well as the presence of a sizeable number of international and domestic investors. Due to its commitment of development to the software industry, close industry partnerships, and support for innovation, the U.K. has established an environment that is conducive to investment.

The asset performance management market in Germany held a substantial market share in 2024. In Germany, the increasing need for predictive analytics solutions to monitor equipment health, generate early warnings, and streamline operational processes is expected to drive country’s market growth.

Asia Pacific Asset Performance Management Market Trends

Asia Pacific is growing significantly at a CAGR of 13.2% from 2025 to 2030. The Asia Pacific APM market is poised for significant growth, driven by rapid industrialization, urbanization, and the increasing adoption of advanced technologies across the region. Countries such as China, India, and Japan are heavily investing in infrastructure development, energy production, and manufacturing, creating a strong demand for APM solutions.

The Japan asset performance management market is expected to grow rapidly in the coming years. Japan's proactive approach to disaster preparedness and risk management is fueling demand for APM systems. With frequent natural disasters, such as earthquakes and typhoons, the need for robust asset monitoring and preventive maintenance has become a priority for both public and private sectors.

The asset performance management market in China held a substantial market share in 2024. The country's focus on modernizing its industrial base through initiatives like "Made in China 2025" supports the adoption of APM technologies. These initiatives aim to enhance productivity and technological innovation, encouraging industries to integrate APM systems for better asset management.

Key Asset Performance Management Company Insights

Key players operating in the asset performance management industry are ABB, IBM Corporation, AVEVA Group Limited, GE Vernova, and SAP SE. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In October 2024, IBM Corporation announced the acquisition of Prescinto, an Indian AI-powered platform aimed at bolstering its Maximo Application Suite (MAS) for renewable energy asset performance management. This acquisition strengthens IBM's position in the energy and utility sector, which is undergoing rapid transformation with a growing focus on renewable energy. By integrating Prescinto's capabilities, IBM aims to provide enhanced solutions for managing and optimizing solar, wind, and renewable energy storage assets. IBM MAS is used by enterprises in sectors such as water, oil, natural gas, nuclear, and other energy and utilities, and this expansion is expected to further support the industry's shift toward sustainable energy management.

-

In August 2024, SAP SE announced the integration of an AI-powered copilot into its Asset Performance Management (APM) solution, enhancing the asset management process through advanced natural language capabilities. This innovative feature provides seamless access to the SAP Help Portal, enabling users to retrieve relevant information and guidance more efficiently. By leveraging AI, the copilot aims to streamline workflows, improve decision-making, and offer a more intuitive user experience, reflecting SAP’s commitment to integrating cutting-edge technology into its solutions to optimize operational performance and support digital transformation.

Key Asset Performance Management Companies:

The following are the leading companies in the asset performance management market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Aspen Technology Inc

- AVEVA Group Limited

- Bentley Systems, Incorporated

- DNV GLAS

- GE Vernova

- IBM Corporation

- Rockwell Automation

- SAP SE

- SAS Institute, Inc.

- Siemens Energy

Asset Performance Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 26.51 billion |

|

Revenue forecast in 2030 |

USD 47.18 billion |

|

Growth rate |

CAGR of 12.2% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Base year for estimation |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report services |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Category, deployment, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

ABB; Aspen Technology Inc.; AVEVA Group Limited; Bentley Systems, Incorporated; DNV GLAS; GE Vernova; IBM Corporation; Rockwell Automation; SAP SE; SAS Institute, Inc.; Siemens Energy |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Asset Performance Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global asset performance management market report based on category, deployment, vertical, and region:

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Predictive Asset Management

-

Asset Reliability Management

-

Asset Strategy Management

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Hosted

-

Public Cloud

-

Private Cloud

-

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy & Utilities

-

Oil & Gas

-

Manufacturing

-

Metal & Mining

-

Transportation

-

Government & Public Sector

-

Chemical & Pharmaceutical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global asset performance management market is expected to grow at a compound annual growth rate of 12.2% from 2025 to 2030 to reach USD 47.18 billion by 2030.

b. The asset performance management market in North America held a largest share of over 33.0% in 2024, driven by the growing awareness of the importance of asset health management in reducing environmental impact and promoting sustainability.

b. Some of the key players operating in asset performance management include ABB, Aspen Technology Inc, AVEVA Group Limited, Bentley Systems, Incorporated, DNV GLAS, GE Vernova, IBM Corporation, Rockwell Automation, SAP SE, SAS Institute, Inc., Siemens Energy.

b. The emergence of the fourth industrial revolution (Industry 4.0) has encouraged the adoption of Internet of Things (IoT) technologies, such as industrial sensors, across several industry verticals. The growing adoption of industrial sensors has enabled the rapid deployment of APM solutions.

b. The global asset performance management market size was estimated at USD 23.75 billion in 2024 and is expected to reach USD 26.51 billion in 2025.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."