- Home

- »

- Medical Devices

- »

-

Asia Pacific Wound Care Market Size, Industry Report, 2030GVR Report cover

![Asia Pacific Wound Care Market Size, Share & Trends Report]()

Asia Pacific Wound Care Market Size, Share & Trends Analysis By Product (Advanced, Traditional), By Application (Chronic Wounds, Acute Wounds), By End-use, By Mode Of Purchase, By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-295-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Asia Pacific Wound Care Market Trends

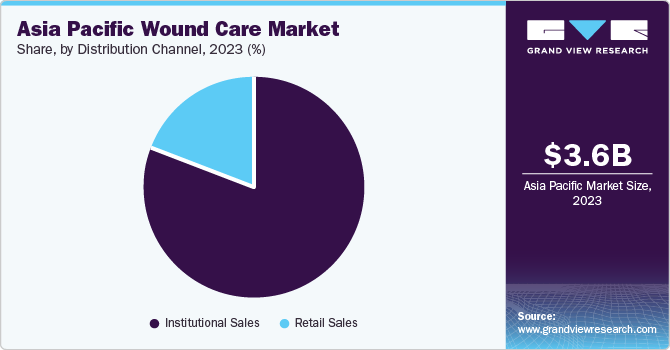

The Asia Pacific wound care market size was anticipated at USD 3.6 billion in 2023, and it is expected to grow at a CAGR of 4.8% from 2024 to 2030. The increasing prevalence of chronic wounds in patients who have diabetes, a growing geriatric population, a rising number of new cases of chronic diseases, and easy accessibility to advanced wound care technologies are some of the factors driving the market growth. In addition, the prevalence of a sedentary lifestyle in the region is expected to fuel the growth of this market in the approaching years.

Asia Pacificheld a 16.0% share of the global wound care market revenue in 2023. Growing income levels, the existence of emerging and technologically progressive healthcare infrastructure, the increasing availability of professionals trained in wound care management, the rising number of new cases associated with chronic wounds and surgery site infections, and a large share of the geriatric population in the region are some of the factors fueling the growth of this market in Asia Pacific.

Reassuring atmosphere for startups promoting innovation, constant new product launches backed by intensive R&D, associations, mergers and acquisitions initiated by prominent companies for growth and technology enhancements, collaborations, alliances, and contracts for novel product developments and innovation efforts are a few other factors that have been helping this market in its growth.

Products Insights

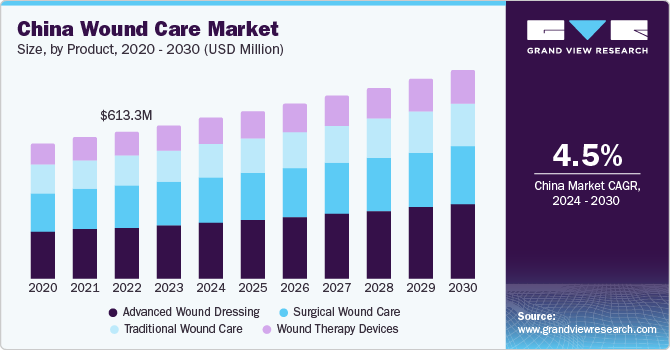

The advanced wound dressing segment held the largest revenue share of 34.9% in 2023. The products are regularly utilized in the management of non-healing and chronic wounds. A few advanced wound dressing products are characterized by antimicrobial agents such as honey or silver, which help initiate rapid wound healing and prevent the spread of infections. Performance boundaries of traditional products used for wound care and several new cases of chronic diseases reported every year are most likely to help this segment propel further in upcoming years.

The surgical wound care segment is expected to experience a CAGR of 4.9% from 2024 to 2030. Surgical wounds are commonly caused due to increasing surgical site infections. According to the World Health Organization (WHO), 11% of patients who undergo surgical treatments are usually infected during the process in low and middle-income countries.

Application Insights

The chronic wounds segment held a revenue share of 59.8% in 2023. One of the key factors influencing the segment is the increasing number of chronic wounds, such as foot ulcers, in patients suffering from diabetes. A growing number of diabetic people is adding to the scenario. Furthermore, a rise in other chronic wounds such as postsurgical, arterial, venous stasis, and pressure ulcers is projected to fuel growth for this market.

The acute wounds segment is likely to attain a CAGR of 4.9% from 2024 to 2030. This can be attributed to increasing trauma cases in the Asia Pacific region. Acute wounds comprise surgical wounds, burn wounds, and traumatic wounds. Various alternatives used in acute wound care include traditional wound care products, biologics, and advanced dressings.

End-use Insights

The hospitals segment held the largest market share of 39.0% in 2023. Hospitals experience a constant inflow of patients in need of wound care. Therefore, hospital settings are often equipped with resources to embrace advanced wound care technologies, novel therapies, and equipment characterized by innovation.

The home healthcare segment is anticipated to witness a CAGR of 6.1% from 2024 to 2030. The projected growth of this segment is driven by numerous factors, such as the growing geriatric population in the region, an increase in the occurrence of diabetic foot ulcers, increasing response to home healthcare services in urbanized areas, lifestyle changes, and the growing implementation of advanced wound care management in home healthcare.

Mode Of Purchase Insights

The prescribed mode of purchase held the largest revenue share of 62.7% in 2023. Wound care management process is regularly supervised by licensed medical practitioners, experts, surgeons, or other industry experts to avoid complications. These experts prescribe the necessary dosage of wound care products and therapies and advise on consumption patterns and time.

The prescribed segment is expected to witness a significant CAGR during 2024 to 2030. This is primarily due to Medicare/insurance reimbursements that can only be availed if the medicines and wound care products are prescribed by an expert after the necessary diagnosis. Such factors encourage patients to visit licensed practitioners and get prescribed wound care products.

Distribution Channel Insights

The institutional sales segment dominated the industry in Asia Pacific and accounted for 81.5% in 2023. The institutional distribution includes hospitals, dedicated wound care clinics, and other healthcare settings, such as diagnostic laboratories, long-term care facilities, and nursing homes. The prominent originations in the wound care industry prefer to engage in long-term agreements with such healthcare facilities to improve their market presence and revenue share every year.

The retail sales segment is anticipated to witness a CAGR of 5.2% from 2024 to 2030. This mainly results from hassle-free accessibility to wound care products through retail distribution points such as pharmacy stores and e-commerce websites. Usually, buyers who do not have prescriptions for wound care products buy them from retail pharmacy stores, primarily for emergency treatments. Online ordering is chosen by those who need services such as instant home deliveries, detailed product descriptions, and product reviews shared by other buyers.

Country Insights

China Wound Care Market Trends

The China wound care market dominated Asia Pacific and held a revenue share of 18.0% in 2023. This can be attributed to the presence of several global healthcare companies engaged in the wound care industry, the growing percentage of the geriatric population in the country, increasing new incidences of traumas, injuries, and chronic wounds, and the growth in the prevalence of chronic wounds.

India Wound Care Market Trends

The wound care market in India is expected to experience a CAGR of 6.1% from 2024 to 2030. Some of the key factors driving the growth of this market in India are enhanced healthcare infrastructure facilities, drastic changes in lifestyle, growing urbanization, rising number of road accidents leading to an increase in accident & trauma cases, presence of key healthcare service providers from the global market and easy access to wound care facilities around the country.

Key Asia Pacific Wound Care Company Insights

Some of the key players in the Asia Pacific wound care market include 3M, Smith+Nephew, Triage Meditech Pvt Ltd., and Winner Medical Co., Ltd. To deliver competitive products and healthcare services, organizations in the industry are adopting innovation backed by intense R&D. In addition, enhanced patient care and value-added services are offered by healthcare businesses to generate and retain more number of customers.

-

Medline Industries, LP is one of the prominent organizations from the healthcare industry that delivers products and services associated with various verticals such as advanced wound care, diagnostics, medical equipment, surgery, pharmacy, skincare, and more. Wound care products and services provided by the company include bandages, casts, blister dressings, hemostatic agents, gauze, moleskin, medical bags, protective sleeves, kits, scar dressing, saline spray, wound closure, and tapes.

-

Triage Meditech Pvt Ltd., a major market participant from India, is a renowned expert in the advanced wound care industry. It is one of the leading manufacturers of Negative Pressure Wound Therapy (NPWT) products in the region. Currently, it exports its products across 15 different countries.

Key Asia Pacific Wound Care Companies:

- 3M

- Smith+Nephew

- Triage Meditech Pvt Ltd.

- Winner Medical Co., Ltd.

- Medline Industries, LP

- Healthium Medtech Limited

- APEX MEDIVISION

Recent Developments

- In May 2024, KKR, one of the leading global investment firms, announced that it had signed a definitive agreement to acquire Healthium MedTech Ltd., a renowned manufacturer of surgical products, from an affiliate of Apax Partners LLP.

Asia Pacific Wound Care Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 4.9 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Country scope

China; India; Japan; Australia; Thailand; South Korea

Segments covered

Product, application, end-use, mode of purchase, distribution channel, country

Key companies profiled

3M; Smith+Nephew; Triage Meditech Pvt Ltd.; APEX MEDIVISION; Winner Medical Co.; Ltd.; Healthium Medtech Limited;Medline Industries, LP.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Wound Care Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study; Grand View Research has segmented the Asia Pacific wound care market report based on product, application, end-use, mode of purchase, distribution channel, and country:

-

Product Outlook (Revenue; USD Million, 2018 - 2030)

-

Advanced Wound Dressing

-

Traditional Wound Care

-

Surgical Wound Care

-

Wound Therapy Devices

-

-

Application Outlook (Revenue; USD Million, 2018 - 2030)

-

Chronic Wounds

-

Acute Wounds

-

-

End-use Outlook (Revenue; USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Physician Office

-

Nursing Homes

-

Others

-

-

Mode of Purchase Outlook (Revenue; USD Million, 2018 - 2030)

-

Prescribed

-

Non-prescribed (OTC)

-

-

Distribution Channel Outlook (Revenue; USD Million, 2018 - 2030)

-

Institutional Sales

-

Retail Sales

-

-

Country Outlook (Revenue; USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

Australia

-

Thailand

-

South Korea

-

Frequently Asked Questions About This Report

b. The Asia Pacific wound care market size was anticipated at USD 3.6 billion in 2023.

b. The Asia Pacific wound care market is expected to grow at a CAGR of 4.8% from 2024 to 2030 to reach USD 4.9 billion by 2030.

b. The advanced wound dressing segment held the largest revenue share of 34.9% in 2023. The products are regularly utilized in the management of non-healing and chronic wounds. A few advanced wound dressing products are characterized by antimicrobial agents such as honey or silver, which help initiate rapid wound healing and prevent the spread of infections.

b. Some of the key players in the Asia Pacific wound care market include 3M, Smith+Nephew, Triage Meditech Pvt Ltd., Winner Medical Co., Ltd., and others.

b. The increasing prevalence of chronic wounds in patients who have diabetes, a growing geriatric population, a rising number of new cases associated with chronic diseases, and easy accessibility to advanced wound care technologies are some of the factors driving the market growth. In addition, the prevalence of a sedentary lifestyle in the region is expected to fuel the growth of this market in the approaching years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."