- Home

- »

- Next Generation Technologies

- »

-

Asia Pacific Virtual Events Market, Industry Report, 2030GVR Report cover

![Asia Pacific Virtual Events Market Size, Share & Trends Report]()

Asia Pacific Virtual Events Market Size, Share & Trends Analysis Report By Event Type, By Service, By Industry Vertical, By Application, By End-use, By Establishment Size, By Use-case, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-282-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Asia Pacific Virtual Events Market Trends

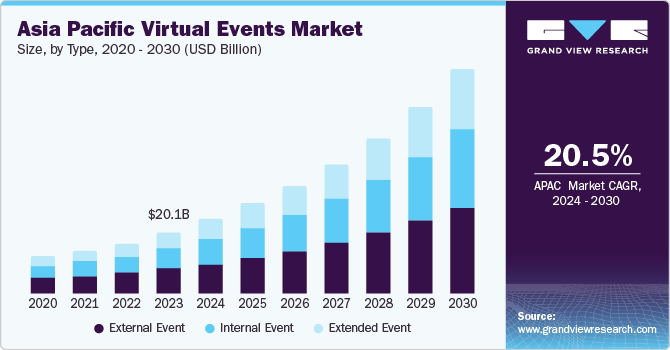

The Asia Pacific virtual events market size was valued at USD 20.1 billion in 2023 and is projected to grow at a CAGR of 20.5% from 2024 to 2030. Factors driving this growth include technological advancements, cost savings, and the need for business continuity post-pandemic. Organizations are increasingly adopting Unified Communication as a Service (UCaaS)-based solutions, enabling efficient virtual engagement in business proceedings. Despite technical challenges like connectivity issues and software glitches, the market is expected to continue its upward trajectory due to digitalization, increased internet penetration, and demand for immersive experiences, including hybrid event formats.

The APAC market accounted for 26.2% of the revenue share of the global virtual events market in 2023.Regulations can significantly impact the APAC virtual events market. On one hand, laws such as China’s Personal Information Protection Law (PIPL) and India’s Data Protection Act (DPA) enhance trust by safeguarding attendee data privacy and security. Given the region’s diverse data privacy regulations, this is crucial. However, compliance with these evolving regulations can be intricate and costly for virtual event platforms, potentially posing challenges for smaller players.

Event Type Insights

The external events segment held the largest market share in 2023, accounting for 41.7% of the total revenue. These events, organized by businesses for press releases, trade shows, client conferences, product launches, and external communication, benefit from widespread collaboration and communication tools across various industries. The convergence of Artificial Intelligence (AI), Augmented Reality (AR), and Virtual Reality (VR) enables comprehensive online communication and collaborative experiences, mirroring physical events. Additionally, companies are swiftly adopting virtual simulated platforms to optimize time and resources, fuelling the market’s growth.

The extended events segment is projected to experience the fastest revenue growth, with a CAGR of 26.6% from 2024 to 2030. This segment includes events that extend beyond the traditional time frame, offering attendees the flexibility to engage with the content and participants at their convenience. The growth of this segment is driven by the increasing demand for flexible and accessible event formats, especially the accelerated shift towards virtual and hybrid events. The market penetration of UCaaS technology has increased as the usage of advanced technology is helping organizations channel a more concrete and operative flow of work.

Service Insights

The communication segment held the largest revenue share of 35.2% in 2023. This dominance can be attributed to the significant rise in digitally simulated gatherings, which are transforming the communication landscape. The widespread use of collaboration and communication tools across various industries, including retail & e-commerce, healthcare, manufacturing, construction, and education, has boosted the market growth. The convenience and flexibility have made communication solutions and technologies indispensable for a range of objectives, from small meetings to large commercial events.

The training segment of the APAC virtual events market is predicted to experience the fastest revenue growth, with a CAGR of 22.2% from 2024 to 2030. This rapid growth can be attributed to the increasing adoption of virtual simulation platforms by companies to effectively manage time and resources.

Establishment Size Insights

The Small and Medium-sized Businesses (SMBs) segment held the largest market share in 2023, accounting for 50.7% of the total revenue. The widespread use of collaboration and communication tools in various industries, including retail & e-commerce, healthcare, manufacturing, construction, and education, among others, is anticipated to boost the market growth. These tools allow SMBs to effectively manage time and resources.

The large institutions segment is projected to experience the second-fastest revenue growth, with a CAGR of 19.3% from 2024 to 2030. Large institutions are increasingly adopting UCaaS-based solutions, enabling efficient virtual engagement in business proceedings. Despite the dominance of SMBs, large institutions are catching up as they realize the benefits of hosting virtual events.

End-use Insights

The enterprises segment held the largest revenue share in the Asia Pacific virtual events market, accounting for 54.5% of the total revenue in 2023. Enterprises, including corporate, private, and public organizations, are increasingly adopting digital event platforms for communicating with target audiences, promoting their business, and several other business functions.

The educational institutions segment is projected to experience the fastest revenue growth, with a CAGR of 21.7% from 2024 to 2030. This surge is driven by the growing popularity of online learning and the need for adaptable and accessible education. Virtual events empower institutions to conduct lectures and webinars for a global audience, offer structured online courses, and even host meaningful virtual graduation ceremonies, all while removing geographical limitations.

Application Insights

The exhibitions/trade shows segment dominated the market, accounting for 31.0% of the total revenue share in 2023. This dominance can be attributed to the ability of virtual platforms to effectively replicate the core elements of physical exhibitions. Virtual exhibition platforms offer features like interactive product demonstrations, virtual booths, and live chat functionalities, allowing businesses to showcase their products and services to a geographically dispersed audience. Attendees can conveniently network with exhibitors and access product information, creating a valuable experience similar to physical events.

The conferences segment is projected to experience the fastest revenue growth, with a CAGR of 21.4% from 2024 to 2030. This surge is fueled by the effectiveness of virtual platforms in facilitating knowledge sharing and networking. Features like presentations, webinars, and virtual lounges enable attendees to learn and connect, even across vast distances. Furthermore, virtual conferences eliminate travel costs, making them a more accessible and budget-friendly option for attendees across the region. This two-pronged approach, exhibitions' dominance, and conferences' growth potential highlight the versatility of the APAC virtual events market. It offers a promising future for businesses seeking innovative and cost-effective ways to engage audiences throughout the Asia-Pacific region.

Industry Vertical Insights

The Information Technology (IT) segment held the largest revenue share of 20.4% in 2023. The IT industry has been at the forefront of adopting virtual events as a means of communication and collaboration. The widespread use of collaboration and communication tools in the IT industry is anticipated to boost market growth. This positively impacts the virtual events industry. Furthermore, IT companies are rapidly adopting virtual simulated platforms to effectively manage time and resources, thereby driving the growth of the virtual events market.

The Banking, Financial Services, and Insurance (BFSI) segment is projected to experience the fastest revenue growth, with a CAGR of 22.7% from 2024 to 2030. The BFSI industry has been quick to adopt virtual events as a means of communication, customer engagement, and employee training. The widespread use of collaboration and communication tools in the BFSI industry is anticipated to boost market growth. This positively impacts the virtual events industry. Furthermore, BFSI institutions are rapidly adopting virtual simulated platforms to effectively manage time and resources, thereby driving the growth of the virtual events market.

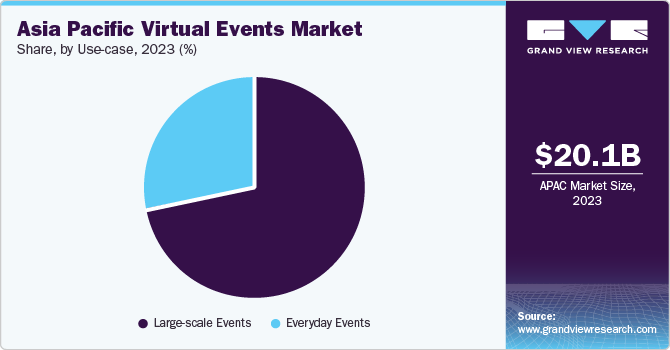

Use-case Insights

The large-scale events segment dominated the APAC virtual events market, with a 72.1% revenue share in 2023. This segment encompasses major conferences, exhibitions, and trade shows that attract participants from across the globe. The success of large-scale virtual events can be attributed to their ability to replicate the experience of physical events while offering additional benefits such as greater reach, reduced costs, and improved analytics. The ability to connect with a global audience without geographical constraints has made large-scale virtual events a preferred choice for multinational corporations and large institutions looking to host impactful events.

On the other hand, the everyday events segment is projected to witness the fastest revenue growth, with a projected CAGR of 21.5% from 2024 to 2030. This segment includes smaller, more frequent events like team meetings. The growth of everyday events is driven by the increasing adoption of remote work policies and the need for continuous professional development and networking. As businesses and educational institutions continue to leverage virtual platforms for daily operations, the demand for tools that facilitate effective communication and collaboration is surging. Everyday events offer the flexibility and convenience of connecting individuals from various locations, fostering a culture of continuous learning and engagement.

Country Insights

China Virtual Events Market Trends

The China virtual events market dominated the Asia Pacific virtual events market in 2023, holding a 28.0% revenue share. China's dominance in the market is a reflection of its vast population and rapid technological advancements. The country's robust digital infrastructure and high internet penetration rate have facilitated the growth of virtual events. Furthermore, the increasing adoption of VR and AR technologies in various sectors such as education, real estate, and entertainment has also contributed to China's substantial market share.

India Virtual Events Market Trends

On the other hand, the virtual events market in India is expected to witness the fastest growth in the APAC virtual events market. The country is expected to grow at a CAGR of 23.1% from 2024 to 2030. This surge is fueled by India's rapidly expanding internet access, making virtual events a cost-effective way to connect dispersed audiences. Furthermore, India's booming startup scene thrives on digital solutions, and virtual events offer a perfect platform for them to connect globally.

Key Asia Pacific Virtual Events Company Insights

The APAC virtual events market is characterized by a dynamic and competitive landscape, with several key players contributing to the industry’s growth and innovation.

Key players in the Asia Pacific virtual events market:

-

6Connex: As a prominent software and services provider for enterprise online events, 6Connex offers a comprehensive cloud-based product portfolio that includes webinars, learning management, and virtual environments. These are designed for a variety of purposes such as sales, marketing, training, recruitment, and HR communications.

-

Microsoft Corporation: A global technology leader, Microsoft Corporation provides essential platforms and services that facilitate virtual events. Their product, Microsoft Teams, is widely used for collaboration and communication during virtual events, making it a staple in the industry.

Key Asia Pacific Virtual Events Companies:

- Microsoft Corporation

- Cisco Systems, Inc.

- Zoom Video Communications, Inc.

- EventMobi (5Touch Solutions, Inc.)

- Cvent, Inc.

- Kestone

- Accelevents, Inc.

- Bizzabo

- Aventri, Inc.

- Samaaro

Recent Developments

-

In June 2023, Kestone expanded its APAC footprint with a new Indonesian office to serve existing clients, target new markets, and broaden its client base.

-

In April 2024, at its first APAC CX summit, Zoom highlighted the role of AI in personalizing interactions, improving response times, and retaining customers through its video-optimized Zoom Contact Center with over 700 features.

Asia Pacific Virtual Events Market Scope

Report Attribute

Details

Revenue forecast in 2030

USD 74.3 billion

Growth rate

CAGR of 20.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Event type, component, establishment size, end-use, application, industry vertical, use-case, country

Key companies profiled

Microsoft Corporation; Cisco Systems, Inc.; Zoom Video Communications, Inc.; EventMobi (5Touch Solutions, Inc.); Cvent, Inc.; Kestone; Accelevents, Inc.; Bizzabo; Aventri, Inc.; Samaaro

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Virtual Events Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific virtual events market report based on event type, service, establishment size, end-use, application, industry vertical, use-case, and country:

-

Event Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Internal Event

-

External Event

-

Extended Event

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Communication

-

Recruitment

-

Sales & Marketing

-

Training

-

-

Establishment Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small and Medium Enterprises (SMEs)

-

Large Institutions

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Educational Institution

-

Corporate

-

Government

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Conferences and Conventions

-

Exhibitions & Trade Shows

-

Seminars and Workshops

-

Corporate Meetings and Training

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Consumer Electronics

-

Healthcare

-

Information Technology

-

Manufacturing

-

Media & Entertainment

-

Telecom

-

Others

-

-

Use-case Outlook (Revenue, USD Million, 2018 - 2030)

-

Everyday Events

-

Large-scale events

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Japan

-

China

-

India

-

South Korea

-

Frequently Asked Questions About This Report

b. The Asia Pacific virtual events market size was estimated at USD 20.1 billion in 2023 and is expected to reach USD 24.40 billion in 2024

b. The Asia Pacific virtual events market is expected to grow at a compound annual growth rate of 20.5% from 2024 to 2030 to reach USD 74.3 billion by 2030

b. The external events segment dominated the market with a share of 41.7% in 2023, it is attributed to the increasing adoption of virtual simulated platforms to optimize time and resources by large and small & medium enterprises

b. Some key players operating in the Asia Pacific virtual events market include Microsoft Corporation, Cisco Systems, Inc., Zoom Video Communications, Inc., EventMobi (5Touch Solutions, Inc.), Cvent, Inc., Kestone, Accelevents, Inc., Bizzabo, Aventri, Inc., Samaaro

b. Factors such as technological advancements, cost savings, and the need for business continuity post-pandemic are driving the Asia Pacific virtual events market growth

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."