- Home

- »

- Biotechnology

- »

-

Asia Pacific Viral Vector And Plasmid DNA Manufacturing Market, Industry Report, 2030GVR Report cover

![Asia Pacific Viral Vector And Plasmid DNA Manufacturing Market Size, Share & Trends Report]()

Asia Pacific Viral Vector And Plasmid DNA Manufacturing Market Size, Share & Trends Analysis Report By Vector Type (AAV, Lentivirus), By Workflow, By Application, By End-use, By Disease, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-301-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

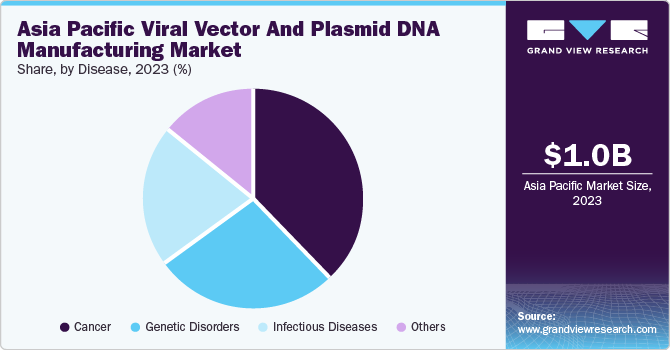

The Asia Pacific viral vector and plasmid DNA manufacturing market size was estimated at USD 1.0 billion in 2023 and is anticipated to grow at a CAGR of 21.9% from 2024 to 2030. The growth is attributed to the growing incidence of target conditions and diseases, as well as the effectiveness of pDNA in delivering gene therapy. Furthermore, funding for the advancement of gene therapy as well as ongoing research on genes as well as cell therapies dependent on viral vectors are factors contributing to this growth.

Asia Pacific accounted for the share of 19.3% of the global viral vector and plasmid DNA manufacturing market in 2023. An increasing number of clinical trials with promising results, a growing incidence of chronic diseases, and growing efforts to advance gene therapy are the main drivers of the market. The region holds a significant elderly population, with Thailand, Japan, and China among the key countries in this context. The rapidly aging population in these countries is expected to boost the demand for viral vectors and plasmid DNA manufacturing in the region.

The local presence of companies and research institutes, such as Sirion-Biotech GmbH, which are specifically engaged in vector research and manufacturing, is driving the country’s market. For instance, in March 2022, GenScript ProBio and the National Cancer Center for Japan entered into a research collaboration to develop a lentiviral and plasmid vector for CMC. This collaboration was anticipated to boost the R&D of novel viral vectors and pDNA, thereby driving the market.

Vector Type Insights

The adeno-associated virus (AAV) segment led the market with the largest revenue share of 20.1% in 2023. Increase adoption of AAV as it offers maximum precision in delivering the gene and is increasingly being used for various research applications in gene therapy. Furthermore, the use of AAV-based vectors is increasing in neuroscience research studies as a preclinical tool. This research space uses AAV-based vectors for brain connectivity mapping and interrogating neurocircuit & cellular functions.

The lentivirus segment is projected to grow at the fastest CAGR of 22.0% during the forecast period. Lentiviral vectors have witnessed significant success in reprogramming induced pluripotent stem cells. Lentiviral vectors have been used with a Cre-Lox-based reversible system, leading to the opening of new areas for research. This has created opportunities for therapeutic research for iPSC technology.

Workflow Insights

The downstream processing segment dominated the market with a revenue share of 53.6% in 2023. The downstream processes involve several purification methods that include multiple steps. The processes are usually divided into three stages: capture, intermediate purification, and polishing.

The upstream processing segment is expected to grow at a CAGR of 21.0% over the forecast period. The initial stage of processing, known as upstream processing, includes introducing cells to the virus, cultivating these cells, and then isolating the virus from them. The growing innovation in product development, such as the ambr 15 microbioreactor system for high-throughput upstream process development, is anticipated to advance this particular field.

Application Insights

The vaccinology segment accounted for the largest revenue share of 22.0% in 2023. The increasing need for vaccines to treat infectious diseases is estimated to drive market growth. Various viral vectors are currently under investigation due to their associated benefits, showing promise for expediting the development of viral vector-based vaccines.

The cell therapy segment is expected to grow at a CAGR of 24.2% over the forecast period. Cell therapy-based medicines are increasingly being adopted owing to the advent of next-generation transfer vectors. These vectors are proven to be safe and efficacious. Patient samples are generally expanded, extracted, and further transduced by using gene therapy vectors.

End-use Insights

The research institutes segment dominated the market with a revenue share of 57.7% in 2023. The segment growth is attributed to the increase in the demand for viral vectors and the increasing involvement of scientific communities in gene and cell therapy research. Research activities carried out for improvement in vector production by research entities are driving the segment growth.

The pharmaceutical and biotechnology companies segment is expected to grow at a CAGR of 22.2% over the forecast period. With increasing investments in the field of cell and gene therapy, several biopharmaceutical companies are shifting their focus toward these advanced therapies. This has resulted in more research studies being conducted by companies to evaluate the potential of gene and cell therapies. Emerging biotechnology and pharmaceutical companies are actively engaged in the development of advanced therapies for several life-threatening diseases.

Disease Insights

The cancer segment held the largest revenue share of 38.1% in 2023. The segment's growth is expected to be driven by an increasing number of cancer cases and a high volume of plasmid DNA and viral vectors used in developing gene therapies. Additionally, the adoption of a Western lifestyle, poor diet, and lack of physical activity are contributing to the rise in cancer cases.

The genetic disorders segment is expected to grow at a CAGR of 22.0% during the forecast period. Gene therapy has been developed to treat rare genetic disorders such as hemophilia, Adenosine Deaminase-Severe Combined Immunodeficiency (ADA-SCID), and Lipoprotein Lipase Deficiency (LPLD). These conditions are caused by genetic abnormalities or missing genes that affect certain traits. Most genetic disorders are present from birth, but some can develop due to random mutations. Common genetic diseases include sickle cell anemia and hemophilia, which involve blood clot formation and abnormal hemoglobin production, impacting the blood's ability to carry oxygen.

Country Insights

China Viral Vector And Plasmid DNA Manufacturing Market Trends

TheChina viral vector and plasmid DNA manufacturing market accounted for a revenue share of 19.6% in 2023 owing to advancements in the regulatory framework for cell-based research activities in the country. Furthermore, several biopharmaceutical companies are shifting their focus toward these advanced therapies with increasing investment in the field of cell & gene therapy. For instance, in April 2022, VectorBuilder announced an investment of USD 500 million to build a new cell research and gene therapy research & manufacturing facility in Guangzhou, China. This production facility has the ability to produce viral and non-viral forms of vectors, including AAV, plasmids, cell lines, lentivirus, and mRNA. This investment is expected to drive viral vectors and the plasmid DNA manufacturing market in China.

Japan Viral Vector And Plasmid DNA Manufacturing Market Trends

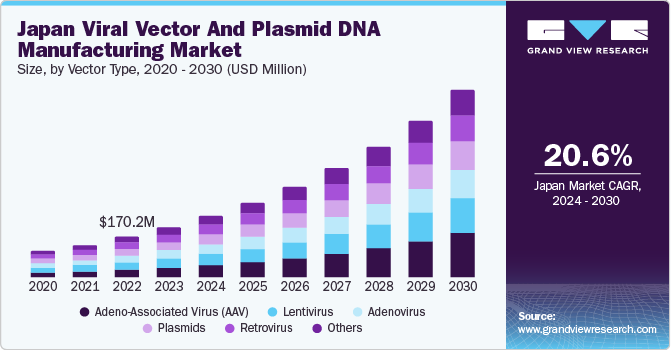

The Japan viral vector and plasmid DNA manufacturing market is anticipated to grow at a CAGR of 20.6% over the forecast period, as it has one of the most developed pharmaceutical and biotechnology sectors in the region. Moreover, the high prevalence of chronic diseases and rare genetic disorders has led to an increase in R&D activities for the development of novel therapies and vaccines, creating a high demand for pDNA manufacturing solutions for research purposes.

Key Asia Pacific Viral Vector And Plasmid DNA Manufacturing Company Insights

Some of the key players operating in the market are FUJIFILM Holdings Corporation, Wuxi Biologics, and Takara Bio Inc.

-

FUJIFILM Holdings Corporation's medical business segment offers digital imaging solutions, special solutions, web-based medical imaging, computed radiography, digital radiography, digital mammography, dry imager, film & screen, endoscopy, point-of-care testing products, ultrasound systems, drug discovery, toxicology testing, and stem cell banking along with cell therapy development.

-

WuXi Biologics is a wholly-owned subsidiary of WuXi AppTec and is a Contract Development and Manufacturing Organization (CDMO). The company offers services for the discovery and production of biologics. Its service portfolio includes solutions for discovery, development, testing, fill/finish, antibody-drug conjugates production, and technologies & platforms for biologics production.

Key Asia Pacific Viral Vector And Plasmid DNA Manufacturing Companies:

- FUJIFILM Holdings Corporation

- Wuxi Biologics

- Takara Bio Inc.

- Astellas Pharma, Inc. (Audentes Therapeutics)

- Lonza

- Charles River Laboratories (Cobra Biologics)

- Virovek Incorporation

- BioMarin

Recent Development

-

In June 2022, Charles River Laboratories expanded its cell and gene therapy products portfolio to include CDMO services covering viral vectors, cellular therapy, and plasmid DNA production.

Asia Pacific Viral Vector And Plasmid DNA Manufacturing Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 4.1 billion

Growth rate

CAGR of 21.9% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vector type, workflow, application, end-use, disease

Regional scope

Asia Pacific

Country scope

Japan; China; India; South Korea; Australia; Thailand

Key companies profiled

FUJIFILM Holdings Corporation; Wuxi Biologics; Takara Bio Inc.; Astellas Pharma, Inc. (Audentes Therapeutics); Lonza; Charles River Laboratories (Cobra Biologics); Virovek Incorporation; BioMarin

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Viral Vector And Plasmid DNA Manufacturing Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Asia Pacific viral vector and plasmid DNA manufacturing market report based on vector type, workflow, application, end-use, disease, and country:

-

Vector Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Adenovirus

-

Retrovirus

-

Adeno-Associated Virus (AAV)

-

Lentivirus

-

Plasmids

-

Others

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Upstream Manufacturing

-

Vector Amplification & Expansion

-

Vector Recovery/Harvesting

-

-

Downstream Manufacturing

-

Purification

-

Fill Finish

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Antisense & RNAi Therapy

-

Gene Therapy

-

Cell Therapy

-

Vaccinology

-

Research Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biopharmaceutical Companies

-

Research Institutes

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Genetic Disorders

-

Infectious Diseases

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific viral vector and plasmid DNA manufacturing market size was estimated at USD 1.0 billion in 2023 and is expected to reach USD 1.270 billion in 2024.

b. The Asia Pacific viral vector and plasmid DNA manufacturing market are expected to witness a compound annual growth rate of 21.9% from 2024 to 2030 to reach USD 4.1 billion by 2030.

b. AAV is expected to witness a compound annual growth rate of 20.15% owing to the development of ocular and orthopedic gene therapy treatment exhibiting increased efficacy and efficiency.

b. Merck, Lonza, FUJIFILM Diosynth Biotechnologies, Thermo Fisher Scientific, Cobra Biologics, Catalent Inc., Wuxi Biologics, Takara Bio Inc., and Waisman Biomanufacturing are some key companies operating in the viral vector and plasmid DNA manufacturing market.

b. Some of the factors boosting the market growth include robust pipeline for gene therapies and viral vector vaccines, and technological advancements in manufacturing vectors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."