- Home

- »

- Communication Services

- »

-

Asia Pacific Unified Communications Market, Report, 2030GVR Report cover

![Asia Pacific Unified Communications Market Size, Share & Trends Report]()

Asia Pacific Unified Communications Market Size, Share & Trends Analysis Report By Deployment Mode (Hosted, On-premise), By Solution, By Organization Size, By Industry Vertical, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-312-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

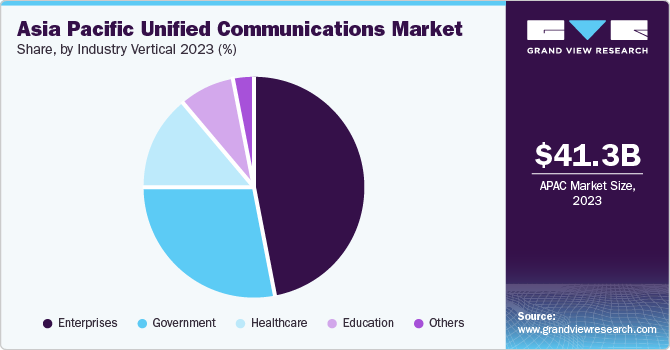

The Asia Pacific unified communications market size was estimated at USD 41.3 billion in 2023 and is projected to expand at a CAGR of 20.0% from 2024 to 2030. This impressive growth can be attributed to the rapid digital transformation across various industries in the region, the increasing adoption of cloud-based solutions, and the growing need for effective communication and collaboration tools in the era of remote work. Furthermore, government initiatives to promote digitalization, coupled with the proliferation of high-speed internet and smart devices, are also contributing to the expansion of the market.

The Asia Pacific unified communications marketaccounted for a 26.9% share of the global unified communications market in 2023. The telecom industry across countries like Japan, China, and India has strict regulatory barriers that might impact the growth of the Unified Communication & Collaboration (UC&C) market. These regulations often pertain to cloud-based UC&C services and enterprise telephony. Additionally, regulators have implemented stringent data governance frameworks. These frameworks encompass meticulous procedures for data capture, privacy, trade surveillance, and the timely detection and resolution of suspicious activity.

Moreover, there has been a marked increase in regulatory reporting and record-keeping requirements, particularly regarding customer on boarding interactions, since the emergence of the COVID-19 pandemic. However, it's worth noting that the unified communications market is not regulated by certain government guidelines and regulations, leading to potential security concerns for both large and small and medium-sized enterprises. Therefore, the call for stricter government regulations to secure data and information is becoming increasingly prominent.

Deployment Mode Insights

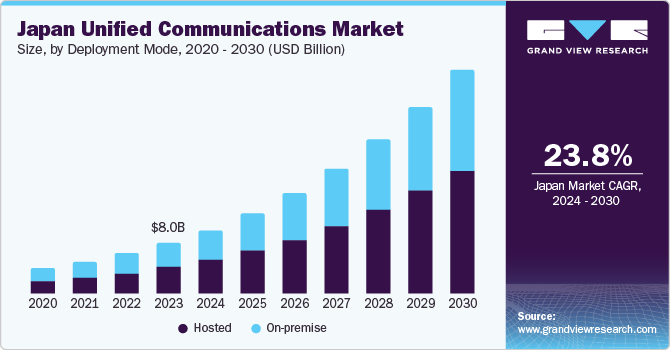

Based on deployment mode, the on-premise segment held the largest revenue share of 50.3% in 2023 and is attributed to the control and security offered by on-premise solutions, which are particularly appealing to large enterprises that handle sensitive information. These solutions are fully managed by the organization's IT department, allowing for customization and control over data, networks, and systems. However, the deployment of on-premise unified communication solutions involves challenges such as knowledge transfer, resistance change, and infrastructure capabilities, which could pose a threat to the growth of this segment.

The hosted segment is predicted to witness the fastest CAGR of 22.4% from 2024 to 2030. The growth is driven by the increasing adoption of cloud-based solutions, particularly among small and medium-sized enterprises (SMEs) that are looking for cost-effective communication solutions. The rising number of SMEs has resulted in their increased dependency on the cloud, as unified communication offers the benefits of cost reduction for these enterprises. Moreover, the region is experiencing a continuous rise in cloud infrastructure investment, which is acting as a key driver for the growth of the hosted service segment.

Solution Insights

Based on solution, the instant & unified messaging solution segment held the largest revenue share of 32.1% in 2023. This can be attributed to the increasing need for real-time and efficient communication tools in various industries. Instant and unified messaging solutions provide a platform for seamless and immediate communication, which is crucial in today's fast-paced business environment. These solutions allow users to send and receive messages in real time across different devices, thereby enhancing collaboration and productivity. However, the growth of this segment could be hindered by challenges such as data security and privacy concerns, as these solutions often involve the exchange of sensitive information.

The collaboration platform and applications segment is predicted to witness the fastest CAGR of 24.7% from 2024 to 2030.The customer engagement solutions market is experiencing significant growth, fueled by the demand for advanced functionalities within large enterprises. This surge is driven by the rise of collaboration platforms and applications that facilitate real-time communication and foster teamwork. These solutions empower companies to cultivate trust-based relationships with their customers. These platforms often include features like live chat, text messages, chatbots, and social media integration, which enhance customer engagement and satisfaction. Furthermore, the advent of cost-effective cloud-based solutions has increased the adoption of these platforms.

Organization Size Insights

Based on organization size, the large enterprises segment held the largest revenue share of 78.0% in 2023. This dominance can be attributed to the extensive use of unified communication tools in large enterprises to enhance business communications and processes. Large enterprises often have a global presence and a large number of employees, making effective communication crucial for their operations. Unified communication solutions offer real-time access to services like phone communications, conferencing, data sharing, and messaging from various devices, thereby enhancing business communications and processes. However, the deployment of these solutions in large enterprises involves challenges such as the integration of various technologies and the management of a vast amount of data.

Small and Medium-sized Enterprises (SMEs) is predicted to witness the fastest CAGR of 22.9% from 2024 to 2030. The growth of this segment is driven by the increasing number of SMEs in the Asia Pacific region and their increased dependency on the cloud. Unified communication offers the benefits of cost reduction for SMEs, making it an attractive solution for these businesses. Moreover, the rising growth of e-commerce and the large presence of convenience stores in the region are also contributing to the increased demand for unified communication solutions among SMEs. However, the deployment of unified communication in SMEs involves challenges such as knowledge transfer and resistance to change.

Industry Vertical Insights

The enterprise segment held the largest revenue share of 46.7% in 2023. This dominance can be attributed to the extensive use of unified communication tools in enterprises to enhance business communications and processes. Enterprises, particularly large ones, are increasingly adopting unified communication tools such as text messages, live chat, chatbots, and social media to build trustworthy relationships with their customers.

The government segment is projected to witness the fastest CAGR of 23.4% from 2024 to 2030. The growth of this segment is driven by the increasing digitalization initiatives taken by the governments of China and India. These initiatives have supported the region’s digital transformation in the communication space, thereby boosting the demand for unified communication systems. However, the deployment of unified communication in government agencies involves challenges such as the integration of various technologies and the management of a vast amount of data.

Country Insights

China Unified Communications Market Trends

China unified communications market dominated the APAC market with the largest revenue share of 44.7% in 2023. This dominance can be attributed to the country's rapid digital transformation and the increasing adoption of unified communication systems in various sectors. The rise in demand for better business communication infrastructure by enterprises has propelled the market demand for unified communication systems. Additionally, the increasing digitalization initiatives taken by the Chinese government have supported the region’s digital transformation under the communication space. However, the growth of this segment could be hindered by challenges such as LAN dependency on voice-related unified communication, which would hinder the work efficiency of the solutions.

Japan Unified Communications Market Trends

The unified communications market in Japanis predicted to witness the fastest CAGR of 23.8% from 2024 to 2030. The growth of this segment is driven by the increasing number of SMEs in Japan and their increased dependency on the cloud¹. Unified communication offers the benefits of cost reduction for SMEs, making it an attractive solution for these businesses. Moreover, the rising growth of e-commerce and the large presence of convenience stores in Japan are also contributing to the increased demand for unified communication solutions. However, the deployment of unified communication in SMEs involves challenges such as knowledge transfer and resistance to change.

Key Asia Pacific Unified Communications Company Insights

Some of the key players operating in the Asia Pacific unified communications market include Zoho, AstraQom, Zoom, and Microsoft:

-

Zoho Corporation, an Indian multinational technology company, has made significant strides in the Asia Pacific unified communications market. In February 2023, Zoho launched a unified communication & collaboration platform, Trident, to strengthen collaboration technologies for businesses.

-

AstraQom, a South Korean company, is another key player in this market. While specific details about AstraQom’s contributions to the Asia Pacific unified communications market are not readily available, it’s safe to say that as a major company in this market, AstraQom is likely playing a significant role in shaping the industry’s landscape.

Key Asia Pacific Unified Communications Companies:

- Zoho Corporation

- AstraQom

- Tata Communications

- First Unity Limited

- China Telecom Pte. Ltd.

- Infosys Limited

- Fujitsu Limited

- Zoom Video Communications

- Microsoft Corporation

- Cisco Systems, Inc.

Recent Developments

-

In June 2024, Singtel expanded its Communications Platform-as-a-Service (CPaaS) portfolio by integrating Zoom Phone Connector with its existing 5G and unified communications (UC) solutions. This rollout, commencing next month, signifies Singtel's commitment to enhancing enterprise communication and collaboration within the hybrid work landscape.

-

In April 2024, Toku signed a definitive agreement to acquire AiChat, a prominent Southeast Asian AI-powered conversational CX platform. This strategic move strengthens Toku's position as a comprehensive CX technology provider, allowing them to deliver a unified and personalized omnichannel customer engagement experience.

-

In February 2024, Smart IMS Inc. concluded the acquisition of IT Consulting Solutions (ITCS Group). This acquisition includes ITCS operations in Japan, Hong Kong, Australia, and Singapore, substantially enhancing Smart IMS's capabilities in infrastructure management, virtualization, digital transformation services, and IT-managed services for its broad APAC client base.

Asia Pacific Unified Communications Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 147.5 billion

Growth rate

CAGR of 20.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Deployment mode, solution, organization size, industry vertical, country

Country scope

Japan; China; India; Australia; South Korea; New Zealand

Key companies profiled

Zoho Corporation; AstraQom; Tata Communications; First Unity Limited; China Telecom Pte. Ltd.; Infosys Limited; Fujitsu Limited; Zoom Video Communications; Microsoft Corporation; Cisco Systems, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Unified Communications Market Report Segmentation

This report forecasts revenue growth at regional and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific unified communications market report based on deployment mode, solution, organization size, industry vertical, and country:

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hosted

-

On-premise

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Instant & Unified Messaging

-

Audio & Video Conferencing

-

IP Telephony

-

Collaboration Platform and Applications

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Enterprises

-

Education

-

Government

-

Healthcare

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

New Zealand

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."