Market Size & Trends

The Asia Pacific third-party logistics market size was estimated at USD 465.1 billion in 2023 and is expected to grow at a CAGR of 9.6% from 2024 to 2030. The development of new technologies includingrobotics, big data analytics, the Internet of Things (IoT), and artificial intelligence (AI), in automation is the primary factor driving the market growth. Companies are utilizing these technologies to help enhance supply chain efficiency, improve logistics management, and reduce operational costs.

Asia Pacific third-party logistics market held a share of 42.4% of the global third-party logistics market revenue in 2023. Increased digitalization in the e-commerce sector is a key factor driving the market growth. With growing online sales, the need for effective shipping, last-mile delivery, and inventory management is also growing. The overall reduction in operational costs achieved through outsourcing logistics services is also a crucial factor to consider. Several logistics companies help manage IT systems efficiently and deliver services more cost-effectively. They also help reduce inventory costs and strategize to optimize shipping and delivery expenses. Core companies often lack the time and expertise to update their logistics services, making 3PL providers crucial for timely product delivery during high business growth periods. In addition, the rise of international trade in the region is expected to impact the market growth. 3PL providers facilitate seamless movement of goods across borders, offering customs clearance, freight forwarding, and other essential services.

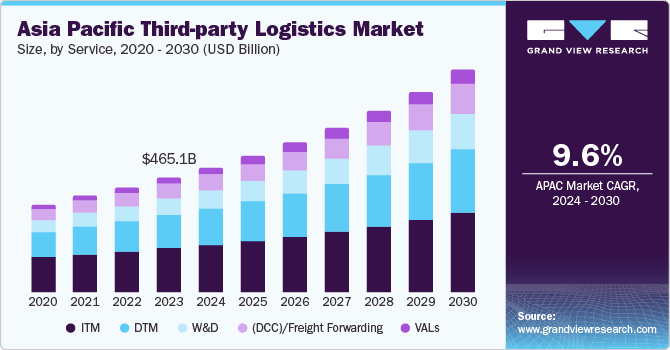

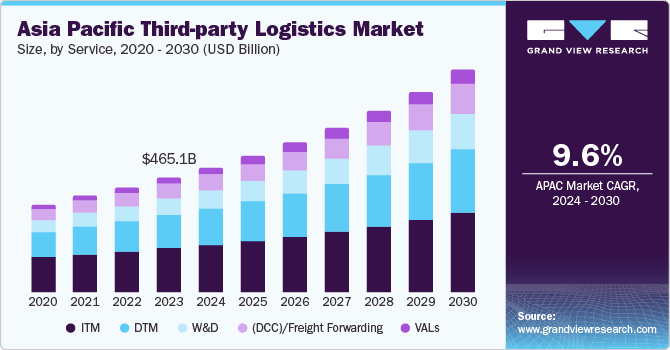

Service Insights

The International Trade Management (ITM) segment led the market with a share of 35.9% in 2023. These services played a crucial role in optimizing logistics operations and encompassed end-to-end transportation management, including route planning, load optimization, real-time tracking, and efficient utilization of resources. By leveraging ITM solutions, companies can enhance supply chain visibility, reduce costs, and improve overall efficiency. As the market evolves, ITM services are expected to be a key growth contributor, enabling businesses to navigate the complexities of regional logistics effectively. Companies that adopt ITM solutions can gain a competitive edge by streamlining their transportation processes and ensuring timely deliveries.

The Value-Added Logistics (VALs) segment is expected to grow at a CAGR of 12.6% over the forecast period. These services go beyond traditional logistics, offering customized solutions to meet industry needs. The anticipated growth is owing to the service VALs provide adept inventory management, ensuring optimal stock levels, efficient storage, and timely delivery for industries like retail and manufacturing.

End Use Insights

The manufacturing sector dominated the market with a share of 26.7% in 2023. Manufacturing has a complicated supply chain process. It involves procuring raw materials from several resources and various suppliers and distributors for transport activities. 3PL providers help this sector in terms of reduced transportation costs, supply chain visibility, inventory and vendor management, business process development, and improved customer services. This makes the 3PL services a better measure for the manufacturing industry. The manufacturing sectors in India and China have witnessed a rapid rise in outsourced transportation activities.

The retail segment is projected to register the fastest CAGR of 10.8% in the coming years. The increasing demand for express or same-day delivery from consumers has made transportation and supply chain management the backbone of the modern retail industry. With e-retailing and dedicated transportation services, medium-scale companies are expected to enter the 3PL market, which can help retail companies expand their operations and offerings in semi-urban areas. Furthermore, 3PL offers flexibility to retail businesses to develop new transport, enhance capabilities, and grow their regional presence.

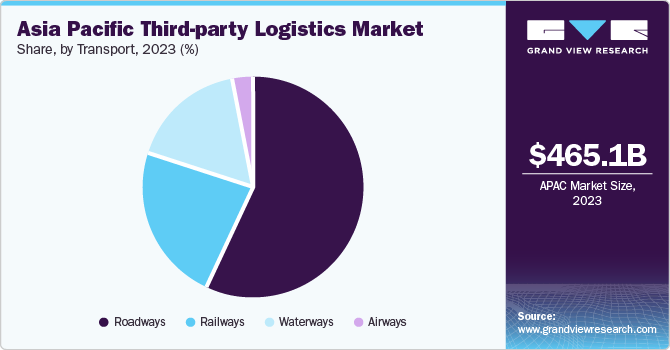

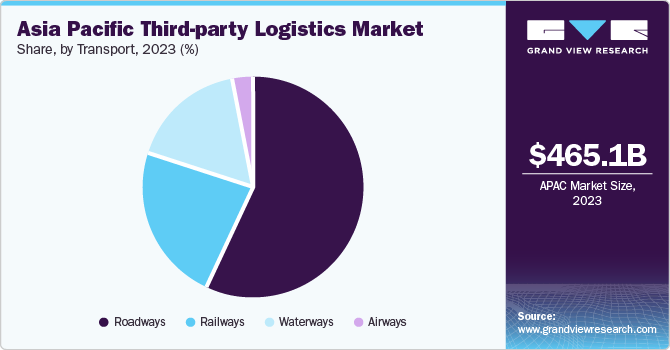

Transport Insights

The roadways segment led the market with a share of 56.7% in 2023. Due to a heavy emphasis on the public-private partnerships model and logistics infrastructure, the segment is expected to witness rapid growth. In addition, several government initiatives are aiding the segment development.

The airways segment is expected to grow at a CAGR of 10.8% during the forecast period owing to the rapid growth of cross-border e-commerce. 3PL providers facilitate cross-border logistics, including customs clearance and international transportation, making air freight essential for efficient trading activities. In addition, significant infrastructure improvements, including expanded airports and transportation networks, have further augmented the 3PL operations in the region.

Country Insights

The China third-party logistics market held a dominant revenue share of 61.5% in 2023 due to the rapid expansion of e-commerce in the 3PL sector. With global digitalization, consumers have gradually inclined towards online shopping, and hence, companies face pressure to provide efficient delivery options. This has been covered by China’s 3PL providers who offer distribution services and last-mile deliveries. There is also an increasing demand to outsource logistics requirements to 3PL providers from several businesses’ ends, so the latter can focus on their core competencies, maintain operational efficiency, and reduce costs. Furthermore, China’s 3PL market, driven by efficient technologies, including AI, blockchain, and IoT, helps enhance productivity, and better visibility for clients is expected to augment its growth.

The third-party logistics market in India is expected to register the fastest CAGR of 10.9% over the forecast period. The market has seen major technological innovations, applied by sectors, such as fast-moving consumer goods (FMCG), retail, manufacturing, and e-commerce. This is the primary factor supporting domestic market growth as these industries require complex solutions to manage their supply chain operations. In addition, by distribution activities and outsourcing logistics, businesses can streamline operations and optimize costs related to warehousing and transportation.

Key Asia Pacific Third-party Logistics Market Company Insights

The Asia Pacific third-party logistics market is fragmented. The key players are set to expand businesses through strategic partnerships, new service offerings, and facility center expansions, to cater to the increasing demand for warehousing and transportation services.Countries including China, Japan, and India are home to new software systems that ensure easy resolution to the complexities of logistics. Companies in this market concentrate on tech, developing services, and forming strategic partnerships to gain a competitive advantage. Key Asia Pacific Third-party Logistics Market Companies:

Key Asia Pacific Third-party Logistics Companies:

- Agility

- Americold Logistics, LLC

- BDP International

- C.H. Robinson

- CEVA Logistics

- DB Schenker Logistics

- Deutsche Post AG

- DSV PANALPINA A/S

- Expeditors International of Washington, Inc.

- FedEx Corporation

- Flexport Inc.

- Kerry Logistics Network Limited

Recent Developments

-

In May 2023, BDP International, Inc. and PSA Cargo Solutions jointly introduced the new brand, PSA BDP. The PSA BDP brand leverages the combined strengths and capabilities of both companies to enhance service and solution offerings throughout the entire supply chain

-

In March 2023, Americold Logistics LLC invested in RSA Cold Chain, a Dubai-based cold storage company, to create an expandable operating platform for market entry and growth in the Middle East and India

Asia Pacific Third-party Logistics Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2023

|

USD 465.1 billion

|

|

Revenue forecast in 2030

|

USD 884.3 billion

|

|

Growth Rate

|

CAGR of 9.6% from 2024 to 2030

|

|

Actual data

|

2018 - 2023

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Service, end use, transport, country

|

|

Country scope

|

Japan; China; India; Australia

|

|

Key companies profiled

|

Agility; Americold Logistics, LLC; BDP International; C.H. Robinson; CEVA Logistics; DB Schenker Logistics; Deutsche Post AG; DSV PANALPINA A/S; Expeditors International of Washington, Inc.; FedEx Corp.; Flexport Inc.; Kerry Logistics Network Ltd.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Asia Pacific Third-party Logistics Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific third-party logistics market report based on service, transport, end use, and country:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dedicated Contract Carriage (DCC)/Freight forwarding

-

Domestic Transportation Management (DTM)

-

International Transportation Management (ITM)

-

Warehousing &Distribution (W&D)

-

Value Added Logistics Services (VALs)

-

Transport Outlook (Revenue, USD Billion, 2018 - 2030)

-

Roadways

-

Railways

-

Waterways

-

Airways

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manufacturing

-

Retail

-

Healthcare

-

Automotive

-

Others