Asia Pacific Thermal Paper Market Trends

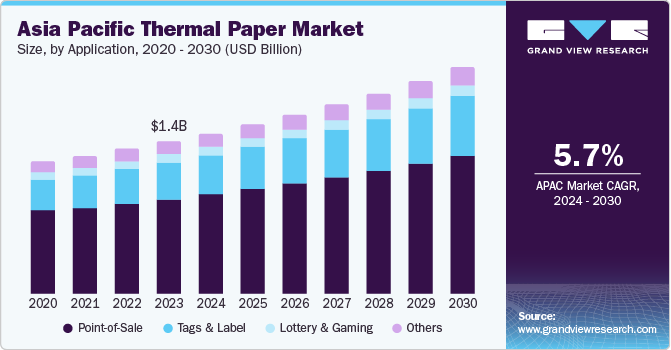

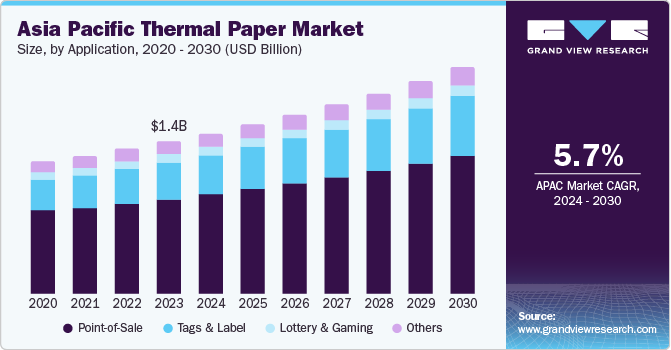

The Asia Pacific thermal paper market size was estimated at USD 1.4 billion in 2023 and is anticipated to grow at a CAGR of 5.7% from 2024 to 2030. A surge in retail transactions and the expanding e-commerce industry are primary contributors to this growth. In addition, the rising adoption of digital payments and point-of-sale systems fuels the need for reliable and efficient thermal printing solutions. Furthermore, increased governmental and regulatory emphasis on sustainable and eco-friendly paper products is prompting innovations within the market, ensuring compliance and meeting consumer expectations for environmental responsibility.

The Asia Pacific thermal paper market accounted for a revenue share of 34.7% of the global thermal paper market in 2023. Regulations in the region significantly impact the market dynamics, primarily due to stringent environmental and health-related laws. For instance, China's Ministry of Ecology and Environment has enforced stricter controls on the use of bisphenol A (BPA), a chemical commonly found in thermal paper, under its chemical management regulations, pushing manufacturers towards BPA-free options. Similarly, South Korea's Ministry of Environment has introduced regulations under the Chemicals Control Act, mandating the reduction of hazardous substances in paper products.

Width Insights

The 80mm thermal paper segment captured the largest revenue share in 2023. This widespread popularity stems from its versatility across various applications. Cash registers, parking tickets, receipt printers, and ATMs all rely on 80mm thermal paper for their operations. The prevalence of these applications in the region, particularly in the booming retail sector, fuels the demand for this size.

The 57mm thermal paper segment also held a significant market share in 2023. Its compact size makes it ideal for credit card terminals and mobile POS devices. The rise of mobile payments and the growing adoption of mPOS (mobile point-of-sale) systems in the region contribute to the strong demand for 57mm thermal paper. This segment caters to the need for on-the-go transactions and receipts, a trend that is expected to continue in the APAC market.

Technology Insights

The direct thermal segment dominated the market in 2023 due to the cost-effectiveness and speed of direct thermal technology. This technology utilizes heat-sensitive paper that darkens when exposed to a thermal printhead, allowing for quick printing without the need for additional ribbons. This makes it ideal for applications where fast turnaround and affordability are key, such as retail receipts, parking tickets, and ATM receipts. The thriving retail sector in Asia Pacific, coupled with the rise of e-commerce, has fueled the demand for direct thermal paper, solidifying the segment’s lead in the market.

While direct thermal reigns supreme, thermal transfer technology is poised for significant growth. This method uses a ribbon coated with wax or resin, which is melted onto the thermal paper by the printhead. This creates high-quality, durable labels that can withstand greater wear and tear compared to direct thermal prints. Thermal transfer is particularly attractive for applications requiring longer-lasting labels, such as shipping labels, product labels, and medical labels. As industries in Asia Pacific place a growing emphasis on product identification and traceability, the demand for thermal transfer labels is expected to rise, propelling this segment's growth trajectory.

Application Insights

The POS segment accounted for a revenue share of 62.2% in 2023. This dominance is attributed to the widespread deployment of POS systems across the growing retail and hospitality sectors in the region. The convenience and efficiency of thermal paper receipts, coupled with the increasing adoption of contactless payments and digital transactions that require immediate physical records, have bolstered the demand for POS thermal paper. The segment's growth is further supported by emerging retail markets in countries like India and China, where rapid urbanization and consumerism drive an upsurge in retail outlets and, consequently, POS systems.

The tags & label segment is expected to grow at a CAGR of 6.9% from 2024 to 2030. This growth is driven by the rising need for accurate and durable labeling solutions in logistics, inventory management, and product identification. The rise of e-commerce platforms has also significantly contributed to this growth, as sellers seek reliable labeling for shipping and handling. In addition, the healthcare sector's increasing reliance on thermal paper for patient identification tags and prescription labels adds to this upward trajectory. The tags & label segment's expansion reflects a broader trend toward automation and efficiency in supply chain management in the APAC region.

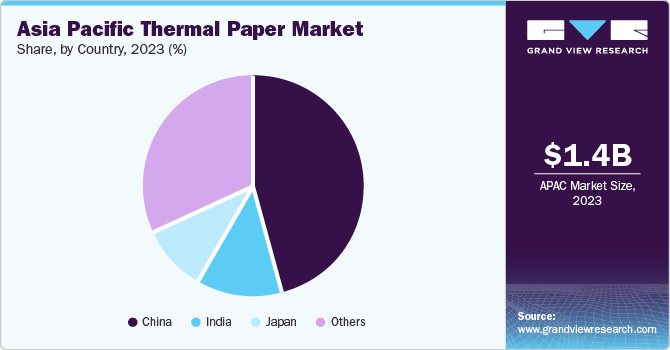

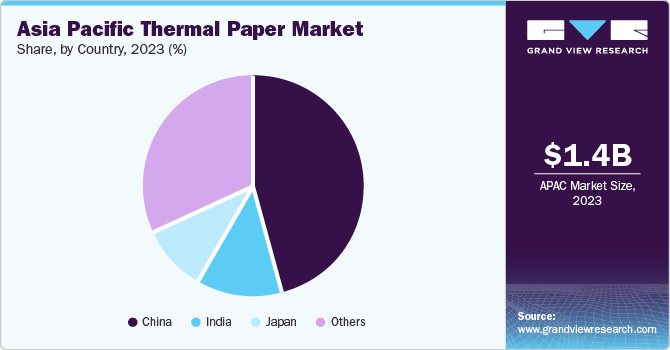

Country Insights

China Thermal Paper Market Trends

The China thermal paper market captured the largest revenue share of 45.5% in 2023. This dominance can be attributed to China's expansive retail sector and its massive manufacturing industry, which demands high volumes of thermal paper for POS receipts and product labels. The country's well-established supply chain infrastructure, combined with its technological advancements in thermal paper production, further consolidates its leading position. Moreover, China's push towards a digital economy has paradoxically increased the need for thermal receipts as proof of transaction in digital payments, thereby driving the demand for thermal paper.

India Thermal Paper Market Trends

The India thermal paper market is expected to grow at a CAGR of 6.6% from 2024 to 2030. This rapid expansion can be attributed to India's growing retail sector, fuelled by a growing middle-class population with increased spending power and a shift towards organized retail. In addition, the government's initiatives to promote digital transactions have led to a proliferation of POS terminals, which require thermal paper rolls. The country's expanding e-commerce sector also plays a crucial role, necessitating reliable tagging and labeling solutions for logistics purposes. The country’s focus on modernizing its retail infrastructure and adopting new technologies is expected to continue propelling the demand for thermal paper.

Key Asia Pacific Thermal Paper Company Insights

Some of the key players operating in the market include Mitsubishi Paper Mills, Ricoh, and Oji Holdings Corporation:

-

Ricoh delivers high-quality thermal paper products that cater to a diverse range of industries

-

Oji Holdings Corporation, with its commitment to sustainability and innovation, offers eco-friendly thermal paper solutions that meet stringent environmental standards

Key Asia Pacific Thermal Paper Companies:

- Ricoh

- Oji Holdings Corp.

- Appvion Operations, Inc.

- Koehler Group

- Hansol

- Mitsubishi Paper Mills (MPM) Ltd.

- Jujo Thermal Ltd.

- Nakagawa Manufacturing

- Thermal Solutions International Inc.

- Domtar

Recent Developments

-

In November 2024, The MPM Group undertook a strategic restructuring initiative to optimize its operational efficiency. This involved the integration of Diamic Co., Ltd. into Mitsubishi Oji Paper Sales Co., Ltd., consolidating subsidiaries at the Kitakami site, and merging those at the Hachinohe site

-

In November 2023, a collaborative study by the UTS Business School and the UTS Faculty of Science, commissioned by Slyp, revealed that Australia generates over 10.6 billion paper receipts annually. These receipts are predominantly thermal paper, containing Bisphenol A (BPA), a chemical rendering them unsuitable for recycling and posing a potential health risk 1,000 times greater than BPA exposure from plastic bottles

Asia Pacific Thermal Paper Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2030

|

USD 2.1 billion

|

|

Growth rate

|

CAGR of 5.7% from 2023 to 2030

|

|

Base year for estimation

|

2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion, volume in kilotons, and CAGR from 2024 to 2030

|

|

Report coverage

|

Volume & revenue forecast, competitive landscape, growth factors, trends

|

|

Segments covered

|

Width, technology, application, and country

|

|

Country scope

|

Japan; China; India

|

|

Key companies profiled

|

Ricoh, Oji Holdings Corp.; Appvion Operations, Inc.; Koehler Group; Hansol, Mitsubishi Paper Mills (MPM) Ltd.; Jujo Thermal Ltd.; Nakagawa Manufacturing; Thermal Solutions International Inc.; Domtar

|

|

Customization scope

|

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Asia Pacific Thermal Paper Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific thermal paper market report based on width, technology, application, and country:

-

Width Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Direct Transfer

-

Thermal Transfer

-

Others

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

POS

-

Tags & Label

-

Lottery & Gaming

-

Others

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)