Asia Pacific Sports Betting Market Size, Share & Trends Analysis Report By Platform, By Type, By Sports Type (Football, Basketball, Baseball, Horse Racing, Cricket, Hockey, And Others), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-218-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Asia Pacific Sports Betting Market Trends

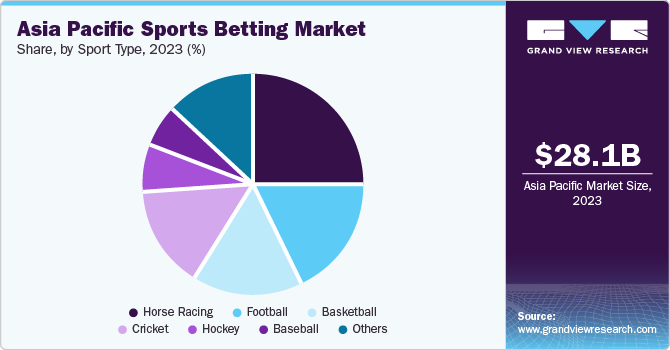

The Asia Pacific sports betting market size was valued at USD 28.09 billion in 2023 and is expected to grow at a CAGR of 11.5% from 2024 to 2030. The increasing number of sports events and leagues fueled by the development of digital infrastructure and the growing number of eSports competitions are key factors driving the sports betting market in the region. According to Maple Capital Advisors’s “Indian Gaming - At an inflexion point” report published in March 2021, India’s online gaming traffic accounted for 15% of the global gaming traffic.

With the widespread cancellation or postponement of sporting events, including major tournaments and leagues, the industry faced a substantial downturn during the COVID-19 pandemic as Asia Pacific registered a large number of patients. The absence of live sports led to declining betting opportunities, affecting online and offline platforms. However, some sectors, such as esports betting, witnessed increased activity during lockdowns as people pursued alternative forms of entertainment. As sporting events gradually resumed with safety measures in place, the market began to recover. The pandemic prompted a shift in consumer behavior, fostering more significant interest in online platforms, mobile betting, and esports, influencing the overall sports betting market in the Asia Pacific region.

Conservative attitudes towards gambling in certain cultures and religions within the Asia Pacific region contribute to a decline in the growth of sports betting. Gambling is often viewed negatively in these societies for moral, ethical, or religious reasons. This cultural conservatism translates into stricter regulations or outright bans on gambling activities, limiting the expansion of sports betting operators. Public perception and societal norms also play a crucial role in influencing individuals to abstain from or express reservations about engaging in sports betting. These conservative attitudes create a challenging environment for the sports betting industry to gain widespread acceptance and thrive in specific regions within the Asia Pacific.

Online sports betting has experienced significant growth due to the increasing penetration of the internet and mobile technology, which has substantially driven its growth. With the widespread availability of smartphones and affordable internet connectivity, many individuals in the Asia Pacific region now have access to online betting platforms, enabling them to participate in sports betting activities conveniently from their mobile devices or computers.

In Japan, ongoing developments in sports betting revolve around the nation's exploration of expanding legalized gambling options. The government is actively considering the introduction of integrated resorts, which may include casinos and potentially open avenues for a broader spectrum of sports betting activities. While discussions are ongoing, the exact regulatory framework remains fluctuating, and the industry is closely watching for updates. This potential shift represents a significant departure from Japan's historically restrictive approach to gambling. It reflects a broader trend in Asia, where countries are exploring ways to tap into the lucrative sports betting market.

In Australia, sports betting initiatives are characterized by a well-established and regulated industry. The government focuses on consumer protection and responsible gambling practices. Licensing systems are in place for online and offline bookmakers to ensure compliance with regulations. Ongoing initiatives involve refining and adapting rules to address emerging challenges, such as the impact of new technologies on the betting landscape. Authorities closely monitor the industry to maintain integrity, prevent corruption in sports, and uphold standards of fair play. Overall, Australia's initiatives aim to balance providing a thriving sports betting market and safeguarding the well-being of consumers.

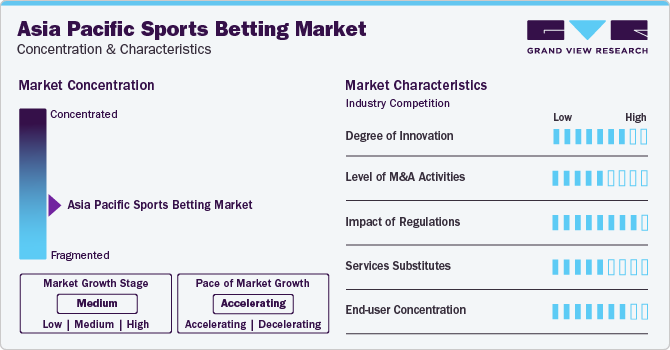

Market Concentration & Characteristics

The Asia Pacific sports betting market growth stage is medium, and the pace is accelerating. The sports betting market in the region is characterized by a rapidly and actively evolving landscape driven by technological advancements, diverse sports options, and a supportive ecosystem. Regulatory frameworks vary across countries, with some jurisdictions embracing legalization and regulation to ensure consumer protection and integrity. Additionally, technological advancements such as live streaming, in-play betting, and virtual sports contribute to a dynamic and immersive betting experience for users in the Asia Pacific region.

Asia Pacific's government actions for sports betting include a range of steps to control the sector and guarantee safe gaming. Establishing or improving regulatory frameworks to ensure openness, just competition, and legal compliance in the sports betting sector is a major priority for many Asia Pacific nations. The frequently strict licensing requirements demonstrate the need for operators to adhere to specific standards to function in the market. Protecting consumers from the possible harm that comes with gambling is a top responsibility, which is why measures like age verification procedures, tools for responsible gaming, and advertising limitations have been put in place.

Governments also aggressively combat problems associated with problem gambling by endorsing therapy, helplines, and self-exclusion initiatives, among other forms of support. Anti-money laundering measures are commonly implemented to prevent illicit financial activities within the sports betting industry. Taxation policies may be revised to ensure fair contributions from both operators and consumers. These multifaceted initiatives underscore the commitment to fostering a regulated, secure, and socially responsible sports betting environment across Asia Pacific.

The Asia Pacific sports betting market is developing and has a significantly concentrated nature, featuring several global and regional players. The market players are investing in research & development (R&D) to develop advanced solutions and gain a competitive edge. Moreover, they are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change.

Type Insights

Based on types, the market is further bifurcated into live/in-play betting, fixed odds wagering, exchange betting, eSports betting, and others. Others include spread betting and parimutuel. The fixed-odd wagering segment accounted for a significant revenue share of 24.7% in 2023. Moreover, the rising popularity of sports betting as an entertainment and leisure activity has contributed to the growth of fixed odds wagering in Asia Pacific. Many view sports betting as a way to add excitement and thrill to their viewing experience, enhancing their engagement with matches and events. Fixed odds betting offers a straightforward and accessible way for bettors to participate in sports betting, whether they are casual fans looking to place a simple wager or experienced punters seeking strategic opportunities for profit.

The eSports betting segment is anticipated to witness the fastest growth during the forecast period. The integration of esports betting into traditional sports platforms expanded the reach and appeal of esports betting in Asia Pacific. Many sports betting operators now offer eSports betting alongside traditional sports markets, providing bettors with a comprehensive betting experience that caters to their diverse interests and preferences. This integration has helped mainstream eSports betting and attracted a wider audience of sports bettors interested in exploring new betting opportunities within the growing eSports industry.

Platform Insights

Based on platform, the market is segmented into online and offline platforms. The online segment held the largest revenue share in 2023, which can be attributed to its convenience. Online betting services provide convenience by enabling consumers to place bets from their comfort using computers or mobile devices. The shift towards online sports betting in Asia has also been facilitated by safe payment alternatives and the simplicity of opening and maintaining online accounts, thus driving the growth of the online segment in the Asia Pacific sports betting market.

The offline segment is expected to grow at a significant CAGR during the period segment. Offline betting venues typically offer various payment options, including cash, credit/debit cards, and vouchers, making it convenient for bettors to fund their accounts and place wagers. For individuals who prefer to use cash or do not have access to online payment methods, offline betting shops provide a convenient and accessible way to participate in sports betting. This flexibility in payment options enhances the appeal of offline betting venues and drives growth in the segment.

Sports Type Insights

Based on sports type, the market is segmented into football, basketball, baseball, horse racing, cricket, hockey, and others. The horse racing segment held the largest market share in the year 2023. The accessibility and availability of horse racing events contribute to the growth of horse race betting in Asia Pacific. Many countries host regular horse racing meets and events, including the Japan Cup, the Melbourne Cup, the Hong Kong Derby, and the Singapore Gold Cup. These races attract large audiences and generate significant betting activity, thus driving the growth of the Asia Pacific sports betting market.

The baseball segment is expected to grow at the fastest CAGR during the forecast period. Integrating live streaming and real-time statistics into online betting platforms enhances the baseball betting experience for users in Asia Pacific. Many betting operators now offer live streaming of baseball games and real-time statistical updates, allowing bettors to follow the action closely and make informed betting decisions during a game. This interactivity and engagement contribute to the overall appeal of baseball betting and drive growth in the segment.

Country Insights

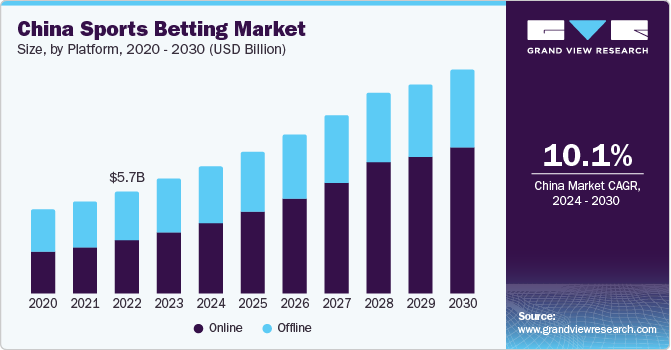

China Sports Betting Market Trends

China dominated the industry with a share of 22.8% in 2023 and is projected to grow at a significant CAGR during the forecast period. The increase in the middle-class population and rise in disposable incomes drive the market growth in the region. China’s disposable income reached USD 4,529.3 in 2022, a year-year-on-year increase of 4.7%. As incomes rise and lifestyles become more affluent, there is a growing need for entertainment and recreational activities, including sports betting, thus driving the growth of sports betting in the region.

Philippines Sports Betting Market Trends

The sports betting market in the Philippines is expected to grow significantly during the forecast period. The availability of a favorable regulatory environment for sports betting in the Philippines drives the market growth in the region. The presence of MegaSportsWorld, a bookmaker licensed and regulated by the Philippine Amusement and Gaming Corporation, has over 100 locations spread over the island to offer legal sports betting, which is expected to drive the growth of sports betting in the country.

Key Asia Pacific Sports Betting Company Insights

Some of the key players operating in the market includeDafabet, SBOBET, and 1xBet.

-

Dafabet is an online betting platform that engages in sports betting across various global events, including football, basketball, and tennis. The company has a strong presence in the online gambling industry, offering services such as online betting and gaming, including in-play gaming for sports events such as the Barclays Premier League, FIFA World Cup, NBA, US Open, and UFC.

-

SBOBET is an online bookmaker that offers a wide range of sports betting options. It offers online betting on all online games, major sports, racing (parimutuel betting), financial betting, and poker in multiple languages. The company partners with ONEworks to process customer data and offers an online affiliate program for website owners and advertisers.

-

Some of the other players operating in the market includeDream 11, Parimatch, and Cricketx

-

Dream11 is an Indian fantasy sports platform that enables users to participate in fantasy versions of handball, basketball, cricket, hockey, football, kabaddi, volleyball, and rugby. In this online game, participants construct virtual teams comprising real-life players, earning points corresponding to these players' performances in live matches. Dream11 hosts free and paid contests, with users required to pay an entry fee for the latter, offering them the chance to compete for actual cash prizes.

-

Parimatch is a renowned player in the sports betting market, offering a comprehensive platform for engaging in betting activities across various sports. Parimatch caters to a global audience, providing a diverse range of betting options for popular sports such as football, basketball, tennis, and cricket. Additionally, Parimatch prioritizes responsible gambling practices, ensuring a safe and secure user environment.

Key Asia Pacific Sports Betting Companies:

- Dafabet

- SBOBET

- 1xBet

- TAB

- CrownBet

- UBET

- Sports Toto Malaysia

- Mansion88

- 12BET

- W88

Recent Developments

-

In September 2023, Fun88 launched Asia Cup betting app in 2023. The app is designed to offer sports fans an engaging and seamless experience while placing bets on their favorite sports.

-

In October 2023, NUSTAR Resort and Casino, a tourism complex in the Philippines, launched NUSTAR Sports Max, a sports betting platform. It provides an interface that is easy to use, ensuring a smooth and hassle-free betting experience for the users.

Asia Pacific Sports Betting Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 31.05 billion |

|

Revenue forecast in 2030 |

USD 60.34 billion |

|

Growth Rate |

CAGR of 11.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Platform, type, sports type, region |

|

Country scope |

China; India; Japan; South Korea; Australia; Philippines |

|

Key companies profiled |

Dafabet; SBOBET; 1xBet; TAB; CrownBet; UBET; Sports Toto Malaysia; Mansion88; 12BET; W88 |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Asia Pacific Sports Betting Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific sports betting market report based on platform, type, sports type, and region:

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fixed odds wagering

-

Exchange Betting

-

Live/In Play Betting

-

eSports Betting

-

Others

-

-

Sports Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Football

-

Basketball

-

Baseball

-

Horse Racing

-

Cricket

-

Hockey

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Philippines

-

Frequently Asked Questions About This Report

b. The Asia Pacific sports betting market size was estimated at USD 28.09 billion in 2023 and is expected to reach USD 31.05 billion by 2024

b. The Asia Pacific sports betting market is expected to grow at a compound annual growth rate of 11.5% from 2024 to 2030 to reach USD 60.34 billion by 2030

b. The fixed odd wagering segment accounted for a significant revenue share of 24.7% in 2023. Moreover, the rising popularity of sports betting as an entertainment and leisure activity has contributed to the growth of fixed odds wagering in Asia Pacific.

b. Some key players operating in the Asia Pacific sports betting market include Dafabet, SBOBET, 1xBet, TAB, CrownBet, UBET, Sports Toto Malaysia, Mansion88, 12BET, W88

b. The increasing number of sports events and leagues fueled by the development of digital infrastructure and the growing number of eSports competitions are key factors driving the sports betting market in the region

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."