- Home

- »

- Plastics, Polymers & Resins

- »

-

Asia Pacific Recycled Plastics Market, Industry Report, 2030GVR Report cover

![Asia Pacific Recycled Plastics Market Size, Share & Trends Report]()

Asia Pacific Recycled Plastics Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Plastic Bottles, Plastic Films, Polymer Foam), By Type (PE, PET, PP, PVC, PS), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-169-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

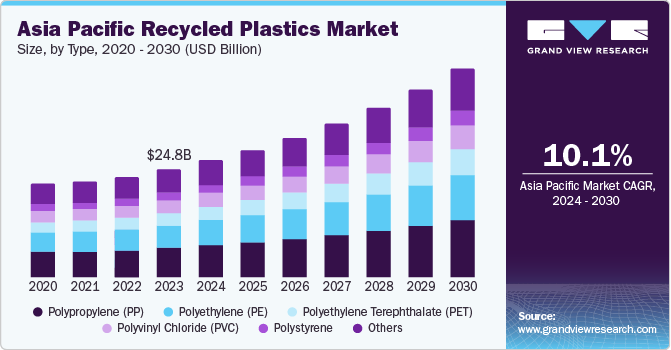

The Asia Pacific recycled plastics market size was valued at USD 24.80 billion in 2023 and is projected to grow at a CAGR of 10.1% from 2024 to 2030. This growth is driven by increasing environmental awareness, and stringent government regulations are pushing industries to adopt sustainable practices, including the use of recycled plastics. Secondly, rapid urbanization and industrialization in countries such as China and India are generating significant plastic waste, which in turn fuels the demand for recycling solutions.

In addition, advancements in recycling technologies are making the process more efficient and cost-effective, encouraging more businesses to invest in recycled plastics. The rising demand for recycled plastics in various industries such as packaging, automotive, and construction also plays a crucial role in market growth. Also, supportive government initiatives and policies aimed at promoting recycling and reducing plastic pollution are further propelling the market forward.

Increasing consciousness of eco-friendly processes and the restricted use of plastics have been central drivers of the recycled plastics market in the Asia-Pacific region. To mitigate the effects of plastic waste, strong policies and measures are being implemented by governments and organizations, emphasizing recycling. Additionally, heightened consumer awareness of the effects of plastic waste and the advantages of utilizing post-consumer recycled plastics have positively shaped the market.

Moreover, organizations involved in producing products from recycled plastics benefit significantly from increased awareness, as they can highlight the commercial benefits of recycled plastics, thereby changing consumer perceptions and encouraging adoption. The growing popularity and utility of recycled plastics in various sectors, including packaging, automotive, construction, and consumer products, further drive market growth. The shift in consumer behavior and the sustainability goals set by large corporations are key reasons why companies are actively using recycled plastics instead of virgin plastics.

Technological innovations in recycling methods, such as improved sorting and purification processes, have made value-added recycled plastics more feasible. Product and process innovations, including chemical recycling and the creation of new products from recycled plastics, have expanded the market for recycled plastics across different industries. These technological advancements play a crucial role in broadening the potential of the Asia-Pacific recycled plastics market.

Source Insights

The plastic bottles segment accounted for a revenue share of 74.9% in 2023 as they are one of the most commonly used plastic products, leading to a significant amount of waste that can be recycled. The widespread use of plastic bottles in the beverage and personal care industries ensures a steady supply of recyclable material. Additionally, the recycling of plastic bottles is well-established, with efficient collection and processing systems in place across many countries in the Asia Pacific region. The high demand for recycled PET (polyethylene terephthalate) from plastic bottles in various applications, such as packaging and textiles, further drives the growth of this segment. Moreover, government regulations and initiatives promoting the recycling of plastic bottles contribute to the segment’s significant market share.

The plastic films segment is anticipated to grow at a CAGR of 9.9% from 2024 to 2030 driven by the increasing demand for flexible packaging solutions in various industries, including food and beverage, pharmaceuticals, and consumer goods. Plastic films offer several advantages, such as lightweight, durability, and versatility, making them a preferred choice for packaging applications. The rising awareness of environmental sustainability and the push for reducing single-use plastics are encouraging the adoption of recycled plastic films.

Technological advancements in recycling processes, such as improved sorting and purification techniques, are enhancing the quality of recycled plastic films, making them more attractive to manufacturers. Additionally, the development of innovative recycling methods, such as chemical recycling, is expected to further boost the growth of the plastic film segment. The increasing investments in recycling infrastructure and the implementation of supportive government policies are also contributing to the segment’s robust growth prospects.

Type Insights

The polypropylene segment accounted for the largest market revenue share at 27.1% in 2023. This significant share can be attributed to the extensive use of polypropylene in various applications, including packaging, automotive components, textiles, and consumer goods. Polypropylene is favored for its excellent chemical resistance, durability, and versatility, making it a popular choice for manufacturers looking to incorporate recycled materials into their products.

The growing emphasis on sustainability and the circular economy has led to increased demand for recycled polypropylene, as it helps reduce plastic waste and conserve resources. In addition, advancements in recycling technologies have improved the quality and performance of recycled polypropylene, further boosting its adoption across different industries. The strong regulatory framework and government initiatives promoting plastic recycling in the Asia Pacific region also play a crucial role in driving the growth of the polypropylene segment.

The polyethylene terephthalate segment is expected to grow at a CAGR of 10.6% from 2024 to 2030. This growth is primarily driven by the increasing demand for recycled PET in the packaging industry, particularly for food and beverage containers. PET is highly valued for its clarity, strength, and recyclability, making it an ideal material for packaging applications. The rising awareness of environmental sustainability and the push for reducing single-use plastics are encouraging the adoption of recycled PET.

Moreover, technological advancements in PET recycling processes, such as chemical recycling and enhanced sorting techniques, are improving the quality and efficiency of recycled PET production. The growing investments in recycling infrastructure and the implementation of supportive government policies are also contributing to the robust growth prospects of the PET segment.

Application Insights

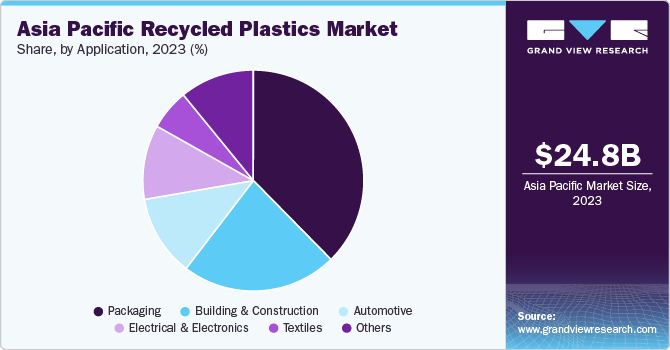

The packaging application segment dominated the market in 2023. This growth is driven by the high demand for sustainable packaging solutions across various industries. Packaging is a significant consumer of plastics, accounting for a large portion of plastic waste. The shift towards eco-friendly and recyclable materials has led to increased adoption of recycled plastics in packaging applications. This trend is particularly strong in the food and beverage industry, where there is a growing emphasis on reducing the environmental impact of packaging materials.

Moreover, the rise of e-commerce and the need for durable, lightweight packaging solutions have further fueled the demand for recycled plastics. The implementation of stringent regulations and policies by governments to reduce plastic waste and promote recycling has also played a crucial role in the dominance of the packaging segment. Companies are increasingly investing in recycled plastic packaging to meet consumer demand for sustainable products and to comply with regulatory requirements.

The building & construction segment is expected to grow fastest from 2024 to 2030. This growth is driven by the increasing use of recycled plastics in various construction applications, such as insulation, roofing, flooring, and structural components. Recycled plastics offer several advantages in construction, including durability, resistance to moisture and chemicals, and ease of installation. The growing focus on sustainable building practices and the use of eco-friendly materials are key factors driving the adoption of recycled plastics in the construction industry.

The rapid urbanization and infrastructure development in countries such as China and India are creating significant opportunities for the use of recycled plastics in construction projects. Technological advancements in recycling processes are also enhancing the quality and performance of recycled plastics, making them more suitable for construction applications. Government initiatives and policies promoting green building practices and the use of recycled materials are further expected to boost the growth of the building & construction segment.

Country Insights

China Recycled Plastics Market Trends

China recycled plastics market dominated the Asia Pacific market with a share of 36.0% in 2023. This dominance can be attributed to supportive government policies, economic benefits, technological advancements, increasing societal concern for the environment, and a market environment that encourages the development of the recycled plastics industry.

Japan Recycled Plastics Market Trends

Japan recycled plastics market was identified as a lucrative region in 2023. This growth is driven by enhanced global environmental awareness, robust regulatory frameworks, availability of new technologies, rising industrial and economic demands, and changing consumer preferences.

India Recycled Plastics Market Trends

India recycled plastics market is anticipated to witness the fastest growth, with a projected CAGR of 10.5% from 2024 to 2030 driven by increased environmental awareness, government support, rising demand due to the country’s growing economy, advancements in recycling technology, initiatives promoting circular economy products, shifting consumer preferences towards eco-friendly products, and the global move towards sustainability.

Key Asia Pacific Recycled Plastics Company Insights

Some of the key companies in the Asia Pacific recycled plastics market include Veolia, SUEZ, Polindo Utama (GBG), Bingo Industries, and many others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Veolia is the environmental solutions provider offering sustainable strategies in the field of waste and water management and energy. Veolia in Asia Pacific is energy and waste management company that strives to bring change in the company by promoting circular economy through implementing new technologies in recycling and providing recycling services that turn the plastic waste into better quality recycled products in support of the sustainable development goals.

-

Imerys is a global company dealing in mineral specialties for materials that enhance performance of recycled plastics and uses in Asia and Pacific. Among them, they provide a variety of functional additive and filler materials that can increase the specific mechanical properties and durability, as well as appearance of recycled plastics, promote recycling projects or sustainable development, and improve product added value in the field of recycling plastics.

Key Asia Pacific Recycled Plastics Companies:

The following are the leading companies in the Asia Pacific recycled plastics market. These companies collectively hold the largest market share and dictate industry trends.

- Veolia

- SUEZ

- IMERYS

- Plastipak Holdings, Inc.

- Polindo Utama (GBG)

- Pt. Production Recycling Indonesia

- The Shakti Plastic Industries

- KK Asia Pte Ltd. (K K Asia (HK) Ltd.)

- Astron Sustainability

- Bingo Industries

Recent Developments

-

In May 2024, Dow and SCG signed a memorandum of understanding to process 200,000 metric tons of plastic waste annually by 2030. The initial stages of this groundbreaking partnership will focus on developing innovative solutions for waste sorting, mechanical recycling, and advanced recycling technologies in Thailand.

-

In October 2023, Covestro, a leading supplier of engineering materials, inaugurated its first mechanical recycling compounding line for polycarbonate at its Shanghai production facility.

-

In April 2024, BASF highlighted its circular solutions at the CHINAPLAS 2024 event, showcasing Ultramid Ccycled polyamide (PA) made with mass-balanced pyrolysis oil from Asian post-consumer plastic waste. This innovative material exemplifies BASF's commitment to circularity within its integrated value chains. Additionally, the company introduced its 'Design-for-Recycling' technology for polyurethane foam, simplifying and scaling recycling processes.

Asia Pacific Recycled Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.0 billion

Revenue forecast in 2030

USD 48.0 billion

Growth Rate

CAGR of 10.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, Type, Application, Country

Regional scope

Asia Pacific

Country scope

China, India, Indonesia, Thailand, Vietnam, Philippines

Key companies profiled

Veolia; SUEZ; IMERYS; Plastipak Holdings, Inc.; Polindo Utama (GBG); Pt. Production Recycling Indonesia; The Shakti Plastic Industries; KK Asia Pte Ltd. (K K Asia (HK) Ltd.); Astron Sustainability; Bingo Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Recycled Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific recycled plastics market report based on source, type, application, and country.

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic Bottles

-

Plastic Films

-

Polymer Foam

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polyethylene Terephthalate (PET)

-

Polypropylene (PP)

-

Polyvinyl Chloride (PVC)

-

Polystyrene

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Packaging

-

Electrical & Electronics

-

Textiles

-

Automotive

-

Others

-

-

Countries Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Indonesia

-

Thailand

-

Vietnam

-

Philippines

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.