- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Rainscreen Cladding Market Size, Report, 2030GVR Report cover

![Asia Pacific Rainscreen Cladding Market Size, Share & Trends Report]()

Asia Pacific Rainscreen Cladding Market Size, Share & Trends Analysis Report By Raw Material (Fiber Cement, Terracotta, Composite Material), By Application (Residential, Official, Commercial), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-313-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

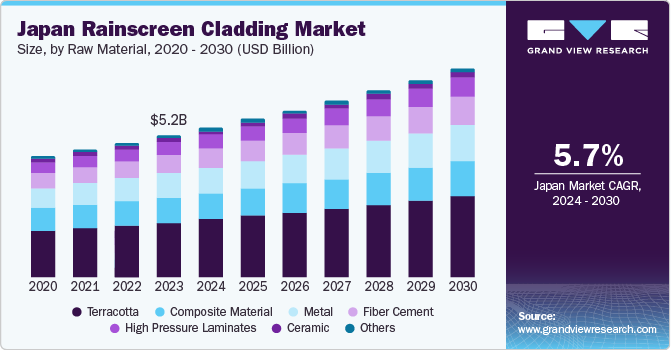

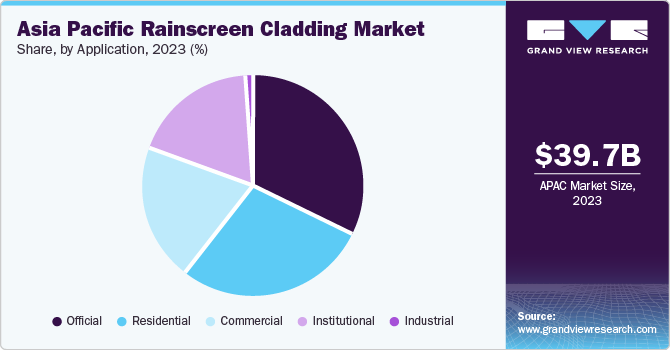

The Asia Pacific rainscreen cladding market size was estimated at USD 39.7 billion in 2023 and is expected to grow at a CAGR of 8.4% from 2024 to 2030. Several factors contribute to the market growth, including rapid urbanization and a rising population that has led to increased construction projects. Favorable government policies and increasing awareness of energy-efficient building materials play a crucial role in market expansion. In addition, the high durability of rainscreen cladding systems propels their adoption, supporting market growth.

The Asia Pacific rainscreen cladding market accounted for a share of 27.5% of the global rainscreen cladding market revenue in 2023. Regulation can significantly impact the market. Stricter fire safety codes, enacted in response to major building fires, drive demand for fire-resistant cladding materials. For instance, Singapore's Building Control Act mandates the use of Class 0 or Class 1 fire rating for external wall materials on tall buildings. This pushes manufacturers and developers towards materials like metal or ceramic rainscreen cladding, which often comply with these classifications. Conversely, regulations can also restrict certain materials.

Raw Material Insights

The terracotta segment dominated the market, with a revenue share of 39.2% in 2023. Terracotta panels offer a blend of aesthetics, durability, and thermal performance. Architects and designers appreciate their natural, earthy tones, which harmonize with various architectural styles. In addition, terracotta’s non-combustible properties contribute to fire safety compliance. As the market evolves, manufacturers innovate, enhancing terracotta panels’ performance and expanding their applications.

The metal-based segment is anticipated to grow at the fastest CAGR of 9.2% from 2024 to 2030. Metals, such as aluminum, zinc, and stainless steel, are preferred for their versatility, low weight, and ease of installation. Architects appreciate metal panels for their sleek, modern appearance and ability to create striking facades. Moreover, advancements in metal coating technologies improve corrosion resistance and longevity. As sustainability gains prominence, metal cladding’s recyclability and energy efficiency contribute to its rising popularity in the APAC market.

Application Insights

The official buildings segment accounted for the largest revenue share of 37.9% in 2023. These structures often prioritize durability, aesthetics, and energy efficiency. Rainscreen cladding systems enhance the appearance of official buildings while providing insulation, weather protection, and fire resistance. With rapid urbanization, the demand for efficient and visually appealing cladding solutions in official buildings remains strong in the region.

The commercial sector is projected to register a rapid CAGR of 8.7% from 2024 to 2030. Commercial buildings, such as offices, retail spaces, and hotels, increasingly adopt rainscreen cladding for several reasons. Primarily, it allows architects to create striking facades that attract customers and tenants. The energy-saving properties of rainscreen systems also align with sustainability goals. As businesses seek environmentally friendly solutions, the adoption of rainscreen cladding in commercial projects is expected to increase across the APAC region.

Country Insights

China Rainscreen Cladding Market Trends

The China rainscreen cladding market held the largest revenue share of 49.1% in 2023. Several factors contribute to China’s dominance, including rapid urbanization and infrastructure development, which drive demand for high-quality building exteriors. Rainscreen cladding, with its aesthetic appeal, weather resistance, and energy efficiency, aligns well with these requirements. Stringent building codes and regulations emphasize fire safety and energy conservation, prompting architects and developers to adopt rainscreen systems. As China continues to invest in commercial and residential construction, the product demand is expected to remain robust.

India Rainscreen Cladding Market Trends

The rainscreen cladding market in India is expected to exhibit the fastest CAGR of 9.5% from 2024 to 2030. The Indian construction industry is expanding rapidly, driven by urbanization, population growth, and infrastructure projects. Rainscreen cladding gained prominence due to its ability to enhance building aesthetics, improve insulation, and provide protection against harsh weather conditions. As awareness of sustainable construction practices grows, Indian developers increasingly opt for rainscreen systems. In addition, government initiatives promoting energy-efficient buildings further boost product adoption in the Indian market.

Key Asia Pacific Rainscreen Cladding Company Insights

Some of the key players operating in the market include 3M, BASF SE, XPEL, and Imerys S.A.

-

Kingspan offers innovative insulation solutions and high-performance cladding systems. Its commitment to sustainability drives adoption across the region

-

ROCKWOOL contributes significantly to the APAC market. Their fire-resistant and energy-efficient products find widespread use in rainscreen cladding applications

Key Asia Pacific Rainscreen Cladding Companies:

- Kingspan Insulation Plc

- SIKA AG

- Rockwool International A/S

- SFS Holding AG

- Promat UK Limited

- CGL Facades Co.

- ECO Earth Solutions Pvt. Ltd.

- FunderMax

- Alucobond Inc.

- Fairview Architectural

Recent Developments

-

In June 2024, Fairview announced the expansion of their Smartbric ventilated rainscreen system with a new, extended color range. This enhancement will provide architects with greater flexibility in creating unique and visually appealing building system

-

In December 2023, Schweiter Technologies bolstered its architecture business portfolio in China by acquiring a 60% stake in Jiangsu ZNL Coating New Materials, a recently formed joint venture specializing in innovative, multi-color aluminum solid sheets for building applications. This strategic move supports its growth within the Chinese and broader Asian markets

-

In October 2023, ALUCOBOND unveiled a new range of "Concrete" shades in response to the demand for a contemporary aesthetic. These shades are designed for cladding applications and are crafted from aluminum composite material (ACM) to replicate the look of real concrete

Asia Pacific Rainscreen Cladding Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 39.7 million

Revenue forecast in 2030

USD 69.7 million

Growth rate

CAGR of 8.4% from 2024 to 2030

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in million square meters, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, trends

Segments covered

Raw material, application, and country

Key companies profiled

Kingspan Insulation Plc; SIKA AG; Rockwool International A/S; SFS Holding AG; Promat UK Ltd.; CGL Facades Co.; ECO Earth Solutions Pvt. Ltd.; FunderMax; Alucobond Inc.; Fairview Architectural

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Rainscreen Cladding Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific rainscreen cladding market report based on raw material, application, and country:

-

Raw Material Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Fiber Cement

-

Composite Material

-

Metal

-

High Pressure Laminates

-

Terracotta

-

Ceramic

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Official

-

Institutional

-

Industrial

-

-

Country Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Austria

-

Poland

-

Belgium

-

Denmark

-

Turkey

-

Switzerland

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."