- Home

- »

- Medical Devices

- »

-

Asia Pacific Radiation Oncology Market, Industry Report, 2030GVR Report cover

![Asia Pacific Radiation Oncology Market Size, Share & Trends Report]()

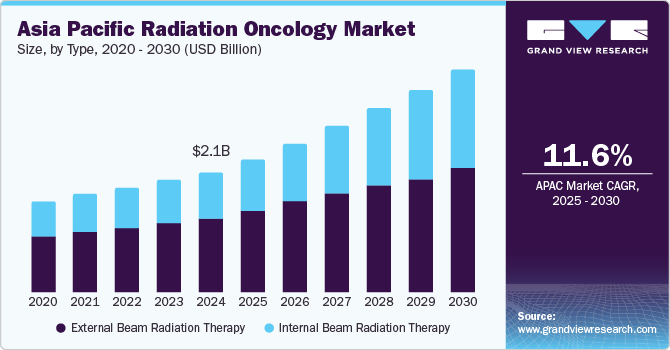

Asia Pacific Radiation Oncology Market Size, Share & Trends Analysis Report By Type (External Beam Radiation Therapy, Internal Beam Radiation Therapy), By Technology, By Application, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-952-4

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

The Asia Pacific radiation oncology market size was estimated at USD 2.13 billion in 2024 and is projected to grow at a CAGR of 11.6% from 2025 to 2030. The rising prevalence of cancer has proven to be a primary driver for market growth, aided by an aging population, lifestyle changes, and environmental factors. With increasing awareness of cancer and treatment options, more patients are pursuing radiotherapy as a vital component in managing diverse cancer types.

Over the past two decades, significant progress has been made in reducing poverty, altering lifestyles, and enhancing healthcare literacy in Asian countries, resulting in increased life expectancy. In terms of pancreatic cancer, there has been a notable rise in incidence, with 46% of new cases originating from Asia and Australia, as reported by the NCBI. The World Health Organization predicts that by 2050, the number of new cancer cases in the Asia Pacific is expected to soar, with a projected 77% increase in cases compared to 2022, underscoring the urgent need for effective radiation oncology solutions.

Innovations such as intensity-modulated radiation therapy (IMRT) and 4D radiotherapy offer enhanced precision in targeting tumors while minimizing collateral damage to healthy tissues. These advancements not only improve treatment efficacy but also attract significant investment aimed at enhancing patient outcomes. As healthcare facilities adopt these cutting-edge technologies, the overall effectiveness and safety of radiotherapy are optimized, creating a favorable environment for the market’s expansion.

Increased healthcare spending is also pivotal in developing the radiation oncology landscape. Governments and private entities are committing substantial resources to upgrade healthcare infrastructure, particularly radiation therapy centers. This investment leads to improved availability and quality of radiotherapy services, making them more accessible to patients across the region. Moreover, enhanced healthcare spending facilitates better screening and early detection, increasing the demand for radiotherapy.

Lastly, the growing trend toward multidisciplinary approaches in cancer treatment is expanding the utilization of radiation therapy. By integrating various treatment modalities, such as surgery and chemotherapy, healthcare providers can improve overall treatment effectiveness and patient outcomes. Government initiatives and awareness programs to educate the public about cancer treatments also contribute significantly to market growth. Countries such as China and India are actively investing in healthcare access and cancer care infrastructure, further solidifying the potential of the radiation oncology market in the Asia Pacific region.

Type Insights

External beam radiation therapy (EBRT) dominated the market with a revenue share of 35.9% in 2024. EBRT’s prominence is credited to its precision in tumor targeting and adaptability across diverse cancer types, including breast, lung, and prostate cancers. Advances such as image-guided radiation therapy (IGRT) and IMRT further improve treatment efficacy and safety while ensuring broader accessibility and cost-effectiveness.

Internal beam radiation therapy is expected to grow at the fastest CAGR of 16.5% over the forecast period. This method, especially brachytherapy, is effective for treating various cancers, including prostate and breast cancer. Advancements in imaging technologies improve treatment planning and execution, leading to better patient outcomes. Moreover, intracavitary brachytherapy (IBRT) provides shorter recovery times and reduced postoperative complications, appealing to patients and healthcare providers.

Technology Insights

EBRT technology held the largest market share of 66.4% in 2024. Within the leading EBRT segment, IMRT captured the largest market share in 2024, facilitating precise tumor targeting while preserving healthy tissue. Moreover, Image-Guided Radiation Therapy (IGRT) enhances treatment accuracy, while Proton Beam Therapy is anticipated to grow significantly due to technological advancements and rising demand.

Brachytherapy is expected to register significant growth over the forecast period. In the brachytherapy segment, High-Dose Rate (HDR) brachytherapy saw the highest demand in 2024, delivering precise, high doses directly to tumors while reducing exposure to healthy tissue. Low-dose rate (LDR) brachytherapy remains popular for prostate cancer, promoting market growth by enhancing treatment efficacy and improving patient satisfaction.

Application Insights

Applications in breast cancer under the EBRT segment led the market with 26.3% of the total revenue share in 2024, driven by EBRT’s effectiveness, increased awareness, and early detection initiatives. IMRT and IGRT further enhance treatment outcomes, driving growth in this segment.

The prostate cancer segment under internal beam radiation therapy is projected to grow significantly over the forecast period, driven by the effectiveness of brachytherapy for localized cases. HDR and LDR brachytherapy enhance treatment outcomes and patient satisfaction, aiding segment growth further.

Country Insights

China radiation oncology market dominated the Asia Pacific market with a revenue share of 18.5% in 2024, fueled by a substantial patient population and rising cancer incidence due to aging demographics and lifestyle factors. Key investments in healthcare infrastructure and advanced technologies, supportive government initiatives, and a strong pipeline of new products further solidify its market dominance in cancer treatment.

The radiation oncology market in Indonesia is projected to grow at the fastest CAGR of 14.5% in 2024. Enhanced healthcare infrastructure and government initiatives to improve cancer care are bolstering investments in radiotherapy facilities in Indonesia. Rising disposable incomes enable greater patient access to advanced treatment options.

The Japan radiation oncology market in Indonesia is projected to grow lucratively over the forecast period. Japan is prioritizing cancer care enhancement amid a growing aging population and rising cancer rates by investing in advanced radiotherapy technologies, including proton therapy and image-guided techniques. The presence of major medical equipment manufacturers, robust government support for cancer research, and a focus on professional education will drive the adoption of radiation oncology services.

The radiation oncology market in India held a substantial share of the Asia Pacific market in 2024, aided by rising cancer incidence and increased awareness of treatment options. Enhanced healthcare infrastructure investments and government initiatives drive demand for advanced radiotherapy technologies, including economically accessible treatments.

Key Asia Pacific Radiation Oncology Company Insights

Some key companies operating in the market include NTP Radioisotopes SOC Ltd, Varian Medical Systems, Inc., and Nordion Inc. These key companies are prioritizing strategic initiatives, including mergers, acquisitions, and partnerships, to strengthen their research and development capabilities and drive innovation in the industry.

-

Varian Medical Systems, Inc. specializes in advanced cancer treatment technologies. Their product offerings include linear accelerators and treatment planning software, exemplified by the precision-enhancing Halcyon system.

-

Mevion Medical Systems specializes in compact proton therapy solutions. Their flagship Mevion S250i provides high-precision proton therapy with a reduced footprint, enhancing treatment accessibility and aiming to improve patient outcomes through accurate tumor targeting.

Key Asia Pacific Radiation Oncology Companies:

The following are the leading companies in the Asia Pacific Radiation Oncology Market. These companies collectively hold the largest market share and dictate industry trends.

- NTP Radioisotopes SOC Ltd

- Varian Medical Systems, Inc.

- Nordion Inc.

- Mevion Medical Systems

- Perspecitve Therapeutics Inc.

- Accuray Incorporated

- BD

- IBA Radiopharma Solutions

- Elekta

- Curium

View a comprehensive list of companies in the Asia Pacific Radiation Oncology Market

Recent Developments

-

In October 2024, Curium announced a strategic partnership with PeptiDream for developing and commercializing 177Lu-PSMA-I&T and 64Cu-PSMA-I&T for prostate cancer theranostics in Japan, targeting high PSMA-expressing tumors.

-

In September 2024, Gifu Prefectural General Medical Center was the first in Japan to use Accuray’s Radixact System and VitalHold solution, improving access to precision radiation therapy.

-

In August 2024, Varian launched the HyperSight imaging solution for TrueBeam and Edge systems across Asia Pacific, enhancing radiotherapy accuracy and efficiency while streamlining clinician workflows and personalizing patient care.

-

In May 2024, Elekta launched Evo, an AI-powered adaptive CT-Linac, offering enhanced imaging and online adaptive capabilities, improving radiation therapy precision and personalization for cancer treatment. Elekta Evo requires CE certification.

-

In May 2024, Novartis announced the acquisition of Mariana Oncology, enhancing its radioligand therapy pipeline and expanding research capabilities to advance next-generation cancer treatment options for patients with high unmet needs.

Asia Pacific Radiation Oncology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.32 billion

Revenue forecast in 2030

USD 4.02 billion

Growth rate

CAGR of 11.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, technology, application, country

Regional scope

Asia Pacific

Country scope

Japan, China, India, South Korea, Australia, Singapore, New Zealand, Malaysia, Thailand, Indonesia, Vietnam

Key companies profiled

NTP Radioisotopes SOC Ltd; Varian Medical Systems, Inc.; Nordion Inc.; Mevion Medical Systems; Perspecitve Therapeutics Inc.; Accuray Incorporated; BD; IBA Radiopharma Solutions; Elekta; Curium

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Radiation Oncology Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific radiation oncology market report based on type, technology, application, and country:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

External Beam Radiation Therapy

-

Electron-emitting high-energy Linear Accelerators (Linac)

-

MRI LINACs

-

Compact Advanced Radiotherapy Systems

-

Cyberknife

-

Gamma Knife

-

Tomotherapy

-

-

Proton Therapy

-

Segment

-

Cyclotron

-

Synchrotron

-

-

-

Internal Beam Radiation Therapy

-

Brachytherapy

-

Seeds

-

Applicators and Afterloaders

-

Electronic Brachytherapy

-

-

Systemic Beam Radiation Therapy

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

External Beam Radiation Therapy

-

Image-Guided Radiotherapy (IGRT)

-

Intensity Modulated Radiotherapy (IMRT)

-

Stereotactic Technology

-

Proton Beam Therapy

-

3D Conformal Radiotherapy (3D CRT)

-

Volumetric Modulated Arc Therapy (VMAT)

-

-

Brachytherapy

-

HDR Brachytherapy

-

LDR Brachytherapy

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

External Beam Radiation Therapy

-

Prostate Cancer

-

Breast Cancer

-

Lung Cancer

-

Head and Neck Cancer

-

Colorectal Cancer

-

Others

-

-

Internal Beam Radiation Therapy

-

Prostate Cancer

-

Gynecological Cancer

-

Breast Cancer

-

Cervical Cancer

-

Penile Cancer

-

Others

-

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Singapore

-

New Zealand

-

Malaysia

-

Thailand

-

Indonesia

-

Vietnam

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."