- Home

- »

- IT Services & Applications

- »

-

Asia Pacific Quality Management Software Market, Industry Report, 2030GVR Report cover

![Asia Pacific Quality Management Software Market Size, Share & Trends Report]()

Asia Pacific Quality Management Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution, By Deployment, By Enterprise Size, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-296-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific QMS Market Size & Trends

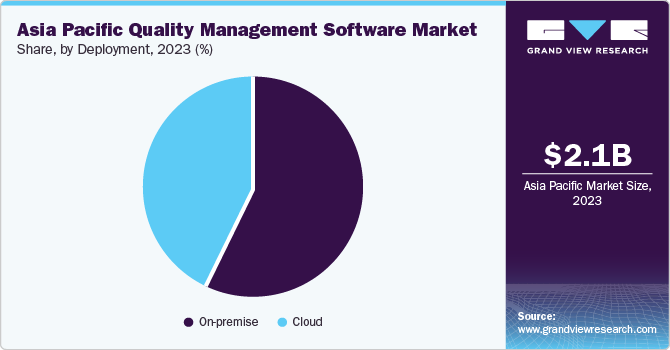

The Asia Pacific quality management software market size was estimated at USD 2.1 billion in 2023 and is anticipated to grow at a CAGR of 12.7% from 2024 to 2030. The fast pace of technological advancements and innovations in the region and the substantial growth of various industries, such as logistics, manufacturing, and consumer goods, are expected to drive industry growth in the coming years. In addition, integrating the Six Sigma approach in quality management software (QMS) further ensures continual improvements in the quality management system. The region's adoption of hybrid cloud services for deploying QMS is increasing. It is attributed to hybrid cloud services that offer greater flexibility and lower costs. Internet of Things (IoT) technology and smart devices have also significantly contributed to providing reliable and efficient quality management solutions to businesses in countries like India, China, and South Korea.

Asia Pacific accounted for a revenue share of 21.0% in the global quality management software market in 2023. Regional businesses increasingly focus on reducing production and process costs while delivering better-quality products. Quality management software helps improve the process and operating margin by evaluating performance effectiveness and elevating the quality of the finished products. In addition, it promotes consistent record-keeping by creating employee awareness while reducing wastage and unnecessary expenses. Frequent use of QMS helps minimize quality issues and quickly identify areas that organizations can improve. These tools aid businesses in realizing cost efficiency, especially in areas like warranty cost reduction, scrap, rework, and field service.

These cost reductions directly influence bottom-line profits without bringing in any added costs, therefore helping users increase their profitability and productivity. The need for QMS has become evident in areas, such as IT and telecom, which have become a fast-growing industry due to industrialization in the region. The need to improve documentation processes to review operations and IT services is driving the demand for QMS in IT and telecom organizations. An effective QMS solution helps telecom service providers enhance their communication strategies by enabling them to adhere to the highest quality standards in the telecom services industry.

The utility sector has also emerged as a notable end-user of QMS solutions. Utility companies are rapidly replacing several manual processes with their modern variants, backed by technologies, such as the IoT, AI, and cloud computing. It has led to a rise in the demand for QMS. Moreover, utility companies operate in harsh conditions and observe higher production and operational downtimes. Several organizations still rely on aging infrastructure, affecting end-use offerings' output. To tackle these challenges, organizations are investing substantially in QMS solutions to realize effective results for reducing downtime and improving the efficiency of business operations and asset health monitoring.

Solution Insights

The complaint-handling solutions segment accounted for the largest revenue share of 19.5% in the market for quality management software in 2023. Furthermore, this segment is anticipated to advance with the highest growth rate from 2024 to 2030. With the increasing incidences of negative customer feedback requiring immediate attention, the importance of effective complaint management solutions has risen substantially. Furthermore, the trend of changing purchase patterns and customer behavior, coupled with the growing popularity of customized solutions and services, has translated to adopting advanced systems that can efficiently handle customers' complex queries and provide them with an improved customer experience.

Change management and calibration management are other notable solutions that are expected to witness substantial growth in demand over the coming years in the Asia Pacific QMS market. Calibration management helps schedule and record the results of all calibration activities and costs of enterprises and helps perform Repeatability and Reproducibility (R&R) studies to obtain statistically analyzed reports. Some notable software providers in this area include QT9 QMS, Metquay, Intellect QMS, GAGEtrak, and Ideagen Quality Management. On the other hand, a change management solution ensures consistent and compliant changes and helps implement informed decisions quickly. It allows users to manage various changes, harmonize change control procedures, and maintain well-documented & transparent changes.

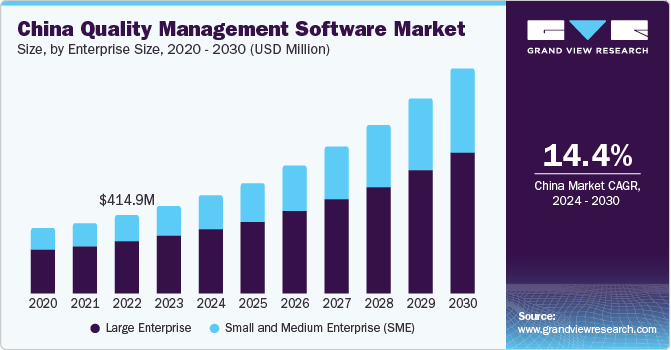

Enterprise Size Insights

In terms of enterprise size, the large enterprise segment accounted for the leading revenue share in 2023. The region has witnessed the emergence of several organizations catering to industry verticals that necessitate compliance with regulatory standards. These businesses demand customized QMS and services tailored to their specific operations to streamline business processes and cater to customer requirements. The diverse demands from sectors, such as healthcare, BFSI, aerospace & defense, and government, are fuelling the demand for customized solutions to manage and control quality concerns. As a result, the demand for QMS from this segment is expected to remain significant in the coming years.

The small & medium enterprise (SME) segment is projected to grow at a CAGR of 13.6% from 2024 to 2030. The region has seen a proliferation of SMEs in the past few years, aided by initiatives from governments in countries, such as India, China, and Australia. Implementing QMS solutions can lead to improved customer retention, reduced wastage, and better opportunities to win new contracts that help organizational growth in the long run. Such businesses are investing substantially in quality management to improve business structure and ensure efficient implementation of processes. Moreover, structured quality management software makes it convenient for owners of small- and medium-sized businesses to adapt to changes or improve processes. All these benefits ultimately prove profitable, justifying the demand for these solutions.

End-use Insights

The manufacturing segment accounted for the largest revenue share of 24.9% in 2023. The rapid expansion of the regional sectors, such as petroleum & plastics, chemical products, textile & printing, electrical & electronic products, machinery, and metal products, is a major market growth driver. QMS helps the manufacturing industry reduce equipment downtimes, improve yield, and increase the Overall Equipment Efficiency (OEE) on the shop floor. It helps incorporate better quality in the process, determine the optimum level of manufacturing output, and mitigate risks associated with manufacturing and production. For instance, in metal manufacturing, using QMS solutions helps improve process control, reduce waste and costs, and elevate customer satisfaction.

The healthcare segment is projected to register the fastest CAGR of 15.3% during the forecast period. The rapid pace of advancement of medical institutions in countries, such as Japan, India, and China, coupled with the need to follow quality standards for medical devices and pharmaceuticals by companies, are factors driving the demand for QMS. These solutions assist in developing quality medical equipment and drugs, meeting healthcare requirements for patient safety, and reducing clinical risks involved in planning, realization, and management processes. QMS solutions are used in the pharmaceutical sector to manufacture medicines, compounds, or therapeutics subject to regulations, such as drugs or controlled substances. In the medical device segment, they aid in creating a structured system of processes and procedures covering all aspects of designing, manufacturing, risk management, supplier management, clinical data, storage, complaint handling, distribution, and product labeling.

Deployment Insights

The on-premise segment dominated the market with a revenue share of 58.2% in 2023. This deployment is usually preferred by large enterprises that can manage their data and do not want to lose control over this data. Thus, organizations prioritizing high data protection levels and minimizing the loss of critical and sensitive information are leading adopters of on-premise deployment. Moreover, several businesses in countries, such as Japan, China, and South Korea are bound by stringent regulations, making this deployment ideal for adhering to guidelines and avoiding penalties. In addition, this mode provides the benefit of increased customization options as per the client's business needs, aiding its substantial demand.

The cloud deployment segment is projected to advance at a much faster CAGR of 15.5% from 2024 to 2030. Cloud deployment has witnessed a sharp increase in adoption, particularly in emerging economies of Asia Pacific that still possess vast untapped potential for leveraging QMS across different verticals. The vendor manages every system upgrade in this deployment to provide end-users convenient access to data from any location. Moreover, cloud-based deployment of QMS solutions avoids purchasing expensive hardware equipment, making it a cost-effective option for organizations, especially SMEs, in this region.

Country Insights

China Quality Management Software Market Trends

The quality management software market in China held the largest revenue share of 21.6% in 2023. The strong growth of the SME sector in the country, coupled with the increasing adoption of cloud computing technologies, are notable factors driving market expansion. China, being one of the leading global producers of chemicals, has witnessed continuous improvements in its quality and processes. Such developments in the chemical sector are likely to propel the use of QMS solutions in the coming years. Chinese standards and regulations, such as GB/T, GB/Z, and GB, which are either mandatory or voluntary, in addition to numerous international standards, have dramatically boosted the demand for compliant QMS solutions.

South Korea Quality Management Software Market Trends

The South Korea QMS market is projected to grow at the fastest CAGR of 14.7% from 2024 to 2030. QMS providers in the country mainly focus on launching advanced solutions that cater to multiple critical industries, such as manufacturing, logistics, transportation, and consumer goods. Increasing awareness regarding compliance and standards in quality management has resulted in high demand for these products in the country's transportation & logistics and manufacturing industries. Furthermore, the growing emphasis on strong Supplier Quality Management within QMS and the need to ensure optimal quality of components and raw materials provided by external vendors for better overall product quality is also driving market expansion.

Key Asia Pacific Quality Management Software Company Insights

Some of the leading organizations developing cutting-edge solutions in the quality management software space in Asia Pacific include Dassault Systèmes, AmpleLogic, Siemens AG, Ideagen, and Arena Solutions.

-

Dassault SystèmesSE is a subsidiary of the Dassault Group and develops and markets 3D design software, 3D digital mock-up, and Product Lifecycle Management (PLM) software. It has been a leader in offering next-generation software, such as Computer-Aided Design (CAD), Computer Aided Manufacturing (CAM), and CATIA. Dassault Systèmes SE’s product portfolio includes social and collaborative applications, 3D modeling applications, content and simulation applications, and information intelligence applications. The company is established across several Asian Pacific countries, including Australia, China, India, and Japan, among others

-

Siemens AG is an industrial manufacturer operating globally in around 200 countries, with over 290 major manufacturing and production plants worldwide. The company operates in six segments - Digital Factory (DF); Power and Gas (PG); Building Technologies (BT); Energy Management (EM); Mobility (MO); and Process Industries and Drives (PD). The company provides product lifecycle management software and services through its subsidiaries, Siemens PLM Software and IBS QMS. They operate under the Siemens Digital Factory Division. The company offers QMS for industry-specific usage, including car manufacturers, electronics, steel, chemicals, packaging, railway, and consumer goods

Key Asia Pacific Quality Management Software Companies:

- Arena Solutions, Inc.

- AURA QUALITY MANAGEMENT

- Dassault Systèmes

- Ideagen

- Intelex Technologies

- AmpleLogic

- MasterControl Solutions, Inc.

- Oracle Corporation

- SAP SE

- Siemens AG

- Sparta Systems Inc. (a subsidiary of Honeywell)

Recent Developments

-

In April 2024, Ideagen announced the acquisition of Damstra Technology, an Australia-based workforce safety solution. The Damstra software offers comprehensive workforce management solutions to aid organizations in predicting, mitigating, and reducing unforeseen business challenges and risks. The acquisition would enable Ideagen to strengthen its global position as a leading name in the regulatory compliance software space

-

Laurus Labs, an Indian biotech and pharmaceutical company, announced that it had selected AmpleLogic to implement a GMP-compliant solution-calibration and Preventive Maintenance Software-at the former’s facilities to further its progress in digital transformation. This development would allow Laurus Labs to digitize its paper-based processes fully and streamline operations to minimize errors and enhance efficiency

Asia Pacific Quality Management Software Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 4.95 billion

Growth rate

CAGR of 12.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, enterprise size, end-use, country

Country scope

China; India; Japan; Australia; South Korea

Key companies profiled

Arena Solutions, Inc.; AURA QUALITY MANAGEMENT; Dassault Systèmes; Ideagen; Intelex Technologies; AmpleLogic; MasterControl Solutions, Inc.; Oracle Corporation; SAP SE; Siemens AG; Sparta Systems Inc. (a subsidiary of Honeywell)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Quality Management Software Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific quality management software market report based on solution, deployment, enterprise size, end-use, and country:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Document Control

-

Non-conformances/Corrective & Preventative

-

Complaint Handling

-

Employee Training

-

Quality Inspections (PPAP & FAI)

-

Audit Management

-

Supplier Quality Management

-

Calibration Management

-

Change Management

-

Mobile Incidents and Event Reporting

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprise (SME)

-

Large Enterprise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecom

-

Transportation & Logistics

-

Consumer Goods & Retail

-

Defense & Aerospace

-

Manufacturing

-

Healthcare

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.