- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Asia Pacific Protein Supplements Market Size, Report, 2030GVR Report cover

![Asia Pacific Protein Supplements Market Size, Share & Trends Report]()

Asia Pacific Protein Supplements Market (2024 - 2030) Size, Share & Trends Analysis Report By Source, By Product, By Application, By Distribution Channels, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-325-3

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

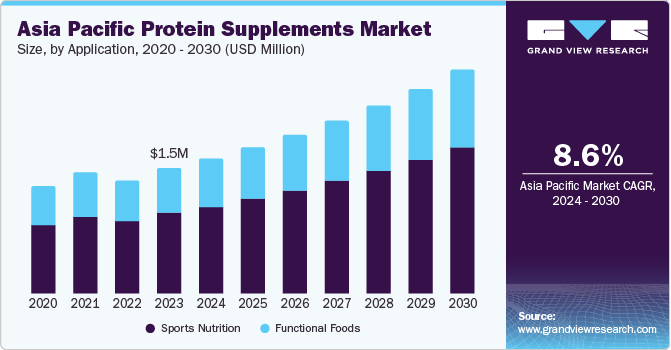

The Asia Pacific protein supplements market size was estimated at USD 1.5 billion in 2023 and is expected to grow at a CAGR of 8.6% from 2024 to 2030. The rising demand in the protein supplements industry in this region can be attributed to a major paradigm shift in consumer preferences. Millennials’ interest in health and wellness is augmenting the growth of protein supplements making it the key driving factor.

The Asia Pacific protein supplements market held a share of 24.2% of the global protein supplements market revenue in 2023. The target consumers are growing more conscious about their health amidst the rise of obesity and environmental sustainability. From the environmental consciousness perspective, plant-based proteins emit fewer greenhouse gases, use fewer natural resources, and have a low ecological footprint. Regarding nutritional and dietary preferences, plant-based products such as soy proteins are gaining popularity as an alternative to dairy and meat proteins in the APAC region. The market is also inclining toward veganism. With culinary innovation and technological advancements in the food industry, the sector is acting up as the next best substitution for animal-based protein since it is more cost-effective and has similar nutritional attributes.

Although the market is witnessing a robust transition to the plant-based protein sector, with countries like China and India, APAC is still dominated by the quality-centric animal-based protein supplements market. Moreover, soy protein is gaining momentum as a high-quality substitution for poultry, livestock, and aquaculture. These proteins improve immunity, help prevent cardiovascular diseases, and promote bone health.

Furthermore, the sports culture and fitness nutrition sub-segment dominates the market. There is a growing demand for fortified ingredients and products with high stability and longer shelf life. Most target consumers are upgrading their fitness regime with a high intake of protein supplements and keeping track of their health with cutting-edge gadgets.

Plant-based proteins use spirulina, pea, and pumpkin seeds as supplements in the form of shakes, smoothies, and energy drinks. They have displayed considerable improvement in terms of market demand as they are significant vegetarian protein sources. For instance, pea protein is fat, gluten, and cholesterol-free, which attracts a large customer base. In addition, manufacturers of wheat and hemp are attempting to improve in reducing the distinctive starchy aroma.

Source Insights

The animal-based protein supplements segment dominated the market with a share of 55.0% in 2023. Proteins, such as whey, casein, egg, and fish, are the key sources as animals have greater protein concentration than plants or other sources. Athletes/bodybuilders are the key demographic in the animal-based protein segment, as these supplements are highly effective in building muscles and weight & muscle management. Consumers can easily avail these supplements, including dry-mix beverages and protein shakes, from online stores or supermarkets that offer vast options. Hence, the market will likely exhibit significant growth in the coming years.

The plant-based protein segment is expected to witness the fastest CAGR of 9.0% over the forecast period. As the market witnesses a major transition in consumer awareness about cruelty-free products, the vegan diet has been gaining popularity. Soy, spirulina, pea, pumpkin seed, hemp, and wheat are some of the most used plant-based protein sources. Protein sourced from rice in the form of powders is further growing as its rich amino acid properties help reduce body fats and blood pressure.

Product Insights

The protein powder segment held a share of over 50.0% in 2023. Since consumers are becoming more health-conscious, there is a high demand for protein powders in regular diets to help gain muscle mass, manage weight, and improve overall wellness. Whey is found to be the most effective protein powder for healing the tissues post-workout. Protein powder comes in various forms including dairy and plant-based powders which make them both versatile and flexible. It can be mixed with water or milk beverages or used as an ingredient in various food products to suit preferred tastes. Major companies offer protein powders in assorted flavors, ingredients, and packaging to attract more consumers.

Several protein supplement companies invest in R&D to introduce innovative products that can meet consumers’ tailored preferences. Consumers who are sensitive to traditional animal-based protein powders or have dietary restrictions often prefer plant-based protein powders that are gluten- and lactose-free. According to a Harvard T.H. Chan School of Public Health report, women who include plant protein in their diets have more chances of healthy aging. High competition in the market is expected to result in a considerable reduction in products’ cost, making them affordable and accessible.

The ready-to-drink (RTD) segment is expected to grow at a CAGR of 9.1% from 2024 to 2030. These easily consumable beverages are more portable and convenient for consumers who lead fast-paced lives. Recently, MusclePharm, a global leader in sports nutrition products, expanded in the RTD category with whey protein drinks in different flavors that offer more than 20g of protein per serving

Application Insights

The sports nutrition segment held a revenue share of 64.0% in 2023. Nutritional supplements for sports and activity are ideal for fitness enthusiasts, bodybuilders, and athletes. Manufacturers are introducing several products such as RTD protein shakes, low pH, nutritional beverages, or dry mix beverages in the sports nutrition segment. These supplements ensure building endurance and core strength. Additionally, gym-goers prefer these protein supplements as they aid in developing lean muscles, improving performance, managing weight, and boosting stamina.

The functional food segment is expected to grow at a CAGR of 8.0% over the forecast period. Consumers primarily opt for functional food to ensure the intake of nutritional constituents. With the prevalence of increased cardiovascular diseases caused by slow and inactive lifestyles and unhealthy dietary patterns in the age group of 30-40, consumers have become aware of the importance of omega-3-based products. Consumers have exhibited a considerable inclination toward an active lifestyle and balancing a nutrient-rich diet with exercise. This, in turn, supports segment growth.

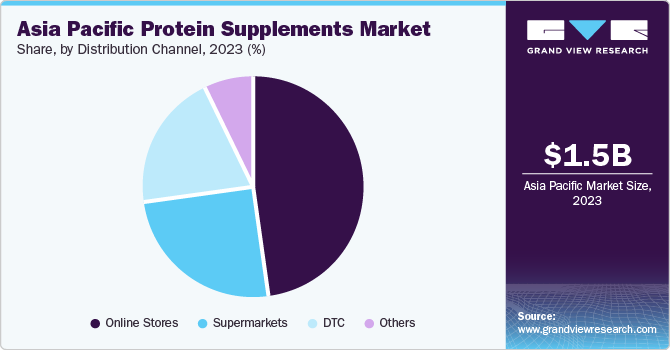

Distribution Channel Insights

The online store segment held a share of 47.0% in 2023. Since most consumers have easy access to the Internet, the sales of online distribution channels are rapidly growing. Online stores offer easy access to different brands depending on individual preferences and affordability, balancing today’s agile lifestyle. Hence, consumers find it more convenient to shop online. Online platforms also provide discounted products, seasonal offers, and an easy check-out process, which further helps in brand promotion and increased sales.

The supermarket segment is expected to grow at a CAGR of 8.6% over the forecast period. These markets perform in-depth consumer analysis, they offer products that consumers prefer the most, build brand credibility and even keep premium price points as target consumers are willing to pay for their products. Supermarkets offer a huge variety of options so that consumers can compare the pros & cons and quality of each product, before making a purchase.

Country Insights

China Protein Supplements Market Trends

The China protein supplements market accounted for a dominant share of 20.0% in 2023. Whey protein is the most widely consumed protein in the Chinese market. As whey protein offers antimicrobial, prebiotic, and hypertensive properties, it is most used in sports nutrition. These proteins exhibit excellent digestibility in all grades. The plant-based protein segment has also highlighted a major share where soy and hemp have spiked considerably while substituting as more convenient alternatives to traditional diets.

India Protein Supplements Market Trends

The protein supplements market in India is expected to grow substantially with a CAGR of 8.8% during the forecast period. Even though animal-based proteins stand dominant in the Indian market, the plant-based supplement segment is anticipated to grow substantially over the forecast period. Furthermore, Indian consumers are becoming conscious of the health benefits of outdoor sports, making sports nutrition a dominant segment.

Key Asia Pacific Protein Supplements Company Insights

The Asia Pacific protein supplements market is fragmented and is witnessing an intense competitive landscape. Most manufacturers are using food tech and innovating culinary options to meet tailored consumer preferences.

Key Asia Pacific Protein Supplements Companies:

- Glanbia Nutritionals

- Abbott

- Quest Nutrition LLC

- Dymatize Enterprises LLC

- BRF Global

- Rousselot

- Gelita AG

- Hoogwegt

Asia Pacific Protein Supplements Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 53.6 billion

Growth rate

CAGR of 8.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Source, product, application, distribution channels, and country

Regional scope

Asia Pacific

Country scope

Japan; China; India; Australia

Key companies profiled

Glanbia Nutritionals; Abbott; Quest Nutrition LLC; Dymatize Enterprises LLC; BRF Global; Rousselot; Gelita AG; Hoogwegt

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Protein Supplements Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific protein supplements market report based on source, product, application, distribution channel, and country:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Animal-based Protein Supplements

-

Whey

-

Casein

-

Egg

-

Fish

-

Others

-

-

Plant-based Protein Supplements

-

Soy

-

Spirulina

-

Pumpkin Seeds

-

Wheat

-

Hemp

-

Rice

-

Pea

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Protein Powders

-

Protein Bars

-

RTD

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Nutrition

-

Functional Foods

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets

-

Online

-

DTC

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Japan

-

China

-

India

-

Australia

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.