- Home

- »

- Medical Devices

- »

-

Asia Pacific Preclinical CRO Market, Industry Report, 2030GVR Report cover

![Asia Pacific Preclinical CRO Market Size, Share & Trends Report]()

Asia Pacific Preclinical CRO Market Size, Share & Trends Analysis Report By Model Type, By Service (Toxicology Testing, Bioanalysis & DMPK Studies), By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-308-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Asia Pacific Preclinical CRO Market Trends

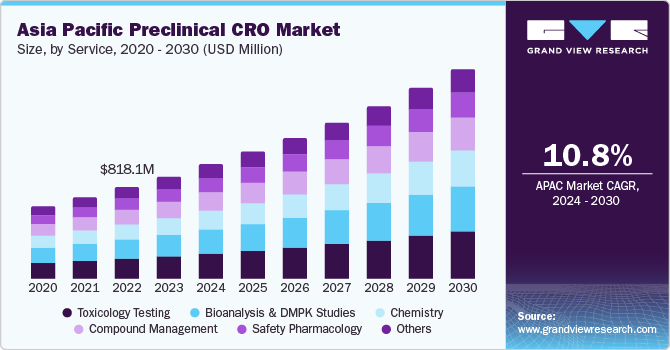

The Asia Pacific preclinical CRO market size was estimated at USD 912.7 million in 2023 and is anticipated to grow at a CAGR of 10.8% from 2024 to 2030. This growth is attributed to the cost efficiency offered by the region owing to the presence of CROs in countries such as India and China. In addition, significant R&D spending by pharmaceutical companies to boost drug development also contributes to the growth of the market. The advanced healthcare infrastructure, partnerships, investments, and development of market players further drive market growth in countries such as India, China, and Singapore.

In 2023, the Asia Pacific region accounted for approximately 16.0% revenue share of the global preclinical CRO market. Strict regulations and pricing policies, as well as substantial financial budget tightening for biomedical research, have led to increased interest in outsourcing clinical trials.

The region's pharmaceutical market is growing faster than the rest of the world owing to the presence of a skilled population, making it a preferred destination for outsourcing clinical trials. In addition, the growing incidence of chronic illnesses such as cancer, heart disease, and neurological conditions encourages biopharmaceutical companies to invest in developing newer drugs with fewer side effects, further driving demand for preclinical CRO services. Furthermore, the increased patient access through recruiting centers also contributes to the growth of the market.

Service Insights

The toxicology testing segment dominated the market in 2023, with the largest market share of 22.6%. This growth is attributed to the increasing demand for preclinical services, mainly in countries such as India and China, where CROs offer cost-efficient services. Furthermore, the region's developing pharmaceutical industry and the increasing occurrence of chronic diseases, such as cancer and heart disease, are also contributing to the segment’s growth.

The bioanalysis and DMPK studies held a substantial market share in 2023 owing to the growing prevalence of chronic diseases, the existence of low-cost CROs, and the increasing investments by governments in research and development activities. Furthermore, the region's biopharmaceutical industry is quickly increasing, leading to a surge in demand for preclinical research services.

Model Type Insights

The Patient Derived Organoid (PDOs) models held the largest revenue share of 80.6% in 2023. This growth is attributed to the increasing emphasis on precision medicine and the need for more representative and personalized disease models. PDO models, derived from patient tissues, can replicate the complexity and heterogeneity of human organs, making them valuable tools for reviewing disease mechanisms, screening drug candidates, and personalizing treatment approaches. In addition, the increasing prevalence of chronic diseases and the growing biopharmaceutical industry in the region are also contributing to the segment growth.

Patient Derived Xenograft (PDX) models are expected to witness a substantial growth owing to the region's budding biopharmaceutical industry and the trend of outsourcing drug discovery services to CROs also contributing to the demand for advanced preclinical research models like PDX. In addition, the rising mindfulness of precision medicine in Asia Pacific is driving the adoption of PDX models for cancer treatment approaches.

End-use Insights

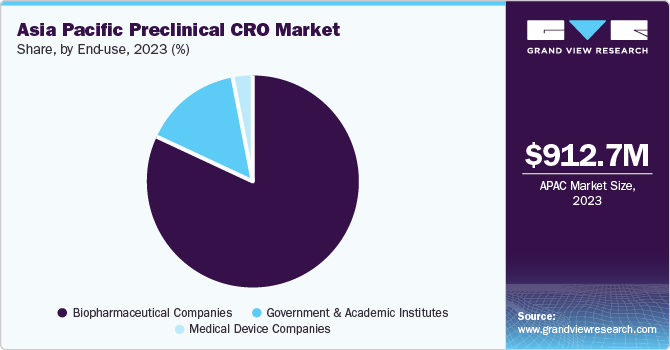

The biopharmaceutical companies segment held the largest revenue share of 81.8% in 2023. This growth is due to the increasing focus on cost-effective and time-efficient drug development. Furthermore, the growing occurrence of chronic diseases and the rise in R&D spending by key pharmaceutical, biotechnology, and medtech businesses in the region are also contributing to the segment’s growth.

Government and academic institutes registered a significant revenue share in 2023 owing to the rising trend of outsourcing preclinical services to CROs by government bodies and academic organizations. Furthermore, the growing investments by governments in research and development activities, particularly in countries such as India and China, are boosting the demand for preclinical CRO services.

Country Insights

China Preclinical CRO Market Trends

The preclinical CRO market in China held the largest market share of 32.1% in the Asia Pacific region in 2023. This growth is attributed to the country's skilled professionals, cost efficiency, and growing pharmaceutical industry. In addition, rising investments, low operational costs, implementation of R&D standards, and strong demand for preclinical CRO services are contributing to the market's growth.

Japan Preclinical CRO Market Trends

The Japan preclinical CRO market is expected to witness significant growth in the coming years owing to the growing pharmaceutical industry, increasing number of preclinical trials, and support from the government.

Key Asia Pacific Preclinical CRO Company Insights

Key players in the market include WuXi AppTec, Pharmaron, and Radyus Research, and Dt&CRO.

-

WuXi AppTec is a global pharmaceutical, biopharmaceutical, and medical device company that offers a broad portfolio of R&D and manufacturing services. The company allows businesses in the pharmaceutical and life sciences industries to advance discoveries and deliver ground-breaking treatments to patients.

-

Pharmaron offers a broad spectrum of R&D and manufacturing service capabilities, including small molecules, biologics, and cell and gene therapy products. The company manufactures and deals in numerous products, including research chemicals, biologics, and medical devices, providing inclusive solutions for the entire drug discovery and development procedure.

Veeda Clinical Research Limited and Stelis Biopharma Ltd. are other participants in the Asia Pacific preclinical CRO industry.

-

Stelis Biopharma Limited provides a comprehensive variety of services, including process development, clinical and commercial manufacturing, and regulatory assistance. Stelis manufactures several biologics and pharmaceutical products, counting small molecules, biologics, and medical devices, supporting the entire product lifecycle from research to commercialization.

Key Asia Pacific Preclinical CRO Companies:

- WuXi AppTec

- Pharmaron

- Radyus Research and Dt&CRO

- Novotech

- Syngene International Limited

- Veeda Clinical Research Limited

- Selis Biopharma Ltd.

- Aragen Life Sciences Ltd.

Recent Developments

-

In December 2023, Syngene International acquired biologics manufacturing facility from Stelis Biopharma Ltd, increasing its capacity to produce biologics drug substances by 20,000 liters. The facility includes a commercial-scale fill-finish unit, crucial for the production of drug products.

-

In May 2023, Aragen Life Sciences Ltd partnered with Far Biotech to advance preclinical research in neurodegeneration. Aragen is expected to leverage its experimental discovery platform to support Far Biotech in attaining an important milestone with its small molecule program in neurodegeneration.

Asia Pacific Preclinical CRO Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.87 billion

Growth rate

CAGR of 10.8% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Service, model type, end-use, country

Regional Coverage

Asia Pacific

Country Coverage

China; Japan; India; South Korea; Australia.

Key companies profiled

WuXi AppTec; Pharmaron; Radyus Research and Dt&CRO; Novotech; Syngene International Limited; Veeda Clinical Research Limited; Stelis Biopharma Ltd.; Aragen Life Sciences Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Preclinical CRO Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific preclinical CRO market report based on service, model type, end-use, and country.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Toxicology Testing

-

Bioanalysis and DMPK studies

-

Chemistry

-

Compound Management

-

Safety Pharmacology

-

Others

-

-

Model Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Patient Derived Organoid (PDOs) Models

-

Patient Derived Xenograft (PDX) Models

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biopharmaceutical Companies

-

Government and Academic Institutes

-

Medical Device Companies

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."