- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Precast Concrete Market, Industry Report, 2030GVR Report cover

![Asia Pacific Precast Concrete Market Size, Share & Trends Report]()

Asia Pacific Precast Concrete Market Size, Share & Trends Analysis Report By Product (Structural Building Components, Transportation Products), By Application (Residential, Commercial, Infrastructure), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-307-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Asia Pacific Precast Concrete Market Trends

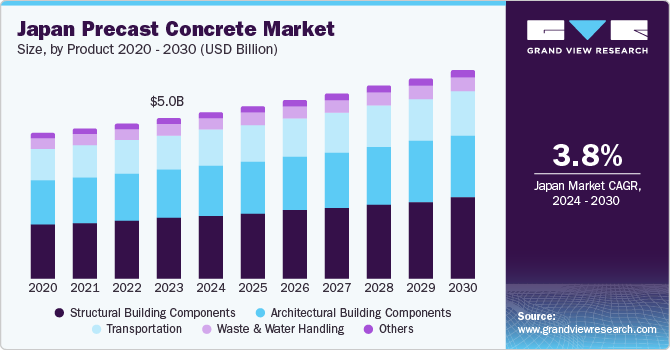

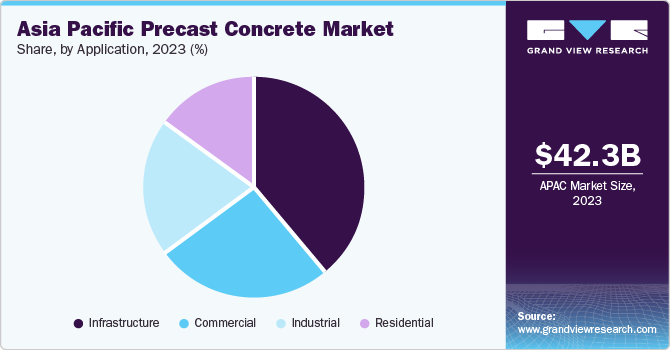

The Asia Pacific precast concrete market size reached a value of USD 42.3 billion in 2023 and is estimated to grow at a CAGR of 6.7% from 2024 to 2030. This growth is driven by several factors including the rapid urbanization and industrialization that are driving the demand for improved housing and business environments. Additionally, rising investments in infrastructure modernization are fueling a surge in renovation and refurbishment activities, further contributing to market expansion. Public sector investment in infrastructure development across emerging economies is also driving growth in this market.

Asia Pacific accounted for a 40.0% revenue share of the global precast concrete market in 2023. The regulatory landscape significantly impacts various aspects of the APAC precast concrete market. China's mandatory GB 11541-2014 code ensures a baseline quality and safety for precast components, while India's BIS 15666-2009 specifically regulates precast concrete pipes used in crucial infrastructure projects. Additionally, Japan's Building Standard Law, demanding earthquake-resistant construction, has driven innovation in the Japanese precast market toward elements that can withstand seismic activity.

Product Insights

The structural building components held the largest revenue share of 36.4% in 2023. The growth of this segment is primarily driven by the rapid infrastructural development and increasing governmental investments in mega projects. The construction industry in the region is witnessing rapid technological and architectural innovation, leading to an increased demand for these components. Moreover, the rising demand for consumer-oriented buildings and the significant engineering competencies and manufacturing capacity in countries like China are also contributing to the growth of this segment.

The architectural building components segment is projected to witness the second-fastest CAGR of 6.9% from 2024 to 2030. This is facilitated by the increasing applications of precast concrete in flexible architectural design and renovations of old buildings. Additionally, the emphasis on green building projects and the rising interest in new construction materials, such as precast concrete, are expected to drive the demand for architectural building components. The growth of this segment is also supported by the expansion of the construction industry.

Application Insights

The infrastructure segment dominated the market with a 38.4% revenue share in 2023. The growth of this segment is primarily driven by the rapid infrastructural development and increasing governmental investments in mega projects. The low life-cycle cost associated with precast concrete, due to its durability and minimal maintenance requirements, positions it favorably within the infrastructure sector. Rising urbanization and population growth in key Asian markets like India, China, and Japan are driving significant expansion of the infrastructure sector in these regions.

On the other hand, the industrial segment is projected to witness the second-fastest growth in terms of revenue with a predicted CAGR of 6.8% from 2024 to 2030. This segment includes applications in manufacturing plants, warehouses, and other industrial facilities. The growth in this segment is facilitated by the expansion of the industrial sector in countries like Japan, where tax breaks and government subsidies granted to businesses are projected to fuel the expansion of the industrial sector.

Country Insights

China Precast Concrete Market Trends

The China precast concrete market held the largest revenue share of 43.0% in the APAC region in 2023. This dominance can be attributed to the significant engineering competencies and tremendous manufacturing capacity in the country. The rising demand for consumer-oriented buildings is expected to play an essential role in aiding the economy of China. Over the upcoming decade, the local government aims to invest in the export of the building as well as construction services to other markets. China’s sector for structural building components is also set to witness a rapid growth rate, thus consequently propelling the demand for precast concrete in the country.

Singapore Precast Concrete Market Trends

The precast concrete market in Singapore is projected to witness the fastest growth in revenue at a predicted CAGR of 9.2% from 2024 to 2030. Singapore's construction sector leverages precast components extensively to achieve enhanced efficiency and quality in building projects. To further promote precast adoption, the government has spearheaded the development of highly automated factories specifically for precast concrete element production. This initiative embodies a strategic shift away from traditional, labor-intensive construction methods and towards maximizing prefabrication. This shift towards precast concrete is expected to drive the market growth in Singapore. This industry-wide move towards precast concrete is anticipated to be a key driver of growth in the Singaporean construction market.

Key Asia Pacific Precast Concrete Company Insights

Some of the key players operating in the APAC precast concrete market include CRH Plc, Holcim, Heidelberg, and Boral:

-

CRH Plc is a key player in the Asia Pacific precast concrete market. With an annual cement production capacity of 25 million tonnes in China and 7.5 million tonnes in the Philippines, CRH Plc is a major supplier to infrastructure projects, contributing to the growth and development of cities in the region.

-

Heidelberg Materials AG holds strong market positions in aggregates and ready-mixed concrete in several countries in Asia Pacific, including Australia, Malaysia, Hong Kong, Indonesia, and Thailand. The company has recently strengthened its presence in Indonesia, further expanding its influence in the Asia Pacific market for precast concrete.

Key Asia Pacific Precast Concrete Companies:

- CRH Plc

- Holcim Ltd

- Heidelberg Materials AG

- Boral

- Forterra

- Cemex SAB de CV

- Balfour Beatty Plc

- Consolis Group SAS

- Abetong AB

- Laing O’Rourke Plc

Recent Developments

-

In July 2023, Hong Leong Asia and SunCon inaugurated the HL-Sunway Prefab Hub, marking the biggest integrated construction and prefabrication hub (ICPH) in Singapore. This strategic investment strengthens Singapore's precast production capacity and enhances the resilience of the construction sector's supply chain, particularly for residential developments.

-

In October 2023, Peikko Group Corporation expanded its manufacturing footprint with a new facility in Johor Bahru, Malaysia. This strategic location positions Peikko to efficiently serve the growing demand within the construction industries of Malaysia, Singapore, Australia, and broader Southeast Asia.

-

In June 2023, the Ministry of Road Transport and Highways (MoRTH) of India issued an office memorandum promoting the use of precast concrete elements manufactured in controlled environments for national highway projects. The memorandum emphasizes the long-term benefits for all stakeholders involved in such projects.

Asia Pacific Precast Concrete Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 66.7 billion

Growth rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, country

Key companies profiled

CRH Plc; Holcim Ltd; Heidelberg Materials AG; Boral; Forterra; Cemex SAB de CV; Balfour Beatty Plc; Consolis Group SAS; Abetong AB; Laing O’Rourke Plc

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Precast Concrete Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific precast concrete market report based on product, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Structural Building Components

-

Architectural Building Components

-

Transportation

-

Waste & Water Handling

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Infrastructure

-

Tunnels

-

Bridges

-

Wind Towers

-

-

Industrial

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Japan

-

China

-

India

-

South Korea

-

Singapore

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."