- Home

- »

- Clinical Diagnostics

- »

-

Asia Pacific Point of Care TB And Drug-resistant TB Testing Market, 2030GVR Report cover

![Asia Pacific Point of Care TB And Drug-Resistant TB Testing Market Size, Share & Trends Report]()

Asia Pacific Point of Care TB And Drug-Resistant TB Testing Market Size, Share & Trends Analysis Report By Test (Molecular Diagnostics, Immunoassays), By End-use (Clinics and Hospitals, Diagnostic Laboratories), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-455-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

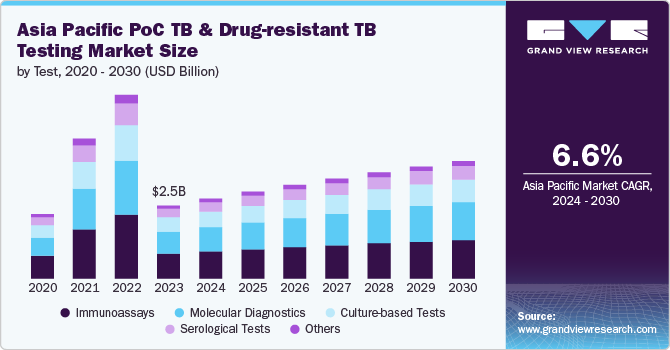

The Asia Pacific point of care TB and drug-resistant TB testing market size was estimated at USD 2.53 billion in 2023 and is anticipated to grow at a CAGR of 6.6% from 2024 to 2030. This growth is driven by the region's high TB burden, technological advancements in diagnostics, supportive regulatory frameworks, and enhanced government and international efforts. The WHO highlights the significant burden of TB in the Asia Pacific region, particularly within the South-East Asia (SEA) region which is home to about 25.0% of the global population and bears over 45.0% of the world's TB cases. In 2022, the region recorded over 4.8 million new TB cases and 600,000 deaths, accounting for more than half of global TB mortality. The increased focus on improving diagnostic capabilities and effective disease management in response to this high incidence and mortality is fueling the market's expansion.

The Asia Pacific region is heavily impacted by tuberculosis (TB), with countries such as India, China, Indonesia, and the Philippines among the leading contributors to the global TB burden. The World Health Organization (WHO) highlights that approximately 87.0% of new TB cases arise in 30 high-burden countries, including Bangladesh, China, the Democratic Republic of the Congo, India, Indonesia, Nigeria, Pakistan, and the Philippines. The region’s high TB prevalence drives a significant demand for efficient diagnostic tools. Moreover, the challenge is compounded by drug-resistant TB, including Multi-Drug Resistant (MDR-TB) and Extensively Drug-Resistant (XDR-TB) strains, which complicate treatment and extend the disease burden. In 2022, the WHO reported around 450,000 new MDR-TB cases globally, with a considerable proportion in Asia Pacific. This widespread prevalence of drug-resistant TB underscores the urgent need for rapid and accurate diagnostic solutions to facilitate timely and effective treatment.

Growing awareness of tuberculosis (TB) and drug-resistant TB is a crucial driver of market growth for PoC diagnostic solutions. Awareness campaigns and educational initiatives by governmental and non-governmental organizations (NGOs) are essential to promoting the importance of diagnostic testing and improving early detection. For instance, China’s Healthy China Initiative 2019-2030, launched by the State Council in July 2019, includes the Tuberculosis Control Action among its 15 unique campaigns to enhance TB prevention and control. Public health efforts emphasize timely diagnosis and adherence to treatment, thereby increasing demand for PoC diagnostic tools. As awareness improves, screening rates rise, and advanced diagnostic technologies are adopted, further accelerating market growth. Enhanced public and professional awareness not only supports higher diagnostic testing uptake but also drives the implementation of innovative testing solutions.

Government initiatives and international collaborations also play a crucial role in market expansion. Governments in high-burden countries have prioritized TB control as part of their public health strategies, leading to increased funding and support for diagnostic innovations. For instance, India’s National Strategic Plan for Tuberculosis Elimination 2017-2025 outlines ambitious goals for TB eradication, including expanding diagnostic and treatment services. Similarly, the Global Fund and the United Nations High-Level Meeting on TB have mobilized significant resources and advocacy to combat TB and its drug-resistant forms, influencing the market dynamics.

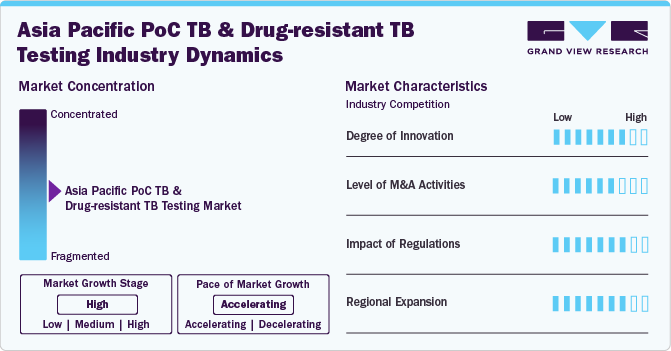

Market Concentration & Characteristics

The Asia Pacific PoC TB and drug-resistant TB testing market is experiencing significant innovation, driven by the need for more accurate, rapid, and accessible diagnostic solutions. In August 2022, BD India launched the BD MAX molecular diagnostic system and the BD MAX MDR-TB panel, enabling clinicians to quickly test for TB and multidrug resistance as a first-line diagnostic tool. Additionally, integrating digital health technologies, including mobile health apps and telemedicine platforms, enhances diagnostic workflows and patient management. Adopting next-generation sequencing technologies and rapid antigen tests further signifies significant strides in the field, offering more precise and efficient diagnostic capabilities. These innovations collectively drive the region's growth and effectiveness of TB and drug-resistant TB testing.

Mergers and acquisitions (M&A) in the market reflect the sector's dynamic growth and consolidation. Major diagnostics companies are acquiring innovative startups and technology firms to enhance their product portfolios and market reach. The drive for M&A is fueled by the need to address the region's high TB prevalence and drug-resistant strains, with significant investments to improve testing accuracy and expand market presence.

Regulations significantly impact the market by ensuring diagnostic products' quality, safety, and efficacy. Regulatory bodies such as the WHO, the U.S. FDA, and national authorities like the Indian Central Drugs Standard Control Organization (CDSCO) and China's National Medical Products Administration (NMPA) set stringent guidelines for TB diagnostics.

The regional expansion of the market is driven by the rising prevalence of TB and drug-resistant strains, alongside robust government and international support. Countries such as India, China, Indonesia, and the Philippines are actively enhancing their diagnostic infrastructure to improve TB detection and management. Key government initiatives include India's National Strategic Plan for Tuberculosis Elimination 2017-2025 and China's comprehensive TB prevention and control efforts, both aimed at bolstering diagnostic capabilities. Additionally, international organizations like the Global Fund and WHO are instrumental in providing financial support and technical assistance. For instance, Roche Ltd partnered with the Global Fund in May 2022 to strengthen diagnostic infrastructure in low and middle-income countries. These combined efforts from national and international stakeholders are crucial in expanding and advancing TB diagnostic capabilities across the region.

Test Insights

The immunoassays segment dominated the market with a substantial share of 34.6% in 2023. This prominence can be attributed to the technology's established efficacy, ease of use, and adaptability in diverse settings. Immunoassays, which include enzyme-linked immunosorbent assays (ELISA) and lateral flow tests, offer significant advantages in TB diagnostics. These tests are valued for their high sensitivity and specificity in detecting TB biomarkers and antibodies. For instance, the QuantiFERON-TB Gold test, a widely used immunoassay, provides reliable results for latent TB infection by measuring immune responses to specific TB proteins. This accuracy is critical in areas with high TB prevalence, such as India and Indonesia, where early and reliable detection is crucial for effective disease management.

The culture-based tests segment is expected to grow at the fastest CAGR of 6.6% during the forecast period. This anticipated growth is driven by several crucial factors, including the increasing demand for definitive diagnostic confirmation, advancements in culture technology, and enhanced understanding of drug resistance. Culture-based tests, such as the Löwenstein-Jensen culture and liquid culture systems, are considered the gold standard for diagnosing tuberculosis due to their high sensitivity and ability to identify drug resistance accurately. Unlike molecular and immunoassay tests, culture-based methods confirm the presence of Mycobacterium tuberculosis and provide critical information on drug susceptibility, which is essential for managing drug-resistant TB.

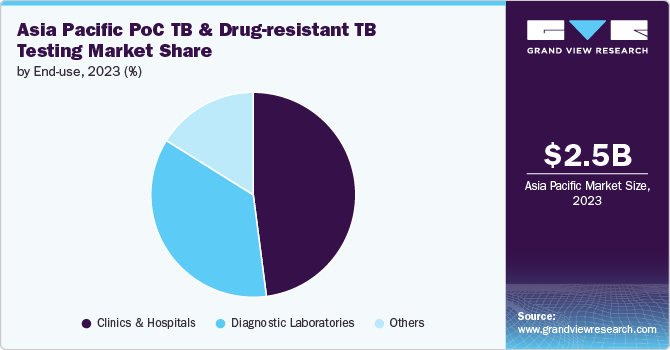

End Use Insights

The clinics and hospitals segment dominated the market with the largest revenue share of 48.0% in 2023. This prominence is primarily driven by these healthcare settings' critical role in comprehensive patient management, advancements in diagnostic technologies, and the escalating need for effective TB and drug-resistant TB diagnostics. Clinics and hospitals are pivotal in TB diagnosis and treatment because they can provide a wide array of diagnostic tests and treatment modalities. These facilities are equipped to perform complex diagnostic procedures, such as molecular tests and culture-based assays, essential for accurate TB detection and drug resistance profiling. The high prevalence of TB in the Asia Pacific region, with countries like India, China, and Indonesia reporting significant caseloads, necessitates sophisticated diagnostic capabilities available in these settings.

Diagnostic laboratories are expected to grow at the fastest CAGR of 7.5% during the forecast period. The growing complexity of TB cases, including multi-drug-resistant (MDR-TB) and extensively drug-resistant (XDR-TB) strains, necessitates more specialized testing capabilities. Diagnostic laboratories are equipped to handle these complex cases by offering comprehensive drug susceptibility testing and detailed microbiological analyses, which are critical for effective treatment planning. The expansion of laboratory networks and the implementation of quality assurance programs have enhanced the capabilities of diagnostic laboratories, making them essential players in TB control. Investments in laboratory infrastructure and technology and government and international support further contribute to the sector's rapid growth.

Country Insights

India Point of Care TB And Drug-resistant TB Testing Market Trends

The PoC TB and drug-resistant TB testing market in India is profoundly shaped by the country’s high TB burden, with 2.4 million cases reported in 2022, according to the Ministry of Health and Welfare. India faces significant challenges with TB, including multidrug-resistant (MDR-TB) and Extensively Drug-Resistant (XDR-TB) strains. To combat this, the government has launched several initiatives. The Pradhan Mantri TB Mukt Bharat Abhiyan has gathered widespread participation, with over 100,000 Ni-kshay Mitras adopting more than 1.1 million TB patients. The Ni-kshay Poshan Yojana has disbursed approximately USD 311 million to over 9.5 million TB patients since 2018. New initiatives like the Family Care Giver Model and Differentiated Care aim to enhance treatment success rates and reduce mortality.

Furthermore, market growth is bolstered by strategic collaborations and new product launches. For instance, in October 2023, Serum Institute of India Pvt. Ltd. and Mylab Discovery Solutions Pvt. Ltd. introduced a cost-effective PoC skin test for Latent Tuberculosis Infection (LTBI), priced 50% to 70% lower than existing tests. These combined efforts will drive significant market growth in the coming years.

China Point of Care TB and Drug-resistant TB Testing Market Trends

China PoC TB and drug- resistant TB testing market is experiencing growth due to the country’s substantial TB burden and ongoing public health efforts. China is among the top countries with the highest TB incidence rates, contributing significantly to the global TB caseload. According to WHO, in 2022, eight countries accounted for more than two-thirds of global TB cases. China accounted for 7.1% of the cases. In response, the Chinese government has prioritized TB control in its national health strategies, including implementing advanced diagnostic technologies. Regulatory bodies in China, such as the National Medical Products Administration (NMPA), are facilitating the introduction of new diagnostic technologies by streamlining approval processes. These initiatives and increasing healthcare investments are driving the growth of the PoC TB and drug-resistant TB testing market in China.

Japan Point of Care TB and Drug-resistant TB Testing Market Trends

The PoC TB and Drug-Resistant TB Testing market in Japan is expanding due to the country’s advanced healthcare system and proactive approach to TB management. Japan has implemented a comprehensive TB control program that includes routine screening and cutting-edge diagnostic technologies. The Ministry of Health, Labour, and Welfare supports the integration of new diagnostic tools, such as rapid molecular assays, to enhance TB detection and management. In April 2024, the health ministry announced the establishment of a new expert body by April 2025 as a preparatory step for tackling the infectious disease crisis in the future. Moreover, strategic initiatives by key market players are further fueling market growth. In April 2023, QIAGEN announced the introduction of its QIAstat-Dx syndromic testing solution in Japan. This advanced technology features a SARS-CoV-2 Respiratory Panel capable of detecting over 20 pathogens from a single patient sample, highlighting the country’s commitment to integrating innovative diagnostics into its healthcare framework.

Key Asia Pacific Point of Care TB And Drug-resistant TB testing Company Insights

The market is characterized by the presence of several key players who dominate the landscape with substantial market share. These companies are leading the industry through a broad portfolio.

Key Asia Pacific Point of Care TB And Drug-Resistant TB Testing Companies:

- Cepheid (Danaher Corporation)

- Molbio Diagnostics

- Abbott Laboratories

- BD (Becton, Dickinson and Company)

- Roche Diagnostics

- Qiagen

- Lucira Health

- BioMérieux

- Thermo Fisher Scientific

- Fujifilm (Fujifilm Healthcare)

- MedMira

- SD Biosensor

- Trivitron Healthcare

Recent Developments

-

In July 2023, EMPE Diagnostics launched the mfloDx MDR-TB rapid test kit, a precise, quick, and inexpensive test that provides accurate information on Mycobacterium tuberculosis presence and genotypic resistance. It was approved by the CDSCO and is currently undergoing clinical testing in other nations.

-

In March 2022, Thermo Fisher Scientific Inc. unveiled the SeqStudio Flex Series Genetic Analyzer, a cutting-edge tool designed to advance research and development in infectious disease detection. This innovative genetic analyzer is poised to significantly enhance the company's product portfolio by offering state-of-the-art capabilities for detailed genomic analysis.

-

In February 2022, QIAGEN announced that the fourth generation of its QuantiFERON tuberculosis (TB) testing solution, QuantiFERON-TB Gold Plus (QFT-Plus), received approval from China's National Medical Products Administration (NMPA). This approval made QFT-Plus the latest generation of the gold standard test for TB detection in China.

Asia Pacific Point of Care TB And Drug-Resistant TB Testing Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.7 billion

Revenue forecast in 2030

USD 4.0 billion

Growth rate

CAGR of 6.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test, end use, region

Regional scope

Asia Pacific

Country scope

Japan; China; India; Australia; Southeast Asia; Rest of APAC

Key companies profiled

Cepheid (Danaher Corporation); Molbio Diagnostics; Abbott Laboratories; BD (Becton, Dickinson and Company); Roche Diagnostics; Qiagen; Lucira Health; BioMérieux; Thermo Fisher Scientific; Fujifilm (Fujifilm Healthcare); MedMira; SD Biosensor; Trivitron Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Point of Care TB And Drug-resistant TB Testing Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific point of care TB and drug-resistant TB testing market report based on the test, end use, and region:

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Molecular Diagnostics

-

Immunoassays

-

Culture-based Tests

-

Serological Tests

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinics & Hospitals

-

Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Southeast Asia

-

Rest of APAC

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific point of care TB and drug-resistant TB testing market was valued at USD 2.53 billion in 2023 and is anticipated to reach USD 2.7 billion in 2024.

b. The Asia Pacific point of care TB and drug-resistant TB testing market is anticipated to grow at a compound annual growth rate (CAGR) of 6.6% from 2024 to 2030 to reach USD 4.0 billion by 2030.

b. In 2023, the immunoassays segment dominated the market with a substantial share of 34.6%. This prominence can be attributed to the technology's established efficacy, ease of use, and adaptability in diverse settings.

b. Some of the key players operating in this market include Cepheid (Danaher Corporation); Molbio Diagnostics; Abbott Laboratories; BD (Becton, Dickinson and Company); Roche Diagnostics; Qiagen; Lucira Health; BioMérieux; Thermo Fisher Scientific; Fujifilm (Fujifilm Healthcare); MedMira; SD Biosensor; Trivitron Healthcare.

What are the factors driving the Asia Pacific point of care TB and drug-resistant TB testing market?b. This market's growth is driven by the region's high TB burden, technological advancements in diagnostics, supportive regulatory frameworks, and enhanced government and international efforts.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."