- Home

- »

- Clinical Diagnostics

- »

-

Asia Pacific Point Of Care Diagnostics Market, Report, 2030GVR Report cover

![Asia Pacific Point Of Care Diagnostics Market Size, Share & Trends Report]()

Asia Pacific Point Of Care Diagnostics Market Size, Share & Trends Analysis Report By Product (Infectious Diseases, Glucose Testing), By End Use (Clinics, Home), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-102-3

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

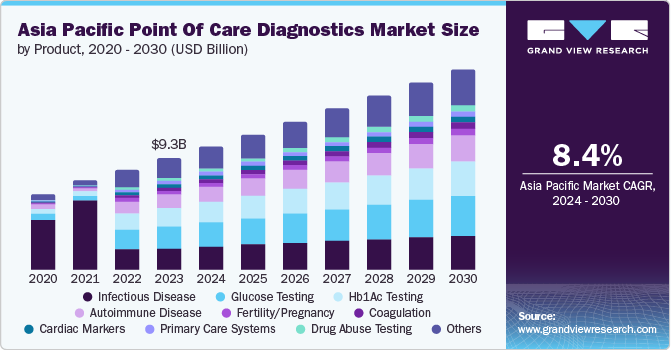

The Asia Pacific point of care diagnostics market size was valued at USD 9.31 billion in 2023 and is projected to grow at a CAGR of 8.4% from 2024 to 2030. Asia Pacific witnessed significant growth in the point of care diagnostics market due to the rising healthcare expenditure, increased awareness about early disease detection, and the need for rapid and accurate diagnostic results. The PoC diagnostics have emerged as a valuable tool for prompt detection and monitoring of these conditions, thereby enhancing the disease management outcomes.

Across the region, various countries are making significant investments in enhancing their healthcare infrastructure, particularly in remote and rural areas. The Point of care diagnostics play a pivotal role in extending healthcare access to underserved population by facilitating rapid and decentralized testing.

The market is driven by major factors such as the growing geriatric population base in countries such as Japan and China, the rising prevalence of target diseases, increasing demand for home healthcare, and introducing new products with technological advantages. Additionally, the growing prevalence of target diseases such as cancer, diabetes, cardiovascular diseases, and infectious diseases is expected to drive market growth over the forecast period.

Cardiovascular diseases are one of the most fatal disorders and are the leading cause of death across the globe. The high presence of unmet medical needs about this disease and the subsequent rise observed in patient awareness in Asia Pacific is expected to boost the demand for point of care (PoC) diagnostics. Moreover, the prevalence of diabetes in the region is also on a constant rise, thus generating a wide patient base for the point of care glucose testing market.

Technological developments have resulted in innovative POC diagnostics solutions and services to increase efficiency. For instance, portable ultrasonography is mostly termed as a simple test, additionally, pulse oximetry test is a quick, simple, and affordable option among the various tests. The major objective of point of care testing is collecting the specimen and concluding the results before the end of patient treatment. The point of care testing is often done through portable instruments such as nerve conduction devices, blood glucose meters, and test kits including HIV salivary assay, Homocysteine, Hb1Ac, and CRP.

Product Insights

Glucose testing dominated the market accounting for around 20% of the revenue share in 2023 owing to the high prevalence of diabetes in Asian countries. Other factors such as rapid urbanization, changing lifestyles, and dietary habits have led to the increasing number of diabetic cases across the region. This has created a great demand for clean-to-use, and accurate glucose-tracking gadgets.

The cancer markers segment is expected to grow at the fastest CAGR of 10.2% over the forecast period. Asia Pacific has experienced a notable rise in the prevalence of cancer in recent years. This upward trend can be attributed to demographic shifts, including aging populations, lifestyle changes, and environmental conditions. Consequently, these factors are expected to boost the demand for cancer markets in the region over the forecast period. In addition, governments in Asia Pacific are emphasizing on cancer control and prevention. They are actively implementing awareness campaigns and screening programs to promote the early detection of cancer. Point of care diagnostics for cancer markers are acknowledged as valuable assets, thus generating an increased demand for these tests.

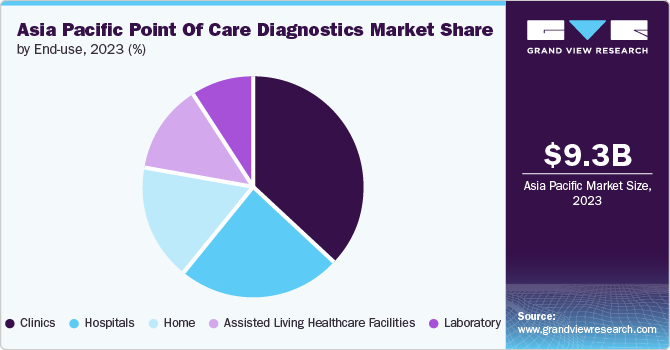

End Use Insights

The clinics segment held the largest revenue share in 2023. Clinics are essential in providing healthcare services, particularly in remote and underserved areas. Point of care diagnostics allows clinics to provide immediate testing and diagnosis without any need for laboratory samples.

This improves patients' access to timely and efficient healthcare in these areas. Respiratory disorders and sexually transmitted infections are some of the major infections in the population posing significant challenges in the region.

Country Insights

China Point Of Care Diagnostics Market Trends

China dominated the Asia Pacific point of care diagnostics with a market share of 41.5% in 2023. China accounts for the leading population and faces notable challenges related to the high prevalence of chronic and infectious diseases within its borders resulting in an increasing demand for point of care diagnostics. Furthermore, China's aging population has contributed to an elevated incidence of chronic ailments like cardiovascular diseases, diabetes, and cancer. The point of care diagnostics is crucial in effectively managing such conditions by enabling early detection, regular monitoring, and timely intervention.

Japan Point Of Care Diagnostics Market Trends

Japan accounted for a market share of 26.2% in 2023. Japan's advanced healthcare infrastructure, high healthcare expenditure, and aging population have extensively contributed to its robust marketplace. Besides, Japan is globally recognized for its technological innovation and early adoption of new medical technology. The country relies on research and development, leading to superior, user-friendly point of care devices.

India Point Of Care Diagnostics Market Trends

India point of care diagnostics market is expected to grow at the fastest CAGR of 11.2% over the forecast period. The major growth factors include a large population, increasing healthcare needs, and a high prevalence of infectious diseases. Besides, rural healthcare accessibility challenges, government initiatives, and technological advancements have increased the demand for point of care diagnostics in India. As the country continues to focus on improving healthcare infrastructure and addressing healthcare disparities, a huge demand for these diagnostics is expected to rise further.

Key Asia Pacific Point Of Care Diagnostics Company Insights

Some key companies in the Asia Pacific point of care market include:

-

F. Hoffmann-La Roche Ltd. offers a wide range of point of care diagnostic solutions. The company's diagnostics division provides various POC testing systems and devices for rapid, near-patient testing in hospitals, clinics, and other healthcare settings. The products include blood glucose monitoring systems, coagulation monitoring devices, and rapid tests for infectious diseases.

-

Siemens Healthcare GmbH offers a diverse portfolio of POC solutions. The company’s offerings are blood gas analyzers, cardiac markers, and various other diagnostic tests designed for rapid results at the patient's side. The company focuses on addressing specific challenges in different Asian healthcare from urban hospitals to rural local clinics.

Key sia Pacific Point Of Care Diagnostics Companies:

- F. Hoffmann-La Roche Ltd.

- Siemens Healthcare GmbH

- Danaher Corporation

- Becton Dickinson (BD)

- bioMérieux

- Abbott

- Qiagen

- Werfen

- Nova Biomedical

- Trividia Health, Inc.

- SEKISUI MEDICAL CO., LTD.

Recent Developments

-

In February 2024, Qiagen launched Qiagen Biomedical KB-AI, designed to expedite the drug discovery process in the biotech and pharma industries. This innovation is designed for data scientists to extract the most comprehensive knowledge to fuel data-driven drug discovery.

-

In December 2023, F. Hoffmann-La Roche Ltd. acquired Carmot Therapeutics. Under this acquisition, Roche acquired access to Carmot’s existing R&D portfolio including all assets in clinical and pre-clinical stages. These assets include CT-996, CT-868, and CT-388 which are used in the analysis to treat potential diabetes and obesity.

Asia Pacific Point Of Care Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.29 billion

Revenue forecast in 2030

USD 16.73 billion

Growth rate

CAGR of 8.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, end use, region

Regional scope

Asia Pacific

Country scope

China; Japan; India; South Korea; Australia; Thailand; New Zealand; Singapore; Vietnam

Key companies profiled

F. Hoffmann-La Roche Ltd.; Qiagen; Danaher Corporation; Becton Dickinson (BD); bioMérieux; Abbott; Siemens Healthcare GmbH; Werfen; Nova Biomedical; Trividia Health, Inc.; SEKISUI MEDICAL CO., LTD.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Point Of Care Diagnostics Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Asia Pacific point of care diagnostics market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Glucose Testing

-

Hb1Ac Testing

-

Coagulation

-

Fertility/Pregnancy

-

Infectious Disease

-

HIV POC

-

Clostridium Difficile POC

-

HBV POC

-

Pneumonia or Streptococcus Associated Infections

-

Respiratory Syncytial Virus (RSV) POC

-

HPV POC

-

Influenza/Flu POC

-

HCV POC

-

MRSA POC

-

TB and Drug-resistant TB POC

-

HSV POC

-

COVID-19

-

Other Infectious Diseases

-

-

Cardiac Markers

-

Thyroid Stimulating Hormone

-

Hematology

-

Primary Care Systems

-

Decentralized Clinical Chemistry

-

Feces

-

Lipid Testing

-

Cancer Marker

-

Blood Gas/Electrolytes

-

Ambulatory Chemistry

-

Drug Abuse Testing

-

Autoimmune Disease

-

Urinalysis/Nephrology

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinics

-

Physician Office

-

Pharmacy & Retail Clinics

-

Non-practice Clinics

-

Urgent Care Clinic

-

-

Hospitals

-

HomeAssisted Living Healthcare Facilities

-

Laboratory

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

Malaysia

-

Singapore

-

Indonesia

-

Vietnam

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."