- Home

- »

- Plastics, Polymers & Resins

- »

-

Asia Pacific Plastics In Consumer Electronics Market Report, 2030GVR Report cover

![Asia Pacific Plastics In Consumer Electronics Market Size, Share & Trends Report]()

Asia Pacific Plastics In Consumer Electronics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Polycarbonate (PC), Liquid Crystal Polymers (LCP)), By End Use, By Country, And Segment Forecasts

- Report ID: GVR-4-68039-501-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

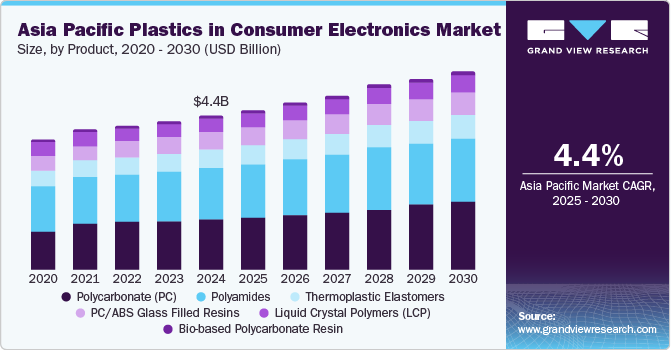

The Asia Pacific plastics in consumer electronics market size was valued at USD 4.42 billion in 2024 and is expected to grow at a CAGR of 4.4% from 2025 to 2030. The growth of this market is primarily influenced by factors such as increasing demand for cost-effective plastic materials and benefits provided by plastics such as lighter weight, flexibility in design, ability to fit in different shapes, and more.

Increasing adoption of bio-based polycarbonate by consumer electronics manufacturers drives the market growth. Increased investments in research & development activities and introducing recycled polymers such as bio-based polycarbonate have been key factors offering a competitive advantage to the players in this market. Using polyamides owing to benefits provided by the material, such as enhanced strength, dimensional stability, resistance to chemicals, and cost-effectiveness, also adds to the growth experienced by this market. Polyamides are used to make buttons, connectors, and device enclosures for smartphones, tablets, and more. It is also utilized to make internal components such as clips, spacers, and brackets of electronic devices.

The low production cost of consumer electronics, especially in the Asia Pacific region, plays a vital role in the growth of this market. Large-scale production of plastics used in the consumer electronics industry in countries such as China, coupled with efficiently designed supply chain networks and lower labor costs, also influences growth.

Growing demand for consumer electronics in the Asia Pacific requires uninterrupted supply. Multiple companies have preferred setting up production facilities in the region to significantly cut down costs such as labor, transportation, import duties, and more. Plastic production capabilities of enhanced manufacturing ecosystems in countries such as China and India have resulted in many electronics manufacturers entering this region.

The increasing focus of businesses, governments, and various institutes on researching and developing multiple parts and elements of consumer electronics, such as smartphones, also contributes to the growing demand. For instance, in December 2024, the Indian Institute of Technology Madras (IIT Madras), one of the applauded institutes in India, inaugurated a research center that aims to develop AMOLED displays characterized by generation technology, specifically for smartphones, wearables, and other consumer electronics products.

Product Insights

The polycarbonate (PC) segment dominated the Asia Pacific plastics industry in the consumer electronics industry, with a revenue share of 33.4% in 2024. Polycarbonate (PC) presents strong resistance to neutral oils, weak acids, alkalis, etc. It is extensively used in manufacturing casings for tablets and laptops. Polycarbonate (PC) offers properties such as transparency, toughness, lighter weight, higher impact strength, enhanced chemical resistance, heat resistance, UV protection, and others, primarily influencing the growing utilization. It is widely used to make refrigerators, coffee machines, food mixers, washing machines, hair dryers, and irons. Polycarbonate (PC) also ensures robustness and enhanced visual appeal of finished goods. These aspects primarily contribute to the dominance of polycarbonate (PC) utilization in manufacturing consumer electronics.

The bio-based polycarbonate resin segment is projected to experience a significant CAGR during the forecast period. The growth of this segment is mainly driven by factors such as growing environmental concerns and increasing awareness regarding sustainability. The inclusion of bio-based polycarbonate resin is believed to enhance the brand image of the manufacturers and marketers. Regulatory scenarios have also stimulated increased utilization of Bio-based polycarbonate resin in recent years. It is extensively used in smartwatch bands, laptop shells, and other consumer electronics products.

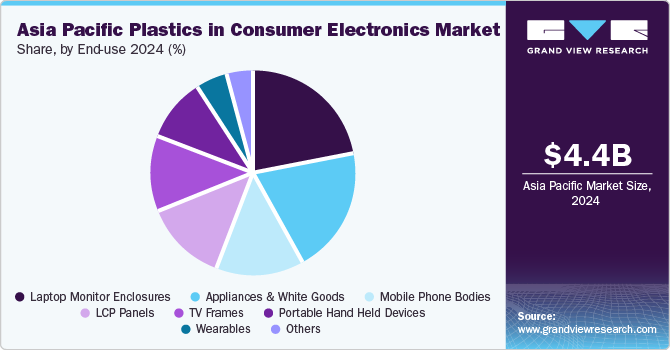

End Use Insights

The laptop monitor enclosures segment dominated the Asia Pacific plastics in consumer electronics industry, with a revenue share of 33.4% in 2024. The rapid pace of digitization has resulted in the growing utilization of laptops in multiple industries. Various sectors, such as education, healthcare, and others, embrace advanced technologies to ensure performance excellence and enhanced output. This has increased demand for monitor enclosures for devices such as laptops, display screens, and others. Materials such as PC/ABS glass-filled resins and thermoplastic polymers are widely used in making enclosures.

The wearables segment is anticipated to experience the highest CAGR during the forecast period. This is attributed to factors such as increasing demand for comfortable and technologically advanced wearables such as smartwatches and growing utilization of wearables in multiple industries such as healthcare, defense & aerospace, logistics, BFSI, security, facility management, and others. Bands of such wearables are often made with Bio-based polycarbonate resin and others that offer robust strength, lighter weight, durability, and more.

Country Insights

China dominated Asia Pacific plastics in the consumer electronics industry with a revenue share of 49.1% in 2024. This market is primarily influenced by factors such as the presence of multiple manufacturing facilities and increasing support from the government. China has been one of the prime manufacturing hubs of plastics and consumer electronics. This plays a vital role in terms of cost-effectiveness and supply chain. Various companies operating in the consumer electronics industry have set up manufacturing units in China owing to factors such as availability of labor at lower costs, ease of accessibility of plastics, and positive regulatory scenarios.

India is expected to experience the fastest CAGR over the forecast period. This is attributed to the increasing number of new entrants in the country's manufacturing industry, infrastructure enhancements, positive regulatory scenarios, and government support for foreign investments in the manufacturing sector. The consumer electronics industry has been experiencing significant growth in demand across India owing to growing disposable income levels, ease of availability through online portals, and increasing accessibility to high-speed telecom and internet networks. These aspects are anticipated to add growth opportunities for this market.

Key Asia Pacific Plastics In Consumer Electronics Company Insights

Some of the key companies operating in Asia Pacific plastics in consumer electronics industry include SABIC, Solvay, Celanese Corporation, Trinseo S.A., KURARAY CO., LTD., and others. Companies are adopting strategies such as capacity enhancements, process automation, new facility developments, collaboration, innovation, and more to address the growing demand from various countries and consumer electronics manufacturers.

-

SABIC, one of the market participants in the global petrochemicals industry, offers a range of products such as polymers, specialty compounds, additives, advanced materials, agri-nutrients, chemicals, and more. It also provides small order quantities, fast formulation, engineering tools, molded sample express, and color Xpress service. Some of its offerings for the manufacturing industry include Polycarbonate, polycarbonate/acrylonitrile-butadiene-styrene (PC/ABS), Polyamide, and others.

-

Celanese Corporation specializes in chemicals and specialty materials primarily used in industrial product manufacturing and processes of multiple sectors. This includes IT & communication, healthcare, appliances, consumer goods, automotive, building & construction, energy, food & beverage, medical & pharma, telecom, personal care, electrical and electronics, and others. Polybutylene Terephthalate offered by the company is widely used in the making of switches, sockets, and stoves or over knobs, handles, and more.

Key Asia Pacific Plastics In Consumer Electronics Companies:

- Trinseo S.A.

- SABIC

- Covestro AG

- KURARAY CO., LTD.

- Polyplastics Co., Ltd.

- Mitsubishi Chemical Corporation

- Solvay

- Celanese Corporation

- TORAY INTERNATIONAL, INC.

- TEIJIN LIMITED

- Sumitomo Chemical Co., Ltd.

Recent Developments

-

In August 2024, SABIC, one of the market participants indiversified chemicals, and the Fujian government signed an agreement on potential investment. It included plans to set up a manufacturing facility for thermoplastics compounding in China’s Fujian province. The agreement further strengthened SABIC’s commitment to meeting unique consumer requirements in domestic markets while delivering innovation.

Asia Pacific Plastics In Consumer Electronics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.56 billion

Revenue forecast in 2030

USD 5.66 billion

Growth Rate

CAGR of 4.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume Tons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, and country

Country scope

India, China, Japan, South Korea, Southeast Asia

Key companies profiled

Trinseo S.A.; SABIC; Covestro AG; KURARAY CO., LTD.; Polyplastics Co., Ltd.; Mitsubishi Chemical Corporation; Solvay; Celanese Corporation; TORAY INTERNATIONAL, INC.; TEIJIN LIMITED; Sumitomo Chemical Co., Ltd

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Plastics in Consumer Electronics Market Report Segmentation

This report forecasts revenue growth at regional and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific plastics in consumer electronics industry report based on product, end use, and country.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Polycarbonate (PC)

-

Liquid Crystal Polymers (LCP)

-

PC/ABS Glass Filled Resins

-

Bio-based Polycarbonate Resin

-

Thermoplastic Elastomers

-

TPU

-

Recycled TPU

-

Others

-

-

Polyamides

-

PA4T

-

PA9T

-

Amorphous Polyamides

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

TV Frames

-

Laptop Monitor Enclosures

-

LCP Panels

-

Portable Hand held Devices

-

Wearables

-

Mobile Phone bodies

-

Appliances & White Goods

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

South Korea

-

Southeast Asia

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.