- Home

- »

- Healthcare IT

- »

-

Asia Pacific Pharmacovigilance Market Size, Report, 2030GVR Report cover

![Asia Pacific Pharmacovigilance Market Size, Share & Trends Report]()

Asia Pacific Pharmacovigilance Market Size, Share & Trends Analysis Report By Service Provider (In-house, Contract Outsourcing), By Product Life Cycle, By Therapeutic Area, By Process Flow, By End Use, By Type, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-317-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

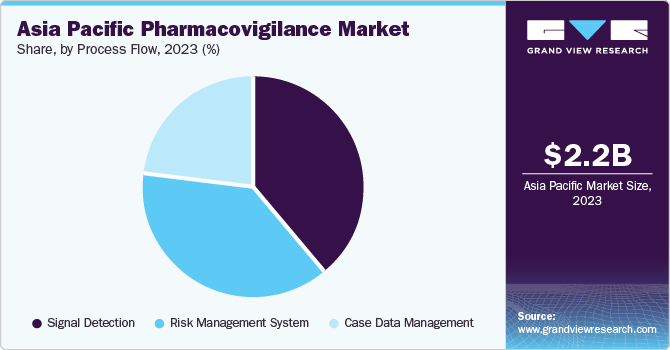

The Asia Pacific pharmacovigilance market size was estimated at USD 2.2 billion in 2023 and is expected to grow at a CAGR of 8.5% from 2024 to 2030. This growth is attributed to the increasing prevalence of chronic diseases and adverse drug reactions (ADRs), along with rising awareness about drug safety among healthcare providers. In addition, the region's pharmaceutical market is dominated by generic drugs, and foreign manufacturers are outsourcing business elements to Asia due to cost advantages, leading to more clinical trials and a greater focus on pharmacovigilance. Furthermore, stringent government regulations, mainly for pre- and post-commercialization of drugs, also contribute to market growth.

The Asia Pacific pharmacovigilance market accounted for a share of 30.7% of the global pharmacovigilance market revenue. The biopharmaceutical sector in the region is growing, driven by ongoing research on new drugs and vaccines. This surge in research is increasing the demand for pharmacovigilance services, as clinical trials are being conducted to develop innovative medicines and vaccines. Countries, such as India, China, Japan, and Australia, have modern infrastructure for pharmacovigilance, and initiatives, such as the Indian Pharmacopoeia Commission's training course for WHO members, are supporting market growth.

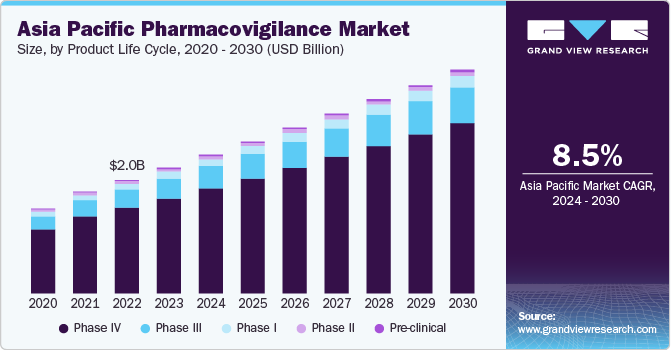

Product Life Cycle Insights

The phase IV segment led the market and accounted for the largest revenue share of 75.8% in 2023. This growth is attributed to the increasing awareness of public health and the need for safe medicines. In addition, the region's pharmaceutical industry is led by generic drugs, which necessitate extensive post-marketing surveillance. The growing number of national pharmacovigilance centers and the need for rigorous pharmacovigilance activities to manage high-risk medicines also contribute to the segment's growth.

The phase III segment is expected to grow at the fastest CAGR of 8.7% from 2024 to 2030. This growth is attributed to the need for rigorous pre-commercialization testing to ensure drug safety and efficacy. In addition, the region's pharmaceutical industry requires extensive pre-commercialization surveillance. Furthermore, the increasing awareness of public health and the need for safe medicines contribute to the growth of this segment.

Service Provider Insights

The contract outsourcing service providers segment dominated the market and accounted for the largest revenue share of 60.8% in 2023. This growth is attributed to the region's economic development and low operating costs, which offer lucrative opportunities for key players. Furthermore, the focus on biopharmaceutical R&D, large-scale drug production, and a surge in cancer prevalence create a need for wide-ranging pharmacovigilance services.

The in-house service provider segment is expected to grow at a CAGR of 7.9% over the forecast period. Pharmaceutical companies are investing in in-house pharmacovigilance operations to safeguard compliance with strict regulations and uphold control over their drug safety procedures.

Type Insights

The spontaneous reporting segment accounted for the largest revenue share of 30.2% in 2023 due to the widespread use of drugs & medical products, growing awareness of drug safety, and the need for early discovery & management of adverse drug reactions (ADRs). Spontaneous reporting plays a crucial role in recognizing and evaluating the safety of drugs and medical products after approval, which is crucial for safeguarding patient safety and regulatory compliance.

The targeted spontaneous reporting (TSR) segment is expected to grow at a CAGR of 9.1% from 2024 to 2030 owing to factors such as increasing public awareness regarding safer pharmaceuticals, outsourcing PV solutions, and the need for enhanced reporting of ADRs. Furthermore, the adoption of electronic health records (EHRs) and rapidly expanding regional pharmaceutical industry contribute to segment growth.

End Use Insights

The pharmaceutical segment accounted for the largest revenue share of 40.1% in 2023. The segment growth is driven by increasing drug consumption, growing prevalence of chronic diseases, and rising consciousness about drug safety. The region's large patient population, expanding healthcare infrastructure, and increasing investments in healthcare services also contribute to this growth. Furthermore, the need for comprehensive drug safety monitoring and compliance with regulatory requirements drives the growth.

The biotechnology companies segment is expected to grow at a CAGR of 9.2% from 2024 to 2030 due to the rising demand for innovative & safe biopharmaceuticals and comprehensive drug surveillance, along with increasing awareness of pharmacovigilance practices. The region's large patient population, developing healthcare infrastructure, and growing investments in healthcare facilities also contribute to the segment’s growth.

Therapeutic Area Insights

The oncology segment led the market and accounted for a revenue share of 27.2% in 2023. This growth is attributed to a large patient population pool, high cancer incidence, regulatory reforms, faster enrolment, the evolution of the local drug development ecosystem, availability of key leaders & specialized clinical trial centers and skilled workers, and rising data quality.

The cardiology segment is expected to grow at a CAGR of 8.7% from 2024 to 2030 due to the growing incidence of cardiovascular diseases (CVDs), rising awareness about adverse drug reactions, and the need for effective drug monitoring and safety management. This is particularly significant in countries, such as China, India, and South Korea, where the incidence of CVDs is high.

Process Flow Insights

The signal detection segment dominated the APAC regional market, accounting for the highest revenue share of 38.8% in 2023. The increasing demand for effective risk management approaches, developments in data analytics, and the need for harmonization of pharmacovigilance systems across countries drive the segment growth. Furthermore, the region's growing pharmaceutical industry and the significance of safeguarding patient safety are key factors contributing to the demand for signal detection services in the region.

The case data management segment is anticipated to grow at a CAGR of 8.8% from 2024 to 2030 owing to the adoption of pharmacovigilance software by outsourcing companies and stricter government regulations for pre- and post-commercialization drug safety. In addition, the region is seeing a rise in clinical trials and research activity, further fuelling the need for robust pharmacovigilance systems and software. Furthermore, factors, such as the high healthcare expenditure, rising disease prevalence, and the push for better drug safety monitoring, across the region contribute to the segment’s growth.

Country Insights

China Pharmacovigilance Market Trends

The pharmacovigilance market in China dominated the APAC regional market and accounted for the largest revenue share of 27.8% in 2023. This growth is attributed to rising healthcare expenditures and favorable government initiatives, including incentives for local pharmaceutical companies to adopt pharmacovigilance practices. In addition, the rapid growth of the biotechnology sector and the development of the economy with increasing disposable income are further driving the market’s growth in the country.

India Pharmacovigilance Market Trends

The India pharmacovigilance marketis expected to grow at a CAGR of 8.9% from 2024 to 2030. The country's pharmaceutical industry growth, increasing patient medicine usage, and rising focus on drug safety are key drivers. Furthermore, the availability of a skilled workforce and cost-effectiveness have made India an attractive outsourcing hub for pharmacovigilance services.

Key Asia Pacific Pharmacovigilance Company Insights

Key players operating in this market include Clinquest Group B.V. (LINICAL AMERICAS), Take Solutions Limited, Wipro, Fosun Pharma, and Sinopharm.

- Clinquest Group B.V. offers pharmacovigilance (PV) services, post-marketing surveillance, and clinical trial services. The company has extensive therapeutic expertise across various areas, including cardiology and reproductive systems. Furthermore, the company provides a wide range of product development services to the biopharmaceutical, medical device, diagnostics, and medical data industries

-

Take Solutions Limited operates in three main segments: life sciences, supply chain management, and enterprise IT services. The life sciences division, renamed Navitas, offers solutions to four key areas: safety, regulatory, clinical, and commercialization. These solutions cater to the needs of various life sciences companies

Key Asia Pacific Pharmacovigilance Companies:

- Clinquest group B.V. (LINICAL AMERICAS)

- Take Solutions Limited

- WIPRO

- Fosun Pharma

- Sinopharm

- Sinovac Biotech

- Daewoong Pharmaceutical

- ALTEOGEN Inc.

- A.N.B. Laboratories Co., Ltd.

- Biopharm Chemicals Co., Ltd.

Recent Developments

-

In January 2023, Alteogen Inc. signed an exclusive agreement with Sandoz AG, granting Sandoz global rights to use Alteogen's novel hyaluronidase, ALT-B4, developed using Hybrozyme technology. This technology enables the subcutaneous administration of drugs typically given intravenously. The agreement includes an option for Sandoz to license Hybrozyme technology for two additional products

Asia Pacific Pharmacovigilance Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.2 billion

Revenue forecast in 2030

USD 4.0 billion

Growth rate

CAGR of 8.5% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product life cycle, service provider, type, end use, therapeutic area, process flow, country

Regional scope

Asia Pacific

Country scope

Japan; China; India; Australia; South Korea; Thailand

Key companies profiled

Dr. Reddy’s Laboratories Ltd.; Sun Pharmaceutical Industries Ltd.; Cipla Inc.; Aurobindo Pharma.; Asymchem Laboratories; Reyoung Pharmaceutical; CSPC Pharmaceutical Group Limited; Otsuka Pharmaceutical Australia Pty Ltd.; GC Biopharma Corp.; Chong Kun Dang Pharmaceutical Corporation.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Pharmacovigilance Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific pharmacovigilance market report based on product life cycle, service provider, type, end use, therapeutic area, process flow, and country:

-

Product Life Cycle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pre-clinical

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Service Provider Outlook (Revenue, USD Billion, 2018 - 2030)

-

In-house

-

Contract Outsourcing

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Spontaneous Reporting

-

Intensified ADR Reporting

-

Targeted Spontaneous Reporting

-

Cohort Event Monitoring

-

EHR Mining

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceuticals

-

Biotechnology Companies

-

Medical Device Manufacturers

-

Others

-

-

Therapeutic Area Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oncology

-

Neurology

-

Cardiology

-

Respiratory Systems

-

Other

-

-

Process Flow Outlook (Revenue, USD Billion, 2018 - 2030)

-

Case Data Management

-

Signal Detection

-

Risk Management System

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."