Asia Pacific Pet Wearable Market Size, Share & Trends Analysis Report By Technology (RFID, GPS), By Product(Smart Collar, Smart Camera, Smart Harness & Vest), By Animal, By Component, By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-315-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Asia Pacific Pet Wearable Market Trends

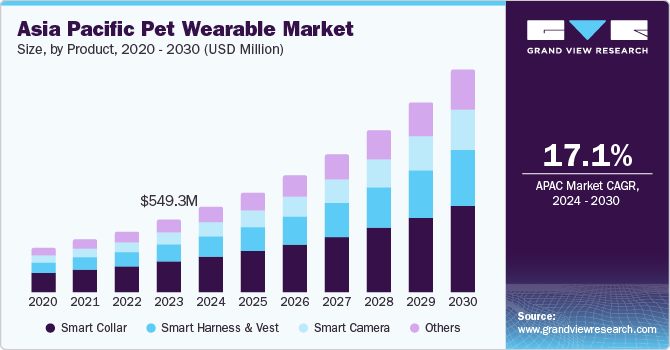

The Asia Pacific pet wearable market size was estimated at USD 549.3 million in 2023 and is anticipated to advance at a CAGR of 17.1% from 2024 to 2030. The increasing pet population in the region, along with a strong focus on integrating technologically advanced products into the lifestyle of modern consumers, are primary factors boosting the market growth. In addition, rapid urbanization and increasing disposable income levels are expected to lead to market expansion. Pet care spending is rising in Asia Pacific, driven by growing concerns over pet health and well-being. This drives the demand for innovative solutions, such as smart collars, cameras, and fitness trackers. As pet owners in developed and developing countries prioritize pets’ well-being, the market is poised to present substantial opportunities for pet wearable companies.

The Asia Pacific market for pet wearables accounted for a revenue share of 20.3% in 2023 in the global pet wearables market. An increasing focus on technological advancements is expected to present several avenues for market growth. Pet wearables are rapidly evolving with the integration of advanced sensors to thoroughly track various aspects of pet health, such as activity levels, sleep patterns, and vital signs. On the other hand, implementing AI algorithms to analyze pet data offers personalized insights into their health and behavior, potentially aiding in the early detection of health issues.

The development of user-friendly mobile applications accompanying pet wearables enables owners to monitor the health of their pets in real time and receive timely alerts or recommendations, which helps maintain their optimal health and improve their lifespan. The fast expansion of the region's veterinary and pet training sectors also presents opportunities for leading market players to boost their sales. Pet wearables are valuable supplements to traditional pet care practices, such as veterinary care and professional training. These devices, equipped with features, such as health monitoring and activity tracking, provide pet owners with additional insights into their pet's well-being and behavior.

Product Insights

The smart collar segment accounted for the largest revenue share of 42.2% in 2023. With the growing pet population in the region, there is a significant demand for innovative products that can ensure the well-being of these animals. Smart collars include useful features, such as GPS tracking, so that owners can keep an eye on the movement of their pets. Moreover, they also allow monitoring pet activities, such as their daily exercise and routine rest patterns, which helps understand if they are facing any underlying health issues and are indulging in optimal amounts of physical activity. Brands focus on integrating as many beneficial features as possible to provide owners with comprehensive insight about their pets, leading to significant expansion of this segment.

The smart harness and vest segment is projected to advance at the fastest CAGR of 18.6% from 2024 to 2030. They are generally equipped with features, such as GPS tracking, activity monitoring, and, in some cases, health sensors, to optimize pets' safety, comfort, and overall well-being. Other notable products considered in the industry include trackers and monitors. These tools enhance pet care by providing real-time location tracking, monitoring physical activity, tracking health metrics, promoting owner-pet communication, and offering valuable insights into behavioral patterns.

Animal Insights

The cats segment accounted for a revenue share of 43.2% in 2023. The increasing adoption of cats, especially among single people as a companion, has driven the demand for pet wearables in this segment. Pet wearables for cats focus on feline well-being and health monitoring. They include activity trackers, breakaway collars, light-up collars, calming collars, puzzle feeders, light therapy collars, and health monitors customized. Moreover, significant developments are underway concerning the development of wearables that can better analyze cat behavior and improve their relationship with owners, which is expected to aid segment expansion.

The dogs segment is projected to expand at a substantial CAGR from 2024 to 2030. This is due to the variety of available breeds and their generally friendly behavior. Moreover, westernization in emerging economies has led to the increased appeal of keeping these animals as pets, especially in single-family homes. Pet wearables for dogs prioritize safety, training, and active lifestyles, offering products, such as GPS trackers and training collars, for behavioral correction and obedience training.

Component Insights

The connectivity integrated circuit segment accounted for the largest revenue share in 2023. This segment includes Bluetooth chips, Wi-Fi chips, and cellular chips. The demand for Bluetooth chips is high due to advancements, such as Bluetooth 5.0, which offers a longer range and faster data transfer speeds than previous versions. This has helped improve the performance of pet wearables and allowed them to provide new features and functionalities. Wi-Fi chips allow for easier and more reliable remote firmware updates for pet wearables. This can be important to ensure that the wearable has the latest features and security patches. Moreover, if a pet wearable needs to transmit large amounts of data, such as high-resolution video or live streaming, Wi-Fi can be a much better option than Bluetooth due to its faster data transfer speeds.

The sensors segment is projected to emerge as a leading contributor in terms of revenue during the forecast period. With features including respiratory and skin temperature tracking becoming widely available, sensors, such as accelerometers and heart rate monitors, are offering deeper insights into pet health. These sensors also enable personalized care through food and hydration monitoring, waste management in litter boxes, and even fall detection for aging pets.

Application Insights

The identification & tracking application segment accounted for the largest revenue share in 2023. With the increasing pet population in major economies and the growing appeal of exotic animals, there has been an increased risk of these pets being stolen to sell them at high prices. The selling of dog meat as a delicacy in some Southeast Asian economies also presents a threat to dog owners, making the use of wearables, which can accurately track and identify pets, a necessity.

The medical diagnosis & treatment segment is projected to expand at a significant CAGR from 2024 to 2030. There has been a noticeable increase in disorders among common pets, such as cats and dogs, across households in Asia Pacific economies, leading to an increased demand for devices that can monitor their physical and mental health at all times and alert the owners in case of any problems. Companies are developing wearables that are highly beneficial for pet owners and veterinarians by monitoring vital signs, such as temperature, heart rate, and activity levels, while providing valuable data for the early detection of underlying health issues.

Technology Insights

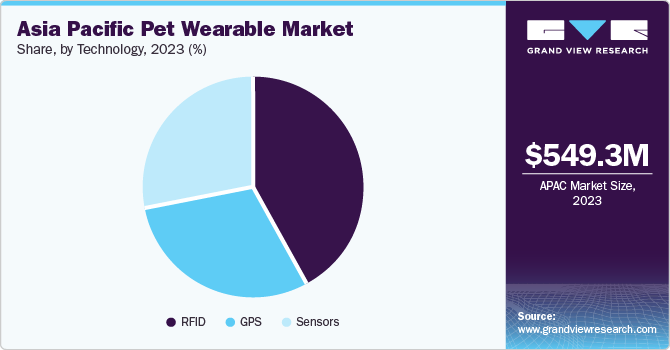

The RFID technology segment held the largest revenue share in 2023. The primary focus of wearable manufacturers on developing advanced solutions for pet tracking and identification has created significant demand for RFID technology. This technology involves a small microchip implanted under the pet’s skin, generally between the shoulder blades. Every chip possesses a unique identification number that can be easily scanned using a compatible reader. When a lost animal is found, veterinary clinics or shelters can scan the chip to retrieve the owner's contact information from a database. RFID tags offer the benefit of strong security as they are tamper-proof and can be read only using authorized scanners.

GPS technology is expected to witness substantial growth in demand over the forecast period. GPS tags are generally mounted on pet collars so that the location of pets can be tracked accurately in real time. This technology enables pet owners to mark geo-fenced locations, making it convenient for them to be alerted whenever their pets move away from that confined area. In addition, GPS can be easily installed in modern devices, including smartphones and smartwatches, which helps pet owners keep a continuous track of their pets. With the growing consumer interest and awareness regarding the benefits of GPS technology in pet wearable solutions, the market is expected to expand significantly in the coming years.

Country Insights

China Pet Wearable Market Trends

The China pet wearable market accounted for the largest revenue share of 41.1% in 2023. Pet wearables integrated with cutting-edge technologies and advanced features, such as GPS tracking and real-time health monitoring, are gaining popularity in China. Integrating precise health monitoring features based on Artificial Intelligence (AI) and Machine Learning (ML) into pet wearables allows owners to obtain personalized suggestions, a trend that corresponds to the preferences of tech-savvy Chinese consumers. Moreover, significant technical improvements not only enhance the experience of pet owners but also represent a broader trend of technological proliferation in the country.

South Korea Pet Wearable Market Trends

The pet wearables market in South Korea is expected to witness the fastest CAGR of 20.9% from 2024 to 2030. Pet owners in the country are concerned about the safety and well-being of their pets, leading to a surge in demand for wearables with GPS tracking, activity monitoring, and health insights, among other advanced features. Smart collars provide users with valuable data about their pets’ health and activity levels. In January 2021, a South Korean start-up, Petpuls Lab Inc., launched an AI-powered dog collar capable of detecting five emotions, including happiness, relaxation, anxiety, anger, and sadness, through voice recognition technology. Using a smartphone application, pet owners can understand the emotional state of their dogs, while also receiving data regarding their activity. Such initiatives are expected to mark the country as a leading contributor to industry expansion.

Key Asia Pacific Pet Wearable Company Insights

Some of the key companies involved in the development of advanced pet wearable solutions in Asia Pacific include Datamars, Tractive, Pet Tracker Australia, Petble, and SUGA International Holdings, among others.

- Tractive, headquartered in Austria, manufactures GPS-tracking gadgets designed for dogs and cats. The company specializes in developing pet technology, wearables, and applications. Tractive offers various advanced GPS trackers including Tractive DOG 4, Tractive DOG 4 + Screen, Tractive DOG 4 Packaging, Tractive CAT Mini, and Tractive CAT Mini Packaging. It also offers a selection of useful applications for owners, including LIVE Tracking, Location History, Virtual Fence, Wellness Score, and Sleep Monitoring, among others.

Key Asia Pacific Pet Wearable Companies:

- Mobiusworks Private Ltd.

- PETBLE

- PetPace

- Mars, Inc.

- FitBark

- DeLaval

- SUGA International Holdings Ltd.

- Datamars

- PETREK

- Tractive

- Allflex

Recent Developments

-

In January 2024, PETREK announced the launch of the company’s Petrek GPS-4, which serves as a successor to the Petrek 3G. The new model provides benefits, such as support for 4G and 4G LTE, as well as 3G as a backup network. The company also promises lower batter consumption, reduced working heat temperature, and better accuracy from the GPS-4. The use of Lintek GPS and GSM antenna is expected to search and lock down signals at three times the faster speed in comparison to the preceding generation

Asia Pacific Pet Wearable Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 1.66 billion |

|

Growth rate |

CAGR of 17.1% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, trends |

|

Segments covered |

Technology, product, animal, component, application, and country |

|

Country scope |

China; India; Japan; Australia; South Korea |

|

Key companies profiled |

Mobiusworks Private Ltd.; PETBLE; PetPace; Mars, Inc.; FitBark; DeLaval; SUGA International Holdings Ltd.; Datamars; PETREK; Tractive; Allflex |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Asia Pacific Pet Wearable Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific pet wearable market report based on technology, product, component, animal, application, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

RFID

-

GPS

-

Sensors

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart Collar

-

Smart Camera

-

Smart Harness and Vest

-

Others

-

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Other Animals

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

GPS Chips

-

RFID Chips

-

Connectivity Integrated Circuit

-

Bluetooth Chips

-

Wi-Fi Chips

-

Cellular Chips

-

-

Sensors

-

Processors

-

Memory

-

Displays

-

Batteries

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Identification & Tracking

-

Behavior Monitoring & Control

-

Facilitation, Safety & Security

-

Fitness Monitoring

-

Medical Diagnosis & Treatment

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."