- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Personal Protective Equipment Market, Industry Report, 2030GVR Report cover

![Asia Pacific Personal Protective Equipment Market Size, Share & Trends Report]()

Asia Pacific Personal Protective Equipment Market Size, Share & Trends Analysis Report By Product (Hand Protection, Eye Protection), By End-use (Construction, Manufacturing), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-291-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

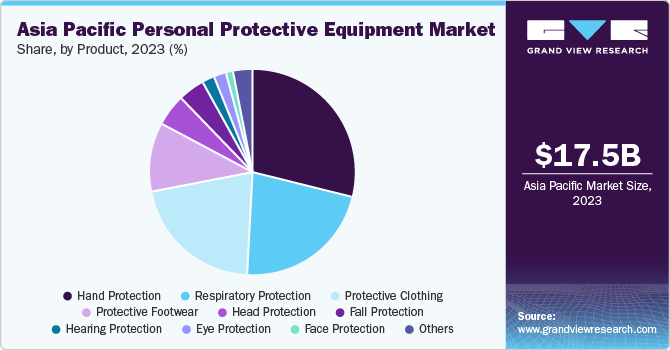

The Asia Pacific personal protective equipment market size was estimated at USD 17.5 billion in 2023 and is anticipated to expand at a CAGR of 7.8% from 2024 to 2030. Increasing awareness regarding the safety of employees at the workplace across several industries is anticipated to drive the demand for personal protective equipment (PPE) in this region. Asia Pacific has witnessed a substantial improvement in industrial operating processes, brought about by increasing awareness regarding the use of equipment that can ensure the safety of workers and employees from any machinery or chemical-related mishaps. Infrastructural spending in economies such as China, Malaysia, Vietnam, and India has grown significantly with the advent of industrialization and modernization, marking the region as a significant market for PPE.

The Asia Pacific personal protective equipment market accounted for a revenue share of 22.1% of the global PPE industry in 2023. Regulatory agencies have played an essential role in driving the adoption of protective kits by initiating a range of initiatives and guidelines. Regulations vary from economy to economy, reflecting varying levels of preparedness, industrial development, and safety standards. For instance, the State Administration of Work Safety (SAWS) has implemented standards in China that ensure employers are responsible for providing PPE and ensuring its correct usage. Additionally, workers must be provided training and complete assessments regularly to remain aware of the latest developments in this area.

In Japan, the Ministry of Health, Labour and Welfare (MHLW) oversees the implementation of standards such as Japanese Industrial Standards (JIS) and Industrial Safety and Health Law. Guidelines necessitate the provision of PPE kits to employers at zero cost and their conformance to JIS standards. Similarly, other countries have also introduced their own standards and practices, thus ensuring extensive usage of personal protective equipment and driving market expansion.

With the advent of technologically advanced materials and improved production methodologies, the market for PPE in the region has the potential to expand at a robust pace. These developments have helped elevate the safety, functionality, and comfort these products offer. For instance, the use of nanotechnology has resulted in an improvement in the protective qualities of these types of equipment. Masks in industrial settings leverage nanofibers to improve filtration efficiency, thus offering enhanced protection against airborne pathogens and particles. Phase Change Materials (PCMs) are incorporated in protective clothing to regulate temperatures and enhance comfort for the wearer in extreme environments. Improvements in 3D printing technology and the demand for ergonomic design also positively shape the demand for PPE in the Asia Pacific market.

End-use Insights

The manufacturing segment accounted for a significant revenue share of 19.0% in 2023. The increasing presence of large multinational companies in economies such as Malaysia, Japan, Australia, and China has created significant demand for kits aiding in hand protection, fall protection, respiratory protection, and eye protection. General manufacturing involves both heavy manufacturing, such as chemical handling and plastics manufacturing, as well as light manufacturing, which includes food processing and apparel production, and all of these require different levels of protective features based on the hazard involved and the type of activity.

The construction segment is projected to advance at a significant CAGR of 9.2% during the forecast period. The fast pace of modernization and infrastructural development activities, increasing population, and improved living standards have provided a significant push to the construction sector. Products offering advanced hand protection, respiratory protection, and fall protection features have witnessed substantial growth in sales in recent years. Another notable factor driving market expansion in the region is the overhead costs associated with workshop injuries and mortalities in the construction industry.

Product Insights

The hand protection equipment segment accounted for the largest revenue share of 28.9% in 2023. The extensive use of hand protection kits to guard and protect the body from several hazards, including extreme temperatures, cuts & abrasions, and dermatitis & skin irritation, among others, is the primary reason for the high sales of these products. The fast growth of the manufacturing and automotive sectors and developments in the healthcare and chemicals segment in Asia Pacific have attracted PPE manufacturers to increase their presence and extend their product portfolio.

The COVID-19 pandemic, which impacted the region substantially, has also helped increase awareness regarding the use of PPE kits that can help prevent the spread of infections. Disposable gloves are widely used in the food and healthcare industries to offer protection and to avoid cross-infection between patients and caregivers. Different types include nitrile, natural rubber, neoprene, and vinyl.

The respiratory protection segment is anticipated to advance at the fastest CAGR of 8.7% from 2024 to 2030. Industries such as chemicals, food & beverage, mining, and oil & gas have expanded steadily in the region, increasing the risk of workers and employees getting exposed to harmful gases or chemicals that can prove life-threatening. Products such as dust masks, PAPR (powered air purifying respirators), and SCBA (self-contained breathing apparatus), among others, have seen an increase in demand among enterprises in fast-growing economies such as China and India. Technological innovations, improved performance of respirators, and the stringent enforcement of workplace safety standards across Asia Pacific are factors expected to drive investments in this segment in the regional market.

Country Insights

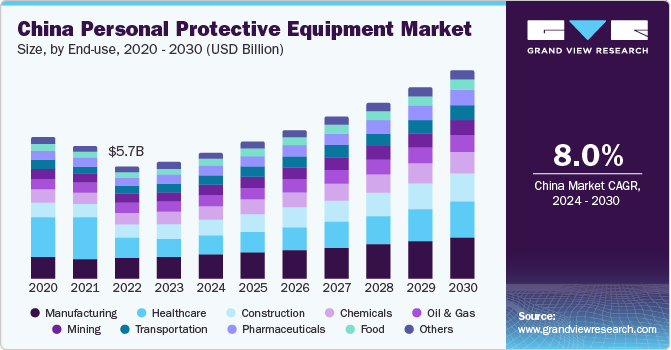

China Personal Protective Equipment Market Trends

China personal protective equipment market accounted for the largest revenue share of 33.4% of the Asia Pacific PPE market. The fast pace of industrial development, growth in the number of infrastructural projects, and improvements in regulatory standards across different verticals have combined to boost growth in demand for PPE in the country. Rapid urbanization in China is a notable factor boosting the growth of the construction sector. Various demographic factors such as the rising elderly population and increasing standards of living owing to urbanization are expected to drive the Chinese construction industry.

India Personal Protective Equipment Market Trends

The personal protective equipment market in India is projected to expand at the fastest CAGR of 9.3% during the forecast period. The promising growth of the healthcare sector has emerged as a leading factor driving product demand. This sector is expected to advance significantly owing to several factors, including increasing population, rising disposable incomes, increasing access to insurance, greater health awareness, and increasing expenditure by the public and private players in the industry. Consequently, the market growth for personal protective equipment is anticipated to remain strong in the country. Additionally, favorable initiatives such as “Make in India” are driving investments in aircraft, electronics, and automotive manufacturing industries. Stringent product testing and compliance with regulatory standards in the electronics and pharmaceutical industries are expected to drive the demand for PPE through 2030.

Key Personal Protective Equipment Company Insights

The market is characterized by the presence of several well-established companies that have an extensive portfolio of products, along with emerging and niche players that are focusing on the incorporation of innovative materials in their products, as well as advanced technologies, to drive their growth. Ansell, Honeywell International, DuPont, and 3M are major manufacturers of personal protective equipment in the region.

-

3M, headquartered in Minnesota, is a global manufacturer and distributor of eye protection, head & face protection, hearing protection, fall protection, and protective communication products.

-

DuPont caters to a number of end-use verticals, including food & beverage, agriculture, electronics & communications, safety & protection, chemicals, packaging & printing, marine, energy, mining, apparel, aerospace, automotive, building & construction, healthcare & medical, government & public sector, and manufacturing & industrial. The company markets its personal protective equipment under various brand names such as Nomex, Kevlar, Tyvek, and Tychem.

Key Asia Pacific Personal Protective Equipment Companies:

- Ansell Limited

- Honeywell International Inc.

- Lakeland Industries Inc.

- DuPont

- 3M

- ALPHAPROTECH

- Mine Safety Appliances (MSA)

- Top Glove Corporation Bhd

- KARAM Safety Pvt. Ltd.

- MALLCOM INDIA LIMITED

- Hartalega Holdings Berhad

- VF Corp.

- Kimberly-Clark Worldwide, Inc.

- W. L. Gore and Associates (U.K.) Limited

Recent Developments

-

In April 2024, Kimberly-Clark announced that it had sold its PPE (personal protective equipment) business, KCPPE, to Australia-based Ansell. This development is expected to aid Ansell in expanding its specialist product portfolio in the clean room and life sciences segment. The KleenGuard and Kimtech brands of KCPPE are included in this acquisition.

-

In May 2024, KARAM Safety, a notable fall protection solutions, and PPE provider announced that it had acquired Midas Safety India, which specializes in hand protection safety solutions. This development is anticipated to aid KARAM Group in expanding its geographical presence and improving its product offerings.

Asia Pacific Personal Protective Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 17.5 billion

Revenue forecast in 2030

USD 30.9 billion

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Growth rate

CAGR of 7.8% from 2024 to 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, country

Country scope

China; India; Japan; South Korea; Indonesia; Australia; Thailand; Malaysia

Key companies profiled

Ansell Limited; Honeywell International Inc.; Lakeland Industries Inc.; DuPont; 3M; ALPHAPROTECH; Mine Safety Appliances (MSA); Top Glove Corporation Bhd; KARAM Safety Pvt. Ltd.; MALLCOM INDIA LIMITED; Hartalega Holdings Berhad; VF Corp.; Kimberly-Clark Worldwide, Inc.; W. L. Gore and Associates (U.K.) Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Personal Protective Equipment Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific personal protective equipment market based on product, end-use, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Head Protection

-

Hard Hats

-

Bump Caps

-

-

Eye Protection

-

Safety Glasses

-

Goggles

-

-

Face Protection

-

Full Face Shields

-

Half Face Shields

-

-

Hearing Protection

-

Earmuffs

-

Earplugs

-

-

Protective Clothing

-

Heat & flame protection

-

Chemical defending

-

Clean room clothing

-

Mechanical protective clothing

-

Limited general use

-

Others

-

-

Respiratory Protection

-

Air-purifying respirator

-

Supplied air respirators

-

-

Protective Footwear

-

Leather

-

Rubber

-

PVC

-

Polyurethane

-

Others

-

-

Fall Protection

-

Soft Goods

-

Hard Goods

-

Others

-

-

Hand Protection

-

Disposable by Type

-

General purpose

-

Chemical handling

-

Sterile gloves

-

Surgical

-

Others

-

-

Disposable by Material

-

Natural Rubber

-

Nitrile

-

Vinyl

-

Neoprene

-

Polyethylene

-

Others

-

-

Durable

-

Mechanical gloves

-

Chemical handling

-

Thermal/flame retardant

-

Others

-

-

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemicals

-

Food

-

Pharmaceuticals

-

Healthcare

-

Transportation

-

Mining

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Australia

-

Thailand

-

Malaysia

-

Frequently Asked Questions About This Report

b. The Asia Pacific personal protective equipment market size was valued at USD 17.5 billion in 2023.

b. The Asia Pacific personal protective equipment market is anticipated to expand at a compound annual growth rate (CAGR) of 7.8% from 2024 to 2030 to reach USD 30.9 billion by 2030

b. China dominated the Asia Pacific PPE market with a share of 33.4% in 2023, owing to the presence of stringent norms concerning occupational health & safety established by regulatory bodies.

b. Some of the key players operating in the Asia Pacific PPE market include Oftenrich Holdings Company Limited, Top Glove Corporation Bhd, Hartalega Holdings Berhad, Kossan Rubber Industries Bhd, Supermax Corporation Berhad, Sempermed USA, Inc., Adventa Health, Logonet Thailand, GB Industries Sdn Bhd, Pangolin Protective Equipment Co., Ltd, North Safety Products, Safetyware Sdn Bhd (Safetyware Group)

b. The key factors that are driving the Asia Pacific personal protective equipment market include rising awareness among industry participants regarding the importance of worker security and safety at workplaces, stringent regulations, rising manufacturing & chemical industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."