Asia Pacific Paint Protection Film Market Size, Share & Trends Analysis Report By Material (Thermoplastic Polyurethane, Polyvinyl Chloride), By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-312-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

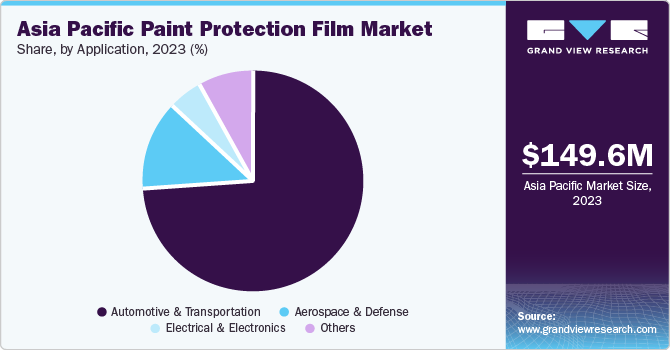

The Asia Pacific paint protection film market size was estimated at USD 149.6 million in 2023 and is projected to grow at a CAGR of 6.4% from 2023 to 2030. The rising automotive sales in emerging economies and the growing middle-class population fuel market expansion. Technological advancements in film materials and application techniques enhance product performance and accessibility, attracting more consumers. Moreover, the popular trend of automotive customization and the preference for high-quality aftermarket products are significant factors propelling the market growth.

The Asia Pacific paint protection film market accounted for a share of 29.9% of the global paint protection film market revenue in 2023. The regulatory landscape in this region significantly impacts the paint protection film market, shaping both challenges and opportunities for industry players. For instance, China's "GB 18581-2020" standard mandates stringent limits on volatile organic compounds (VOCs) in coatings and adhesives, pushing manufacturers to innovate and produce eco-friendly films. Similarly, Japan's Chemical Substances Control Law (CSCL) enforces rigorous screening and assessment of chemical substances, ensuring paint protection products' safety and environmental compatibility.

In India, the Bureau of Indian Standards (BIS) has established specific guidelines for automotive paints and coatings, indirectly influencing the standards for paint protection films used in the automotive sector. In addition, Australia's National Industrial Chemicals Notification and Assessment Scheme (NICNAS) requires detailed evaluation and registration of chemicals used in manufacturing processes, promoting the development of safer, high-performance films. While ensuring consumer safety and environmental protection, these regulations compel manufacturers to invest in research and development, fostering innovation and potentially increasing production costs. Compliance with these standards also enhances product quality and market credibility, driving consumer trust and market growth in the region.

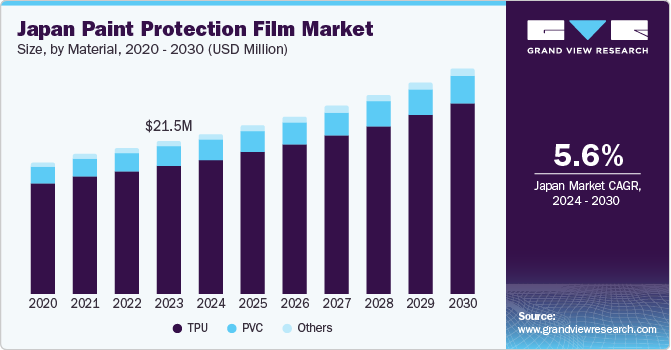

Material Insights

The Thermoplastic Polyurethane (TPU) segment held the largest revenue share of 81.2% in 2023. The segment is also expected to register the fastest CAGR from 2024 to 2030. The segment dominance can be attributed to the TPU’s superior characteristics, such as high elasticity, excellent resistance to abrasion, and exceptional transparency, which make it an ideal choice for automotive applications. The material's self-healing properties, where minor scratches can repair themselves with heat, further enhance its appeal to consumers seeking long-lasting vehicle protection. In addition, TPU's environmental resistance, including its durability against UV radiation and chemical exposure, contributes to its popularity. As a result, manufacturers increasingly focus on TPU-based products, driving innovation and market expansion.

The Polyvinyl Chloride (PVC) segment is projected to witness a CAGR of 6.0% from 2024 to 2030. The segment growth is driven by the cost-effectiveness and ease of application of PVC, making it an attractive option for consumers and manufacturers. While PVC films may not offer the same level of performance as TPU in terms of elasticity and self-healing properties, they provide adequate protection against scratches and minor impacts at a lower price point. This makes PVC a preferred choice for budget-conscious consumers and for applications where extreme durability is not a primary concern. The segment's growth is further supported by continuous improvements in PVC formulations, which enhance its flexibility and resistance to yellowing over time. As economic growth and urbanization in the region drive up automotive sales, the demand for affordable protective solutions like PVC paint protection films is expected to rise, contributing to the segment's steady expansion.

Application Insights

The automotive & transportation segment accounted for a share of 73.8% in 2023. The dominance is driven by the automotive industry in the region, particularly in countries like China, Japan, and India, where vehicle ownership is rapidly increasing. Consumers and manufacturers are recognizing the benefits of paint protection films in preserving vehicles' aesthetic appeal and resale value. The rising popularity of luxury and premium cars, which often come with high-quality exterior finishes, further boosts the demand for advanced protective solutions like paint protection films.

The electrical & electronics segment is expected to grow at a CAGR of 6.1% from 2023 to 2030. The rapid expansion of the consumer electronics market, due to high demand for smartphones, tablets, laptops, and other portable devices, drives the segment growth. As these devices become more integral to daily life, consumers seek effective solutions to protect their investments from scratches, impacts, and wear and tear. Paint protection films provide a reliable means of maintaining the functionality and appearance of electronic gadgets, thereby extending their lifespan. The rapid technological advancements in the electronics industry and consumer demand for high-performance protective solutions are key drivers of this segment's growth. In addition, the rise of smart home devices and IoT applications further accentuates the need for robust protective films.

Country Insights

China Paint Protection Film Market Trends

The paint protection film market in China dominated the market with a share of 49.9% in 2023. China's significant presence in this sector is due to its automotive industry, which annually produces and sells millions of vehicles. These films are widely used to safeguard car exteriors from scratches, stone chips, and environmental damage. In addition, China’s growing middle-class population and rising disposable income levels drive the adoption of premium automotive accessories, including paint protection films. With a strong foothold in the market, China is likely to maintain its leadership position in the coming years.

India Paint Protection Film Market Trends

The India paint protection film market is projected to register the fastest CAGR of 7.0% from 2024 to 2030. The automotive sector in India is expanding rapidly, driven by urbanization, increasing vehicle ownership, and a growing preference for personal mobility. As more Indians invest in cars and motorcycles, the need to protect their vehicles’ paintwork becomes paramount. Paint protection films offer a cost-effective solution to maintain the appearance and resale value of vehicles. Furthermore, India’s rising awareness of vehicle aesthetics, coupled with a surge in luxury car sales, contributes to the segment’s robust growth.

Key Asia Pacific Paint Protection Film Company Insights

Some of the key players operating in the market include 3M, Kimoto, Saint-Gobain and XPEL.

-

Kimoto specializes in high-quality polyurethane films used in various industries, including automotive paint protection

-

Xpel offers a comprehensive line of high-performance films for various applications, catering to the growing demand in the APAC region

Key Asia Pacific Paint Protection Film Companies:

- 3M

- Saint-Gobain

- Eastman Chemical Company

- XPEL, Inc.

- HEXIS S.A.S.

- Avery Dennison Corporation

- STEK India

- Reflek Technologies Corporation

- Kimoto

- CPFilms

- Hexis

- Turtle Wax

Recent Developments

-

In February 2023, Eastman Chemical Company acquired Ai-Red Technology (Dalian) Co., Ltd., to reinforce its position as a specialty materials provider while expanding its service network in China and the Asia Pacific region

-

In April 2024, Nippon Paint introduced Mastercraft, its new brand for premium automotive body and paint repair services encompassing everything from same-day velocity repairs to advanced paint protection and detailing

-

In May 2024, Turtle Wax, Inc. commemorated five years of operations in India by introducing their innovative Smart Shield Paint Protection Film (PPF). This product claims self-healing properties for exceptional UV resistance and scratch protection on OEM-painted surfaces

Asia Pacific Paint Protection Film Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 233.4 million |

|

Growth rate |

CAGR of 6.4% from 2024 to 2030 |

|

Base year for estimation |

2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, volume in million square meters, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors, trends |

|

Segments covered |

Material, application, country |

|

Key companies profiled |

3M; Saint-Gobain; Eastman Chemical Company; XPEL, Inc.; HEXIS S.A.S.; Avery Dennison Corp.; STEK India; Reflek Technologies Corp.; Kimoto; CPFilms; Hexis; Turtle Wax |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Asia Pacific Paint Protection Film Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific paint protection film market report based on material, application, and country:

-

Material Outlook (Volume, Thousand Sq. Meters; Revenue, USD Million, 2018 - 2030)

-

Thermoplastic Polyurethane (TPU)

-

Polyvinyl chloride (PVC)

-

Others

-

-

Application Outlook (Volume, Thousand Sq. Meters; Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Electrical & Electronics

-

Aerospace & Defense

-

Others

-

-

Country Outlook (Volume, Thousand Sq. Meters; Revenue, USD Million, 2018 - 2030)

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Indonesia

-

Malaysia

-

Thailand

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."