- Home

- »

- Pharmaceuticals

- »

-

Asia Pacific Ophthalmic Drugs Market, Industry Report, 2030GVR Report cover

![Asia Pacific Ophthalmic Drugs Market Size, Share & Trends Report]()

Asia Pacific Ophthalmic Drugs Market Size, Share & Trends Analysis Report By Drug Class, By Disease, By Dosage Form, By Route Of Administration, By Product Type, By Product, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-313-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Asia Pacific Ophthalmic Drugs Market Trends

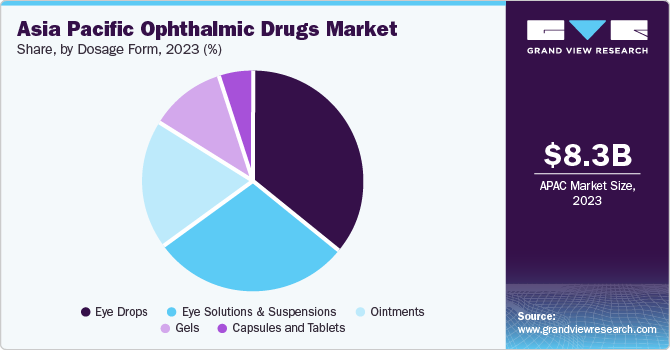

The Asia Pacific ophthalmic drugs market size was estimated at USD 8.3 billion in 2023 and is anticipated to grow at a CAGR of 10.0% from 2024 to 2030. The rising awareness regarding ophthalmic disorders is poised to drive industry growth in the coming years. Around 66.0% of the regional population lives with vision impairment or blindness, significantly deteriorating the quality of life. As a result, several pharmaceutical companies have realized the urgent need to introduce economical and effective medications to tackle these issues and other ocular disorders. The development of novel technologies across medical and research institutes in fast-growing economies, such as India and China, is poised to expedite the development of healthcare facilities in Asia Pacific.

The Asia Pacific market for ophthalmic drugs accounted for a revenue share of 21.9% in the global ophthalmic drug market in 2023. Asia Pacific consists of a blend of rapidly developing and developed economies. Increasing healthcare expenditure in the region is anticipated to be a major factor fuelling market expansion. The rising geriatric population and increased awareness concerning common conditions, such as dry eye syndrome, are expected to fuel the demand for ophthalmic drugs. Moreover, the availability of key players, such as Otsuka Pharmaceutical, Santen Pharmaceutical, Dr. Reddy’s Laboratories, and Arctic Vision, is expected to contribute to industry advancement. Indian companies, such as Sun Pharmaceutical, are strengthening their presence in the market with new products, such as CEQUA.

The presence of an established regulatory framework and reimbursement policies across economies is expected to significantly impact market expansion. For instance, Japan’s Ministry of Health, Labour and Welfare (MHLW) and the Pharmaceutical and Medical Device Agency (PMDA) govern drug applications, clinical trials, and approval of new drugs. The PMDA submits, recommends, and forwards applications to the MHLW for approval. The country has a universal insurance system that works under the Health Insurance Act of 1961. Public insurance covers all public healthcare costs, and citizens have free access to all healthcare providers. The prices of drugs and devices are regulated by the National Health Insurance (NHI) Drug Pricing Standard.

Drug Class Insights

The anti-VEGF agent segment emerged with a leading revenue share of 32.9% in 2023. These agents can effectively address critical retinal disorders, such as retinal vein occlusion, age-related macular edema, and diabetic retinopathy. They are utilized as an innovative therapy to slow down the progression of diabetic macular edema, wet AMD, and macular edema secondary to retinal vein occlusion (RVO). The introduction of differentiation therapies on account of their novel action mechanisms has also proved to be a major factor aiding market advancement.

Meanwhile, the gene & cell therapy segment is projected to advance at the fastest CAGR of 15.4% over the forecast period. The area of gene therapy has witnessed heavy investments in recent years, as it is considered to effectively address Inherited Retinal Disorders, including Leber congenital amaurosis, achromatopsia, Stargardt disease, and retinitis pigmentosa through the delivery of functional copies of the faulty gene into retinal cells to restore their functioning. On the other hand, cell-based therapies entail the transplantation of retinal cells or stem cell-derived retinal cells into the eye to replace dysfunctional or damaged cells.

Understanding the potential of this drug class, leading organizations in Asia Pacific are investing heavily in developing novel gene therapies. For instance, in September 2023, Otsuka Pharmaceutical and Shape Therapeutics announced a multi-target collaboration concerning the development of adeno-associated viruses (AAVs) delivered intravitreally for ocular disorders, with options to include additional targets and tissue types. Shape Therapeutics is a programmable medicine organization that leverages AI and RNA to combat genetic conditions.

Disease Insights

The retinal disorders segment held the largest revenue share of 30.4% in 2023. Disorders, such as AMD, diabetic retinopathy, and retinitis pigmentosa, have become commonly prevalent in the region in recent years, with a sharp rise in the aging population. Furthermore, the emergence of other disorders, such as inherited retinal dystrophies, choroideremia, Best Vitelliform Macular Dystrophy, and X-linked retinoschisis, is anticipated to increase the sales of ophthalmic drugs in this region. Macular degeneration significantly contributes to the segment’s expansion, as older people are at high risk of contracting this condition. The growing prevalence of diabetes in major regional economies, resulting in an increased risk of diabetic retinopathy, is expected to strengthen demand for medications further. For instance, as per estimates published in the BMJ Open Ophthalmology, by 2040, there will be around 123 million cases of diabetes in India, owing to changing lifestyles and dietary habits.

The dry eye disease segment is projected to advance at a substantial CAGR over the forecast period. Dry eye syndrome (DES) is a common ophthalmic disease reported across the region, whose risk of occurrence increases with age, which has accelerated the demand for effective & efficient therapeutic options. In addition, the high occurrence rate of diabetes mellitus, a major risk factor associated with DES, is anticipated to boost the demand for ophthalmic drugs in the region. In recent years, companies have invested heavily in developing products that can adequately address this condition. For instance, in November 2022, in Japan, Santen Pharmaceutical launched its DIQUAS LX ophthalmic solution to treat patients with dry eye disease.

Route of Administration Insights

The topical administration segmentation held the largest revenue share in 2023. This drug administration route is extensively utilized as it offers advantages, such as a high patient compliance rate, non-invasiveness, and ease of self-administration. The widespread availability of several drugs by major manufacturers that can be effectively and conveniently delivered through the topical mode is anticipated to act as a major industry driver. The topical route of drug administration allows therapeutic agents to enter the action site directly, leading to high bioavailability. Pharmaceutical companies have focused on technological innovations to increase topical drug delivery efficiency ensuring maximum corneal drug absorption and minimal pre-corneal drug loss.

The local ocular segment is anticipated to witness substantial growth during the projection period. The segment is further classified into sub-conjunctival, intravitreal, retrobulbar, and intracameral. Out of these, the intravitreal mode significantly contributes to the regional revenue in this segment, as this is a highly efficient method for delivering drugs into the posterior segment of the eye. IVT delivers therapeutic systems, such as suspensions, solutions, and depot formulations, directly inside the vitreous humor via pars plana. The major advantage of this targeted drug delivery is that it allows administering high drug concentration to the retina and vitreous with an increased and immediate therapeutic effect on the intended tissue. Anti-VEGF antibodies are frequently administered via the intravitreal route and used to treat neovascular AMD.

Product Type Insights

The prescription drugs segment held a dominant revenue share in 2023. These products are generally preferred over their OTC counterparts and are indicated to address ocular disorders resulting from bacteria & viruses, as well as conditions such as retinal disorders, dry eye syndrome, and glaucoma. Notable prescription drugs include Lotemax gel/ointment, Zylet, BEPREVE, Durezol, and artificial tears. BEPREVE is noted as an antihistamine and is indicated to treat allergic conjunctivitis in patients. Drug makers are also developing prescription products that utilize lubricating and moisturizing agents to improve tear secretion temporarily.

The OTC product segment is projected to experience a substantial growth rate from 2024 to 2030. The increasing availability of generic products on account of the expiration of patent exclusivity faced regularly by major drugs is poised to act as a significant market driver. OTC drugs can be purchased commercially in various dosage forms, including emulsions, gels, eye drops, capsules, and ointments.

Product Insights

The branded drugs segment held a larger share of the regional market revenue in 2023 owing to the exclusivity of branded medications, along with their high cost, and an extensive regional presence of pharmaceutical companies. In addition, the increasing approval rate for novel forms of therapy, such as anti-VEGF, cell & gene therapies, and biologics, is anticipated to shape this industry segment positively. Ophthalmic pharmaceutical companies are pivoting heavily towards strategic initiatives, such as acquisitions and collaborations, to improve and strengthen their pipeline with innovative & advanced clinical-stage candidates.

The generic segment is expected to witness the fastest growth rate over the forecast period. The easy availability of generic variants of branded ophthalmic drugs, and their significantly lower prices, remain a primary factor driving segment demand in the region. Generics and branded drugs are very similar in parameters, such as route of administration, performance characteristics, safety, strength, dosage form, and quality. However, branded medications face constant patent expiration risks, providing an opportunity for generics manufacturers to launch their products on a large scale.

Dosage Form Insights

The eye drop dosage form segment held the largest revenue share in 2023. The rising prevalence of common retinal disorders and the need to provide cost-effective medications have been the primary factors boosting eye drop sales. These products are economical, easy to use, and indicated for several ocular diseases. Furthermore, manufacturers are increasing the pace of development of innovative eye drop medications to address the emerging challenge of rare eye disorders that can significantly impact patients’ lives. In May 2022, Zhaoke Ophthalmology and Visus Therapeutics announced a licensing agreement to develop and commercialize Carbachol PF and BRIMOCHOL PF eye drops in South Korea and Greater China, as well as select Southeast Asian regions.

The eye solutions & suspensions segment is poised to contribute substantially to the market growth during the forecast period. There has been a steady rise in the occurrence of ocular conditions such as dry eye disease and AMD among the regional population, particularly in the elderly demographic, which has highlighted the importance of this form of drug delivery. Commonly available eye solutions such as Neosporin, Moxeza, and Ocuflox allow drugs to be directly delivered to the site of action, offering a significant clinical advantage. In addition, the development and implementation of advanced technologies for drug delivery to enable improvements in physicochemical stability & bioavailability are anticipated to drive market expansion in the coming years.

Country Insights

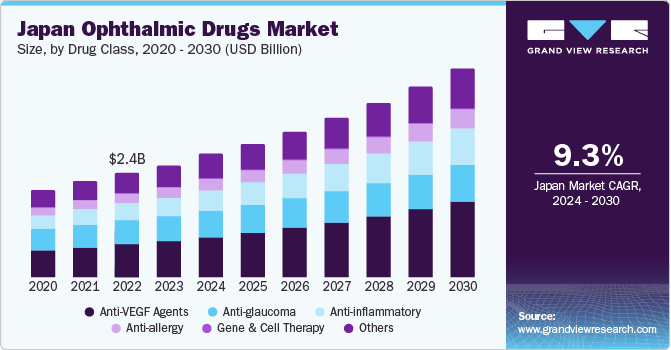

Japan Ophthalmic Drugs Market Trends

The ophthalmic drugs market in Japan accounted for a leading revenue share of 28.7% in Asia Pacific in 2023. In Japan, there is a rising prevalence of several types of eye-related diseases, driving the demand for cost-effective treatments. According to a November 2020 article in the Clinical Epidemiology journal, 12.4% of the population studied in Japan had glaucoma, while 2.4% had preperimetric glaucoma. Besides these, macular degeneration (1.2%), diabetic retinopathy (1.0%), chorioretinal atrophy (0.5%), branch retinal vein blockage (0.7%), macular epiretinal membrane (2.9%), and other retinal disorders (2.0%) were also quite common in the countrywide population. Moreover, the high geriatric population in the economy significantly contributes to market growth. According to the most recent national data, over 10% of the country’s population is aged 80 years or older, while over 29% are aged 65 years and above. This demographic is highly susceptible to ocular disorders, leading to a strong demand for ophthalmic drugs to address these challenges.

Indonesia Ophthalmic Drugs Market Trends

The Indonesia ophthalmic drugs marketis anticipated to witness the fastest growth rate of 11.8% during the forecast period. A steady rise in the aging population, as well as extensive prevalence of blindness and severe vision impairment, are factors driving the demand for advanced medications. The rising prevalence of retinal disorders and lack of knowledge concerning their timely diagnosis and treatment are fuelling the need for the development of novel therapeutics in Indonesia. The pharmaceutical market in the economy is the largest in Southeast Asia. However, 90% of raw materials used to manufacture medicines are still imported. Consequently, the need for more awareness is propelling public and private organizations to initiate research programs to educate stakeholders and improve the therapeutics ecosystem in the country.

India Ophthalmic Drugs Market Trends

The ophthalmic drugs market in India is steadily growing on account of the increasing aging population in the economy, which has resulted in the rising prevalenceof ocular disorders. According to an article published in the Indian Journal ofOphthalmology in October 2023, age-related macular degeneration (AMD) isexpected to impact 1.4-3.1% of the country’s population in the coming years,resulting in an expected economic burden of over USD 1.5 billion per year.Glaucoma is another widespread disorder in India, with the number of people livingwith this condition estimated to be around 12 million; moreover, it is stated to beresponsible for 12.8% of the overall blindness cases in the country. As a result, thereis a significant scope for generic and branded ophthalmicdrug manufacturers to enter this market, to effectively address such conditions. InMarch 2024, Roche launched Vabysmo (faricimab), which has been indicated totreat neovascular or “wet” or neovascular age-related macular degeneration (nAMD) and diabeticmacular edema (DME).

Key Asia Pacific Ophthalmic Drugs Company Insights

Leading companies involved in the development of ophthalmic drugs in the Asia Pacific region include Pfizer, Santen Pharmaceutical, Bayer AG, and Arctic Vision, among others.

-

Santen Pharmaceutical is engaged in the R&D of ophthalmic and other pharmaceutical products. Its portfolio includes products for conjunctival epithelial & corneal disorders, rheumatism, ocular hypertension & glaucoma, allergy, and uveal & retinal disorders, as well as OTC products & medical devices, such as intraocular lenses. The company has a collaboration agreement with the Foundation for Biomedical Research and Innovation at Kobe and RIKEN to identify new drug candidates for diseases such as AMD & retinitis pigmentosa

-

Arctic Vision, headquartered in Hong Kong, is extensively involved in the identification and development of innovative therapies for treating various ophthalmic conditions, such as diabetic retinopathy, dry eye disease, and AMD. The company has a robust pipeline of ophthalmic therapies in different clinical development stages, including both small-molecule drugs and biologics that address a range of ocular diseases. Notable programs include ARVN601 for glaucoma, ARVN 602 & 603 for Inherited Retinal Degeneration, ARVN701 for dry eye disease, and ARVN003 for presbyopia

Key Asia Pacific Ophthalmic Drugs Companies:

- AbbVie Inc.

- Merck & Co., Inc.

- Alcon

- Pfizer Inc.

- Novartis AG

- Bayer AG

- Lupin

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Santen Pharmaceutical Co., Ltd.

- Zhaoke Ophthalmology

- Arctic Vision Hong Kong Biotech Ltd.

Recent Developments

-

In May 2024, in Japan, Santen Pharmaceutical and Mitsubishi Tanabe Pharma Corporation announced the launch of Alesion Eyelid Cream 0.5% (epinastine hydrochloride), indicated for allergic conjunctivitis. The product is the first of its kind cream-type allergic conjunctivitis medication that needs to be administered once daily to the lower and upper eyelids

-

In January 2024, Zhaoke Ophthalmology announced that Zhaoke (Hong Kong) Ophthalmology Pharmaceutical Ltd., its wholly-owned subsidiary, had entered into a supply and distribution agreement for ‘BRIMOCHOL PF’ with Kwangdong Pharmaceutical, a Korea-based company involved in the manufacturing and distribution of pharmaceutical solutions. BRIMOCHOL PF has been developed in partnership with the U.S.-based clinical-stage pharma company Visus Therapeutics and is a potential treatment to correct near vision loss due to presbyopia

-

In June 2023, Arctic Vision announced that Australia’s Therapeutic Goods Administration (TGA) formally accepted the company’s new drug application (NDA) for ‘Arcatus’ to treat Uveitic Macular Edema (UME). The medication is a triamcinolone acetonide suprachoroidal injectable suspension that leverages the innovative Suprachoroidal Space Microinjection therapy, which was the first approved therapy globally for treating UME

Asia Pacific Ophthalmic Drugs Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 16.1 billion

Growth rate

CAGR of 10.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Drug class, disease, dosage form, route of administration, product type, product, country

Country scope

Japan; China; India; Australia; South Korea; Thailand; Indonesia

Key companies profiled

AbbVie Inc.; Merck & Co., Inc.; Alcon; Pfizer Inc.; Novartis AG; Bayer AG; Lupin; Sun Pharmaceutical Industries Ltd.; Dr. Reddy’s Laboratories Ltd.; Santen Pharmaceutical Co., Ltd.; Zhaoke Ophthalmology; Arctic Vision Hong Kong Biotech Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Ophthalmic Drugs Market Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific ophthalmic drugs market report based on drug class, disease, dosage form, route of administration, product type, product, and country:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Anti-allergy

-

Anti-inflammatory

-

Non-steroidal drugs

-

Steroidal drugs

-

-

Anti-VEGF Agents

-

Anti-glaucoma

-

Gene & Cell Therapy

-

Others

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry Eye

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Allergies

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Glaucoma

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Eye Infection

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Retinal Disorders

-

Retinal Disorder Treatment Market, By Type

-

Macular Degeneration

-

Diabetic Retinopathy

-

Others

-

-

Retinal Disorder Treatment Market, By Dosage Type

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

-

Uveitis

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Others

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical

-

Local Ocular

-

Subconjunctival

-

Intravitreal

-

Retrobulbar

-

Intracameral

-

-

Systemic

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription Drugs

-

OTC

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Branded Drugs

-

Generic Drugs

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Indonesia

-

Thailand

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."