- Home

- »

- Clinical Diagnostics

- »

-

APAC Oncology Based Molecular Diagnostics Market, 2030GVR Report cover

![Asia Pacific Oncology Based Molecular Diagnostics Market Size, Share & Trends Report]()

Asia Pacific Oncology Based Molecular Diagnostics Market Size, Share & Trends Analysis Report By Type (Breast Cancer, Lung Cancer), By Product (Instruments, Reagents), By Technology, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-201-5

- Number of Report Pages: 131

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The Asia Pacific oncology based molecular diagnostic market size was estimated at USD 605.42 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 15.07% from 2024 to 2030. The rising prevalence of various types of cancer, such as breast, prostate, and colon, along with the increase in geriatric population, advancement in technology, rising necessity of point-of-care testing (POCT), and growth in biomarker identification systems, are predicted to be the major drivers for the market. In addition, the increase in demand for precise and quick diagnosis, coupled with advancements in Next Generation Sequencing (NSG) techniques, and increased awareness of personalized medications are also major market boosters.

In the year 2020, Asia accounted for 45% of the worldwide total of 2.3 million breast cancer cases and more than 50% of all cervical cancer cases. Furthermore, every country in the region is experiencing an increase in breast cancer deaths. It’s projected that by 2025, countries like Indonesia and the Philippines will see a nearly 20% increase in breast cancer mortality compared to 2020. The National Cancer Institute reports approximately 439.2 new cases and 163.5 deaths per 100,000 people annually. Thus, molecular diagnostics provide insights into the biology of a patient’s tumor and are crucial in cancer management. Furthermore, the demand for home healthcare and other medical establishments is increasing due to an aging population and government initiatives to reduce hospital stays, which is expected to boost the demand for point-of-care diagnostics. Significant growth opportunities exist in over-the-counter and rapid diagnostic product segments, particularly in Asian countries with rapid economic growth.

Minimally invasive diagnostic procedures are becoming more popular as they offer quicker recovery times compared to invasive procedures. These procedures, including needle-based blood tests, biomarker tests, and biopsies, allow for the screening of tumors before complex surgical procedures. They aid in accurate cancer diagnosis, help physicians determine the best treatment plan, and minimize patient discomfort. Technological advancements leading to accurate results, portability, and cost-effectiveness are expected to drive this market. For tumor diagnosis, companies like Sigma Aldrich Corporation and Qiagen are developing new molecular diagnostic techniques, such as Loop-Mediated Isothermal Amplification (LAMP) and Transcription-Mediated Amplification (TMA). For instance, Sigma Aldrich Corporation is engaged in advancing the principles and applications of diagnostic molecular microbiology. Their focus lies on state-of-the-art methods such as nucleic acid probes and in vitro amplification, which are utilized for pathogen identification.

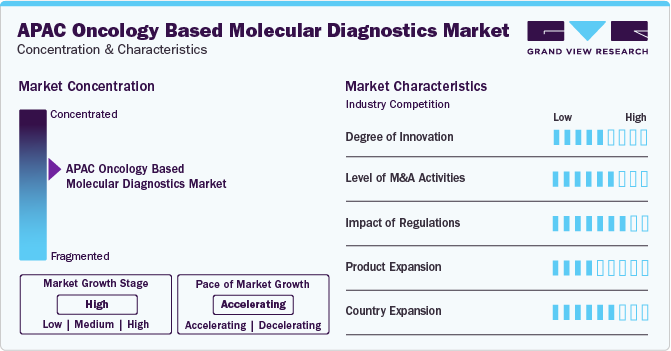

Market Characteristics & Concentration

The market growth is accelerating and is characterized by a high degree of innovation, owing to the introduction of novel tests using PCR, NGS, and other molecular diagnostic techniques for different healthcare conditions. The market is witnessing substantial advancements with the emergence of liquid biopsies. These are alternative or supplementary tools for cancer detection and tracking. Liquid biopsies examine circulating tumor DNA (ctDNA) or cells (ctC) in the blood to identify cancer-related mutations or biomarkers. This non-invasive method has several benefits over conventional tissue biopsies, including less risk, comfort, and cost. It also allows for real-time tracking of disease development and treatment response. The increasing use of liquid biopsies is anticipated to fuel the expansion of the market in future.

The market is also characterized by a high level of mergers and acquisitions that have been active by leading market players in recent years. For instance, in April 2023, Quest Diagnostics Incorporated acquired the MRD Platform of Haystack Oncology, a circulating tumor DNA-based technology for early detection of cancer and personalized medicine. Moreover, in January 2024, Roche Holding AG announced its intention to acquire LumiraDx's diagnostics technology platform for USD 295 million. The acquisition is expected to strengthen Roche’s position in the point-of-care diagnostics market.

Stringent regulatory requirements for the approval of new molecular diagnostic techniques can hinder market growth. While regulations are well-established in the West, in Asia Pacific, they are evolving. Only Japan and Australia have currently established detailed registration regulations for companion diagnostics (CDx). Moreover, the unavailability of skilled professionals and stringent government regulations for product approvals hinder market growth. However, it's important to note that these regulations are in place to ensure the safety and efficacy of new diagnostic techniques. Despite these challenges, the market is still projected to grow, indicating that the benefits of advancements in this field are seen to outweigh the regulatory hurdles.

Factors like rising cancer rates, increasing expenditure and growing awareness of personalized medicines are now leading the market players to implement new products. Developing non-invasive blood tests for monitoring cancer, thus offering less invasive alternative tissue biopsies, and offering comprehensive genomic profiling of tumors for identifying actionable mutation and guiding treatment decisions are some of the major initiatives taken by market players. For instance, MGI has partnered with the National Cancer Centre Singapore to profile the somatic genomic landscape of selected Asian-prevalent cancers, such as head and neck, ovary, breast, stomach, colon, as well as Asian angiosarcomas, lymphoma, rare cancers, fibroepithelial tumors, and several tumor cell-lines.

The high growth potential due to large population and increasing healthcare expenditure has propelled market investment. Moreover, rise in patient registrations and cost-effective solutions tailored to local needs in countries like China and India has increased the market accessibility for major participants. Furthermore, establishing local manufacturing facilities can reduce costs, improve supply chain efficiency, and cater to specific regional requirements. For instance, Danaher Corporation has been making strategic shifts to leverage the platform-as-a-service business model. It has also completed close to 30 transactions in China, focusing on digitalization, molecular diagnostics, bioprocessing, and bioproduction.

Type Insights

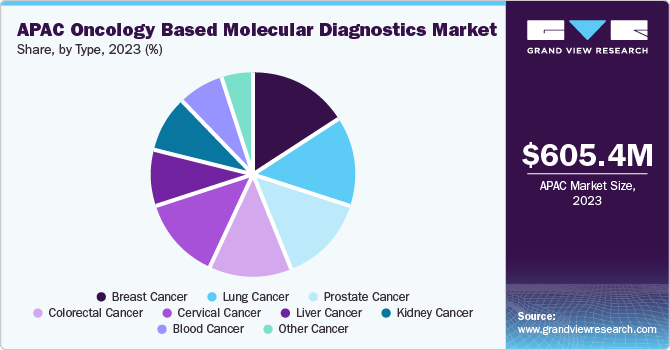

The main types of cancer studied under this segment include breast cancer, prostate cancer, colorectal cancer, cervical cancer, liver cancer, lung cancer, blood cancer, and kidney cancer, among others. Of these, breast cancer dominated the overall market in 2023 in terms of revenue share due to large test volumes and an extensive portfolio of commercialized products. For instance, a consensus was reached at the ESMO Asia Congress 2023 on practical gaps in genetic counselling and testing, risk assessment, and management of germline BRCA mutations (gBRCAm)-associated breast cancer (BC) in the Asia-Pacific region.

On the other hand, liver cancer and prostate cancer diagnostics markets are also estimated to witness significant growth, in addition to colorectal cancer, due to rising prevalence and increasing awareness levels among consumers. Broad avenues mark oncology-based molecular diagnostics for the development of diagnostic technology at molecular levels in personalized medicine for medication and new drug discovery.

Technology Insights

The polymerase chain reaction (PCR) technology segment held the highest revenue share of 31.05% in 2023. This can be attributed to its growing utilization in research labs and the increased need for enhanced diagnostics. The industry is segmented based on technology into seven major types, which include polymerase chain reaction (PCR), In Situ Hybridization, Isothermal Nucleic Acid Amplification Technology (INAAT), Chips and microarrays, Mass Spectrometry, Sequencing, and Transcription Mediated Amplification.

The sequencing segment is anticipated to witness a significant growth rate of YY.Y% during the forecast period. The growth in demand for sequencing technology is augmented by an increase in research and development expenditure and the widespread use of sequencing technologies in clinical diagnosis, which is anticipated to provide a favorable environment for market expansion during the forecast period, due to its benefits such as quick turnaround times and speedier processing.

Product Insights

The reagents segment held the highest share of 58.51% of the overall revenue in 2023. This can be attributed to the high-volume usage of reagents for conducting tests and diagnostics in cancer research. The expansion in the field of molecular biology technology, progress in biotechnology advancements, rising demand for synthetic biology, and increasing investment in research and development by biotechnology companies are the main factors fueling the rapid growth of this industry segment.

The reagents segment is also anticipated to expand at a significant CAGR over the forecast period. The CE-IVD marked PD-L1 IHC 22C3 pharmDx assay from Agilent Technologies, Inc. was made available for esophageal cancer patients in August 2021. Using a cumulative positive score, this assay was employed to help identify individuals with esophageal cancer who would benefit from KEYTRUDA therapies.

Country Insights

Japan oncology based molecular diagnostics market accounted for the largest revenue share of 40.54% in 2023. High diagnosis rate and management of the disease is one of the major factors responsible for market growth in Japan. Japan’s population is 127 million and the proportion of the geriatric population is increasing rapidly, wherein the life expectancy rate is above 80 years and the per capita income is high. According to Japan’s Ministry of Health, Labor and Welfare, cancer is the major cause of death in Japan, contributing to around 30% of the total deaths. Aging has become a substantial risk factor for numerous diseases including cancer. The process of becoming older is a complex situation influenced by the interaction of several environmental and genetic factors. These factors are accelerating the growth in this region. Key market drivers in this region are increasing prevalence of cancer, growing awareness about genetic testing, and rising geriatric population.

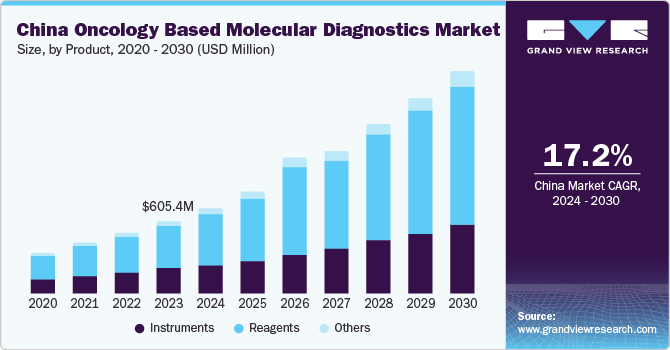

China Oncology Based Molecular Diagnostics Market Trends

The oncology based molecular diagnostics market in China is growing lucratively over the forecast period. The universal healthcare system is the primary form of Chinese healthcare, which consists of basic medical insurance, serious illness aid, urban & rural medical assistance, and critical illness insurance. This is one of the initiatives undertaken by the government to increase access to healthcare. Rising government initiatives and huge unmet clinical needs are some of the factors expected to drive the market over the forecast period.

India Oncology Based Molecular Diagnostics Market Trends

The oncology based molecular diagnostics market in China is expanding significantly over the coming years. According to data published by WHO, it has been estimated that incidence of cancer in India is very high with an alarming mortality rate, i.e., about 806,000 existing cases and mortality of about 0.3 million deaths per year due to lack of availability of diagnosis and treatment options. In addition, there are internal as well as external factors that can be attributed to the high incidence rate—internal factors like (genetic, mutations, hormonal, poor immune conditions, etc.) and external factors such as (unhealthy food habits, industrialization, overgrowth of population, social, and more). These factors are key drivers of the market and contribute to the improving economic status of this nation. This factor coupled with high demand for better diagnosis and preventive medicine is expected to boost the oncology-based molecular diagnostics market growth.

Key Asia Pacific Oncology Based Molecular Diagnostics Company Insights

The development of new products by key players has also resulted in the expansion of their existing product portfolio. Market players are constantly striving to innovate and improve their products. This involves investing in research & development to create products that are more efficient, effective, or cater to a wider range of customer needs. The launch of these new and improved products enhances their companies and attracts more customers. In addition to product innovation, market players are also engaging in strategic mergers and acquisitions. This strategy allows them to expand their market presence by gaining access to new markets, customer bases, and technologies that were previously inaccessible. This can also lead to cost efficiencies through economies of scale and scope, further enhancing their market position.n

Key Asia Pacific Oncology Based Molecular Diagnostics Companies:

The following are the leading companies in the Asia Pacific oncology based molecular diagnostics market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these Asia Pacific oncology based molecular diagnostics companies are analyzed to map the supply network.

- Abbott Laboratories

- Agilent Technologies, Inc

- bioMerieux SA

- Danaher Corporation

- F. Hoffmann-La Roche Ltd.

- Illumina

- Novartis AG

- Qiagen NV

- Siemens Healthineers AG

- TBG Diagnostics Limited

- Thermo Fisher Scientific Inc

- Sysmex Corporatio

Recent Developments

-

In September 2023, Agilent Technologies, Inc. entered into research agreement with National Cancer Centre Singapore (NCCS) with an aim to accelerate translational cancer research on genomic landscape of cancers prevalent in Asian countries.

-

In April 2023, Novartis AG extended its collaboration with laboratories in Malaysia to enhance access to PIK3CA testing to extend the early diagnosis and intervention on breast cancer (aBC) to improve patient’s quality of life.

Asia Pacific Oncology Based Molecular Diagnostics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.63 billion

Growth rate

CAGR of 15.07% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, product, country

Country scope

Japan; China; India; Australia; New Zealand

Key companies profiled

Abbott Laboratories; Agilent Technologies Inc; bioMerieuz SA; Danaher; F. Hoffmann-La Roche Ltd.; Illumina Inc; Novartis AG; Qiagen NV; Siemens Healthineers AG; TBG Diagnostics Limited; Thermo Fisher Scientific Inc; Sysmex

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Oncology Based Molecular Diagnostics Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific oncology based molecular diagnostics market report based on type, technology, product, and country.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast Cancer

-

Prostate Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Liver Cancer

-

Lung Cancer

-

Blood Cancer

-

Kidney Cancer

-

Other Cancer

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

PCR

-

In Situ Hybridization

-

INAAT

-

Chips and Microarrays

-

Mass Spectrometry

-

Sequencing

-

TMA

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

New Zealand

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific oncology based molecular diagnostic market is estimated at USD 605.42 million in 2023 and is expected to reach USD 702.0 million in 2024.

b. The Asia Pacific oncology based molecular diagnostic market is expected to grow at a CAGR of 15.07% from 2024 to 2030 to reach USD 1.63 billion in 2030.

b. Breast cancer dominated the overall market in 2023 in terms of revenue share due to large test volumes and an extensive portfolio of commercialized products.

b. Some of the key players in the Asia Pacific oncology based molecular diagnostic market include Abbott Laboratories, Agilent Technologies, Inc, bioMerieux SA, Danaher Corporation, F. Hoffmann-La Roche Ltd., Illumina, Novartis AG, Qiagen NV, Siemens Healthineers AG, TBG Diagnostics Limited, Thermo Fisher Scientific Inc, Sysmex Corporation.

b. The rising prevalence of various types of cancer, such as breast, prostate, and colon, along with the increase in geriatric population, advancement in technology, rising necessity of point-of-care testing (POCT), and growth in biomarker identification systems, are predicted to be the major drivers for the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."