- Home

- »

- Renewable Energy

- »

-

Asia Pacific Oleochemicals Market Size, Share, Report 2030GVR Report cover

![Asia Pacific Oleochemicals Market Size, Share & Trends Report]()

Asia Pacific Oleochemicals Market Size, Share & Trends Analysis Report By Product (Specialty Esters, Fatty Amines), By Application (Personal Care & Cosmetics, Consumer Goods, Healthcare & Pharmaceuticals), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-321-0

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Asia Pacific Oleochemicals Market Trends

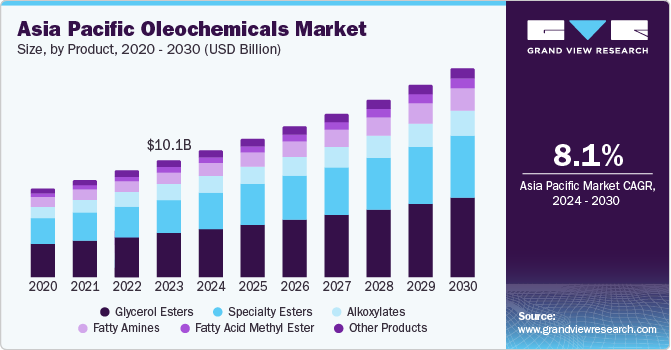

The Asia Pacific oleochemicals market size was estimated at USD 10.1 billion in 2023 and is anticipated to grow at a CAGR of 8.1% from 2024 to 2030. This growth is attributed to a large number of manufacturers in the region, particularly in Malaysia and Indonesia, which are abundant in raw materials, such as palm oil and palm kernel oil. In addition, rapid industrialization and a growing manufacturing sector in emerging markets, such as China and India, contribute to market growth. Furthermore, the importance of bio-based products, particularly biofuel, is also expected to drive market growth.

The Asia Pacific oleochemicals marketaccounted for a share of 41.4% of the global oleochemical market revenue. Oleochemicals are generated from the natural fats and oils in plants and animals. Usually, the triglyceride structure of oils and fats is broken down into glycerol and fatty acids to produce these compounds. Among the often utilized oleochemicals are fatty acids, fatty alcohols, and glycerol. These substances are used in different industries, such as biofuels, electronics, mining, and wax. The APAC regional market is projected to expand due to the rising costs of petrochemical goods and the growing demand for bio-based, renewable, and sustainable chemicals across various industries, including food and beverage, pharmaceutical, personal care, and cosmetics.

In addition, other factors influencing the market include the use of oleochemicals in the form of fatty acids for the manufacture of pharmaceuticals, soaps, surfactants, detergents, varnishes, and lubricants and initiatives to replace chemically derived products with bio-based chemicals to reduce the time and expense associated with reformulation and re-equipment. The market is expected to face growth challenges due to fluctuations in raw material pricing and the easy availability of raw materials in developing nations over the forecast period.

Product Insights

The glycerol esters segment dominated the market and accounted for the largest revenue share of 36.8% in 2023. This growth is attributed to the growing demand from the cosmetics and personal care sectors. In addition, the segment's growth is further aided by the region's strong production of raw materials, especially palm oil. Furthermore, the availability of raw resources and the acceptance of green alternatives also drive the segment growth.

The fatty acid methyl ester segment is expected to grow at a CAGR of 9.7% from 2024 to 2030 owing to the growing demand for biodiesel, increasing environmental awareness, and government support through tax incentives and rebates. Furthermore, the region's growing industrial base and increasing use of fatty acid methyl esters in lubricants, coatings, and food & agriculture applications contribute to market's growth.

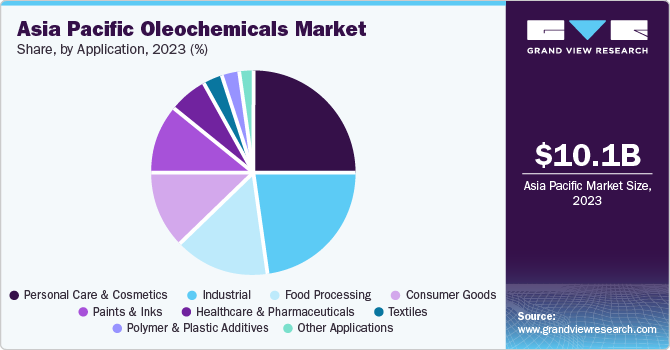

Application Insights

The personal care & cosmetics application segment led the market and accounted for the largest market share of 24.9% in 2023. This growth is attributed to the rising need for goods with uses, especially in the skincare and hair care industries. In addition, the growing trend of clean beauty and sustainability and the increasing awareness of the advantages of natural and organic products contributed to segment growth. The demand for personal care and cosmetics items is further driven by the growing middle-class population and rising disposable income levels of consumers in nations such as China and India.

The industrial segment is expected to grow at a CAGR of 8.7% from 2024 to 2030 owing to the rising demand for oleochemicals in various industries, such as polymers, pharmaceuticals, and food & beverages. In addition, the increasing implementation of bio-based thickeners, stabilizers, and other food additives in the food industry contributes to segment growth. Furthermore, the growing awareness of the environmental benefits and cost-effectiveness of oleochemicals is driving their adoption in various industrial applications, supporting segment growth.

Country Insights

China Oleochemical Market Trends

The oleochemicals market in China dominated the market and accounted for the largest revenue share of 21.3% in 2023. This growth is attributed to the rising demand for end-use products like medicines, cosmetics, and home cleansers. In addition, the demand for products is further fueled by China's growing manufacturing sector, rising captive consumption, and easy access to raw materials.

India Oleochemical Market Trends

The India oleochemical market witnessed significant growth owing to the rising product demand from the personal care, pharmaceutical, home, and industrial cleaning sectors. Furthermore, a major contribution is anticipated from the increasing demand for glycerol derivatives, particularly in the food and pharmaceutical industries. In addition, the growing usage of methyl esters and fatty amines in agrochemical products further drives market growth. Furthermore, the expansion of the biodiesel sector is anticipated to impact market demand but at a reduced cost for biodiesel segments.

Key Asia Pacific Oleochemicals Company Insights

Key players in the market include Emery Oleochemicals, Wilmar International Ltd., and Kao Chemicals Global.

-

Emery Oleochemicals produces and markets natural compounds derived from fats and natural oils. The company uses five business units, namely Bio-Lubricants, Green Polymer Additives, Agro Green, Oleobasics, and Eco-Friendly, to distribute its goods. It produces Oleochemicals under the Oleobasics business division

Ecogreen Oleochemicals, IOI Corporation Berhad, and KLK OLEO are other participants in the Asia Pacific oleochemical market.

-

Ecogreen Oleochemical’s product portfolio consists of unsaturated fatty alcohols, glycerin, fatty acids, and specialized esters, including alcohol ethoxylates, medium-chain triglycerides, and primary fatty amines. It produces specialty chemicals under the trade names Rofamin, Romulgin, and Rofetan. The company's primary product is natural fatty alcohols; however, it also produces various types of saturated fatty alcohols, from C8 to C18, at its production sites in Germany and Indonesia

Key Asia Pacific Oleochemicals Companies:

- Emery Oleochemicals

- Wilmar International Ltd.

- Kao Chemicals Global

- Ecogreen Oleochemicals

- IOI Corporation Berhad

- KLK OLEO

- Sakamoto Yakuhin kogyo Co., Ltd.

- VVF Limited

- LG Chem.

Recent Developments

-

In April 2023, Emery Oleochemicals unveiled a new product, INFIGREEN 420R, a polyester polyol with recycled components made from waste from the post-industrial era. Autocatalytic qualities, mechanical and hydrolytic resistance, and 50% biobased certification are some of the main advantages. Furthermore, the business sells EMEROX renewable polyester polyols, which have advantages in terms of sustainability and performance. Emery offers a wide range of polyester polyol solutions that are ideal for urethane applications

-

In April 2023, KLK OLEO acquired a majority share in Temix Oleo SpA (Temix Oleo). The transaction was finalized after obtaining all required approvals and meeting all usual closing requirements. The company's long-term strategy and growth goal are in line with this acquisition, which will enhance its product specialization strategy throughout its European operations, expand access to important clients, and further diversify the company's product offering

Asia Pacific Oleochemicals Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 17.5 billion

Growth rate

CAGR of 8.1% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2022

Forecast period

2024-2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application

Regional scope

Asia Pacific

Country scope

China; India; Indonesia; Malaysia; Japan; South Korea; Singapore; Australia; Taiwan

Key companies profiled

Emery Oleochemicals; Wilmar International Ltd.; Kao Chemicals Global; Ecogreen Oleochemicals; IOI Corporation Berhad; KLK OLEO; Sakamoto Yakuhin kogyo Co., Ltd.; VVF Ltd.; LG Chem.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Oleochemicals Market Report Segmentation

This report forecasts revenue growth at a regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific oleochemicals market report based on product and application:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Glycerol Esters

-

Specialty Esters

-

Alkoxylates

-

Fatty Amines

-

Fatty Acid Methyl Ester

-

Other Products

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Personal Care & Cosmetics

-

Industrial

-

Food Processing

-

Consumer Goods

-

Paints & Inks

-

Healthcare & Pharmaceuticals

-

Textiles

-

Polymer & Plastic Additives

-

Other Applications

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

China

-

India

-

Indonesia

-

Malaysia

-

Japan

-

South Korea

-

Singapore

-

Australia

-

Taiwan

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."