- Home

- »

- Pharmaceuticals

- »

-

Asia Pacific Nutritional Supplements Market Report, 2030GVR Report cover

![Asia Pacific Nutritional Supplements Market Size, Share & Trends Report]()

Asia Pacific Nutritional Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sports Nutrition, Dietary Supplements), By Consumer Group (Infants, Adults), By Formulation, By Sales Channel, By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68038-105-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

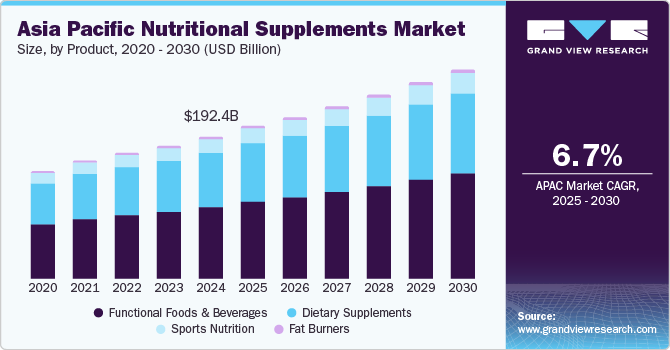

The Asia Pacific nutritional supplements market size was valued at USD 192.44 billion in 2024 and is expected to grow at a CAGR of 6.71% from 2025 to 2030. Asia Pacific has been one of the forerunners in the nutritional supplements industry. The population across the sub-continent has been increasingly leaning toward leading a healthier life by adopting more traditional means and methods, using naturally sourced foods, supplementation, and dietary additives. The geriatric population has reached an all-time high in countries such as Japan and China. Improving the quality of life through nutritional supplementation and functional foods has become a priority, driving the nutritional supplements industry in the Asia Pacific region.

The COVID-19 pandemic has negatively impacted the growth of the nutritional supplements industry in the Asia Pacific region. The majority of the revenue for this region is through exports, and due to global lockdowns, the supply chain was disrupted, negatively affecting the market's growth. The demand for nutritional supplementation grew multi-fold, which allowed local vendors to flourish in the regional market. Immunity-boosting supplements were the highly demanded category across the region. According to a report by FMCG Gurus, more than 55% of people in the Asia Pacific region have been more conscious about boosting their immunity during COVID-19.

The industry is driven primarily by increasing health awareness among consumers. Rapid urbanization and the rise in disposable income have led to a shift in consumer preferences toward preventive healthcare solutions. Many individuals are adopting nutritional supplements to address lifestyle-related health issues, such as obesity, diabetes, and cardiovascular diseases. Additionally, aging populations in countries like Japan and South Korea are increasingly seeking supplements to improve overall well-being, boosting demand for products like vitamins, minerals, and protein supplements.

Government initiatives supporting health and wellness are also significant drivers. Several Asia-Pacific governments promote the use of dietary supplements to combat malnutrition and micronutrient deficiencies, particularly in rural areas. For instance, India’s Food Safety and Standards Authority (FSSAI) introduced regulations encouraging the fortification of food products with essential nutrients, indirectly driving the growth of the supplements market. Moreover, China's Health Food Registration System has simplified regulatory pathways, encouraging global and domestic companies to launch innovative products tailored to local needs.

Another critical factor is the expansion of e-commerce platforms across the region. The widespread penetration of smartphones and internet services, especially in countries like India, Indonesia, and Vietnam, has revolutionized how consumers access nutritional supplements. Online channels offer convenience, a wide variety of products, and competitive pricing, fostering higher adoption rates. In parallel, endorsements by healthcare professionals, influencers, and fitness enthusiasts further validate the effectiveness of these supplements, enhancing consumer trust and driving market growth.

Product Insights

Based on product, the functional food and beverages segment accounted for the largest revenue share of 49.56% in 2024. The increasing awareness about the role of functional ingredients like probiotics, prebiotics, omega-3 fatty acids, and antioxidants in improving gut health, immunity, and cognitive function has significantly boosted this segment. Urbanization and busy lifestyles have also spurred demand for convenient, on-the-go nutritional solutions, such as fortified drinks and snack bars. Additionally, the clean-label trend and preference for natural and plant-based ingredients are prompting manufacturers to innovate, offering tailored products to meet diverse dietary and cultural preferences across the region.

The sports nutrition segment is expected to grow at the fastest CAGR during the forecast period due to the increased number of people moving toward a fitter and more active lifestyle. Asia Pacific is becoming a booming market for sports nutrition products owing to the increasing awareness regarding health and government initiatives toward making people fitter and healthier, thereby reducing the country's disease burden and saving billions of dollars on healthcare. All of these factors have contributed to the growth of the nutritional supplements industry.

Formulation Insights

Based on formulation, the powder segment accounted for the largest revenue share of 37.66% in 2024. Powdered supplements, such as protein powders, meal replacements, and herbal blends, are highly favored among fitness enthusiasts and individuals pursuing weight management goals. The rise of home workouts and fitness trends, accelerated by the COVID-19 pandemic, has further driven demand for such products. Additionally, powders allow for easy customization of dosages and can be mixed into beverages or recipes, appealing to a broad demographic. The increasing prevalence of lactose intolerance in the region has also spurred the development of plant-based and dairy-free powder formulations, meeting the growing demand for allergen-free and vegan options.

The capsule segment is expected to grow at the fastest CAGR during the forecast period. This is because functional food supplements like Omega-3 and certain probiotics are all in capsule formulations, and functional foods are a large market segment. The benefits associated with capsule formulation include including multiple supplements in one dose and ease of consumption by all age groups, which, in turn, is expected to fuel the nutritional supplements industry's growth.

Consumer Group Insights

Based on consumer group, the adult segment accounted for the largest revenue share of 51.77% in 2024 and is expected to grow at the fastest CAGR during the forecast period. The segment is driven by growing health consciousness and the prevalence of lifestyle-related health issues such as obesity, diabetes, and hypertension. Adults increasingly turn to supplements like multivitamins, minerals, and herbal products to support immunity, energy levels, and overall wellness. Urbanization and demanding work environments have also encouraged the adoption of convenient nutritional solutions to bridge dietary gaps.

In addition, the consumer group in the geriatric segment is anticipated to grow with a lucrative CAGR during the forecast period. The growing interest in fitness and wellness among the geriatric population is expected to drive the demand in the segment. According to the article published by Glanbia Nutritionals in February 2021, people in their 50s, 60s, and 70s are the top consumers of nutritional supplementation products.

Sales Channel Insights

Based on sales channel, the brick & mortar segment accounted for the largest revenue share of 66.30% in 2024. The number of retail outlets selling and marketing nutritional supplements has increased. Outlets like Vitamin Shoppe and Walmart have various products from multiple brands. The players have been significantly investing in opening offline stores to reach a wider customer base. For instance, in January 2023, Nutrabay, a premium nutrition supplements brand, entered the offline retail market and planned to target up to 300 stores in India.

The e-commerce segment is projected to register the fastest CAGR from 2025 to 2030. The online sales channel has increased significantly during the COVID-19 pandemic. As a plan to expand its geographical reach, players in the industry have been partnering with e-commerce platforms to make their products available online, which has positively influenced the growth of the industry.

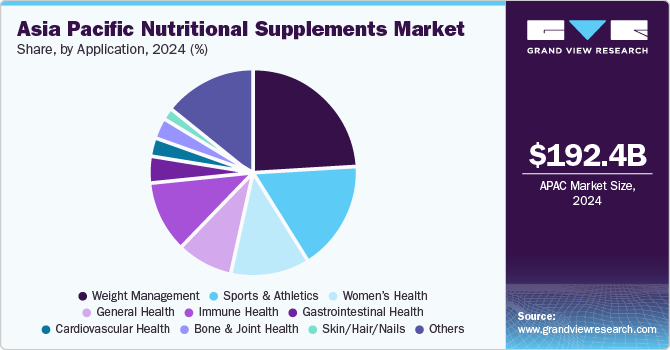

Application Insights

Based on application, weight management accounted for the largest revenue share of 23.91% in 2024. The segment is driven by rising obesity rates and increasing awareness about maintaining a healthy lifestyle. Sedentary urban lifestyles, coupled with high-calorie diets, have led to a surge in demand for supplements such as fat burners, meal replacements, and appetite suppressants. Consumers are increasingly seeking natural and plant-based weight management solutions, aligning with the region's growing preference for clean-label products. Additionally, the influence of fitness trends, social media, and celebrity endorsements has amplified the focus on weight control, encouraging the adoption of these supplements.

The sports & athletics segment is expected to witness significant growth over the forecast period. Rising awareness about the role of supplements like protein powders, amino acids, and energy boosters in enhancing performance and recovery has significantly boosted demand. Additionally, urbanization and the proliferation of gym chains, yoga studios, and fitness clubs have made athletic nutrition more accessible and mainstream. Governments and sports organizations across the region are also investing in programs that promote sports participation, further driving the adoption of supplements tailored to endurance, strength, and muscle-building. Social media influencers and athletes endorsing sports nutrition products add to the momentum, attracting younger demographics to this segment.

Country Insights

China Nutritional Supplements Market Trends

China nutritional supplements market dominated the global industry with a share of 28.75% in 2024. Chinese consumers are prioritizing preventive healthcare and looking for supplements to boost immunity, improve digestion, and enhance overall well-being. The government’s Healthy China 2030 initiative, which emphasizes health education and disease prevention, has further encouraged the adoption of dietary supplements. Additionally, the e-commerce boom in China, fueled by platforms like Tmall and JD.com, has made nutritional supplements more accessible, particularly in smaller cities and rural areas. Growing trust in international brands and local companies offering high-quality, natural, and traditional Chinese medicine (TCM)-based products also contributes to the robust growth of the industry.

Japan Nutritional Supplements Market Trends

The nutritional supplements market in Japan is driven by its aging population, with over 28% of citizens aged 65 and above, creating a strong demand for supplements targeting age-related health concerns such as bone density, joint health, and cognitive function. Japanese consumers highly value preventive healthcare and functional foods, fostering the adoption of vitamins, minerals, and probiotics. The government's regulatory support, such as the Foods for Specified Health Uses (FOSHU) label, enhances consumer trust and market growth. Moreover, the integration of traditional health practices with modern supplements, such as incorporating matcha or collagen, appeals to the health-conscious Japanese demographic, ensuring sustained market expansion.

India Nutritional Supplements Market Trends

India nutritional supplements market is primarily driven by its young population, increasing disposable incomes, and rising health awareness. The growing prevalence of lifestyle-related conditions like obesity, diabetes, and cardiovascular diseases has heightened the demand for supplements addressing weight management, immunity, and general wellness. The popularity of Ayurveda and herbal-based supplements, combined with the government's support for the AYUSH (Ayurveda, Yoga, Unani, Siddha, and Homeopathy) industry, has spurred innovation in natural and plant-based products. Additionally, the rapid expansion of e-commerce platforms and urbanization has improved access to a wide range of supplements, particularly among millennials and health-conscious consumers in metro and tier-2 cities.

Key Asia Pacific Nutritional Supplements Company Insights

The market players operating in the Asia Pacific nutritional supplements market are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Asia Pacific Nutritional Supplements Companies:

- Herbalife International of America, Inc.

- Amway Corp

- Abbott

- Sanofi

- Cliff Bar & Company

- Science in Sports

- GNC Holdings, LLC

- Bayer AG

- Nestlé

- Pfizer Inc.

Recent Developments

-

In June 2023, PepsiCo launched the first edition of the Greenhouse Accelerator program in the Asia Pacific region for innovative solutions centered on sustainable packaging and climate change reduction.

-

In March 2023, Abbott launched Ensure Gold Plant-Based, an organic oral nutritional supplement making it Abbott's first plant-based nutrition product available in the Philippines. It is an animal-based alternative for older persons, especially those with a non-dairy diet or lactose intolerance.

-

In December 2022, Herbalife Nutrition launched Immunoturmeric in the Asia-Pacific region, which has curcumin that is used for its anti-inflammatory and antioxidant properties and modulates immunological function. This strengthens the company's line of nutritional supplements for maintaining a healthy and strong immune system.

-

In June 2022, Nestlé Health Science acquired The Better Health Company and its GO Healthy brand. According to the company, the deal strengthens its presence in New Zealand and APAC regions such as Australia and China.

Asia Pacific Nutritional Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 205.08 billion

Revenue forecast in 2030

USD 283.81 billion

Growth rate

CAGR of 6.71% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products, consumer group, formulation, sales channel, application, country

Regional scope

Asia Pacific

Country scope

China; Japan; India; South Korea; Australia; Thailand; Singapore

Key companies profiled

Herbalife International of America, Inc.; Amway Corp

Abbott; GNC Holdings, LLC; Bayer AG; Sanofi; Nestlé; Pfizer Inc.; Cliff Bar & Company; Science in Sports

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Nutritional Supplements Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific nutritional supplements market report based on product, consumer group, formulation, sales channel, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Nutrition

-

Sports Supplements

-

Protein Supplements

-

Egg Protein

-

Soy Protein

-

Pea Protein

-

Lentil Protein

-

Hemp Protein

-

Casein

-

Quinoa Protein

-

Whey Protein

-

Whey Protein Isolate

-

Whey Protein Concentrate

-

-

-

Vitamins

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

-

Amino Acids

-

BCAA

-

Arginine

-

Aspartate

-

Glutamine

-

Beta-Alanine

-

Creatine

-

L-carnitine

-

-

Probiotics

-

Omega-3 Fatty Acids

-

Carbohydrates

-

Maltodextrin

-

Dextrose

-

Waxy Maize

-

Karbolyn

-

-

Detox Supplements

-

Electrolytes

-

Others

-

-

Sports Drinks

-

Isotonic

-

Hypotonic

-

Hypertonic

-

-

Sports Foods

-

Protein Bars

-

Energy Bars

-

Protein Gel

-

-

Meal Replacement Products

-

Weight Loss Product

-

-

-

Fat Burners

-

Green Tea

-

Fiber

-

Protein

-

Green Coffee

-

Others

-

-

Dietary Supplements

-

Vitamins

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin E

-

-

Minerals

-

Enzymes

-

Amino Acids

-

Conjugated Linoleic Acids

-

Others

-

-

Functional Foods and Beverages

-

Probiotics

-

Omega-3

-

Others

-

-

-

Consumer Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Children

-

Infants

-

Adults

-

Age Group 21-30

-

Age Group 31-40

-

Age Group 41-50

-

Age Group 51-65

-

-

Pregnant

-

Geriatric

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Powder

-

Softgels

-

Liquid

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Brick & Mortar

-

Direct Selling

-

Chemist/Pharmacies

-

Health Food Shops

-

Hypermarkets

-

Supermarkets

-

-

E-commerce

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports & Athletics

-

General Health

-

Bone & Joint Health

-

Brain Health

-

Gastrointestinal Health

-

Immune Health

-

Cardiovascular Health

-

Skin/Hair/Nails

-

Sexual Health

-

Women’s Health

-

Anti-aging

-

Weight Management

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Singapore

-

Frequently Asked Questions About This Report

b. The Asia Pacific nutritional supplements market size was estimated at USD 192.44 billion in 2024 and is expected to reach USD 205.08 billion in 2025.

b. The Asia Pacific nutritional supplements market is expected to grow at a compound annual growth rate of 6.71% from 2025 to 2030 to reach USD 283.81 billion by 2030.

b. Functional foods dominated the Asia Pacific nutritional supplements market with a share of 49.56% in 2024. This is attributable to the rising demand for fortifying food additives and nutritional supplements such as vitamins & minerals, fibers, omega-3 fatty acids, and others.

b. Some key players operating in the Asia Pacific nutritional supplements market include Glanbia plc., Nestle, Abbott Nutrition, Herbalife, International of America, Inc, and Amway.

b. Key factors that are driving the Asia Pacific nutritional supplements market growth include growing consumer awareness about health & fitness, the presence of low-cost raw materials, and the existence of a large number of domestic players in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.