- Home

- »

- Plastics, Polymers & Resins

- »

-

Asia Pacific Molded Pulp Packaging Market, Report, 2030GVR Report cover

![Asia Pacific Molded Pulp Packaging Market Size, Share & Trends Report]()

Asia Pacific Molded Pulp Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Wood Pulp, Non-wood Pulp), By Molded Type, By Product, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-326-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

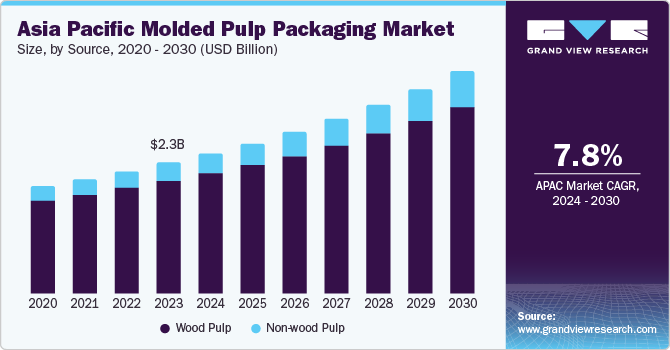

The Asia Pacific molded pulp packaging market size was estimated at USD 2.3 billion in 2023 and is anticipated to grow at a CAGR of 7.8% from 2024 to 2030. Rising environmental issues in economies like China and India have led to an increased emphasis on disposable packaging solutions. The Asia Pacific region, being a major production hub for electronic devices, computer peripherals, mobile phones, components, and parts, relies heavily on packaging for safe product delivery. Many companies in the region have already adopted sustainable packaging solutions to minimize their carbon footprint, thereby contributing to the market growth.

The Asia Pacific molded pulp packaging market accounted for a share of 41.7% of the global molded pulp packaging marketrevenue in 2023. Regulations across the region are driving the market toward sustainability and innovation. India's Plastic Waste Management Rules, amended in 2021, impose stringent restrictions on single-use plastics and encourage eco-friendly packaging solutions. Australia's National Waste Policy Action Plan sets ambitious waste reduction and recycling targets, fostering a favorable environment for molded pulp packaging. These regulations curb plastic pollution and propel the market towards greener alternatives like molded pulp packaging.

Source Insights

The wood pulp segment held the largest revenue share of 86.1% in 2023. A rising demand for sustainable packaging drives this dominance. Consumer pressure for sustainable packaging solutions has driven a surge in demand for molded wood pulp packaging over the past decade. This shift reflects growing environmental concerns, particularly regarding plastic waste, as molded wood pulp offers a fully biodegradable alternative. Additionally, increasing paper recycling rates across the globe have favored the market with raw material availability, reducing deforestation and protecting the environment.

The non-wood pulp segment is predicted to grow at the fastest CAGR of 9.7% from 2024 to 2030. With increasing concerns about deforestation, the demand for non-wood pulp is expected to grow. However, the discharge of black liquor with high viscosity during pulp production is expected to affect the market slightly. Despite this, evolving technology trends, such as Vibratory Shear Enhanced Processing (VSEP) in treating black liquor, are expected to subsidize market growth for the molded non-wood pulp packaging market.

Molded Type Insights

The transfer molded type segment accounted for the largest revenue share of 57.4% in 2023. This segment involves a procedure for transporting wet pulp from a mold to a drying station. The resulting products offer superior protection for fragile goods (electronics, glassware, food) while minimizing environmental impact. The dominance of transfer molded pulp packaging can be attributed to its cost-effectiveness, recyclability, and ability to provide cushioning and protection during transit.

The thermoformed molded type segment is projected to exhibit the fastest CAGR of 9.0% from 2024 to 2030. In this process, dry pulp sheets are heated and formed into specific shapes using molds. Thermoformed products offer customization options, making them suitable for various applications, including consumer electronics, cosmetics, and automotive components. The anticipated growth can be attributed to increased awareness of sustainability, stricter environmental regulations, and the rising demand for eco-friendly packaging solutions.

Product Insights

Molded pulp trays accounted for the largest revenue share in 2023, representing approximately 40.0% of the market share. These trays are gaining popularity due to several advantages over plastic trays. Firstly, molded pulp trays are double ovenable, making them suitable for both microwave and conventional ovens. However, the emergence of bioplastics poses a challenge for molded pulp trays. Bioplastic trays offer benefits such as microwave compatibility and biodegradability, which may limit the growth of molded pulp trays in the food industry. Nonetheless, their eco-friendly nature continues to drive demand.

The demand for molded pulp clamshells is experiencing rapid growth, primarily driven by retail egg packaging. Eggs are commonly packed in either plastic or molded pulp-based clamshells. Plastic clamshell usage has declined due to the rising preference for molded pulp alternatives. The utilization of plastic clamshell packaging has witnessed a decline due to a growing preference for molded pulp alternatives. This shift is driven by the advantageous life cycle of molded pulp, offering comparable convenience in handling during use and responsible disposal at end-of-life.

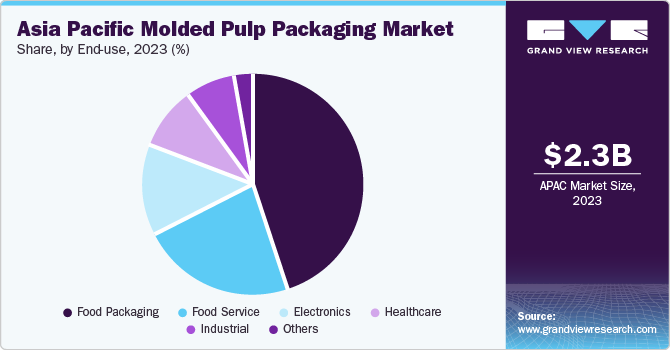

End-use Insights

The food packaging segment dominated the market as the largest revenue contributor in 2023. The dominance of molded pulp in food packaging can be attributed to its eco-friendly nature, lightweight design, and suitability for a wide range of food items. Molded pulp clamshells and trays are commonly utilized for packaging fruits, vegetables, eggs, and meat. As consumers increasingly seek sustainable packaging options, molded pulp’s minimal carbon footprint and biodegradability position it favorably in the food industry. In addition, the rise in on-the-go food consumption and the demand for convenient, environmentally friendly packaging further drive the growth of this segment.

The electronics segment is estimated to grow at a CAGR of 9.0% from 2024 to 2030. Molded pulp packaging solutions are gaining traction in electronics due to their protective properties and sustainability. They offer a sustainable and effective solution for protecting electronics during shipment, catering to the rising e-commerce demand and consumer preference for eco-friendly options. This aligns well with the growing emphasis on environmental responsibility within the electronics industry. The combination of effective protection and environmental responsibility positions molded pulp as a preferred choice for electronics manufacturers.

Country Insights

China Molded Pulp Packaging Market Trends

The China molded pulp packaging market held a share of 53.3% in 2023. The presence of numerous molded pulp manufacturers in China contributes significantly to its dominance. As a manufacturing powerhouse, China has embraced molded pulp packaging for various applications, including food service trays, beverage carriers, and protective packaging. The country’s commitment to sustainability and eco-friendly solutions further fuels the adoption of molded pulp materials. With its robust market infrastructure and growing consumer awareness, China remains a key player in shaping the future of molded pulp packaging.

India Molded Pulp Packaging Market Trends

The India molded pulp packaging market is estimated to grow at a CAGR of 9.4% from 2024 to 2030. India faces increasing demand for sustainable packaging solutions owing to its growing population. Factors, such as rapid urbanization, rising disposable income levels, and heightened environmental consciousness, drive the adoption of molded pulp trays, clamshells, and other packaging forms. The Indian market benefits from the versatility of molded pulp, which caters to diverse end use segments. Whether for food packaging, electronics, or other applications, India’s embrace of eco-friendly alternatives positions it as a significant contributor to the region’s molded pulp packaging growth.

Key Asia Pacific Molded Pulp Packaging Company Insights

Some of the key players operating in the market include Genpak, Huhtamaki, Hartmann and Sonoco:

-

Huhtamaki is one of the market leaders in sustainable packaging solutions, including molded pulp products

-

Hartmann offers a variety of sustainable solutions like trays, bowls, and clamshells made from recycled paper pulp

Key Asia Pacific Molded Pulp Packaging Companies:

- Huhtamaki Oyj

- Sonoco Products Co.

- Brodrene Hartmann A/S

- Genpak LLC

- UFP Technologies

- Sabert Corporation

- Fabri-Kal

- Pro-Pac Packaging

- Henry Molded Products

- Protopak Engineering Corporation

Recent Developments

-

In September 2023,RyPax and CelluComp partnered to launch the industry's first commercially viable all-fiber bottle with an interior coating, utilizing a novel pulp fiber blend for a sustainable packaging solution

-

In November 2023, ITC announced its plans to invest approximately USD 179.8 million in Madhya Pradesh, India to establish an integrated food production and logistics facility alongside a sustainable packaging plant, while also strategically increasing in-house pulp production

-

In February 2023, Huhtamaki expanded its control over the distribution of food service packaging in Australia by acquiring full ownership of Huhtamaki Tailored Packaging Pty. Ltd. (HTP)

Asia Pacific Molded Pulp Packaging Market Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.8 billion

Growth rate

CAGR of 7.8% from 2024 to 2030

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, trends

Segments covered

Source, product, molded type, end-use, country

Regional scope

Asia Pacific

Country scope

China; India; Japan; South Korea; Australia

Key companies profiled

Huhtamaki Oyj; Sonoco Products Co.; Brodrene Hartmann A/S; Genpak LLC; UFP Technologies; Sabert Corp.; Fabri-Kal; Pro-Pac Packaging; Henry Molded Product; Protopak Engineering Corp.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Molded Pulp Packaging Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific molded pulp packaging market report based on source, molded type, product, end-use, and country:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Wood Pulp

-

Non-wood Pulp

-

-

Molded Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Thick Wall

-

Transfer

-

Thermoformed

-

Processed

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Trays

-

End Caps

-

Bowls & Cups

-

Clamshells

-

Plates

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food Packaging

-

Food Service

-

Electronics

-

Healthcare

-

Industrial

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Frequently Asked Questions About This Report

b. The food packaging segment dominated the market as the largest revenue contributor in 2023. Molded pulp's dominance in food packaging can be attributed to its eco-friendly nature, lightweight design, and suitability for a wide range of food items.

b. Some of the key players operating in the market include Huhtamaki Oyj, Sonoco Products Co., Brodrene Hartmann A/S, Genpak LLC, UFP Technologies, Sabert Corporation, Fabri-Kal, Pro-Pac Packaging, Henry Molded Products, and Protopak Engineering Corporation.

b. Rising environmental issues in economies like China and India have led to an increased emphasis on disposable packaging solutions. The Asia Pacific region, being a major production hub for electronic devices, computer peripherals, mobile phones, components, and parts, relies heavily on packaging for safe product delivery.

b. Asia Pacific molded pulp packaging market was estimated at USD 2.3 billion in 2023.

b. Asia Pacific molded pulp packaging market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030, reaching USD 3.8 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.