- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Medical Injection Molding Market, Report, 2030GVR Report cover

![Asia Pacific Medical Injection Molding Market Size, Share & Trends Report]()

Asia Pacific Medical Injection Molding Market Size, Share & Trends Analysis Report By Material (Metal, Plastic), By System (Hot Runner, Cold Runner), By Product (Consumable), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-301-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

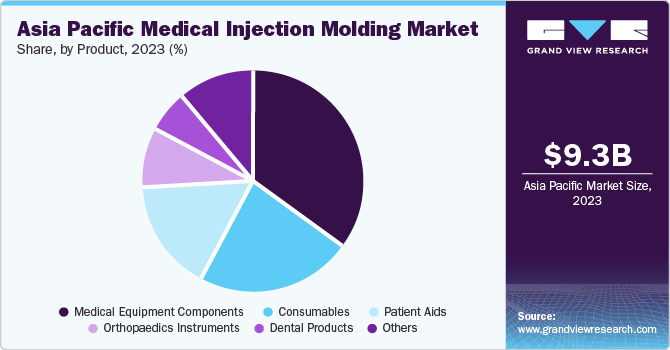

The Asia Pacific medical injection molding market size was estimated at USD 9.3 billion in 2023 and is projected to grow at a CAGR of 6.6% from 2024 to 2030. The demand for innovative medical components and equipment is increasing due to the region's growing population and healthcare needs, accelerating the use of injection molding technology. The need for accurate and economical production processes in the healthcare industry and the rising incidence of chronic illnesses is driving the market's expansion. Additionally, the region's reputation as a medical device manufacturing center is fueled by the availability of trained labor and improvements in injection molding technologies in nations such as China and India.

The main drivers are the increasing demand for medical equipment and devices in the Asia Pacific as an outcome of population growth, rising healthcare costs, and advancements in healthcare infrastructure. The adoption of cutting-edge medical solutions, the move toward sophisticated healthcare technology, and significant industry players funding R&D initiatives all contribute to expanding the medical injection molding market in the Asia Pacific.

Companies can offer new materials, technologies, and production methods by continuous investment in research and development, which keeps them at the forefront of the market and enables them to fulfil the changing needs of medical device manufacturers. Additionally, new product launches are essential to a company's ability to remain competitive since they introduce cutting-edge solutions specifically designed to meet the medical industry's demands.

Nolato AB has demonstrated its dedication to innovation and product quality by introducing high-performance injection molding resins especially made for medical device applications. By prioritizing accuracy, excellence, and adherence to regulations, these enterprises are well-positioned to benefit from the increasing need for medical injection molding solutions in Asia. They want to grow by forming strategic alliances, making R&D investments, and putting the consumer's needs first.

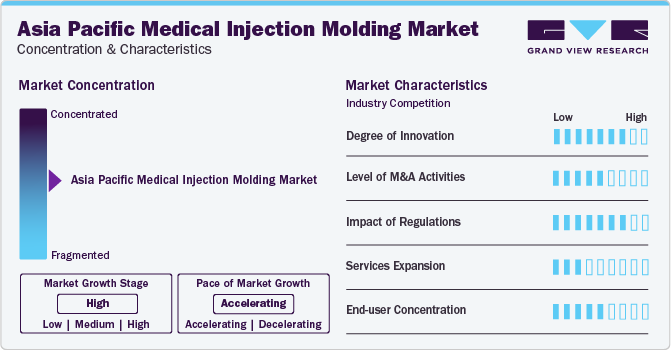

Market Concentration & Characteristics

The industry growth stage is high, and the pace of industry growth is accelerating. Rising healthcare infrastructure in emerging nations, the growing need for medical disposable items, and favorable government policies and regulations contribute to the region's significant rise. The substantial expansion of the market in the Asia Pacific region is attributed to the rise in cardiovascular and respiratory disorders, increased knowledge of medical injection molding procedures, and the adoption of new technology.

The industry exhibits a high degree of innovation. The innovation is driven by a combination of technological advancements, market demand, and regulatory requirements. This continuous innovation plays a crucial role in driving the growth and competitiveness of the region’s healthcare industry.

The level of mergers and acquisitions (M&A) in the market varies over time and is influenced by factors such as market dynamics, regulatory environment, and strategic objectives of companies operating in the industry. For instance, in August 2021, The Chinese Company Weihai Hengyu Medical Products Co., Ltd., which produces plastic and elastomeric components for injectable medication administration, has agreed to sell Aptar 80% of its stock interests.

The impact of regulations on the medical injection molding market is high, reflecting the stringent regulatory requirements governing the design, manufacturing, and distribution of medical devices in the region. Regulations play a critical role in ensuring the safety, efficacy, and quality of medical products, thereby influencing the operations and strategies of companies operating in the medical injection molding sector.

The presence of service substitutes in the Asia Pacific medical injection molding market can vary depending on factors such as market maturity, technological advancements, and customer preferences. Generally, the availability of service substitutes in this market can be considered relatively low, primarily due to the specialized nature of medical injection molding processes and the unique requirements of the healthcare industry.

The end-user concentration in this market is moderate to high, with a significant portion of demand driven by a relatively small number of large healthcare institutions, medical device manufacturers, and OEMs (Original Equipment Manufacturers).

Material Insights

Based on material, the plastics segment dominated the industry and accounted for a revenue share of 98.1% in 2023. This is due to the growing population with increasing chronic diseases and this is leading to a greater demand for medical equipment such as syringes, IV connectors, catheters, surgical instruments, implantable components and others.

The metal segment market is expected to grow significantly over the forecast period. The use of metal in injection molding technology for the manufacture of medical components and equipment has significantly increased. This increase can be ascribed to metal materials' outstanding qualities, which make them perfect for use in medical applications. These qualities include biocompatibility, strength, and resistance to corrosion. The region's need for sophisticated, highly precise medical equipment is fuelling the metal injection molding market's growth, especially in the healthcare sector.

Product Insights

The medical equipment component dominated the industry and accounted for a revenue share of 34.8% in 2023. Several essential elements drive the growing need for medical injection molding in medical equipment manufacturing. Injection molding offers a very accurate and efficient production procedure to meet the ever-increasing need for sophisticated and state-of-the-art medical devices in the healthcare industry. Innovation across a wide range of medical equipment, from wearables to surgical instruments and diagnostic gadgets, depends on injection molding's ability to produce intricate and sophisticated components. Additionally, the materials used in injection molding are highly versatile, especially medical-grade plastics and biocompatible polymers, ensuring that the final products meet stringent safety and legal requirements.

The dental products are expected to grow significantly over the forecast period from 2024 - 2030. This market has grown considerably due to patients' increasing need for personalized dental products such as crowns, bridges, and orthodontic devices. These dental goods are made using injection molding techniques, enabling precise and detailed designs tailored to each patient's unique requirements. Plastic injection molding has been a popular option for making dental components due to its cost-effectiveness and versatility, which has aided in the industry's rapid growth in Asia.

System Insights

Based on system, the hot runner system segment dominated the industry and accounted for a revenue share of 57.75% in 2023. Several benefits of the system are responsible for the growth, such as reduced cycle times and less pressure needed to push the molten mixture into the mold cavity, waste elimination from the removal of runners, housing more significant parts with higher production volumes, and enhanced part quality and uniformity. The need for hot runner systems is growing because of several advantages, including shorter cycle times and less pressure to force the molten mixture into the mold cavity.

The cold runner system segment is expected to grow significantly over the forecast period. This approach is a desirable option in many applications because of its exceptional capacity to generate high-quality parts. The swift growth in the use of cold runner systems is ascribed to their cheaper initial outlays in contrast to other systems. These systems are appealing because of their adaptability to a wide range of manufactured thermoplastics, ease of updating or altering gate placements, and flexibility in design possibilities.

Country Insights

Asia Pacific medical injection molding market dominated the global industry in 2023. The growing population in the region, with increasing healthcare requirements, is fuelling the need for sophisticated medical devices and parts, prompting the uptake of injection molding technologies. The rising incidence of chronic illnesses and the demand for economical and accurate manufacturing methods in healthcare are additional factors driving the market’s expansion.

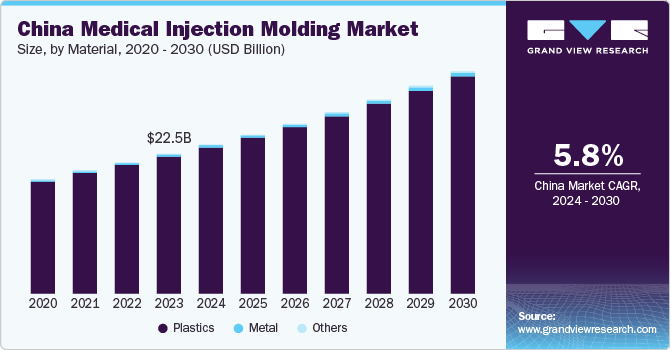

China Medical Injection Molding Market Trends

The medical injection molding market of China accounted for the largest revenue share in Asia Pacific in 2023. The country possesses a robust manufacturing infrastructure, advanced injection molding facilities, and a skilled workforce, allowing for efficient and cost-effective production of medical devices and components. The Chinese government has implemented policies to support the development of the healthcare industry, including incentives for medical device manufacturers and investments in healthcare infrastructure.

India Medical Injection Molding Market Trends

India medical injection molding market is expected to grow significantly over the forecast. The healthcare sector in India has been expanding quickly due to a number of causes, including rising income levels, population expansion, and increased public awareness of healthcare. As a result, there is now a greater need for medical equipment and devices, particularly injection-molded ones. For instance, to meet local demand, Philips has increased its local production of personal health products in India, in August 2023. Additionally, Philips announced the release of the Philips Beard Trimmer Series 1000 and the Philips Hair Straightening Brush, which are both made in India and specifically designed to meet the demands of Indian consumers.

Key Asia Pacific Medical Injection Molding Company Insights

In the Asia Pacific region, some of the key companies dominating the medical injection molding market include Nipro Corporation, Flex Ltd., HTI Plastics, C&J Industries, and Milacron Holdings Corp. Nipro Corporation, a Japanese company, is a major player in the medical device industry with a significant market share in medical injection molding. These companies have established strong footholds in the Asia Pacific region due to their technological expertise, quality products, and strategic partnerships within the medical injection molding market.

Key Asia Pacific Medical Injection Molding Companies:

- NIPRO

- Flextronics International, LTD.

- Freudenberg Medical

- Sunningdale Tech Ltd

- Teruma Medical Corporation

- Jabil Inc.

- Haitian Plastic Machinery Group Co., Ltd.

- Yizumi Holdings Co., Ltd.

- SeaskyMedical

Recent Developments

- In March 2022, TriMas disclosed its acquisition of Intertech Plastics, a provider of sophisticated, precision injection molded components renowned for innovative solutions. This strategic move aims to broaden TriMas’s product offerings and enhance its capabilities, particularly in catering to the demanding requirements of the medical sector.

Asia Pacific Medical Injection Molding Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.9 billion

Revenue forecast in 2030

USD 14.5 billion

Growth rate

CAGR of 6.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, system, product, country

Regional scope

Asia Pacific

Country Scope

China; India; Japan; South Korea; Australia

Key companies profiled

NIPRO; Flextronics International, LTD.; Freudenberg Medical; Sunningdale Tech Ltd.; Teruma Medical Corporation; Jabil Inc.; Haitian Plastic Machinery Group Co., Ltd.; Yizumi Holdings Co., Ltd.; SeaskyMedical

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Medical Injection Molding Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented Asia Pacific medical injection molding market report based on material, system, product, and country:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Metal

-

Others

-

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Hot Runner

-

Cold Runner

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Equipment Components

-

Consumables

-

Patient Aids

-

Orthopaedics Instruments

-

Dental Products

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Frequently Asked Questions About This Report

b. Asia Pacific medical injection molding market size was valued at USD 9.3 billion in 2023 and is expected to reach around USD 9.9 billion in 2024.

b. Asia Pacific medical injection molding market is projected to grow at a compound annual growth rate (CAGR) of 6.6% from 2024 to 2030 to reach around USD 14.5 billion by 2030.

b. The plastics segment dominated the industry and accounted for a revenue share of 98.1% of the Asia Pacific market revenue in 2023 owing to the growing population with increasing chronic diseases, and this is leading to a greater demand for medical equipment such as syringes, IV connectors, catheters, surgical instruments, implantable components and others.

b. Some of the key players operating in the market include NIPRO, Flextronics International, LTD., Sunningdale Tech Ltd, and Teruma Medical Corporation.

b. The need for accurate and economical production processes in the healthcare industry and the rising incidence of chronic illnesses is driving the expansion of the Asia Pacific medical injection molding market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."