- Home

- »

- Medical Imaging

- »

-

Asia Pacific Medical Imaging Market, Industry Report, 2030GVR Report cover

![Asia Pacific Medical Imaging Market Size, Share & Trends Report]()

Asia Pacific Medical Imaging Market Size, Share & Trends Analysis Report By Product (X-ray Devices, Ultrasound, Computed Tomography, Magnetic Resonance Imaging), By End-Use (Hospitals, Diagnostic Imaging Centers), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-210-8

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Asia Pacific Medical Imaging Market Trends

The Asia Pacific medical imaging market was valued at USD 8.60 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.56% from 2024 to 2030. The increasing prevalence of chronic diseases, surging demand for early detection tools, growing geriatric population, and rising investments by key players & funds by governments in India & China are expected to drive market growth during the forecast period.

The rapid growth of population and increased R&D activity in the region are projected to propel the market growth. The market is majorly driven by China and Japan. In 2023, China dominated the overall medical imaging market in terms of revenue share. This can be attributed to the presence of major market players and the increasing prevalence of chronic disorders. In addition, technological advancements in medical imaging devices, increasing geriatric population, and the growing prevalence of chronic diseases, such as cancer, are anticipated to promote market growth.

The market is expected to witness a lucrative growth over the forecast period owing to supportive government initiatives for improving healthcare infrastructure in the region. The presence of a large population with low per capita income in Asia Pacific countries has led to a high demand for affordable treatment options. Multinational companies are keen to invest in developing economies, such as India and China. Thus, many market players are entering into collaborative partnerships and strategic alliances with local players. This is anticipated to boost the market growth.

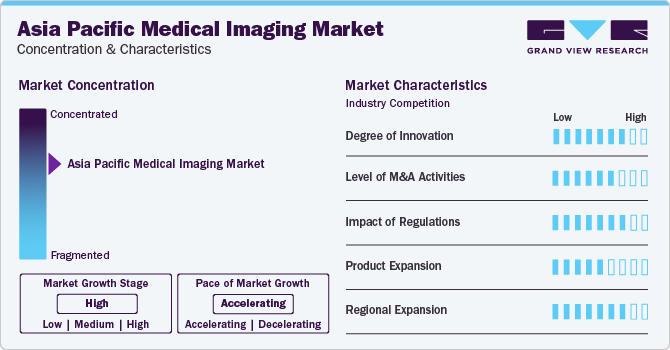

Market Concentration & Characteristics

The market growth stage is high, and pace of the market growth is accelerating. Rapid technological advancements in medical imaging devices are expected to enhance the diagnosis and treatment of various diseases, such as cardiovascular diseases & cancer. Rising demand for minimally invasive treatment is leading to innovation in medical imaging devices. Advancements in imaging devices, such as 3D & 4D image detailing, accelerating processing speed, automating workflow, and Point-of-Care (PoC) technologies, are expected to increase medical imaging adoption during the forecast period.

Asia Pacific medical imaging market is witnessing an increasing number of merger & acquisition (M&A) activities that are being undertaken by the prominent players. Several Asia Pacific medical imaging companies are adopting these strategies to upgrade their portfolio in the region. For instance, in August 2022, United Imaging Healthcare and Sunway Medical Centre announced their partnership. This partnership was aimed to optimize molecular imaging products, leveraging AI-enabled reconstruction for diagnosis of cancer.

The National Medical Applications Administration (NMPA) is responsible for the regulation of drugs and medical devices in China. NMPA’s Department of Medical Device Registration regulates domestic class III and imported class I, II, and III devices, whereas provincial NMPA is responsible for domestic class I and II devices. Medical devices in India are governed under The Drugs and Cosmetics Act, 1940, whereas The Medical Device Rules, 2017 (MDR) are meant for quality requirements, which need to be followed by manufacturers, importers, or marketers.

Life sciences organizations are devising innovative product development strategies and focusing on expanding their regional business footprints, which is driving the need to adopt advanced imaging solutions to understand the patient needs & predict the outcomes. For instance, in August 2021, Samsung Medison and Intel received FDA clearance for NerveTrack solution. This is a real-time nerve-tracking ultrasound device, which was expected to help anesthesiologists identify nerves in a patients’ arm.

Prominent medical imaging companies in Asia Pacific include Samsung Medison Co., Ltd., Mindray Medical International, and Canon Medical Systems Corporation, among others. However, they are also focusing on their expansion in the other countries in Asia Pacific and North America. For instance, in May 2023, Mindray entered into a strategic partnership with Vithas, a Spain-based chain of hospitals. According to this agreement, Vithas planned to incorporate advanced & innovative patient monitoring technology in its 20 hospitals.

Product Insights

The ultrasound segment held the largest share of 32.3% in 2023 and is expected to maintain its lead over the forecast period. The segment growth can be attributed to the rising number of ultrasound applications. Recent developments of advanced ultrasound transducers have opened new avenues for ultrasound devices into biomedical and cardiovascular imaging. Moreover, a high focus on the development of portable ultrasound devices is expected to expand the applications of this modality in ambulatory as well as emergency care. Integration of artificial intelligence into ultrasound systems to automate the process of image quantification and selection, is also expected to influence the market growth.

The CT segment is expected to witness the fastest growth during the forecast period. High demand for point of care CT device and the development of a high-precision CT scanner by the integration of artificial intelligence, machine learning, and advanced visualization systems are the primary factors driving the segment growth.

End-use Insights

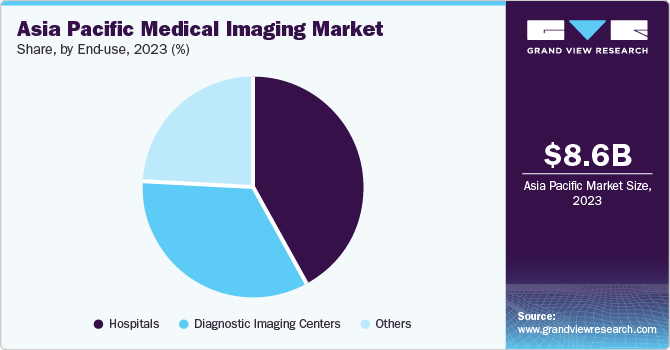

Hospitals captured the largest share of 42.2% in 2023. Rising demand for advanced imaging modalities and the integration of surgical suits with imaging technologies are some of the factors driving the segment growth. Over the years, there has been a sharp rise in demand for these modalities in teaching hospitals as compared to general or special hospitals. New hospitals generally provide dedicated space for imaging modalities. Rising competition and increasing demand for world-class healthcare services are the factors expected to fuel the segment growth in upcoming years.

The diagnostic imaging centers segment is expected to witness significant growth during the forecast period, owing to an increase in awareness about chronic diseases such as cancer, neurological diseases, and neurodegenerative disorders. This has accelerated the demand for CT and MRI procedures used for diagnosis, treatment planning, and prevention of chronic disorders. The increased adoption of advanced technology, improved infrastructure, and high funding for the development of these centers is supplementing the segmental growth.

Country Insights

Asia Pacific medical imaging market held a share of 21.6% in 2023. Changes in demographics & disease patterns and growth of the private healthcare sector are among the key factors expected to drive the market growth. The number of private hospitals is increasing every year, including those delivering specialized care, such as maternity and orthopedic treatment centers. This can be attributed to the allowance of foreign investments in the healthcare sector.

China in Asia Pacific Medical Imaging Market Trends

China medical imaging market held the largest market revenue share in 2023. The growing number of hospitals is likely to drive the demand for medical imaging devices in the country, as medical imaging services are an integral and essential part of modern healthcare facilities. Companies interested in establishing their business in China should recognize that they must overcome existing barriers in an ambiguous and changing regulatory environment. The country also offers high potential for U.S. companies interested in expanding and entering into the Chinese market.

Japan in Asia Pacific Medical Imaging Market Trends

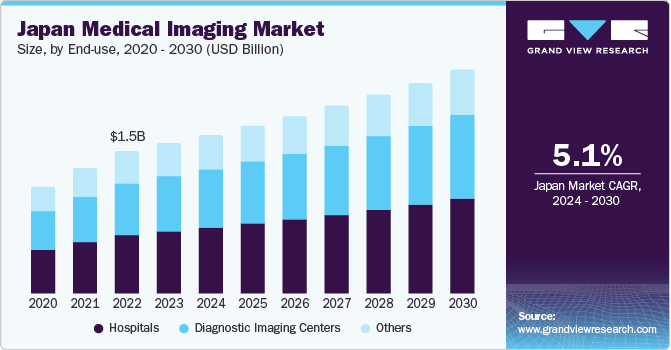

The medical imaging market in Japan is projected to witness the fastest CAGR of 5.9% during the forecast period. Most healthcare facilities in Japan are well-equipped with advanced and latest medical imaging device technologies. In recent times, there has been growth in the adoption of medical imaging devices in primary care centers and clinics. This can be attributed to the launch of novel medical imaging devices, which are available at affordable prices, coupled with a growing interest shown by physicians in early clinical interventions.

India in Asia Pacific Medical Imaging Market Trends

India medical imaging market recorded the highest number of babies born on New Year’s Day worldwide. This signifies the surging demand for maternity services in India. The increasing birth rate in India is anticipated to boost the adoption of medical imaging devices. Furthermore, many manufacturers are investing and expanding their businesses in the country. For instance, in May 2022, Philips announced the expansion of its Manufacturing and Research and Development Facility in Maharashtra, India. The unit houses MR radio frequency coil, mobile surgery systems, and ultrasound assembly businesses, among others.

Key Asia Pacific Medical Imaging Company Insights

The key companies in Asia Pacific medical imaging market, including Samsung Medison Co., Ltd., Mindray Medical International, and Canon Medical Systems Corporation, among others are involved in mergers and acquisitions to increase their share in the market and provide innovative solutions to the users which is anticipated to boost the market growth during the forecast period. For instance, in March 2022, Canon Medical Systems Corporation announced that it signed a deal for acquiring Nordisk Røntgen Teknik (NRT), a company with advanced technology and resources for manufacturing diagnostic X-ray systems.

Key Asia Pacific Medical Imaging Companies:

- GE Healthcare

- Koninklijke Philips N.V.

- Siemens Healthineers

- Canon Medical Systems Corporation

- Mindray Medical International

- Esaote

- Hologic, Inc.

- Samsung Medison Co., Ltd.

- Koning Corporation

- PerkinElmer Inc.

- FUJIFILM VisualSonics Inc.

- Cubresa Inc.

Recent Developments

-

In January 2022, United Imaging announced a strategic partnership with King Hussein Cancer Center (KHCC). In accordance with this agreement, the two organizations planned to work together to advance the field of oncology & molecular imaging and improve healthcare delivery in the area through academic exchange, research on clinical applications, and talent development.

-

In November 2022, Canon, Inc. planned to establish an entirely new subsidiary, which would be called Canon Healthcare USA, INC. Canon boosted the development of medical business by expanding its position in the American medical market.

-

In May 2021, United Imaging announced its uAIFI Technology Platform for magnetic resonance imaging and uExcel Technology Platform for PET/CT at the China International Medical Equipment Fair (CMEF).

Asia Pacific Medical Imaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.05 billion

Revenue forecast in 2030

USD 12.52 billion

Growth Rate

CAGR of 5.56% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, country

Regional scope

Asia Pacific

Country scope

Japan; China; India; Australia; South Korea; Thailand;

Key companies profiled

GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Koninklijke Philips N.V., Canon Medical Systems Corporation, Mindray Medical International, Esaote, Hologic, Inc., Samsung Medison Co., Ltd., Koning Corporation, PerkinElmer Inc., FUJIFILM VisualSonics Inc., Cubresa Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Medical Imaging Market Report Segmentation

This report forecasts revenue growth in the Asia Pacific market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific medical imaging market based on product, end-use, and country:

-

Product (Revenue in USD Million, 2018 - 2030)

-

X-ray Devices

-

By Modality

-

Radiography

-

Fluoroscopy

-

Mammography

-

-

-

Ultrasound

-

By Portability

-

Handheld

-

Cart/Trolley Based

-

-

Computed Tomography

-

By Technology

-

High end slice

-

Mid end slice

-

Low end slice

-

Cone beam

-

-

-

Magnetic Resonance Imaging

-

By Architecture

-

Closed System

-

Open System

-

-

-

Nuclear Imaging

-

By Product

-

SPECT

-

PET

-

-

-

-

End-use (Revenue in USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

-

Country (Revenue in USD Million, 2018 - 2030)

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Frequently Asked Questions About This Report

b. The Asia Pacific medical imaging market size was estimated at USD 8.60 billion in 2023 and is expected to reach USD 9.05 billion in 2024.

b. The Asia Pacific medical imaging market is expected to grow at a compound annual growth rate of 5.56% from 2024 to 2030 to reach USD 12.52 billion by 2030.

b. China dominated the Asia Pacific medical imaging market with a share of 19.40% in 2023. This is attributable to rising adoption of technologically advanced medical imaging devices, and growing number of geriatric population.

b. Some key players operating in the Asia Pacific medical imaging market include GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Koninklijke Philips N.V., Canon Medical Systems Corporation, Mindray Medical International, Esaote, Hologic, Inc., Samsung Medison Co., Ltd., Koning Corporation, PerkinElmer Inc., FUJIFILM VisualSonics Inc., Cubresa Inc.

b. Key factors that are driving the market growth include rising incidences of chronic diseases and the high demand for advanced imaging devices. An increasing number of local manufacturing units is expected to provide moderately priced diagnostic units, thus helping in this price-sensitive, underpenetrated market space.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."