Asia Pacific Medical Foods Market Size, Share & Trends Analysis Report By Route of Administration (Oral, Entreal), By Product (Powder, Pills), By Application, By Module, By Sales Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-942-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Asia Pacific Medical Foods Market Trends

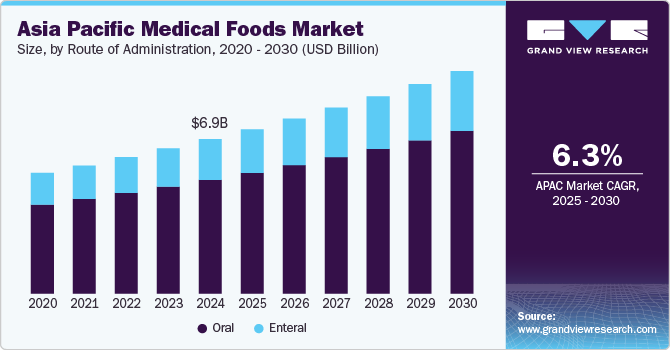

The Asia Pacific medical foods market size was estimated at USD 6.90 billion in 2024 and is projected to grow at a CAGR of 6.27% from 2025 to 2030. The region has a large patient pool and geriatric population, and lifestyle changes are leading to an increase in the prevalence of various diseases, such as cancer, diabetes, gastrointestinal disorders, & autoimmune diseases. For instance, according to data published by WHO in 2023, Thailand has one of the world’s most rapidly aging populations, with 12 million of 67 million residents classified as elderly. In 2021, the estimated percentage of the population older than 65 years was 13.2%, an increase from 12.6% estimated in 2020. Hence, the demand for medical foods for the dietary management of chronic diseases is expected to increase.

Moreover, Japan and China have a large elderly population, which is at a high risk of chronic conditions. Nutritional deficiencies are more common in the geriatric population, which is expected to boost the demand for medical foods in the region. A UN Agencies report stated that the number of undernourished people in Asia increased from 361.3 million to 418.0 million between 2019 and 2020, raising the rate of undernourishment from 7.9% to 9.0%.

The increase in preterm births is expected to boost the adoption of medical foods in the region during the forecast period. For instance, according to an article published by WHO, in 2020, India reported the highest number of estimated 3.02 million preterm births, which accounted for around 23% of all preterm births across the globe.

Medical foods are essential for preterm infants, addressing their unique nutritional needs due to underdeveloped organs and low birth weight. These formulas provide vital nutrients like proteins, fats, vitamins, and minerals in easily digestible forms to support growth, organ development, and immune function. By promoting healthy weight gain and neurological development, medical foods help reduce complications and improve long-term health outcomes. They play a critical role in the care of preterm infants and ultimately contribute to the market's growth.

Furthermore, various government initiatives undertaken to expand the market are anticipated to impel the market growth. For instance, on May 19, 2023, Japan's Consumer Affairs Agency revised the labeling guidelines for Food for Special Dietary Uses (FOSDU), allowing companies to apply for FOSDU certification for Oral Rehydration Solution (ORS) products. The amendment created a new category for companies that develop and market ORS products as medical foods. This initiative is expected to likely increase the variety of ORS products tailored for specific medical conditions, such as dehydration due to illness or during post-surgery recovery.

The Chinese government has progressively strengthened the regulatory framework for Foods for Special Medical Purposes (FSMPs), with growing advocacy for future reimbursement coverage. The regulatory oversight for FSMPs is managed by the National Medical Products Administration (NMPA), formerly the China Food and Drug Administration (CFDA), which facilitates product approvals and supports market growth. As of September 2024, China had 206 registered FSMPs, with key examples in the table below.

|

Sr. No. |

Applicant |

Product Name |

Dosage Form |

Certificate Number |

Expiry Date |

|

1 |

MEAD JOHNSON B.V. |

Enfagrow infant lactose-free formula (powder) for special medical purpose |

Powder |

国食注字TY20185005 |

2028.7.17 |

|

2 |

NESTLE NEDERLAND B.V. |

早瑞能恩 preterm/low birth weight infant formula for special medical purpose |

Powder |

国食注字TY20185006 |

2028.7.17 |

|

3 |

HANGZHOU BEINGMATE MATERNAL AND CHILD NUTRITION CO., LTD. |

Beingmate infant lactose-free formula for special medical purposes |

Powder |

国食注字TY20180001 |

2028.1.17 |

|

4 |

SUZHOU HENGRUI JIANKANG TECHNOLOGY CO., LTD |

乐赋 electrolyte formula for special medical purpose |

Liquid |

国食注字TY20180002 |

2028.6.12 |

|

5 |

SUZHOU HENGRUI JIANKANG TECHNOLOGY CO., LTD |

乐棠electrolyte formula for special medical purpose |

Liquid |

国食注字TY20180003 |

2028.5.30 |

Market Concentration & Characteristics

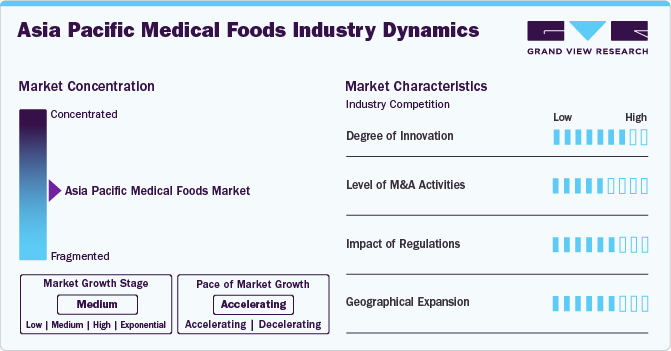

The degree of innovation in the Asia Pacific medical foods industry is high. Leading manufacturers focus on increasing partnerships with hospitals and target different population cohorts to gain large market shares. For instance, in August 2024, Danone India (NIPL) and Apollo 24|7 partnered to launch the Super 6 Diabetes Program, targeting India’s growing diabetes epidemic. As the exclusive nutrition partner, Danone would provide Protinex Diabetes Care (PDC), formulated as a Food for Special Dietary Use (FSDU) to support diabetes management. PDC features high dietary fiber for gradual sugar absorption, reduced carbohydrates, and a low Glycemic Index (GI) to help regulate blood sugar levels.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance, in May 2022, Danone company acquired Dumex Baby Food Co Ltd, a Chinese manufacturer of infant milk formula products, from Yashili. This acquisition would help Danone to expand its business in China.

The industry has low to moderate impact on regulations. For instance, standard 2.9.5 of the Food Standards Code governs the composition, labeling, and sale of FSMPs. Since most of these products are imported from overseas into Australia and New Zealand, the standard aligns closely with relevant European Union and U.S. regulations.

Geographic expansion drives the Asia Pacific medical foods industry by enabling access to diverse resources, increasing market penetration and revenue, and fostering regulatory compliance and standardization. For instance, in November 2023, Danone launched its first medical nutrition product, Fortimel, for adults in China, categorized under foods for special medical purposes. This launch is a crucial component of Danone’s strategy in China, aimed at utilizing its scientific expertise across all life stages and promoting the growth of the adult medical nutrition segment.

“The launch of Fortimel Balanced is another milestone on Danone’s ‘Innovated in China, Made in China’ journey. The product leverages Danone’s cutting-edge science and research capability to cater to the nutritional needs of Chinese patients. It marks a solid step into the aFSMP market in China and helps Danone to further grow its portfolio covering the full life spectrum.”

- Bruno Chevot, Danone’s President of China, North Asia and Oceania

Route Of Administration Insights

Oral led the market and accounted for 73.57% of the total revenue in 2024. Increased preference for orally administered products, commercial viability, and supportive initiatives drive the demand for medical foods. Generally, most people requiring Oral Nutritional Supplements (ONS) are treated using standard ONS products with a calorific value of 1.5 to 2.4 Kcal/ml. These products are available in different flavors to suit patient requirements. Furthermore, increased preference for orally administered products, commercial viability, and supportive initiatives drive the demand for orally administered medical foods.

Enteral route of administration is expected to witness the fastest growth of 6.6% over the forecast years. The demand for enteral feeding formulas is rising due to the increasing prevalence of chronic diseases such as cancer and cardiovascular diseases, which results in various metabolic issues, leading to difficulty in consuming food during the treatment of these diseases. In critically ill patients, providing nutrition is essential to prevent exacerbation of undernutrition and wasting of lean body mass as patients are in a catabolic state due to the inflammatory response of the system. According to an article published in the IIUM Medical Journal Malaysia in July 2020, enteral nutrition was prescribed in patients 30 times more frequently than parenteral nutrition in six intensive care units in Malaysia. Moreover, over 72% of these ICU patients were prescribed enteral nutrition during the study period.

Product Insights

The powder segment accounted for the largest market revenue share of 35.88% in 2024. Medical foods are most widely available in powder form, which can be administered through the oral or enteral route by mixing with milk or water, as advised by the physician. Medical foods in the powdered formula are suitable for patients of all age groups, especially in the oral route. Owing to a high preference for powdered formulations due to ease of consumption, manufacturers are developing product categories in line with consumer preferences.

Liquid is anticipated to grow at the fastest rate during the forecast period owing to the rising adoption of liquid formulations in the pediatric and geriatric population, where the intake of solid formulations is limited or impossible, in case of clinically diagnosed dysphagia, or when oral physiology is limited. Furthermore, liquid-formulated food helps maintain sufficient hydration and electrolyte balance, favoring segment growth.

Application Insights

Cancer application dominated the market with the largest revenue share in 2024. According to Globocan 2022, there were approximately 9.8 million new cancer cases in Asia in 2022. Moreover, the region witnessed almost 5.4 million deaths due to cancer. Cancer weakens immunity and leads to malnutrition in 40% to 80% of cases. Thus, medical food administration is an effective option for restoring the nutritional balance in malnourished patients. Hence, the demand for medical foods in cancer treatments is expected to increase over the forecast period.

In August 2024, the release of the Clinical Oncology Society of Australia (COSA) Cancer-related Malnutrition and Sarcopenia Implementation Toolkit provided multidisciplinary healthcare professionals in Australia with a practical resource to improve the management of malnutrition and sarcopenia in cancer patients. This toolkit follows COSA's national Position Statement on Cancer-Related Sarcopenia and Malnutrition, emphasizing the need for standardized practices to address these conditions. Cancer-related malnutrition and sarcopenia, affecting one in three cancer patients, are significantly expected to contribute to market growth.

However, the Parkinson's Disease (PD) segment is expected to grow at the fastest CAGR during the forecast period. For instance, according to the International Parkinson and Movement Disorder Society in 2021, the estimated prevalence of advanced Parkinson’s disease in Thailand was approximately 37.1%. This condition was more prevalent in the male population. This statistic highlights the widespread impact of Parkinson's disease and highlights the urgent need for continued research, awareness, and support for individuals living with this neurodegenerative condition. Although there is no specific dietary treatment plan for managing it, some foods for medical purposes have shown potential for managing the disorder. Some commonly prescribed medical foods for Parkinson's disease contain omega-3 fatty acids, coenzyme Q, and vitamins D & B. In addition, ketogenic diet plans and probiotics have shown a positive impact and complemented pharmacotherapy.

Module Insights

Protein modules segment held the largest market share in 2024. Protein modules are used in severe infections, trauma, burns, malnutrition, post-surgery recovery, and critically ill patients. The increasing prevalence of chronic diseases, such as cancer, chronic kidney disease, and malnutrition, which require specialized nutritional interventions, likely drive the segment's growth. Patients undergoing treatments like chemotherapy or dialysis often suffer from muscle wasting and protein deficiencies, boosting demand for protein-enriched medical foods. In addition, the aging population, particularly in developed countries, further contributes to the need for protein modules to combat age-related muscle loss (sarcopenia).

Hypoallergic module is expected to grow significantly over the forecast period. The growth is driven by the increasing prevalence of food allergies and intolerances, especially among infants and individuals with chronic health conditions. Hypoallergenic medical foods cater to patients with specific dietary needs, such as those unable to tolerate proteins found in common foods like cow's milk or soy. These products are formulated to minimize allergenic responses and are crucial for managing conditions like severe food allergies, eosinophilic esophagitis, and gastrointestinal disorders. The rising awareness of food-related health issues and advancements in hypoallergenic formulations, such as amino acid-based or extensively hydrolyzed proteins, have significantly boosted demand.

Sales Channel Insights

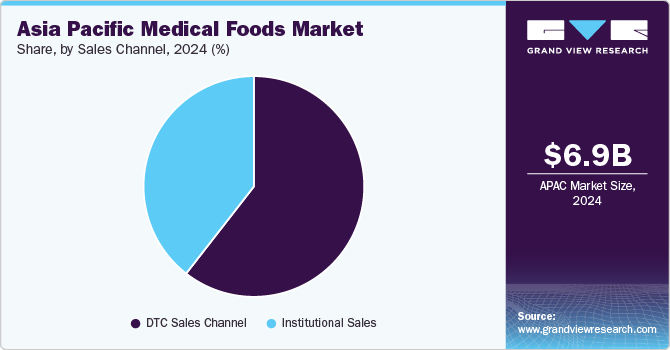

Direct-to-consumer (DTC) sales channel held the largest market share in 2024 and is expected to grow at the fastest CAGR during the forecast period. DTC sales have emerged as a significant channel within the medical foods market, providing opportunities for manufacturers to engage directly with consumers and tailor their offerings to meet specific health needs. DTC sales in the medical foods sector allow companies to bypass traditional retail channels and establish a direct relationship with end users. This model has gained traction due to its ability to provide personalized customer experiences and foster brand loyalty. By leveraging online platforms, companies can offer detailed product information, educational resources, and tailored recommendations based on individual health conditions.

Institutionalsales is anticipated to grow significantly over the forecast period. The segment's growth is driven by increasing recommendations from doctors to use medical foods. Institutions that purchase medical foods include hospitals, long-term care centers, hospices, clinics, and disability facilities. Since the consumption of medical foods is recommended under medical supervision, the revenue generated through institutional sales is the highest. In addition, training programs for healthcare professionals on the benefits of medical foods further enhance their adoption within institutions. As awareness grows among clinicians about the efficacy of these products in improving patient outcomes, institutional sales are expected to witness significant growth.

Country Insights

Japan Medical Foods Market Trends

The growing geriatric population drives Japan's medical foods market demand. Regulatory support and streamlined approval processes for medical foods in Japan, along with product formulation and innovation advancements, are contributing to market expansion. For instance, in June 2024, Wada Calcium Pharmaceutical, a company with over 110 years of expertise in calcium-based products, launched a new Food with Function Claims (FFC) designed to enhance bone and immune health in older adults. Their latest offering, the "Bone Density & Immune Care Tablet," is the company’s first FFC formulated with calcium maltobionate and postbiotics. This product incorporates Kirin’s Lactococcus lactis strain Plasma (LC-plasma) postbiotics and its signature calcium maltobionate to support overall health in aging individuals.

China Medical Foods Market Trends

China medical foods market dominated the Asia Pacific region with a share of 32.88% in 2024 due to an increasing geriatric population and growing FSMP approvals. A UN report indicates that the elderly population in China is projected to double from 10% in 2017 to 20% by 2037. This growing geriatric demographic, along with higher per capita healthcare spending and the growing prevalence of esophageal cancer, is anticipated to be a key market driver.

India Medical Foods Market Trends

The medical foods market in India is expected to grow significantly over the forecast period. An increase in malnutrition and diabetes is expected to drive the market over the forecast period. According to the India Diabetes (INDIAB) study published by the Indian Council of Medical Research (ICMR) in 2023, around 1.2 million people have diabetes. In addition, according to the Poshan Tracker, around 671,922 children in the country suffer from malnutrition.

Key Asia Pacific Medical Foods Company Insights

Some of the key players operating in the market include Danone, Nestlé, Fresenius Kabi AG, and Abbott. Key innovators in the market are utilizing strategies like new product launches to enhance their market presence. For instance, Nestlé, a global player in specialized nutrition, has been actively expanding its range of medical nutrition products in Vietnam. Its offerings include products like Peptamen, a specialized formula for patients with compromised gastrointestinal function, and Resource, aimed at addressing malnutrition in the elderly and individuals recovering from illness.

Key Asia Pacific Medical Foods Companies:

The following are the leading companies in the Asia Pacific Medical Foods market. These companies collectively hold the largest market share and dictate industry trends.

- Mead Johnson & Company, LLC

- SHS International ltd

- Synutra International ltd

- Milupa Gmbh

- Danone

- Nestlé

- Abbott

- Fresenius Kabi AG

View a comprehensive list of companies in the Asia Pacific Medical Foods Market

Recent Developments

-

In November 2023, Danone launched its first medical nutrition product, Fortimel, for adults in China, categorized under foods for special medical purposes. This launch is a crucial component of Danone's strategy in China, aimed at utilizing its scientific expertise across all life stages and promoting the growth of the adult medical nutrition segment.

-

In September 2023, Danone announced a EUR 50 million (USD 53.78 million) line expansion of its production facility at Opole, Poland, to meet the increasing demand for medical nutrition worldwide. This move aims to enhance its position in the adult medical nutrition market, with the growing rate of chronic diseases and aging population. The expansion is anticipated to enable Danone to serve patients across the globe, as many people are expected to require medical nutrition at some point in their lives due to diseases such as cancer and stroke, which can result in malnutrition.

-

In March 2023, Danone acquired ProMedica, a Polish company that specializes in providing care services for patients in their homes. This acquisition strengthens Danone's presence in Poland through its lucrative specialized nutrition market expansion strategy.

-

In February 2023, Neslte and EraCal Therapeutics entered into a research collaboration to identify novel nutraceuticals relevant to controlling food intake.

Asia Pacific Medical Foods Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 7.33 billion |

|

Revenue forecast in 2030 |

USD 9.94 billion |

|

Growth rate |

CAGR of 6.27% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Route of administration, product, application, module, sales channel, region |

|

Country scope |

Japan; China; Australia;India; South Korea; Thailand; Vietnam |

|

Key companies profiled |

Mead Johnson; SHS International ltd; Synutra International ltd; Milupa Gmbh; Danone; Nestlé; Abbott; Fresenius Kabi AG; GlaxoSmithKline PLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Asia Pacific Medical Foods Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific medical foods market report based on route of administration, product, application, module, sales channel, and region:

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Enteral

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Pills

-

Liquid

-

Other

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Kidney Disease

-

Minimal Hepatic Encephalopathy

-

Chemotherapy Induced Diarrhoea

-

Pathogen Related Infections

-

Diabetic Neuropathy

-

ADHD

-

Depression

-

Alzheimer's Disease

-

Nutritional Deficiency

-

Orphan Diseases

-

Tyrosinemia

-

Eosinophilic Esophagitis

-

FPIES

-

Phenylketonuria

-

MSUD

-

Homocystinuria

-

Others

-

Wound Healing

-

-

Chronic Diarrhea

-

Constipation Relief

-

Protein Booster

-

Dysphagia

-

Pain Management

-

Parkinson's Disease

-

Epilepsy

-

Other Cancer related treatments

-

Severe Protein Allergy

-

Cancer

-

Cachexia

-

Other

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

DTC Sales Channel

-

Online Sales

-

Retail Sales

-

-

Institutional Sales

-

Institutional Sales

-

Others (Long-term Care Facilities, etc.)

-

-

-

Module Outlook (Revenue, USD Million, 2018 – 2030)

-

Amino Acid Module

-

Protein Module

-

Vitamin & Mineral Modules

-

Fatty Acid based Modules

-

Carbohydrate Modules

-

Fiber Modules

-

Ketogenic Modules

-

Peptide based Modules

-

Hypoallergic Modules

- Others (Electrolyte Module, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

Japan

-

China

-

Australia

-

India

-

South Korea

-

Thailand

-

Vietnam

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific medical foods market size was estimated at USD 6.90 billion in 2024 and is expected to reach USD 7.33 billion in 2025.

b. The Asia Pacific medical foods market is expected to grow at a compound annual growth rate of 6.27% from 2025 to 2030 to reach USD 9.94 billion by 2030.

b. China dominated the Asia Pacific medical foods market with a share of 32.88% in 2024. The increase in awareness in the Chinese population towards health benefits and use of medical foods in mitigating and managing diseases and their symptoms has grown in recent years.

b. Some key players operating in the Asia Pacific medical foods market include Mead Johnson & Company, LLC, SHS International ltd, Synutra International ltd, Milupa Gmbh, Danone, Nestlé, Abbott, Fresenius Kabi AG, GSK plc.

b. Key factors that are driving the market growth includes the increase in preterm birth rates, rising government initiatives, growing geriatric population and favorable regulatory and reimbursement coverage policies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."