Asia Pacific Master Data Management Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (Cloud, On-premise), By End-use, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-488-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

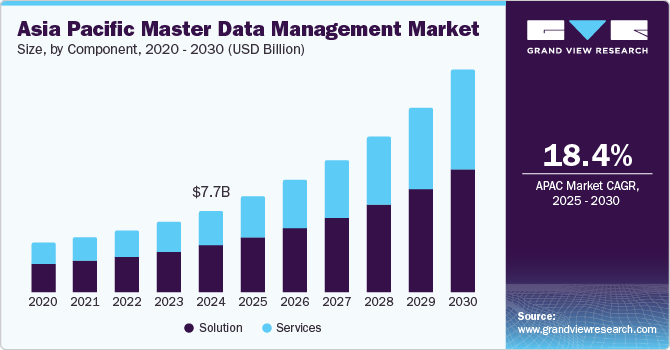

The Asia Pacific master data management market size was valued at USD 7.67 billion in 2024 and is projected to grow at a CAGR of 18.4% from 2025 to 2030. The Asia Pacific region has witnessed significant developments in cloud computing and hybrid IT environments, which has helped drive the demand for master data management (MDM) solutions. These systems can integrate seamlessly with a variety of platforms, enabling businesses and other institutions to ensure streamlined data management processes and better operational efficiency.

Regional enterprises have recognized the importance of MDM in enhancing business operations, thus leveraging upgraded solutions to meet their evolving requirements. Organizations are generating and collecting vast amounts of data from multiple sources, including transactions, customer interactions, and IoT devices, making the management of this data crucial. Companies often have data spread across various systems, applications, and formats, leading to challenges in data integration and consistency. Through proper understanding and analysis of this data by leveraging MDM tools, businesses can improve customer engagement by ensuring personalized marketing campaigns, driving sales.

Master data management solutions enable organizations to utilize their data assets across hybrid environments, aiding the generation of real-time insights, enhanced collaboration, and agile response to evolving business demands. They help enterprises in ensuring free flow of information by removing data silos, synchronizing varied data sources, and creating a unified customer, product, and operational view. This improves business intelligence, supports agile decision-making, enables tailored customer experiences, and encourages innovations in product development and marketing, along with supply chain management. Increasing regulations concerning data privacy, such as the Digital Personal Data Protection Act (DPDP) in India and the Personal Information Protection Law (PIPL) in China, have necessitated organizations to have robust data management practices in place to ensure compliance. Moreover, accurate master data is crucial to report and audit processes, helping organizations meet regulatory requirements. Companies are focused on ensuring that their master data is accurate and integrated across all platforms and applications, which aids in their digital transformation strategies.

The emergence of artificial intelligence (AI) and machine learning technologies has provided further growth avenues to businesses and solution providers. These tools ensure improvements in data quality, automation of data governance processes, and analysis of data in real-time. AI-enabled data modeling and data profiling significantly elevates the accuracy and consistency of the AI and data assets of an enterprise across its functions. High data volumes make it very hard to spot issues in data quality, making the use of machine learning algorithms essential. They can predict data problems easily and suggest specific actions to correct them, streamlining operations. The integration of MDM with Product Information Management (PIM) enables consistent product information across all systems, which is crucial for organizations that need accurate product data for various business processes. Furthermore, MDM’s focus on data governance and quality management complements PIM by ensuring that product data is accurate, complete, and up to date, which is vital for customer trust and compliance.

Component Insights

The solution segment accounted for a leading revenue share of 57.5% in 2024 in the regional MDM market. Organizations are generating and collecting vast amounts of data from multiple sources, necessitating effective management to maintain its accuracy and consistency. Poor data quality can lead to significant operational inefficiencies, making data governance and quality management a top priority for enterprises. Accurate master data solutions enhance the effectiveness of business intelligence and analytics initiatives, leading to better insights and outcomes. With the emergence of several promising businesses in Asia Pacific and the entry of major global enterprises, there has been an intensifying competition across several industries, including BFSI, retail, healthcare, and manufacturing. As a result, organizations are leveraging data as a strategic asset to differentiate themselves, driving the demand for MDM solutions. Regional companies expanding into new markets or geographies, meanwhile, require reliable master data to ensure consistent operations and compliance across borders.

The services segment is expected to witness the fastest CAGR from 2025 to 2030. The rapidly growing demand for master data management tools among businesses to drive business growth and innovation has resulted in the heightened demand for consulting and integration services, as well as training & support for personnel to enable optimal utilization of these solutions. Integration services for MDM are crucial to ensure the accuracy, consistency, and accessibility of master data across an organization. These services help in consolidating, synchronizing, and managing data from various sources and systems. Training and support are also critical components that ensure that stakeholders can understand the effective use of MDM tools and organizations are able to maintain high data quality and governance standards. For instance, Stibo Systems, a leading market player, has established its MDM Academy program that provides comprehensive education and training to interested end-users aiming to manage their master data effectively across various domains.

Deployment Insights

The cloud segment accounted for the largest revenue share in the global market in 2024 and is expected to maintain its leading position over the forecast period. Businesses in Asia Pacific have turned towards cloud-based solutions as they offer several benefits over on-premise systems. As per a study by Oracle published in April 2023, 97% of the surveyed enterprises in the region were utilizing or planning to utilize two or more cloud infrastructure providers, highlighting the financial and operational advantages of this deployment. Cloud-based MDM solutions are easy to install and cost significantly less when compared to on-premise solutions, as they eliminate hardware and maintenance costs, as well as software licenses. Moreover, providers continuously maintain and implement upgrades that leads to lesser downtime for organizations and better returns on investment. Cloud solutions utilize a subscription-based model, making it easier for organizations to budget and eliminate the overall costs associated with on-premise management. They further offer value-added services such as disaster recovery, data backup, and security, all of which are handled by the service provider.

The on-premise segment is expected to advance at a significant CAGR during the forecast period. The installation and management of MDM software and infrastructure within an organization’s own data center provides a number of benefits. Organizations have complete control over their data, infrastructure, and master data management configurations, allowing for customized solutions to meet specific business requirements. Additionally, restrictions concerning cross-border data transfer and data residency needs have compelled organizations to prefer on-premise solutions to comply with local regulations and maintain contractual obligations. However, this deployment also comes with various challenges related to costs, resource management, and scalability that has made the use of cloud-based solutions more profitable in the long run.

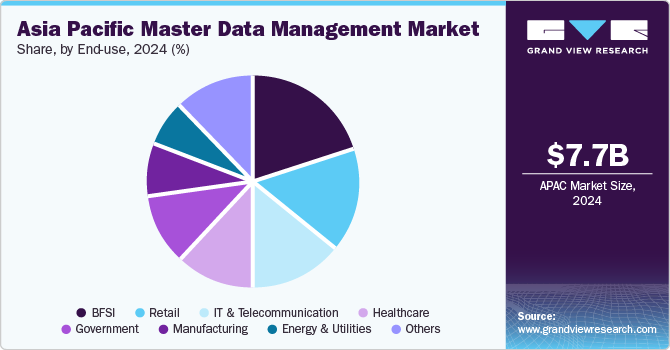

End-use Insights

The BFSI segment accounted for the largest revenue share in the regional market in 2024. The continuously growing need among financial institutions in Asia Pacific to make informed decisions, maintain regulatory compliance, and enhance customer experiences has driven the adoption of advanced MDM solutions. This technology ensures the availability of high-quality data by standardizing, cleansing, and de-duplicating data records while also implementing data governance frameworks to optimize data integrity. The banking sector operates in a highly regulated environment and needs to adhere to various regulations, including BCBS 239, KYC (Know Your Customer), and AML (Anti-Money Laundering), which can be effectively addressed by MDM tools. Moreover, master data management provides a comprehensive view of customers by seamlessly integrating data from multiple sources and supports real-time data analytics and access, leading to improved responsiveness to market developments.

The healthcare segment is expected to advance at the fastest CAGR from 2025 to 2030 in the APAC market for master data management. The rapidly improving healthcare infrastructure in economies such as China, Japan, and India has driven the adoption of advanced technologies to ensure process optimization. MDM consolidates patient records from multiple sources, including hospitals, clinics, and labs, to create a unified view, improving care coordination and reducing errors. It further ensures the accuracy of patient demographic information, facilitating effective communication and care delivery. The seamless integration of data from Electronic Health Records (EHRs), Laboratory Information Systems (LIS), and other clinical systems, made possible by the use of the MDM technology, helps create a holistic view of patient health. Thus, proper implementation of a robust MDM strategy can substantially contribute to the overall effectiveness of healthcare organizations, leading to better patient outcomes and improved satisfaction.

Country Insights

China Master Data Management Market Trends

China accounted for the leading revenue share of 22.9% in the regional master data management market in 2024. The economy has witnessed a sharp growth in its smart manufacturing sector, and the rapid adoption of Industry 4.0 initiatives have further helped drive the demand for MDM solutions. China is also home to a highly competitive e-commerce industry, necessitating companies to have accurate and consistent data to manage customer interactions, product information, and inventory across various platforms. Moreover, the presence of data privacy regulations, such as the Personal Information Protection Law (PIPL), has prompted organizations to enhance their data governance and management practices. Many Chinese companies are expanding globally, particularly in other Asia Pacific markets, the Middle East & Africa, and Europe, necessitating compliance with international data management standards and regulations. This has compelled them to avail the services of master data management solution providers.

Singapore Master Data Management Market Trends

Singapore is anticipated to grow at the fastest CAGR during the forecast period. This growth is being propelled by the adoption of digital transformation initiatives in major industry verticals in the state. The accumulation of vast volumes of data has compelled enterprises to leverage MDM solutions and effectively manage data by ensuring its consistency, accuracy, and reliability. Moreover, increasing investments in big data analytics and AI technologies has driven the need for reliable and accurate master data to enable their seamless functioning. A strong focus on the expansion of Singapore's IT infrastructure is expected to aid market advancements, with the shift towards cloud computing leading organizations to adopt integrated solutions that can support scalable and flexible data management practices.

Key Asia Pacific Master Data Management Company Insights

Some key companies involved in the Asia Pacific MDM market include Informatica, Stibo Systems, and Hitachi Vantara, among others.

-

Informatica is a cloud data management company that offers data integration and management solutions to businesses globally. The company's AI-powered Intelligent Data Management Cloud platform enables organizations to drive their growth, bring innovations in processes, and control costs through flexible pricing features. It also offers advanced MDM solutions with features such as seamless data integration, data quality management, hierarchical data management, analytics and reporting, and support for multiple data domains within a single platform. Informatica serves several major verticals, including healthcare, financial institutes, government, energy & utility, and life sciences, among others.

-

Stibo Systems is a global provider of Master Data Management (MDM) solutions that enable organizations to manage their product, customer, and other critical data effectively. Major offerings include multi-domain MDM, Product Data Management/PIM, Supplier Data Management, Customer Data Management, and Product Data Exchange (PDX), among others. The company's MDM solution allows organizations to create a single, trusted view of their master data, thus helping improve data quality and consistency across the enterprise. Stibo Systems also provides tools for data governance, ensuring compliance with regulations and maintenance of high data quality standards. The company caters to verticals such as manufacturing, banking, retail, insurance, automotive, and life sciences.

Key Asia Pacific Master Data Management Market Companies:

- Ataccama

- Hitachi Vantara LLC

- IBM Corporation

- Informatica Inc.

- Microsoft

- Oracle

- SAP SE

- SAS Institute Inc.

- Semarchy

- Stibo Systems

- Talend, Inc.

- Blumetra Solutions LLC

Recent Developments

-

In August 2024, Hexaware Technologies, an Indian IT solutions and services provider, partnered with Blumetra Solutions to offer customized cloud-based master data management solutions for the life sciences sector. The partnership will enable life sciences organizations to ensure the availability of actionable data across the entire product lifecycle, aiding in regulatory compliance and elevating customer experience.

-

In January 2024, Informatica announced that the UnionBank of the Philippines, a major universal bank in the country, had adopted its advanced Master Data Management software-as-a-service (SaaS) solution. This is part of UnionBank’s cloud-first digitalization strategy, moving from an on-premise setting to the cloud. UnionBank has been able to build a 360-degree view of customers across the enterprise by leveraging Informatica’s Intelligent MDM and 360 applications that run on the company’s AI-enabled Intelligent Data Management Cloud platform.

Asia Pacific Master Data Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 8.95 billion |

|

Revenue Forecast in 2030 |

USD 20.85 billion |

|

Growth Rate |

CAGR of 18.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Component, deployment, end-use, country |

|

Country scope |

China, Japan, India, Australia, South Korea, New Zealand, Singapore |

|

Key companies profiled |

Ataccama; Hitachi Vantara LLC; IBM Corporation; Informatica Inc.; Microsoft; Oracle; SAP SE; SAS Institute Inc.; Semarchy; Stibo Systems; Talend, Inc.; Blumetra Solutions LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Asia Pacific Master Data Management Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific master data management market report based on component, deployment, end-use, and country.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

Consulting

-

Integration Services

-

Training and Support

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Government

-

Retail

-

IT & Telecommunication

-

Manufacturing

-

Energy & Utilities

-

Healthcare

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

New Zealand

-

Singapore

-

Frequently Asked Questions About This Report

b. The Asia Pacific master data management market size was estimated at USD 7.67 billion in 2024 and is expected to reach USD 8.95 billion in 2025.

b. The Asia Pacific master data management market is expected to witness a compound annual growth rate of 18.4% from 2025 to 2030 to reach USD 20.85 billion by 2030.

b. The solution segment accounted for a leading revenue share of 57.5% in 2024 in the regional MDM market. Organizations are generating and collecting vast amounts of data from multiple sources, necessitating effective management to maintain its accuracy and consistency. Poor data quality can lead to significant operational inefficiencies, making data governance and quality management a top priority for enterprises.

b. The key players in the Asia Pacific master data management market includes Ataccama; Hitachi Vantara LLC; IBM Corporation; Informatica Inc.; Microsoft; Oracle; SAP SE; SAS Institute Inc.; Semarchy; Stibo Systems; Talend, Inc.; and Blumetra Solutions LLC., among others.

b. The Asia Pacific region has witnessed significant developments in cloud computing and hybrid IT environments, which has helped drive the demand for master data management (MDM) solutions. These systems can integrate seamlessly with a variety of platforms, enabling businesses and other institutions to ensure streamlined data management processes and better operational efficiency

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."