- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Kaolin Market Size, Share, Industry Report 2030GVR Report cover

![Asia Pacific Kaolin Market Size, Share & Trends Report]()

Asia Pacific Kaolin Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Paper, Ceramics, Paint & Coatings), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-254-5

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Kaolin Market Size & Trends

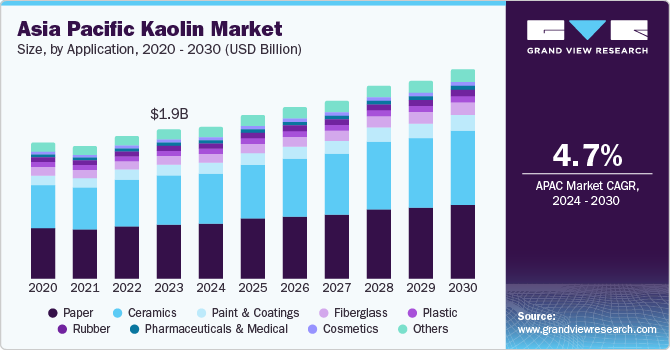

The Asia Pacific kaolin market was valued at USD 1.89 billion in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. This growth can be attributed to several key factors. One major factor is the growing construction sector, which uses kaolin significantly in cement and ceramics. The paper industry, which boosts printing quality by using kaolin as a filler, is another factor driving demand. Additionally, the market is growing because of the expanding cosmetics business in the Asia Pacific, where kaolin is used due to its ability to absorb oil.

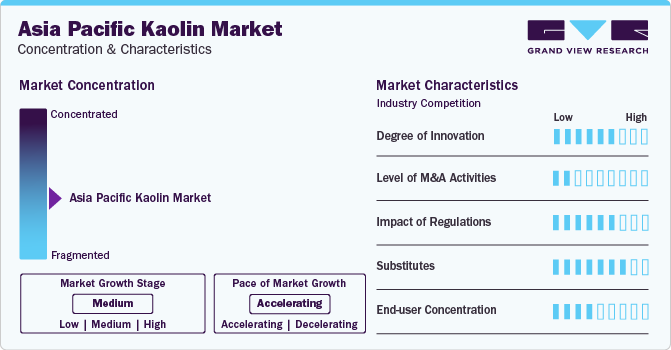

Regulatory frameworks exert a significant impact on the Asia Pacific kaolin market. Regulations from entities such as the U.S. Environmental Protection Agency (EPA) and the European Union’s Regulation concerning the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH), while not specifically targeting the Asia Pacific region, set a global standard that influences regional practices.

Governments have imposed strict environmental regulations to control the effects of mining activities in rapidly urbanizing nations like China and India, where the demand for kaolin is escalating. These regulations can increase mining costs and potentially hinder the speed of growth of the kaolin market.

Market Concentration & Characteristics

The kaolin industry is witnessing continuous advancements in processing and application. Research into kaolin nanotechnology continues to expand its potential uses. Innovations in surface treatment, modification, and nanoparticle technology are expanding Kaolin’s reach into newer industries and applications.

There are several substitutes for kaolin, the most commonly used are talc, carbonates, ball clay, and fuller clay. These minerals are widely available and are often considered more cost-effective and conventional, making them attractive alternatives for industries aiming to save production costs. They are used as fillers across various industries, including paper, plastics, refractories, and fiberglass.

Application Insights

The paper segment held the largest market share of over 37% in 2023 of the Asia Pacific kaolin market. Kaolin is widely used in the paper industry as a filler to enhance printing quality and offer desired flow qualities. Kaolin also improves the overall quality of the paper by adding to its brightness and opacity. The rising demand for high-quality paper products across various sectors, including education, packaging, and media, further fuels this segment’s growth. Moreover, the digitalization trend has not significantly impacted the paper industry’s demand for kaolin, as the need for quality graphics on packaging materials remains high.

The ceramics segment is the second largest in terms of revenue and is projected to witness the fastest growth of 5.2% from 2024 to 2030. Since it molds well, kaolin is widely utilized in the ceramic industry. It is an essential component in the production of tiles, dinnerware, and sanitary products. The rapid urbanization in countries like China and India is driving the construction of residential and commercial buildings, thereby increasing the demand for ceramic products.

Country Insights

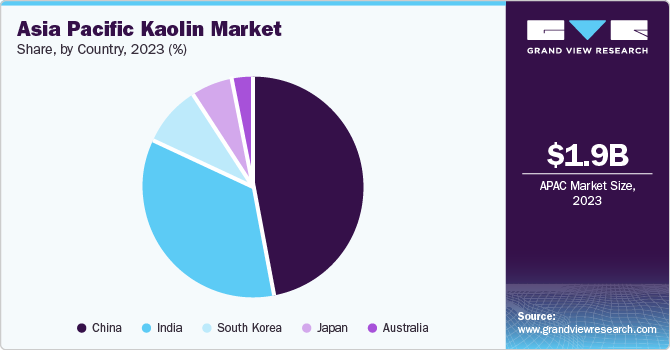

China kaolin Market Trends

China holds the largest market share in the Asia Pacific kaolin market, accounting for 25% of the total revenue. This dominance can be attributed to the country’s rapid urbanization and surging demand for cosmetics and personal care products. The construction of residential and commercial buildings is on the rise in China, which is expected to increase the demand for kaolin.

India kaolin Market Trends

India is the second-fastest-growing market in the Asia Pacific kaolin market, with a projected CAGR of 5.2% from 2024 to 2030. The growth in India can be attributed to the increasing demand from the construction industry. The rising demand for kaolin in various industries such as paper, ceramics, paint & coatings, fiberglass, plastic, rubber, pharmaceuticals & medical, cosmetics, and others is expected to drive the market growth.

Key Asia Pacific Kaolin Company Insights

The Asia Pacific kaolin market is quite diverse and competitive, with a range of players operating in the region. Some key players operating in this market include BASF SE and Imerys S.A.:

-

Imerys S.A. provides a wide range of kaolin products for various applications, including paper, ceramics, paints, and coatings. The company’s strong presence in the Asia Pacific region, coupled with its extensive portfolio of kaolin products, contributes to its significant market share.

-

BASF SE offers a comprehensive range of kaolin-based products for numerous industries, including paper, ceramics, and coatings. The company’s strong distribution network and customer-centric approach have enabled it to establish a strong foothold in the Asia Pacific kaolin market.

Recent Developments

-

In March 2024, Suvo Strategic Minerals signed a sales contract with the Belgian pharmaceutical company Fagron, signifying its inaugural venture into the lucrative pharmaceutical sector. This strategic alignment is poised to leverage Suvo's mineral assets for applications within the specialized pharmaceutical domain.

-

In October 2023, WA Kaolin reported a significant augmentation to the ore reserve at its Wickepin Kaolin project, located in Western Australia. The company disclosed an impressive surge of 113 percent, marking a substantial expansion in the project’s potential. This development underscores the project’s strategic value and the robustness of WA Kaolin’s resource base.

Key Asia Pacific Kaolin Companies:

- BASF SE

- Imerys S.A.

- Ashapura Group

- EICL Limited

- SCR-Sibelco

- 20 Microns Limited

- WA Kaolin

- Jiangxi Sincere Mineral Industry Co., Ltd.

- Uma Group of Kaolin

- Suvo Strategic Minerals

Asia Pacific Kaolin Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.90 billion

Revenue forecast in 2030

USD 2.61 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, country

Country Scope

China; India; Japan; South Korea; Australia

Key companies profiled

BASF SE; Imerys S.A.; Ashapura Group; EICL Limited; SCR-Sibelco; 20 Microns Limited; WA Kaolin; Jiangxi Sincere Mineral Industry Co., Ltd. Uma Group of Kaolin; Suvo Strategic Minerals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Kaolin Market Report Segmentation

This report forecasts revenue and volume growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific kaolin market report based on application, and country:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paper

-

Ceramics

-

Paint & Coatings

-

Fiberglass

-

Plastic

-

Rubber

-

Pharmaceuticals & Medical

-

Cosmetics

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Frequently Asked Questions About This Report

b. The Asia Pacific kaolin market size was estimated at USD 1.89 billion in 2023 and is expected to be USD 1.90 billion in 2024.

b. The Asia Pacific kaolin market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 2.61 billion by 2030.

b. The paper segment dominated the Asia Pacific kaolin market with a revenue share of 37% in 2023 on account of several factors, including the rising demand for high-quality paper products across various sectors, including education, packaging, and media.

b. Some of the key players operating in the Asia Pacific kaolin market include BASF SE; Imerys S.A.; Ashapura Group; EICL Limited; SCR-Sibelco; 20 Microns Limited; WA Kaolin; Jiangxi Sincere Mineral Industry Co., Ltd.; Uma Group of Kaolin; Suvo Strategic Minerals.

b. Key factors that are driving the Asia Pacific kaolin market growth include growing construction sector, which uses kaolin significantly in cement and ceramics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.