- Home

- »

- Next Generation Technologies

- »

-

Asia Pacific IT Services Market Size, Industry Report, 2030GVR Report cover

![Asia Pacific IT Services Market Size, Share & Trends Report]()

Asia Pacific IT Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Approach, By Type, By Application, By Technology, By Deployment, By Enterprise Size, End-use, By Country And Segment Forecasts

- Report ID: GVR-4-68040-311-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific IT Services Market Trends

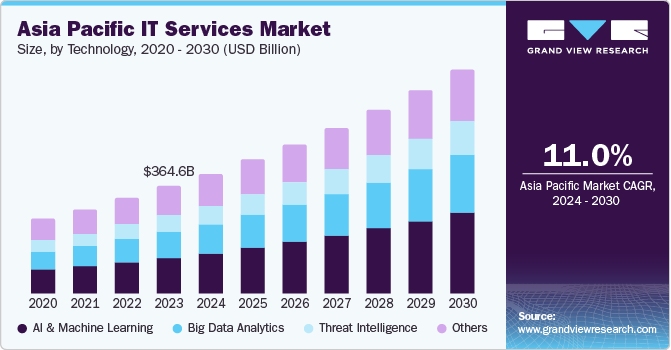

The Asia Pacific IT services market size was estimated at USD 364.6 billion in 2023 and is projected to grow at a CAGR of 11.0% from 2024 to 2030. The growing demand for cloud-based offerings is the key driver of the market. According to a study commissioned by Oracle involving 1,500 enterprises, 97% of enterprises in Asia Pacific have adopted or are planning to adopt at least two cloud infrastructure providers, and 35% are using four or even more. An increasing number of companies are relying on Infrastructure as a service (IaaS) in lieu of keeping on-premises data centers to decrease capital expenditure and operate more efficiently. Additionally, Software as a Service (SaaS) is also projected to expand by 2026 as the model aids organizations in transforming applications into scalable modules and streamlining their processes and operations.

The growth in digital payments is a notable factor responsible for the market growth. For instance, according to the Indian Ministry of Electronics & IT, India has witnessed an extensive adoption of digital payment services. The total number of digital transactions in the country has gone from 2,071 crores in 2018-18 to 9,192 crores in Dec 2022. Moreover, the instant payment system of India - Unified Payments Interface (UPI), is being adopted by other countries in the region, such as Sri Lanka, Singapore, Bhutan, and Nepal.

Asia Pacific is one of the key hubs for data centers across the globe and is poised to become a hotspot for the same over the forecast period. The growth of 5G in the region is expected to propel the demand for data centers, and subsequently lead to the market growth. According to Cushman & Wakefield, a real estate company across 60 nations, demand for data centers in Southeast Asia and North Asia is expected to skyrocket. For instance, Blackstone Inc. announced in November 2022, the launch of its first wholly owned data center platform in the region. Additionally, investments from other major investment firms such as Bain Capital, LP. and Kohlberg Kravis Roberts & Co. L.P. have also been made in recent years. Moreover, China proposed easing its cross-border data controls in 2023, and Singapore lifted its moratorium on data center construction in 2022.

Growing investments in Artificial Intelligence (AI) and Big Data are fueling market expansion. The World Intellectual Property Organization reported in 2019 that 17 of the top 20 academic players in AI patenting are Chinese research organizations, along with 11 of the top 20 in AI-related scientific publications. Moreover, in Japan, investments and supportive policies are being made from both the public and private sectors to back the country's vision called Society 5.0, a proposal made in 2016 to create a society that involves a high level of convergence between physical and cyberspace.

Market Concentration & Characteristics

The market growth rate is high, and the pace of the growth is accelerating. Companies are undertaking numerous strategic initiatives to expand their presence through new product launches, acquisitions, mergers, contractual agreements, and collaboration with other players.

For instance, in March 2024, Accenture announced acquisition of GemSeek, a customer experience analytics provider. The investment was made by Accenture Song, and the deal is adding over 170 skilled people from GemSeek, who are supposed to bring expertise of customer experience and advanced analytics.

The degree of innovation within the region's industry is estimated to be high. Rapid prototyping, product launches, and research programs are paving the way for continuous innovation in the region. In June 2023, Wipro announced the launch of a suite of banking and financial solutions called the Wipro Industry Innovation Experience for Financial Services. These solutions, built on Microsoft Cloud, will aid financial companies in preventing financial crimes, loan origination, transforming banking systems, and among other aspects.

Government regulations and policies play a key role in influencing the IT services market. Initiatives undertaken by governments of countries in the region are fostering a conducive environment for market growth. For instance, the Union Cabinet of India updated the Digital India program in August 2023, under which over six lakh IT professionals were expected to be up-skilled, and three centers of excellence in Artificial Intelligence on agriculture, health, and sustainable cities were to be established. Moreover, ASEAN member nations will publish a guide on AI Governance and Ethics under Singapore’s chairmanship of the ASEAN Digital Ministers’ Meeting. In June 2023, the Monetary Authority of Singapore (MAS) launched an open-source toolkit to facilitate the responsible use of artificial intelligence in the financial industry called the Veritas Toolkit 2.0.

Approach Insights

The reactive IT services segment dominated the market, accounting share of 55.5% in 2023. These services are expected to have a significant CAGR over the forecast period. High costs accompanying downtime are urging organizations to make investments in reactive IT services to avoid revenue and productivity losses, consequently drive the segment’s growth.

The proactive IT services segment held a substantial market share in 2023 and is projected to be the fastest-growing segment over the forecast period. Proactive IT services help companies optimize IT resources and workflows, improve security, and enhance customer experience. Moreover, these services play a critical role in upholding compliance with regulatory policies and optimizing costs. These benefits associated with the segment are expected to drive the demand for these services over the forecast period.

Type Insights

The operations & maintenance segment held the majority of market share in 2023 and is expected to showcase the fastest-growing CAGR from 2024 to 2030. The increased adoption of cloud-based services is fueling the demand for maintenance and support services so that companies can avoid downtime & costs and maintain productivity.

The design & implementation segment accounted for a significant market share in 2023. The growing demand for user-centric solutions is the key driver of this segment’s growth. For instance, Zomato Ltd., a food delivery company with an app-based platform, provides augmented reality solutions to help users authenticate the food they are ordering online.

Application Insights

The application management segment held the largest share above other segments in 2023 and is expected to grow at a rapid CAGR over the forecast period. Companies can utilize application management services to enhance the reliability and performance of applications. They play a critical role in optimizing monitoring, and enhancing the overall value that can be extracted through the applications. These benefits associated with the segment are notable factors accelerating the demand for these services.

The data management segment held a notable share in 2023 and is projected to showcase the fastest CAGR over the forecast period. The trend toward data-driven decision-making by governments and businesses is a key factor driving the segment’s growth. Moreover, there has been a consistent rise in the volume of data produced by companies and customers, and this data is utilized by companies to gain a competitive advantage in the market.

Technology Insights

Artificial Intelligence (AI) & Machine Learning (ML) held the largest market share in 2023 and is estimated to be the fastest-growing sub-segment over the forecast period. The capacity of AI & ML to analyze vast datasets, haul out significant insights, and augment decision-making are some of the factors that are encouraging organizations to adopt AI & ML to refine operations and enhance customer experience.

Big data analytics held a sizeable market share in 2023 and is projected to witness a significant CAGR over the forecast period. Operating on data by companies and public institutions is an increasingly prevalent theme in the region. According to the Asian Development Bank, the public institutions in Southeast Asia embraced the usage of big data after the outbreak of the pandemic to manage and analyze massive datasets and turn them into valuable insights.

Deployment Insights

The on-premises sub-segment dominated the market in 2023, as having an on-premises infrastructure gives a company more control over it and enables it to manage its applications and data more effectively. Additionally, companies acquire the benefit of having a tailor-made IT infrastructure as per their business needs.

The cloud sub-segment is projected to showcase the fastest CAGR over the forecast period. The shift to digital transformation is driving the consumption of public cloud services and the overall sub-segment. Organizations are leveraging cloud services to reduce their time-to-market and develop data-driven business models for more user-centric offerings, and to make informed decisions.

Enterprise Size Insights

The large enterprise segment held the largest share in 2023 and is estimated to expand at a significant CAGR over the forecast period. Large enterprises are expected to raise their IT budgets over the forecast period as the need for IT services becomes more and more prominent. Moreover, the magnitude of operations of large companies and the sought-after need for enhanced customer experience, data security, efficiency, and cost reduction pushes large enterprises towards availing IT services.

The small & medium enterprise segment is expected to grow at the fastest CAGR during the forecast period. The presence of cloud services has been a key driver of this segment as these solutions help SMEs circumvent the costs associated with on-premises infrastructure and effectively manage inventory, connect with customers, and manage processes.

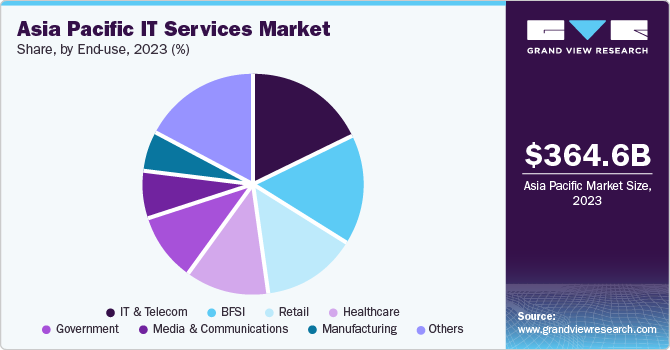

End-use Insights

The IT & telecom sub-segment dominated the market in 2023 as compared to other sub-segments and is expected to grow at a fast-paced CAGR during the forecast period. The adoption of cloud-based technology by telecom companies for the launching of the 5G technology is expected to propel the sub-segment’s growth. Countries such as Japan, China, South Korea, and Australia, among others in the region, have launched 5G networks. These countries, being the early adopters in the market, have outperformed the networks in European countries due to supportive government policies and early spectrum availability. Cloud computing is expected to play an important role in this surge of 5G, primarily for enabling Communications Service Providers (CSPs) 5G networks and in the development of enterprise 5G Edge use cases.

The retail sub-segment is projected to witness the fastest CAGR over the forecast period. The growing adoption of omni-channel retail strategies and e-commerce is fueling the demand of IT services in the retail sector. According to the Asian Development Bank, Asia Pacific is projected to account for the largest Business-to-consumer (B2C) and retail e-commerce market by 2025.

Country Insights

China dominated the Asia Pacific IT services market in 2023 and is estimated to grow at a rapid CAGR over the forecast period. The country's burgeoning growth of AI is a critical factor boosting the nation's market growth. For instance, Stanford University's AI Index, which evaluates advancements in the field worldwide across several metrics such as development, research, and economy, among 20 others, ranked the country among the top three nations for global AI vibrancy in 2021.

India market held 19.0% of the market share in the Asia Pacific IT services market in 2023 and is expected to be the fastest-growing country over the forecast period. The country is witnessing significant strides in AI as well. According to Invest India, the Indian AI market is estimated to be valued at USD 7.8 billion by 2025. Moreover, the revenue flowing from India’s public cloud services market is estimated to grow at a CAGR of 23.4% up to 2027, as per the Indian Brand Equity Foundation, an initiative by the Ministry of Commerce and Industry of the nation.

Key Asia Pacific IT Services Company Insights

Some of the key players operating within the market include Cisco Systems, Inc., Huawei Technologies Co., Ltd., and IBM Corp.

-

Cisco Systems, Inc. is a company offering IT solutions such as cloud networking, industrial IoT, network security, converged infrastructure, application performance management, workload optimization, and a variety of other IT-related products. The publicly owned company caters to industries such as oil and gas, retail, transportation, construction, government, manufacturing, finance, and among others.

-

Huawei Technologies Co., Ltd. offers smart devices and information communication infrastructure. The company has operations across 170 countries and regions and spent over USD 136.1 billion in R&D over the last decade. Within the IT services market, the company offers products such as enterprise networking, cloud services, ascend computing, and data storage catering to industries such as telecommunications, finance, education, manufacturing, healthcare, oil and gas, retail, railway, and a few more.

-

IBM Corp. is a company offering company-built solutions revolving around analytics, AI & machine learning, business automation, databases, networks, operating systems, application management, security, storage, and several other areas. The company serves several industries, such as aerospace and defense, banking, automotive, and finance, construction, consumer goods, chemicals and petroleum, healthcare, energy & utilities, telecommunications, retail, and multiple others.

Key Asia Pacific IT Services Companies:

- Avaya

- Cisco Systems, Inc.

- DXC Technology Company

- Fortinet, Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- IBM Corp.

- Juniper Networks, Inc.

- Microsoft

- Broadcom

- Oracle

- Accenture.

- Wipro

- Infosys Limited

- Amazon Web Services, Inc.

- TATA Consultancy Services Limited

- Sabre GLBL Inc.

Recent Developments

-

In February 2024, Sabre GLBL Inc. announced launching of PowerSuite Cloud in Asia Pacific. The company’s solution, offered in other regions, enables automation of operations, acquires real-time business insights, and improves customer services. Such initiatives help the company expand its market share in North and Southeast Asia.

-

In February 2024, PT Telkom Indonesia (Persero) Tbk., a state-owned enterprise, and Huawei Technologies Co., Ltd. announced the release of a bundle package for small and medium-sized enterprises in the region. The package, jointly launched by both companies, aims to provide solutions that will aid the digital transformation of SMEs in Asia Pacific. The bundle package is cost-effective, easy to operate, and includes many features and options applicable to several scenarios.

-

In November 2023, Huawei Technologies Co., Ltd., and PT XL Axiata Tbk. initiated the first commercial launch of the iMaster NCE Network Digital Map in collaboration. The product essentially enables traffic optimization, optimizes bandwidth efficiency, and automatic load balancing, among other benefits.

-

In September 2023, Oracle announced the launch of a new generative AI service called the Oracle Clinical Digital Assistant to cater to healthcare organizations. Generative AI enables healthcare professionals to reduce manual work through voice commands and even makes patients' tasks easier by checking clinical information and scheduling appointments.

-

In August 2023, DXC Technology Company announced the 5-year contract with Jollibee Foods Corporation, one of the largest restaurant companies across the globe. The contract aims to modernize the applications of Jollibee Foods Corporation and accelerate its digital transformation over the coming five years. As per the contract, DXC Technology Company will deliver IT infrastructure and solutions such as data and analytics, artificial intelligence, and a modern workplace to support the restaurant company's operations in Asia Pacific, the Middle East, Europe, and North America.

Asia Pacific IT Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 408.5 billion

Revenue forecast in 2030

USD 763.4 billion

Growth rate

CAGR of 11.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, company ranking, trends, and growth factors

Segments covered

Approach, type, application, technology, deployment, enterprise size, end-use, country

Key companies profiled

Avaya, Cisco Systems Inc.; DXC Technology Company; Fortinet Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co. Ltd.; IBM Corp.; Juniper Networks Inc.; Microsoft; Broadcom; Oracle; Accenture; Wipro; Infosys Limited; Amazon Web Services Inc.; TATA Consultancy Services Limited; Sabre GLBL Inc.

Country Scope

China; Japan; India; South Korea; Australia.

Customization scope

Free customization of report (equivalent to up to 8 analysts working days) with purchase. Alteration or addition to country, regional & segment scope.

Purchase and pricing options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific IT Services Market Report Segmentation

This report forecasts revenue growth at a regional level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific IT services market report based on approach, type, application, technology, deployment, enterprise size, end-use and country.

-

Approach Outlook (Revenue, USD Billion, 2018 - 2030)

-

Reactive IT Services

-

Proactive IT Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Design & Implementation

-

Operations & Maintenance

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Systems & Network Management

-

Data Management

-

Application Management

-

Security & Compliance Management

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

AI & Machine Learning

-

Big Data Analytics

-

Threat Intelligence

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government

-

Healthcare

-

Manufacturing

-

Media & Communications

-

Retail

-

IT & Telecom

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Frequently Asked Questions About This Report

b. The global Asia Pacific IT services market size was estimated at USD 364.6 billion in 2023 and is expected to reach USD 408.5 billion in 2024.

b. The global Asia Pacific IT services market is expected to grow at a compound annual growth rate of 11.0% from 2024 to 2030 to reach USD 763.4 billion by 2030.

b. China dominated the Asia Pacific IT services market with a share of 26.4% in 2023. This growth is fueled by the increasing adoption of AI, big data analytics, and cloud computing across various sectors, including BFSI, manufacturing, and telecommunications.

b. Some key players operating in the Asia Pacific IT services market include Amazon Web Services, Inc.; Avaya; Cisco Systems, Inc.; DXC Technology Company; Fortinet, Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; IBM Corp.; Juniper Networks, Inc.; Microsoft; Broadcom (Symantec Corp.); Oracle

b. Key factors driving the Asia Pacific IT services market growth include the rise in IT service spending from enterprises in the Asia Pacific region. Organizations in this region have effectively demonstrated the enhanced advantages of integrating technology at all levels of business and society for more connected, effective, and simplified operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.