- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Industrial Air Filtration Market Size, Report, 2030GVR Report cover

![Asia Pacific Industrial Air Filtration Market Size, Share & Trends Report]()

Asia Pacific Industrial Air Filtration Market Size, Share & Trends Analysis Report By Product (HEPA Filters, Dust Collectors), By End-use (Cement, Food & Beverage, Pharmaceutical), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-304-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

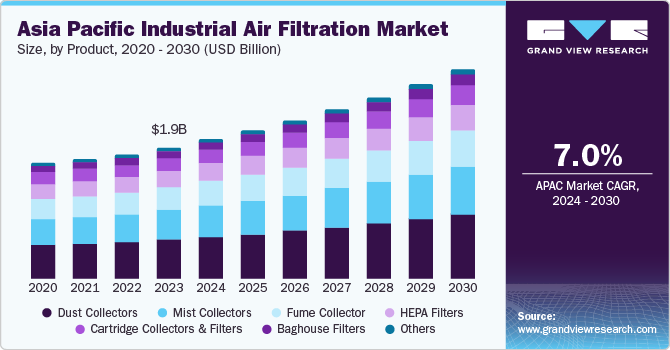

The Asia Pacific industrial air filtration market size was estimated at USD 1.93 billion in 2023 and is projected to grow at a CAGR of 7.0% from 2024 to 2030. The growing demand for compressed air free from impurities and moisture in various industries, including food & beverage, pharmaceuticals, healthcare, and energy, resulted in a rise in the use of industrial air filters. According to the Economic and Social Commission for Asia and the Pacific (ESCAP), the World Health Organization (WHO) considers the air quality in the region to be unsafe for nearly 90% of the population. It has resulted in more than 7 million premature deaths worldwide, with two-thirds of them occurring in Asia Pacific.

The Asia Pacific region has experienced rapid industrialization, led by countries, such as China and India. It has increased air pollution from factories, power plants, and other industrial facilities. In 2021, Beijing made significant progress in reducing air pollution by implementing measures to reduce coal smoke from heavy industry and home heating, resulting in a 63% reduction in dangerous particles in the air since 2013. However, despite these achievements, Beijing’s average pollution level still exceeds the World Health Organization’s recommended limit of 15 micrograms. It highlights the urgency for industrial facilities to adopt cleaner technologies, including air filtration systems.

Industrial air filtration systems in factories are vital for eliminating harmful substances, such as dust, fumes, and allergens, leading to a safer and healthier workplace, improved air quality, and enhanced employee well-being. For instance, in 2024, a study by the Japan Society for Occupational Health found that workers in textile factories exposed to high levels of cotton dust were more likely to develop a respiratory illness. By effectively filtering out these pollutants, industrial air filtration systems contribute significantly to maintaining a conducive and productive work setting.

Market Concentration & Characteristics

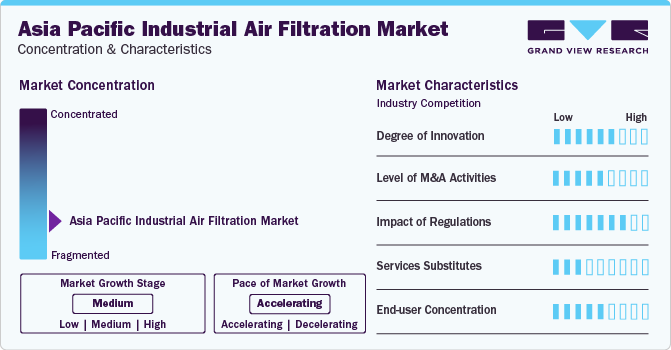

The Asia Pacific industrial air filtration industry's growth rate is medium, and the pace of its growth is accelerating. The industry is characterized by a high degree of innovation driven by the demand for enhanced performance and more sustainable solutions. These innovations focus on improving filtration efficiency, reducing energy consumption, and fulfilling environmental requirements. In addition, companies are investing in research and development to introduce energy-saving filters and improve filtration efficiency, reflecting a strong commitment to innovation in response to environmental concerns and regulatory requirements.

The industry has a moderate level of mergers and acquisitions (M&A) activities. Companies seek strategic partnerships to expand their reach and enhance their product and service portfolios. For instance, in November 2023, Mann+Hummel acquired Suzhou U-Air Environmental Technology to add U-Air's filter portfolio to the company's air filtration business. This acquisition strengthens the company's position in the Southeast Asian air filtration market.

The industry's impact on regulation is high due to the growing environmental concerns and worker safety priorities. Industrial air filtration systems must adhere to rules established by entities, such as OSHA, NFPA, EPA, and ATEX, to manage dust and fumes effectively. These standards uphold indoor air quality, support health, and safety, and guarantee alignment with building design and operational criteria.

End-user concentration plays a vital role in the market due to the high product demand in various industries. Different industries have specific air quality requirements and contaminants to control, leading to a concentration of industrial air filtration systems in these sectors to ensure compliance with regulations and maintain optimal air quality standards.

Product Insights

The HEPA filter segment in product type accounted for the largest revenue share of 29.7% in 2023 and is growing at the fastest CAGR over the forecast period. The demand for HEPA filters is increasing due to the growing awareness of indoor air quality and the need for cleaner air in various industries, including pharmaceuticals, electronics, food processing, and healthcare. HEPA filters excel at capturing tiny particles, making them ideal for multiple industrial applications. HEPA filters have become standard for clean air on planes in the aviation industry. The COVID-19 pandemic has prompted airports to use UVC-LED and Automated Disinfection Facilities to boost safety and cleanliness throughout airport operations.

For instance, in July 2023, Southeast Asian airports began installing HEPA filters in terminals, baggage areas, security checkpoints, and air purifiers for quick and effective sanitization, ensuring smooth operations without disrupting passenger flow. The dust collectors segment held a significant market share in 2023. Industrial dust collectors capture and remove harmful particles and pollutants from industrial air streams. They are used in manufacturing and processing industries to maintain clean and safe working environments and ensure compliance with air quality regulations.

End-use Insights

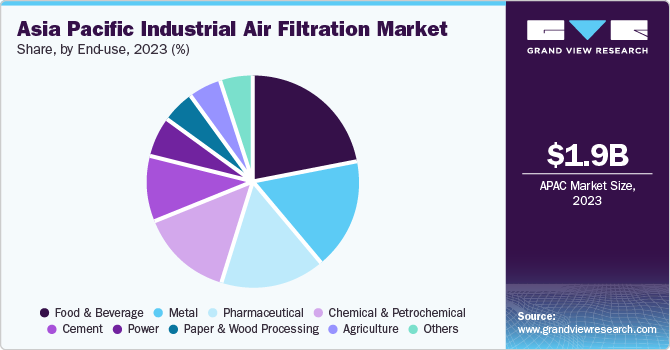

The food & beverage segment dominated the market and accounted for a share of 21.6% in 2023. The food & beverage industry requires stringent air quality standards to ensure the safety and quality of products. Removing contaminants, such as dust, allergens, and microorganisms, is crucial to prevent contamination. Industrial air filtration systems in this sector are vital in preserving clean environments, preventing cross-contamination, and adhering to food safety regulations.

The pharmaceutical segment is anticipated to grow at the fastest CAGR over the forecast period. An air filtration system in pharmaceutical industries plays a critical role in maintaining controlled environmental conditions essential for producing medicines. By effectively filtering out contaminants, such as dust, microbes, and airborne particles, the system ensures the purity of pharmaceutical products and safeguards machinery. In addition, clean air from these systems enhances worker safety by reducing exposure to harmful substances, creating a healthier work environment, and meeting regulatory standards in pharmaceutical manufacturing.

Country Insights

China Industrial Air Filtration Market Trends

China accounted for the largest revenue share of 41.7% in 2023. China's rapid urbanization and industrialization have increased air pollution levels, driving a strong demand for air purification solutions, such as industrial filtration systems. The Chinese government's implementation of environmental regulations and emission standards to address pollution and enhance air quality has further increased the requirement for industrial filtration systems across different industries, contributing to market growth in China. India is anticipated to witness the highest market growth over the forecast period.

India Industrial Air Filtration Market Trends

The market development in India is being driven by stringent environmental regulations aimed at improving air quality and reducing pollution levels. These regulations focus on the use of non-toxic materials, modifications in manufacturing processes, conservation techniques, and encouraging the reuse of items to minimize pollution. The government has taken initiatives to tackle air pollution and enhance air quality using industrial air filtration systems. The National Clean Air Program in India targets a 30% reduction in particulate matter pollution by 2024 through partnerships involving institutions, such as the Indian Institute of Technology Kanpur and the Department of Environment, Forest & Climate Change, with support from the Clean Air Fund.

Key Asia Pacific Industrial Air Filtration Company Insights

Some of the key players in the market include DAIKIN INDUSTRIES, Ltd., Honeywell International Inc., Camfil, Donaldson Company, Inc., PARKER HANNIFIN CORP and MANN+HUMMEL

-

Daikin Industries, Ltd. is globally recognized as the largest producer of air conditioning systems. They provide diverse air conditioning options for homes, businesses, and industrial settings, emphasizing energy efficiency and eco-friendly practices

-

Camfil is a prominent producer of high-quality air purification solutions, specializing in air filtration and pollution control systems for commercial and industrial applications. Operating worldwide across diverse industries, Camfil is dedicated to safeguarding individuals, operations, and the environment through cutting-edge design and a customer-centric approach

Key Asia Pacific Industrial Air Filtration Companies:

- 3M

- ABSOLENT

- Daikin Industries, Ltd.

- Donaldson Company, Inc.

- General Electric

- Honeywell International Inc.

- Industrial Air Filtration, Inc.

- IQAir

- MANN+HUMMEL

- Pall Corp.

- Parker Hannifin Corp.

- PURAFIL

Recent Developments

-

In January 2023, K&N Engineering introduced a new industrial division that provides sustainable air filtration solutions for data centers and various industrial applications. The company's proprietary technology offers high-performance, washable, and reusable air filters with a 15+ year lifecycle, significantly reducing waste and energy consumption while enhancing operational efficiency and sustainability

-

In December 2023, Motion & Control Enterprises acquired Filter Resources Inc., a company based in Pasadena, Texas. Before the acquisition, Filter Resources was a subsidiary of Parker Hannifin Corp. The company distributes process filtration products for industries, such as downstream oil & gas, petrochemicals, and specialty chemicals

Asia Pacific Industrial Air Filtration Market Report Scope

Report Attributes

Details

Revenue forecast in 2023

USD 1.93 billion

Revenue forecast in 2030

USD 3.08 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, and country

Country Scope

China; India; Japan; Australia

Key companies profiled

Daikin Industries, Ltd.; Honeywell International Inc.; Donaldson Company, Inc.; Parker Hannifin Corp.; MANN+HUMMEL; Purafil; Absolent; IQAir; Pall Corp.; 3M; General Electric; Industrial Air Filtration, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Industrial Air Filtration Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Asia Pacific industrial air filtration market report based on product, end-use, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dust Collectors

-

Mist Collectors

-

Fume Collector

-

HEPA Filters

-

Cartridge Collectors & Filters

-

Baghouse Filters

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Cement

-

Food & Beverage

-

Metal

-

Power

-

Pharmaceutical

-

Chemical & Petrochemical

-

Paper & Wood Processing

-

Agriculture

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

Australia

-

Frequently Asked Questions About This Report

b. The Asia Pacific industrial air filtration market size was estimated at USD 1.93 billion in 2023 and is expected to reach USD 2.05 billion in 2024

b. The Asia Pacific industrial air filtration market is expected to grow at a compound annual growth rate of 7.0% from 2024 to 2030 to reach USD 3.08 billion by 2030

b. The HEPA filter segment dominated the market with a share of 29.7% in 2023, it is attributed to the growing awareness of indoor air quality and the need for cleaner air in various industries, including pharmaceuticals, electronics, food processing, and healthcare

b. Some key players operating in the Asia Pacific industrial air filtration market include DAIKIN INDUSTRIES, Ltd., Honeywell International Inc., Donaldson Company, Inc., PARKER HANNIFIN CORP, MANN+HUMMEL, PURAFIL, ABSOLENT, IQAir, Pall Corporation, 3M, General Electric, and Industrial Air Filtration, Inc.

b. Factors such as growing demand for compressed air free from impurities and moisture in various industries, including food & beverage, pharmaceuticals, healthcare, and energyare driving the Asia Pacific industrial air filtration market growth

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."