Asia Pacific Ice Cream Market Size, Share & Trends Analysis Report By Source (Dairy & Water-based, Vegan), By Flavor, By Packaging, By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-296-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Asia Pacific Ice Cream Market Size & Trends

The Asia Pacific ice cream market size was estimated at USD 42.15 billion in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. The Asia-Pacific market is experiencing growth due to consumers having higher disposable incomes and a preference for purchasing high-quality ice cream products. This growth is fueled by the increasing demand for food items like ice cream and frozen desserts in the region, with disposable income being primarily allocated towards food purchases.

The rise in ice cream production is supported by the expanding dairy market in the Asia-Pacific region. The trend of health-conscious consumers seeking ice creams with functional and health benefits is further driving the demand for high-quality products made with ingredients like mung bean and other nutritious components.

The increasing popularity of premium ice creams in the region is anticipated to be a key driver for market growth. Manufacturers are introducing new ice cream innovations, like sugar-free plant-based varieties, to cater to consumer preferences, thereby fueling the market growth of the Asia Pacific ice cream industry in the forecast period. In March 2024, Eclipse Foods, the plant-based ice cream brand known for its commitment to replicating the creamy texture and rich flavors of traditional dairy, launched its latest innovation: Eclipse Bonbons. This exciting new line takes the brand's signature non-dairy ice cream to a whole new level of indulgence, offering a luxurious treat that rivals the most decadent chocolate-covered ice cream bonbons.

Major players in the Asia Pacific market are investing heavily in research and development to introduce new and innovative flavor varieties of ice creams. In April 2024, Havmor, a brand under LOTTE Wellfood Co. Ltd, launched a fresh lineup of ice cream flavors just in time for the upcoming summer heatwave. The range features a mix of traditional favorites and contemporary twists. From classics like Shahi Kesar and Rajwadi Kulfi to modern delights such as Blueberry Cheesecake, Cookie and Cream cones, and ice cream sandwiches. It also added seasonal treats like Jaljeera & Kalakhatta, Ratnagiri Hapus, and rose-flavored ice cream for a cool and revitalizing indulgence.

The increasing expenditure on ice creams in Asian countries such as India, Japan, and New Zealand is projected to support market growth. For instance, according to Japan’s Ministry of Internal Affairs and Communications (MIC), expenditure on ice cream among Japanese consumers witnessed a 135% growth between 2011 and 2020.

Asia Pacific is characterized by an increasing demand for high-end ice creams. The changing consumption habits of consumers and the vast diversity in the region have led to the demand for varied flavor combinations and innovative ice creams. The region has also witnessed the introduction of new brands to the market, which has led to positive competition in the industry. For instance, Chicecream is a premium ice cream brand in China that focuses on high-end and creative ice creams. Founded in 2018, Chicecream was the No. 1 brand in terms of sales in the ice product sector on Tmall in 2020 and 2021. It is also immensely popular at China's annual Double 11 and 618 shopping festivals.

Market Concentration & Characteristics

The degree of innovation in the Asia Pacific market is high, driven by evolving consumer preferences, demand for healthier options, and interest in unique flavors and formats. Companies are investing in product development to introduce novel flavors, textures, and packaging to attract and retain customers.

Mergers and acquisitions (M&A) activities in the Asia Pacific market have been moderate to high in recent years. Major players are engaging in strategic acquisitions to expand their market share, diversify their product portfolios, and enter new geographic regions. This trend is contributing to market consolidation and intensifying competition.

Regulations play a significant role in shaping the Asia Pacific market. Factors such as food safety standards, labeling requirements, and import/export regulations impact product formulation, packaging, distribution, and marketing strategies. Compliance with regulatory standards is essential for market access and consumer trust.

The Asia Pacific market faces competition from various product substitutes, including frozen yogurt, gelato, sorbet, and dairy-free alternatives like plant-based ice creams. The availability of these substitutes, along with their perceived health benefits and flavor variety, influences consumer choices and market dynamics.

End user concentration in the Asia Pacific market varies across different segments and distribution channels. While there are large-scale consumers such as supermarkets, hypermarkets, and convenience stores, there is also a growing trend of niche markets, including artisanal ice cream shops, specialty stores, and online platforms catering to specific consumer preferences.

Source Insights

Based on source, the dairy & water-segment led the market with the largest revenue share of 94.5% in 2023. Dairy-based ice creams have long been traditional favorites across Asia Pacific countries. They are known for their creamy texture, rich flavors, and indulgent experience, appealing to a wide range of consumers. The dairy-based segment also witnesses premiumization, with gourmet flavors, artisanal craftsmanship, and high-quality ingredients becoming increasingly popular. Consumers are willing to pay more for unique and premium dairy-based ice cream experiences.

The vegan segment is projected to grow at the fastest CAGR of 9.0% from 2024 to 2030. Consumers are increasingly adopting plant-based diets for health reasons, including concerns about cholesterol, lactose intolerance, and digestive health. Vegan ice cream, being dairy-free and often lower in saturated fats, aligns with these dietary preferences. Many consumers choose vegan products due to ethical considerations, such as animal welfare and sustainability. Vegan ice cream appeals to environmentally conscious consumers who want to reduce their carbon footprint and support cruelty-free options.

Flavor Insights

Based on flavor, the vanilla segment led the market with the largest revenue share of 31.6% in 2023. Vanilla serves as a base flavor for many other ice cream variations and desserts. It complements a variety of ingredients and can be easily incorporated into different recipes, from sundaes and milkshakes to cakes and pies. This versatility enhances its appeal and usage in both homemade and commercial ice cream products. High-quality vanilla ice cream, made with real vanilla extract or vanilla beans, offers a rich and authentic flavor profile that distinguishes it from artificial alternatives. Consumers appreciate the use of natural ingredients and superior flavor, enhancing their preference for vanilla-flavored ice cream.

The fruit segment is projected to grow at the fastest CAGR of 5.5% from 2024 to 2030. Consumers in the region are increasingly focused on health and wellness. Fruit-flavored ice cream is perceived as a healthier alternative to traditional flavors like chocolate or caramel, especially when made with real fruit purees or extracts. It offers a natural sweetness and vibrant flavors without excessive added sugars or artificial ingredients.Fruit-flavored ice cream is often associated with freshness and seasonality. Seasonal fruits like mangoes in summer or strawberries in spring are widely celebrated in ice cream flavors, creating anticipation and excitement among consumers during specific times of the year.

Packaging Insights

Based on packaging, the ice cream bars segment led the market with the largest revenue share of 32.8% in 2023. Bars packaging offers convenience and portability, making it an ideal choice for on-the-go consumption. Consumers can easily enjoy ice cream bars without the need for bowls or utensils, making them suitable for outdoor activities, travel, and quick indulgences. Ice cream bars come in a variety of flavors and formats, catering to diverse consumer preferences. From classic flavors like chocolate and vanilla to innovative combinations like fruit swirls, nuts, caramel, and cookie coatings, there's a wide range of options to choose from, enhancing consumer choice and satisfaction.

The ice cream cones segment is projected to grow at the fastest CAGR of 5.3% from 2024 to 2030. Cones packaging offers portability and convenience, making it a favored choice for consumers who want to enjoy ice cream on the go. The cone acts as a handheld vessel, eliminating the need for additional serving utensils or dishes, which is particularly appealing for outdoor activities, picnics, and events. Emerging packaging manufacturers are introducing unique and innovative packaging structures to attract consumers to their cone ice creams. In May 2024, Topnotch Foods, an Indian company, specializes in producing rolled sugar cones with aluminum foil sleeves in different sizes, specifically for the ice cream industry. The company recently exhibited its wide range of ice cream cones and sleeves at the IntraPac Exhibition in Greater Noida, India.

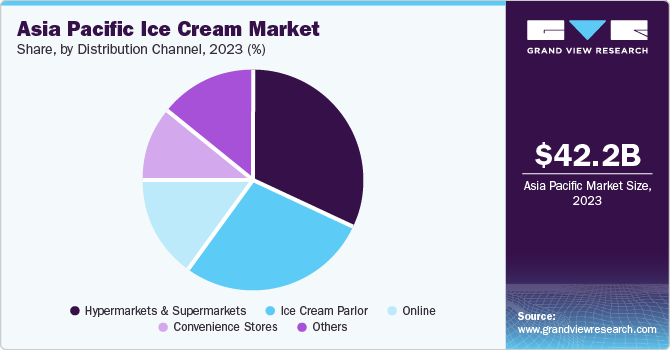

Distribution Channel Insights

Based on distribution channel, the hypermarkets & supermarkets segment led the market with the largest revenue share of 32.2% in 2023. Brands have been diversifying their product offerings in supermarkets and hypermarkets by introducing a wide array of items like sundaes, fudge, bars, popsicles, and fusion products combining two or more flavors. This expansion is driven by the rising consumer interest in exploring new flavors. The increasing demand for sundaes, coupled with the availability of a broad selection of products in supermarkets and hypermarkets, is anticipated to boost sales through these retail channels.

The online channels segment is projected to grow at the fastest CAGR of 6.1% from 2024 to 2030. Online channels provide access to niche and specialty ice cream products that may not be easily found in local supermarkets or convenience stores. This includes artisanal ice creams, gourmet flavors, international brands, limited edition releases, and dietary-specific options (e.g., vegan, gluten-free, low-sugar).Online retailers and delivery services offer convenient delivery options, including scheduled deliveries, express shipping, and door-to-door services. This eliminates the need for consumers to visit physical stores, saving time and effort.

Country Insights

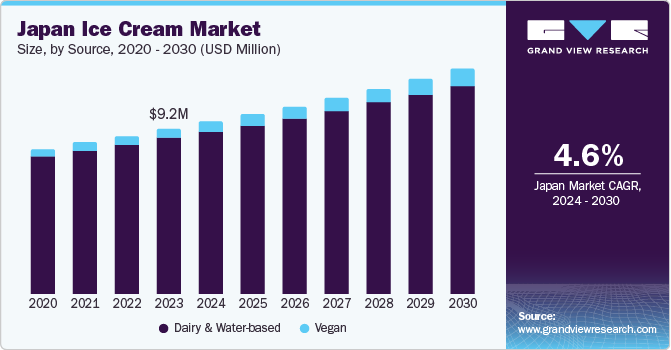

Japan Ice Cream Market Trends

Japan dominated the Asia Pacific ice cream market with the revenue share of 21.8% in 2023. According to the Japan Ice Cream Association, Japanese consumers are flexible and respond well to new products in the market. As a result, the ice cream market in the country is characterized by unique and seasonal flavors, combined with traditional Japanese ingredients and flavors. For instance, the ice cream brand Häagen-Dazs offers innovative flavors such as Hojicha Latte, which is a typical Japanese tea-based flavor loved by people of all ages, the Hanamochi Kinako Kuromitsu flavor, which perfectly encapsulates Japanese cuisine and contains mochi pieces (rice cakes), and the Hanamochi Zunda ice cream, which combines the deliciousness of zunda mochi and lightly salted edamame.

Japanese consumers appreciate traditional flavors like matcha, black sesame, and cherry blossom, alongside more adventurous options such as squid ink and wasabi. Manufacturers are constantly introducing new and unique flavors to cater to diverse preferences. In March 2024, Eclipse Foods introduced its plant-based ice cream in Japan under the brand name "eclipseco." This Japanese product line features enticing flavors like Cookie Butter Crumble, Classic Chocolate, and Mango Passion Fruit, now accessible at Family Mart stores across Tokyo. Kaori Onguchi, the company's country manager for Japan, hailed this move as a pivotal milestone, emphasizing that it marks merely the initial step in their journey.

China Ice Cream Market Trends

The ice cream market in China is mainly driven by changing dietary habits, rising disposable incomes, and a growing middle-class population. According to the State Council Information Office of the People’s Republic of China, the per capita disposable income in China increased by 5% between 2021 and 2022 and stood at about USD 5,487 in 2022. Moreover, according to a report published on the China-US Focus platform, China’s middle-income population accounted for around 76% of urban Chinese households and 45% of the entire Chinese population in 2022. This growth of the middle-income population group and a subsequent rise in purchasing power will provide ample opportunities for the growth of premium and artisanal ice cream brands in China.

Key Asia Pacific Ice Cream Company Insights

Asia Pacific market is expected to witness moderate competition among the companies owing to the presence of numerous players across the industry. Owing to changing consumer trends, numerous companies are expanding their product portfolio to gain a competitive edge in the market. Some of the key market players in the Asia Pacific market are Nestle SA; General Mills Inc.; Appolo Ice Cream Co Ltd; Unilever PLC; Yili Group; CAMPINA ICE CREAM INDUSTRY Tbk.; Diamond Food Indonesia; Dairy Bell Ice Cream

The ice cream market is experiencing significant growth, driven by the contributions of numerous small and mid-size players operating in various countries. To boost sales volume, which has been declining in developed regions like Asia Pacific, manufacturers are introducing innovative flavors and formats. Consumers are increasingly drawn to ice creams made with natural ingredients, low in calories, and featuring health claims, prompting manufacturers to focus on launching products that meet these preferences

Key Asia Pacific Ice Cream Companies:

- Nestle SA

- General Mills Inc.

- Appolo Ice Cream Co Ltd;

- Unilever PLC

- Yili Group

- CAMPINA ICE CREAM INDUSTRY Tbk.

- Diamond Food Indonesia

- Dairy Bell Ice Cream

- PT. United Family Food

- Froneri International Limited

Recent Developments

-

In January 2024, Singapore's OATSIDE has recently broadened its range by introducing a new line of ice cream, leveraging its distinctive oat milk as the primary component. This fresh ice cream collection is currently offered in three flavors: chocolate, peanut butter cookie dough, and coffee with mini chocolate chips

-

In March 2023, Chinese dairy giant Mengniu has taken a significant step in expanding its global reach with the completion of the most extensive smart ice cream factory in Southeast Asia (ASEAN). This new facility, operated by its subsidiary brand Aice Group, marks a historic moment for the Philippines - it is the country's first intelligent ice cream factory

-

In March 2023, Healthy ice cream brand NOTO introduced three new Indian-flavored gelatos that are denser, richer, and creamier, containing half the fat and sugar. Each of these flavors has a significant historical connection with the Indian palate, resonating deeply with consumers

Asia Pacific Ice Cream Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 44.10 billion |

|

Revenue Forecast in 2030 |

USD 58.79 billion |

|

Growth rate |

CAGR of 4.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in million litres, Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Volume & Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Source, Flavor, Packaging, Distribution Channel, country |

|

Regional scope |

Asia Pacific |

|

Country scope |

Hong Kong; Taiwan; South Korea; Thailand; Singapore; Indonesia; Australia; New Zealand; Japan |

|

Key companies profiled |

Nestle SA; General Mills Inc.; Appolo Ice Cream Co Ltd; Unilever PLC; Yili Group; CAMPINA ICE CREAM INDUSTRY Tbk.; Diamond Food Indonesia; Dairy Bell Ice Cream; PT. United Family Food; Froneri International Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Asia Pacific Ice Cream Market Report Segmentation

This report forecasts revenue growth in Asia Pacific and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the Asia Pacific ice cream market report based on source, flavor, packaging, distribution channel, and country:

-

Source Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

-

Dairy & Water-based

-

Vegan

-

-

Flavor Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

-

Vanilla

-

Chocolate

-

Fruit

-

Cookie & Cream

-

Nut

-

Others

-

-

Packaging Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

-

Cartons

-

Tubs

-

Cups

-

Cones

-

Bars

-

-

Distribution Channel Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Ice Cream Parlor

-

Online

-

Others

-

-

Country Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

-

Hong Kong

-

Taiwan

-

South Korea

-

Thailand

-

Singapore

-

Indonesia

-

Australia

-

New Zealand

-

Japan

-

Frequently Asked Questions About This Report

b. The Asia Pacific ice cream market size was estimated at USD 42.15 billion in 2023 and is expected to reach USD 44.10 billion in 2024.

b. The Asia Pacific ice cream market is expected to grow at a compounded growth rate of 4.9% from 2024 to 2030, reaching USD 58.79 billion by 2030.

b. The dairy & water-based segment dominated the Asia Pacific ice cream market with a share of 94.5% in 2023.Dairy-based ice creams have long been traditional favorites across Asia Pacific countries. They are known for their creamy texture, rich flavors, and indulgent experience, appealing to a wide range of consumers.

b. Some key players operating in the Asia Pacific ice cream market include Nestle SA; General Mills Inc.; Appolo Ice Cream Co Ltd; Unilever PLC; Yili Group; CAMPINA ICE CREAM INDUSTRY Tbk.

b. This growth is fueled by the increasing demand for food items like ice cream and frozen desserts in the region, with disposable income being primarily allocated towards food purchases.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."